Key Points

The total market capitalization of cryptocurrencies is $3.97 trillion, up from $3.89 trillion last week, with a weekly increase of 2.06%. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $54.75 billion, with a net inflow of $2.39 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $7.49 billion, with a net inflow of $2.18 billion this week.

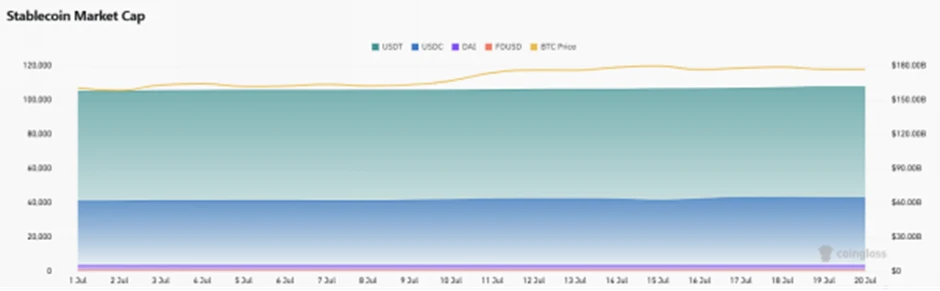

The total market capitalization of stablecoins is $268 billion, with USDT having a market cap of $161.6 billion, accounting for 60.3% of the total stablecoin market cap; followed by USDC with a market cap of $64.46 billion, accounting for 24.05% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 2% of the total stablecoin market cap.

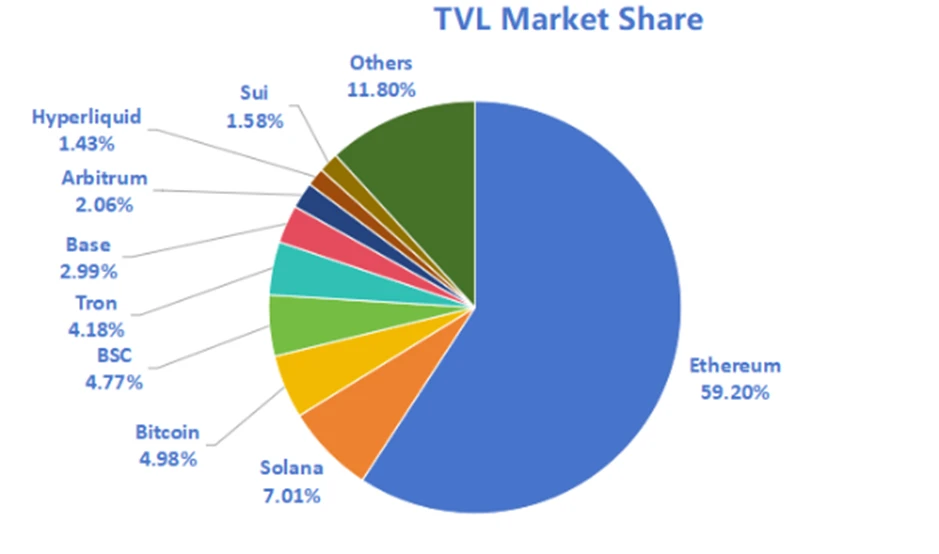

According to DeFiLlama, the total TVL of DeFi this week is $141.5 billion, up from $127.2 billion last week, with a weekly increase of 11.24%. By public chain, the top three public chains by TVL are Ethereum with a share of 56.29%; Solana with a share of 7.49%; and Bitcoin with a share of 5.46%.

