The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on July 25, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

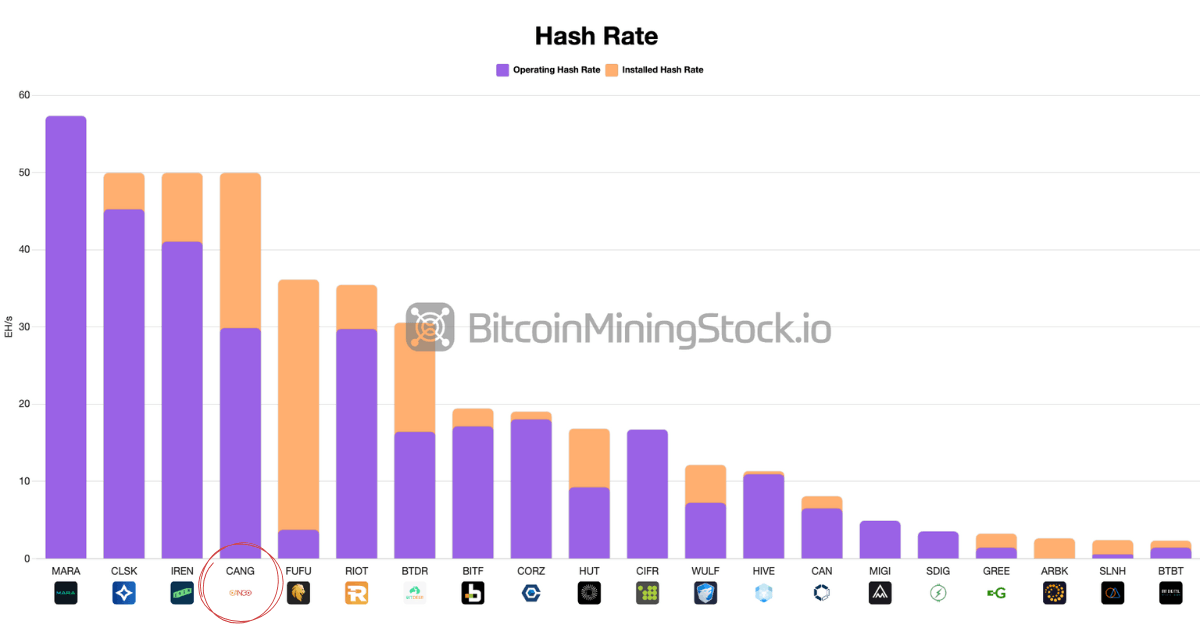

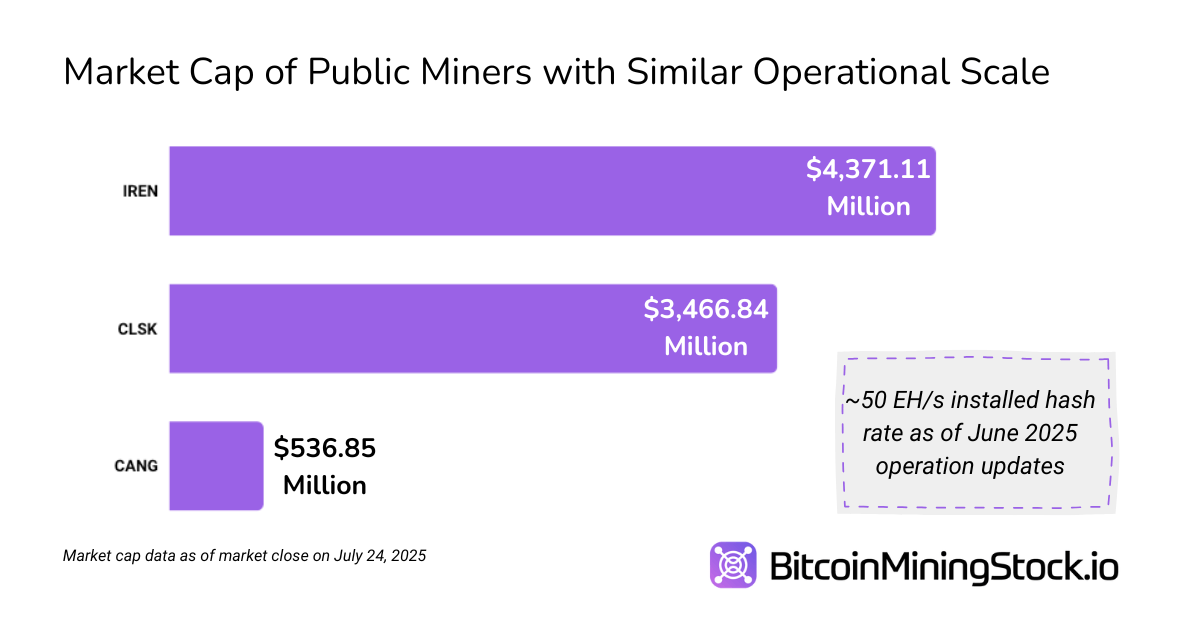

Following Cango’s successful closure of a major secondary acquisition, the company has now become the 4th largest publicly listed Bitcoin miner by hash rate, surpassing industry veterans like Riot Platforms and Bitfarms. This milestone alone raised eyebrows. But what really caught attention was what followed: Cango announced an entirely new executive team, stacked with people from Bitcoin mining and crypto finance. Meanwhile, its original co-founders voluntarily converted their super-voting shares into common stock, signalling a broader leadership handover.

