The Senate Banking Committee has introduced a discussion draft bill for addressing crypto market structure, tackling part of what will overall be a significant legislative push to meet the House's Clarity Act.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Ancillary assets

The narrative

The Senate Banking Committee introduced a discussion draft market structure bill to address how it believes the U.S. Securities and Exchange Commission should oversee digital assets, introducing the concept of an "ancillary asset" and asking the general public to weigh in on the draft by early August.

Why it matters

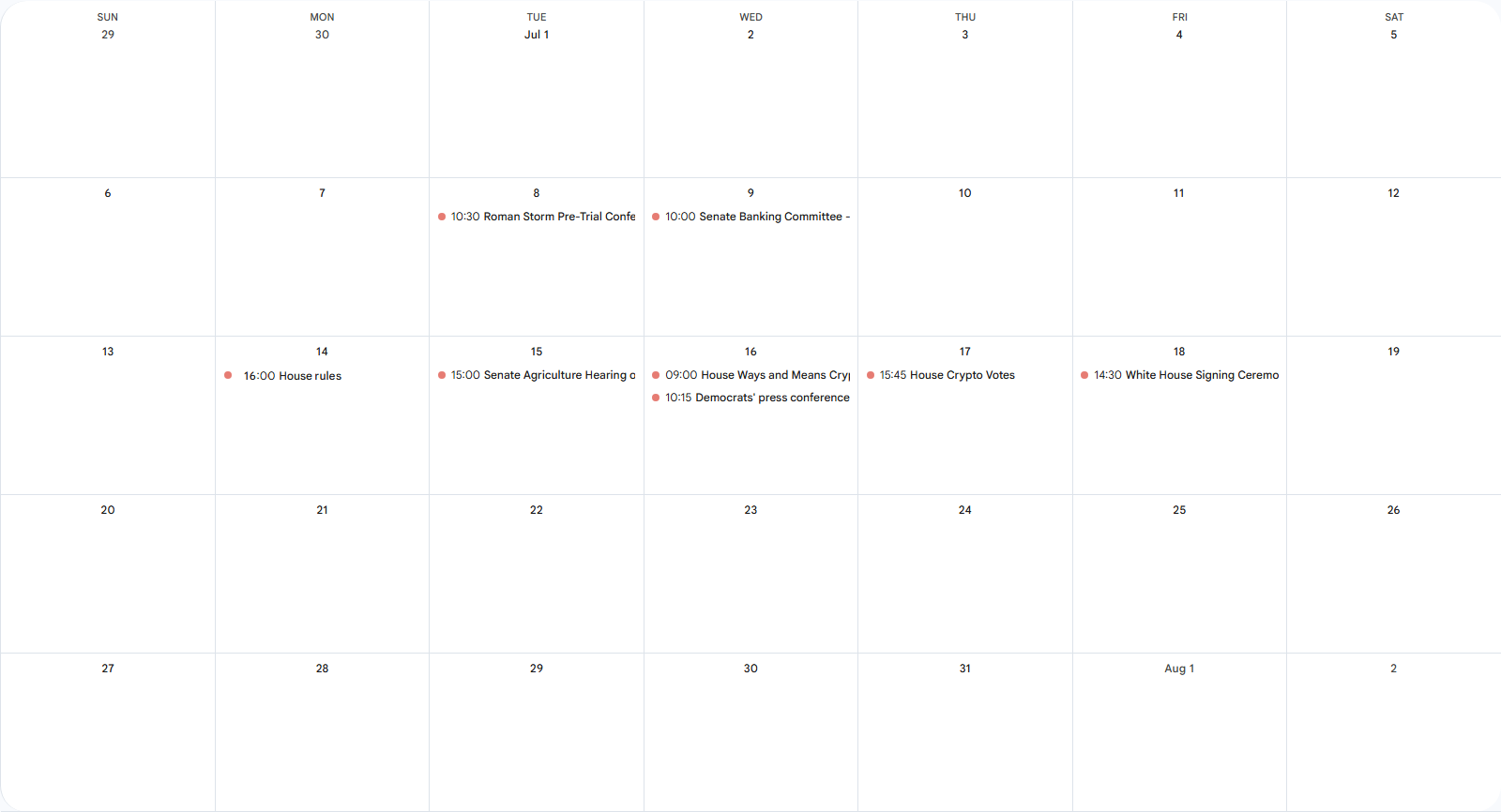

While the House voted to advance its Clarity Act last week, the Senate still needs to sign off on market structure legislation before President Donald Trump can sign it into law. This week, the Senate Banking Committee revealed where its efforts are focused: The SEC and its role, but with a somewhat different tack than the House took.