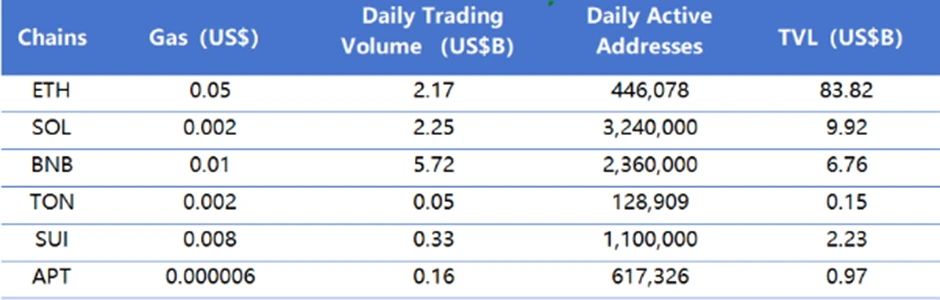

From on-chain data, the trading volume on Sunday this week, except for Sui and BNBChain, remained basically the same as last week, while other public chains showed significant changes. Among them, the following public chains performed most notably: Toncoin increased by 700% compared to last week, Ethereum increased by 35%, while Solana decreased by about 26% compared to last week; in terms of transaction fees, except for Ethereum which increased by 150% compared to last week, Aptos, Toncoin, and Solana decreased by 90%, 66%, and 33% respectively compared to last week; in terms of daily active addresses, except for a slight decrease in Aptos, the overall trend for public chains is upward, with Sui showing the most significant growth of 68% compared to last week; in terms of TVL, the overall trend for public chains is also upward, with Toncoin increasing by 62% compared to last week and Ethereum increasing by 15%.

Innovative projects to watch: TAPEDRIVE is a native storage network on Solana that bundles data into on-chain tapes and uses a novel proof-of-access mining model to protect and retrieve content; Robin is a yield-generating prediction market where users can earn passive income by trading the outcomes of future events; SyFu is a Web3 wallet service aimed at unlocking the value of payment data, which is the only proof of economic contribution from daily consumption activities.

Table of Contents

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Ratios

5. Decentralized Finance (DeFi)

7. Stablecoin Market Capitalization and Issuance Situation

2. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

1. Major Industry Events This Week

2. Major Events Coming Next Week

3. Important Investments and Financing from Last Week

I. Market Overview

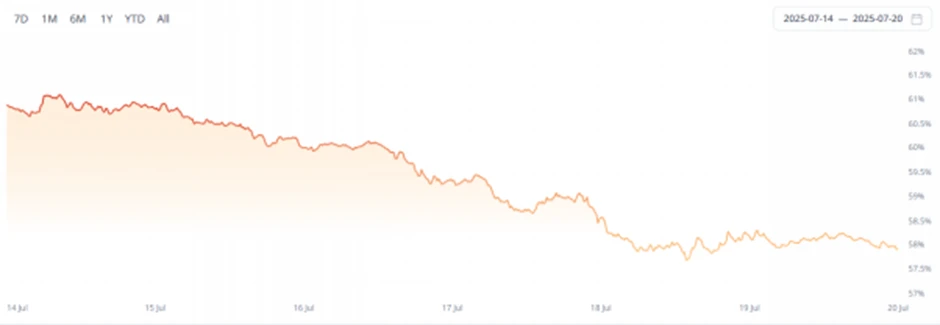

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Cap Proportion

The total market capitalization of cryptocurrencies is $3.97 trillion, up from $3.89 trillion last week, with a weekly increase of 2.06%.

Data Source: cryptorank

As of the time of writing, the market capitalization of Bitcoin is $2.33 trillion, accounting for 58.81% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $268 billion, accounting for 6.75% of the total cryptocurrency market capitalization.