Reported Hash Rate from Public Miners (as of June 30, 2025; live chart)

It’s clear this isn’t just a side experiment into mining – it’s a full pivot.

Back in March, I flagged a few critical factors for investors to monitor: the proposed buyout, the disposal of its PRC business, and the 50 EH/s procurement deal. Those questions have since been answered. But one remains: Has Cango effectively become a proxy for Bitmain?

Why the Proxy Question Matters

It’s a fair question because the answer could impact the entire investment thesis. If Cango were simply a front for Bitmain, concerns around transparency, independence, and geopolitical risk would carry greater weight.

In an industry where nearly everyone interacts with another in some capacity, the details matter. To find out, I examined Cango’s new ownership and leadership structure, and traced the relevant relationships upstream.

Voting Control and Management Changes

As of the press release on July 23, the buyout party, Enduring Wealth Capital Limited (EWCL), now holds 36.73% of the total voting power at Cango, a clear majority compared to the co-founders’ remaining 12.07%. Under the March 2025 non-binding proposal, EWCL not only secured voting rights but also obtained board and management restructuring aligned with its requests..

Following the deal, a new executive team was appointed. Among them, Mr. Xin Jin was named Chairman of the Board and Non-Executive Director, and Mr. Chang-Wei Chiu joined as Director. Both bring substantial Bitcoin mining experience to the table. More notably, they both hold senior roles at Antalpha, a crypto financial services firm with historical connections to Bitmain.

This is where the proxy speculation takes root.

The Antalpha Connection

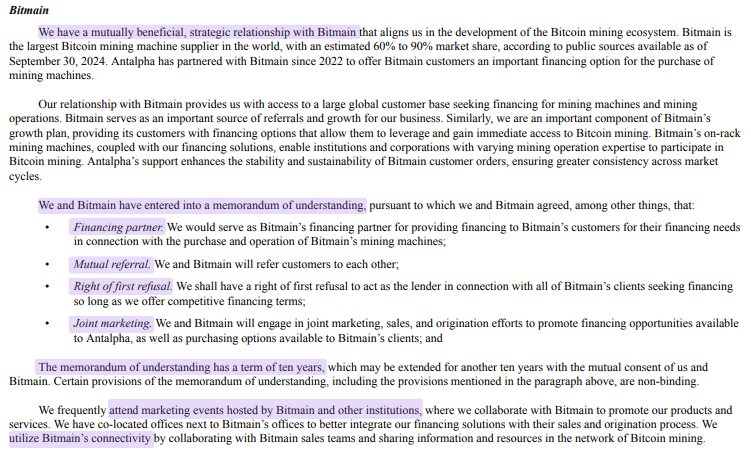

Antalpha is a financial services platform tailored to miners. It went public in May. According to its SEC filings, Antalpha offers financing, technology and risk management solutions. What makes this relevant is that Antalpha is the primary lending partner for Bitmain and its early team included multiple Bitmain alumni. The firm’s product suite was built around the operational needs of large-scale miners, most of whom run Bitmain hardware.

- Xin Jin is Director and CEO of Antalpha Platform Holding Company (NASDAQ: ANTA) and played a major role in developing these miner-focused financial products.

- Chang-Wei Chiu was Director of Antalpha Platform. Prior to that, he served as CIO of Antalpha Capital (BVI) Limited, helping allocate capital into mining infrastructure and digital asset strategies.

However, Antalpha is not owned by Bitmain, and its recent IPO filing makes no mention of current equity ties. The link here is based on shared history, personnel and partnership, not ownership or control.

Summary of Antalpha’s relationship with Bitmain, as disclosed in its IPO filing (see page 107)

So what I see at Cango is a leadership team with exposure to Antalpha, that have deep operating familiarity with Bitmain’s hardware cycles, pricing, and financing norms. It’s not hard to see why people connect the dots.

Understanding the Role of Enduring Wealth Capital

A key part of the speculation around Cango being a proxy is the unclear identity of Enduring Wealth Capital. While its ownership structure is opaque, past associations or overlaps in directorship with Bitmain have fuelled speculation.

Still, based on current disclosures, there is no direct ownership link between Bitmain and Enduring Wealth Capital. On the contrary, it is evident that EWCL installed a team that aligns with large-scale Bitcoin mining operations, and some of those individuals previously worked in firms with Bitmain ties.

That’s not uncommon in this space. Which brings us to a broader point.

