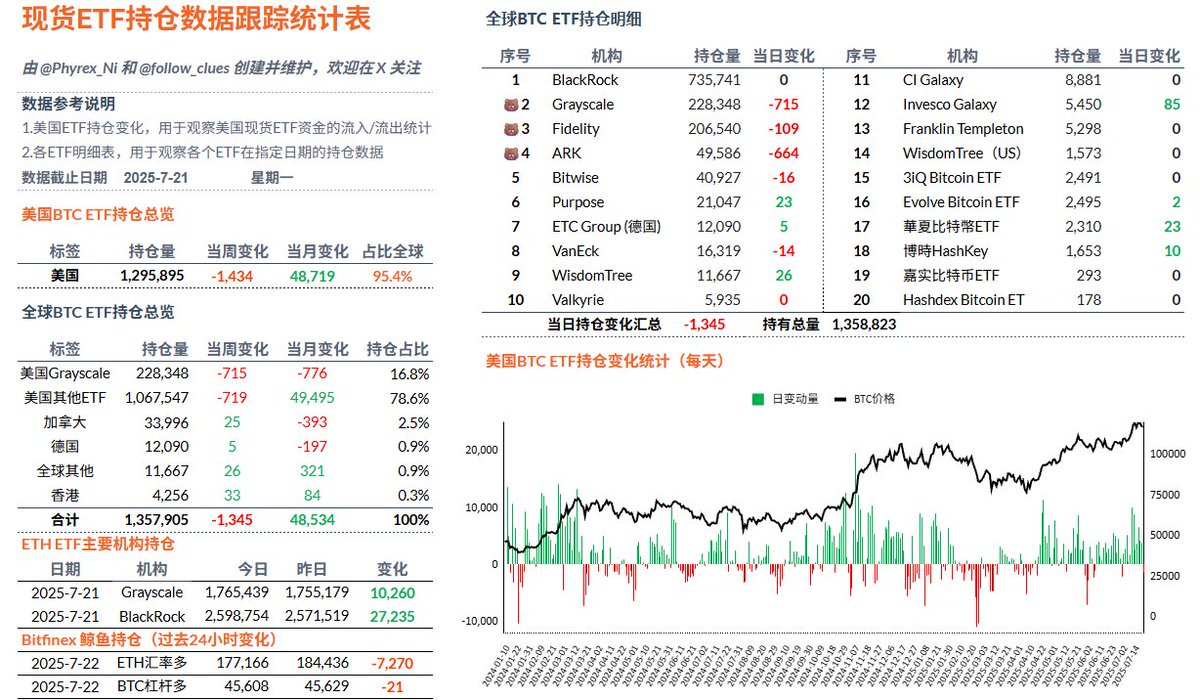

This morning, we were still discussing the retreat of FOMO sentiment in the market, which can also be confirmed by the data from the spot ETF. On Monday, the $BTC spot ETF data ended a 12-day streak of net inflows into Bitcoin. Although the outflow was not significant, it is evident that some investors have chosen to exit. This marks the second consecutive day since Friday that U.S. ETF institutions, excluding BlackRock, have experienced net outflows.

On Monday, BlackRock's investors made no purchases or sales. As we mentioned earlier, the current situation does not indicate that U.S. investors as a whole are experiencing FOMO; rather, it is BlackRock's investors who have been consistently buying. If BlackRock's investors stop buying, it could very well indicate a cooling of FOMO sentiment, and the data from the spot ETF would begin to change.

Let's observe for a few more days. Currently, from a price perspective, although FOMO sentiment is low, the stability of the price is still quite good.

Data link: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。