Data Source: coingeck

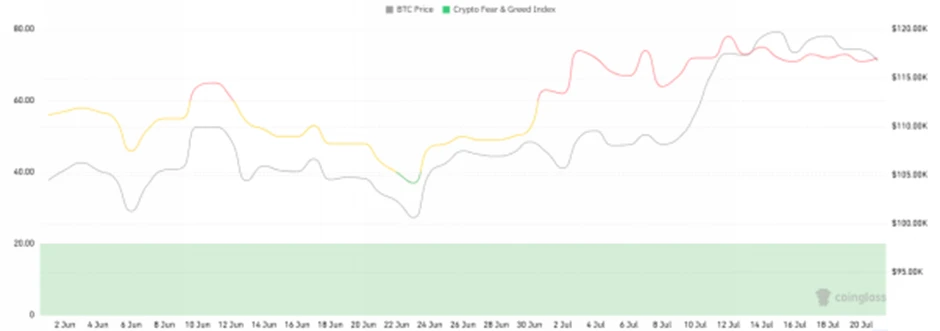

2. Fear Index

The cryptocurrency fear index is at 72, indicating greed.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of Bitcoin spot ETFs in the United States is approximately $54.75 billion, with a net inflow of $2.39 billion this week; the cumulative net inflow of Ethereum spot ETFs in the United States is approximately $7.49 billion, with a net inflow of $2.18 billion this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Ratios

ETHUSD: Current price is $3,739, with a historical high of $4,878, down approximately 23.65% from the peak.

ETHBTC: Currently at 0.031922, with a historical high of 0.1238.

Data Source: ratiogang

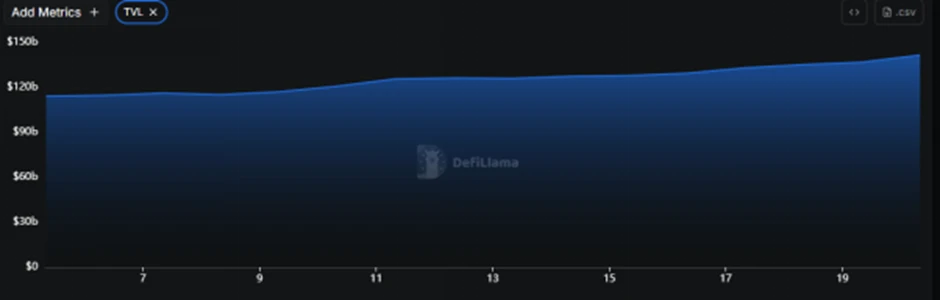

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $141.5 billion, up from $127.2 billion last week, with a weekly increase of 11.24%.

Data Source: defillama

When categorized by public chains, the top three public chains by TVL are Ethereum chain at 56.29%; Solana chain at 7.49%; and Bitcoin chain at 5.46%.

Data Source: CoinW Research Institute, defillama, data as of July 20, 2025

6. On-chain Data

Layer 1 Related Data

Mainly analyzing daily transaction volume, daily active addresses, and transaction fees for major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen, data as of July 20, 2025

Daily transaction volume and transaction fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, daily transaction volume for all public chains, except for Sui and BNBChain, remained relatively stable compared to last week, with significant changes in other public chains. Among them, Toncoin saw a 700% increase compared to last week, Ethereum increased by 35%, while Solana decreased by approximately 26%; in terms of transaction fees, except for Ethereum which increased by 150% compared to last week, Aptos, Toncoin, and Solana decreased by 90%, 66%, and 33% respectively.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, all public chains showed an upward trend except for a slight decline in Aptos, with Sui showing the most significant growth of 68% compared to last week; in terms of TVL, all public chains also showed an upward trend, with Toncoin increasing by 62% and Ethereum increasing by 15% compared to last week.

Layer 2 Related Data

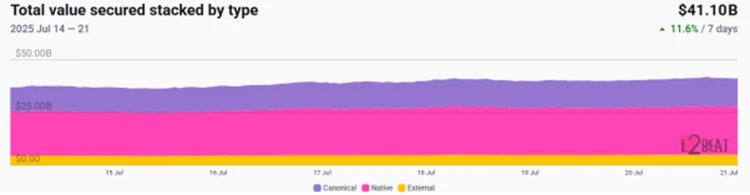

● According to L2Beat, the total TVL of Ethereum Layer 2 is $41.1 billion, up from $36.67 billion last week, with an overall increase of 11.6%.