How Bitmain Shows Up in the Industry Anyway

The Bitcoin mining industry is small and highly interconnected. Bitmain’s dominance (~82% market share according to a report from the University of Cambridge) means nearly every miner, large or small, relies on them for ASICs or supply chain access. It’s not unusual to find shared personnel or business overlap.

In fact, some other public miners are known for their direct association with Bitmain:

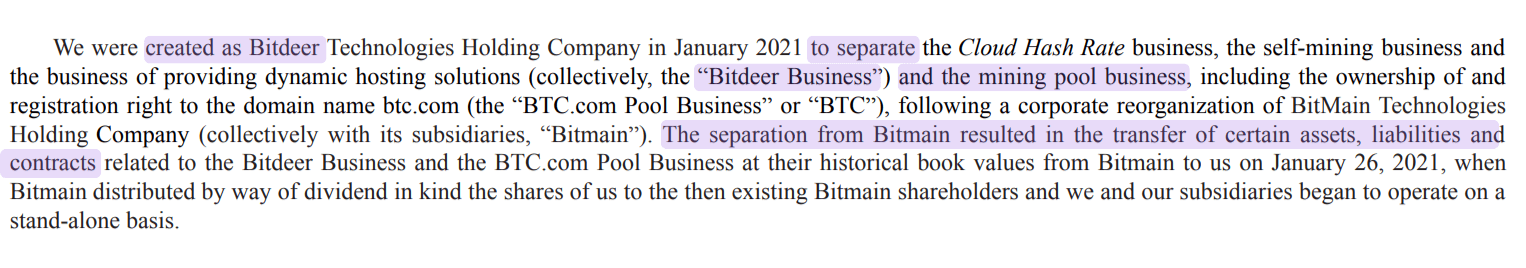

Bitdeer and Bitmain: Share founding DNA

- Bitdeer was originally a spin-off of Bitmain, its founder and Chairman of the board, Jihan Wu is Bitmain’s former co-founder and CEO.

- The company inherited Bitmain’s cloud mining and several hosting operations, and Wu brought over key talent and infrastructure during the separation.

Separation Between Bitdeer and Bitmain, as disclosed in Bitdeer’s SEC filing (see page 58)

*Bitdeer previously stated in their IPO filing that their business model leans on collaboration with Bitmain, from ASIC supply to technical support services. But with Bitdeer’s in-house development of SEALMINER hardware, the commercial agreements around hardware may diminish.

BitFuFu and Bitmain: Both a shareholder and a major supplier

- BitFuFu’s relationship is even more explicit. In its SEC filings, Bitmain is listed as a major shareholder and strategic partner.

“BitFuFu received seed investment from Bitmain in July 2021, and received commitments for further investments from Bitmain and Antpool in January 2022.” (page 110 from BitFuFu’s SEC filing)

- Bitmain supplies a substantial portion of BitFuFu’s ASIC machines.

“BitFuFu is also a S-level client of Bitmain, the highest level among all of Bitmain’s clients, which has provided it with privileges in terms of, among others, miner and hash rate supply and delivery schedule.” (page 110 from BitFuFu’s SEC filing)

- BitFuFu’s cloud mining platform originally launched in partnership with Bitmain and still features hardware bundling, hosting coordination, and ASIC supply agreements.

“BitFuFu has also entered into a ten-year collaboration agreement with Bitmain, pursuant to which BitFuFu can obtain 300 MW hosting capacity…” (page 110 from BitFuFu’s SEC Filing Page 110)

- There are also personnel overlaps where former Bitmain directors and operations staff now serve in key BitFuFu roles.

These cases show that Bitmain has formal, documented entanglements with some miners, and when that’s the case it’s clearly visible.

So, Is Cango a Bitmain Proxy?

As of what current disclosures show, the answer is NO.

There is no documented ownership stake from Bitmain, no direct funding and no unique business dependency aside from standard ASIC procurement that nearly every large miner engages in.

Yes, there are connections. But these ties stem from executive backgrounds and previous partnerships, not from any form of operational or financial control.

In fact, the addition of executives with prior industry experience, including those with exposure to firms that have worked with Bitmain, signals Cango’s intent to scale as a serious player in Bitcoin mining. In this industry, having relationships with Bitmain isn’t unusual and it can be a strategic advantage.

Companies that have partnerships with Bitmain often get early access to next-gen ASICs, discounted pricing, or favorable payment terms. That doesn’t make them proxies – it may simply make them more competitive.

Final Thoughts

With its new 50 EH/s capacity and restructured leadership team, Cango has clearly signalled that its pivot into Bitcoin mining is no trial run – it’s a committed strategic redirection. Its current market cap still largely lags peers of similar hash rate, perhaps due to lingering questions about its direction and affiliations.

From what we can see so far, Cango’s pivot to Bitcoin mining is deliberate, resourced, and moving fast. For investors watching the space, especially those interested in operational scale and under appreciated names, it’s worth keeping Cango on the radar.

I’ll continue monitoring how its strategy unfolds – especially if new filings or business arrangements reveal closer operational ties with Bitmain in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。