Breaking it down

The Senate Banking Committee published a discussion draft bill for its Responsible Financial Innovation Act of 2025, giving the general public two weeks to answer one or more of the dozens of questions it asked about the draft.

The draft creates the term "ancillary asset" and defines it in terms of how the Securities and Exchange Commission might oversee these.

Rashan Colbert, the U.S. policy director for the Crypto Council for Innovation, an industry interest group, told CoinDesk that the discussion draft is clearly focusing on the Banking Committee's jurisdiction.

"Within the bill, you see reference to a digital commodity, but you don't see an attempt to explicitly articulate what that is … along that line, you also don't see an attempt to articulate what the trading of digital commodities actually looks like, because those are things that are squarely within the remit of the Agriculture Committee," he said. "Seeing part of the total picture here, and this is very clear from their work, this is a draft, and they've asked for responses, for information to help them flesh out the picture."

The process for the Senate to advance legislation may look different than how the House passed its Clarity Act, Colbert said, but he expects both Agriculture and Banking Committees to wind up coordinating on market structure legislation.

Whatever bill advances will also need Democrat input, given the 60-vote threshold to move a bill through the Senate — at present, the discussion draft was published in a press release that quoted majority members.

Stories you may have missed

- Roman Storm Trial: Is Coding A Crime? The Tornado Cash Court Battle Intensifies: Roman Storm's criminal trial continues, with the prosecution resting on Thursday. Cheyenne Ligon explains what's been happening inside the courtroom.

- Defense Raises Possibility of a Mistrial Over Allegedly Misleading ‘Victim’ Witness Testimony in Roman Storm Trial: One of the witnesses in the Department of Justice's case against Storm may not have had any connection to Tornado Cash, leading to the defense saying it might consider calling for a mistrial.

- DOJ Considering Criminal Charges Against Dragonfly Capital Employees for Years-Old Tornado Cash Investments: The Department of Justice's prosecutors suggested they might bring charges against executives at Dragonfly Capital for their investments in Tornado Cash years ago, saying they would not grant Dragonfly general partner Tom Schmidt immunity if he testified in Storm's defense.

- SEC Approves, Immediately Pauses Bitwise's Bid to Convert BITW Crypto Index Fund to ETF: Bitwise received delegated staff approval to launch a multi-asset exchange-traded fund but like Grayscale's similar product before it, the SEC paused this approval pending commissioner review.

- Crypto Prediction Market Polymarket Weighs Launching Its Own Stablecoin: Source: Polymarket is considering whether to launch its own stablecoin or enter a revenue sharing agreement with Circle.

- Polymarket Returning to U.S. with $112M Acquisition After Prosecutors Drop Probe: Polymarket also acquired U.S.-licensed derivatives exchange QCX, giving it a path back to legally serving U.S. customers following last week's news that federal investigators were no longer looking into whether it violated a CFTC consent order blocking it from serving U.S. customers.

- FBI Drops Criminal Probe Into Kraken Founder Jesse Powell: Kraken founder and chairman Jesse Powell was under federal investigation on hacking suspicions, but the FBI has dropped this investigation, an attorney for him said in a court filing.

- Grand Jury Charges Pastor, Wife in Alleged Multi-Million Dollar Cryptocurrency Scam: The Denver District Attorney brought charges against a couple who allegedly solicited nearly $3.4 million from visitors to their church and other churches for a cryptocurrency.

- Yuga Labs Bored Ape Yacht Club $9M Win Against Ryder Ripps Overturned, Must Better Prove Trademark Infringement: An appeals court ruled that while Yuga Labs is eligible for trademark protections for its Bored Ape Yacht Club NFTs, it needs to better prove that Ryder Ripps and his associates' NFTs are infringing on that trademark under the law.

- Photos: Trump Signs the GENIUS Act Into Law: Here are some photos my colleague Jesse Hamilton and I took at the White House last week.

This week

This week

- There was a business meeting scheduled for the Senate Agriculture Committee to consider Brian Quintenz's nomination for chair of the Commodity Futures Trading Commission, but it's been rescheduled to July 28.

Elsewhere:

- (Bloomberg) Crypto companies have spent just under $7 million in lobbying over the second quarter of 2025. Coinbase spent just under $1 million on digital assets issues, as well as lobbying "on matters affecting the Securities and Exchange Commission's budget and appropriations request," Bloomberg reported.

- (Politico) U.S. President Donald Trump visited the Federal Reserve's offices, inflating the cost of its ongoing renovation in an exchange with Fed Chair Jerome Powell.

- (Galaxy Digital) Galaxy published an overview of all of Donald Trump's policy changes around crypto over the first six months of his presidential term.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。