Data Source: L2Beat, data as of July 20, 2025

Base and Arbitrum occupy the top positions with market shares of 37.59% and 33.83% respectively, with Base still ranking first in Ethereum Layer 2 TVL this week.

Data Source: footprint, data as of July 20, 2025

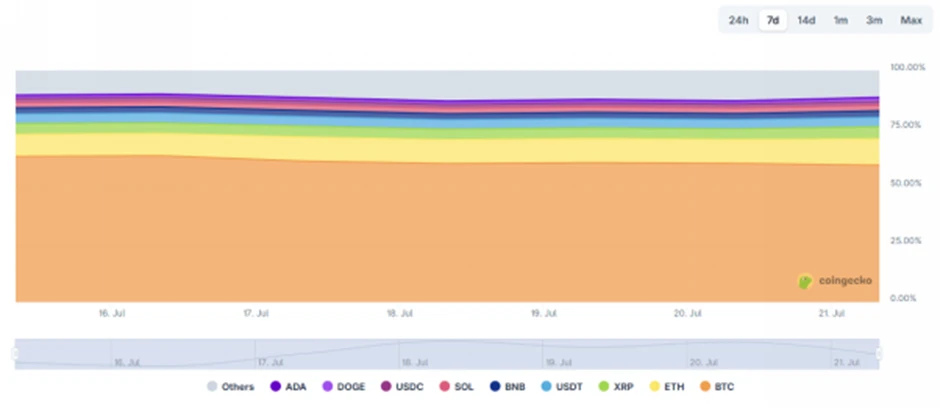

7. Stablecoin Market Capitalization and Issuance

According to Coinglass, the total market capitalization of stablecoins is $268 billion. Among them, USDT has a market capitalization of $161.6 billion, accounting for 60.3% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $64.46 billion, accounting for 24.05%; and DAI with a market capitalization of $5.37 billion, accounting for 2%.

Data Source: CoinW Research Institute, Coinglass, data as of July 20, 2025

According to Whale Alert, this week the USDC Treasury issued a total of 2.55 billion USDC, and the Tether Treasury issued a total of 2 billion USDT, with a total stablecoin issuance of 4.55 billion this week, compared to 2.373 billion last week, representing an increase of approximately 91.74% in stablecoin issuance this week.

Data Source: Whale Alert, data as of July 20, 2025

II. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins by Increase This Week

The top five VC coins by increase in the past week

Data Source: CoinW Research Institute, coinmarketcap, data as of July 20, 2025

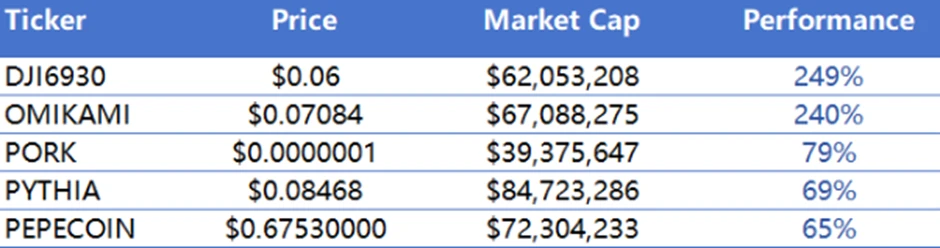

The top five Meme coins by increase in the past week

Data Source: CoinW Research Institute, coinmarketcap, data as of July 20, 2025

2. New Project Insights

TAPEDRIVE is a native storage network on Solana that bundles data into on-chain tapes and uses a novel proof-of-access mining model to protect and retrieve content.

Robin is a yield-generating prediction market where users can earn passive income by trading the outcomes of future events. Unlike traditional prediction markets where funds are idle, Robin invests all matched funds into DeFi protocols to generate actual returns throughout the market lifecycle.

SyFu is a Web3 wallet service designed to unlock the value of payment data, which is the only proof of economic contribution from daily consumption activities. SyFu's cutting-edge product allows users to connect their credit card payment data and upgrade their NFTs. By establishing a symbiotic relationship between data and NFTs, SyFu is revolutionizing the way individuals interact with payment data and digital assets.

III. Industry News Updates

1. Major Industry Events This Week

The Bitcoin-native liquidity protocol Yala announced the opening of Season 1 airdrop claims on the 16th, with a claim period of 1 month. The total amount for this round of airdrop is 34 million YALA, accounting for 3.4% of the total supply, with rewards covering mainnet and testnet participants, content contributors, and early supporters. The snapshot date was July 8, 2025.

The Ethereum SVM L2 network Eclipse announced that the ES token airdrop claims opened on July 16, with ES being issued simultaneously on the Eclipse mainnet, Ethereum mainnet, and Solana network.

The USD1 ecosystem female empowerment meme project Dora will distribute the first batch of 500,000 Dora airdrop rewards to users participating in the StakeStone USD1 full-chain treasury supported by USD1. Previously, the USD1 LiquidityPad full-chain treasury launched by StakeStone reached a deposit cap of $2 million, and a new deposit cap may be raised next.

The parallel multi-party computing network Ika has launched an airdrop query portal, allowing users to connect their wallets for inquiries. Additionally, token claims will open on the 17th. The initial supply of IKA is 10 billion tokens, with over 50% allocated to the community, of which 6% will be distributed through the first community airdrop at the mainnet launch.

The Layer 2 network OpenZK Network, developed based on ZK Rollup technology, has launched its OZK staking feature, allowing users to earn network rewards. Additionally, OpenZK is currently testing a new feature that allows ozETH and OZK to be used as Gas on the Layer 2 network.

2. Major Events Coming Up Next Week

The public beta version of the Sahara AI Data Services Platform will launch on July 22, allowing anyone to participate in building AI and earn real token rewards. The platform will also offer new earning methods and additional incentives from exclusive partners, open to a global audience.

The deadline for claiming the first phase airdrop of Spark's Ignition is July 22. This Ignition plan is Spark's first airdrop activity, aimed at distributing tokens to early supporters and ecosystem participants through a multi-phase distribution mechanism, further expanding the community size and promoting early network growth.

The Starknet Foundation announced the launch of the STRK delegated staking program, aimed at supporting ecosystem builders who contribute to decentralization, security, and network resilience by delegating STRK tokens to network validators. The foundation stated that it will complete the evaluation and announcement of delegated objects by August 31, with eligible validators receiving a delegated quota of up to 5 million STRK at a 1:1 ratio matching their own staking. Applicants must run a complete Starknet validator node and maintain a high online rate and responsiveness.

The Caldera Foundation, a Web3 infrastructure platform, announced the opening of ERA airdrop claims, with wallets that successfully pre-claimed allocations required to claim their tokens by August 1.

3. Important Financing Events Last Week

Hilbert Group raised $31.21 million. Founded in 2020, Hilbert Group is an investment company specializing in quantitative algorithm trading strategies in the digital asset market. (July 15, 2025)

Spiko completed a $22 million Series B financing round, with investors including Index Ventures, Bpifrance, Blockwall, Zach Abrams, and Nik Storonsky. Spiko focuses on providing tokenized money market fund services for European enterprises, allowing users to earn daily returns by investing in low-risk assets such as Eurozone and US government bonds. The platform utilizes blockchain technologies such as Ethereum and Arbitrum and has processed over $900 million in liquidity. (July 17, 2025)

Ephemera completed a $20 million Series B financing round, with investors including Andreessen Horowitz, Faction, USV, and Coinbase Ventures. Ephemera is a decentralized messaging protocol developing XMTP infrastructure, aimed at users committed to decentralized technology and the on-chain future. (July 17, 2025)

Gamesquare raised $70 million. Gamesquare is a publicly traded company focused on the esports and gaming industry. GameSquare (NASDAQ: GAME) aims to change the way brands and game publishers connect with users. (July 17, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。