If BTC and ETH maintain their strength, altcoins may see another wave of upward movement.

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.79 trillion, with BTC accounting for 60.7%, which is $2.3 trillion. The market cap of stablecoins is $265.2 billion, with a 7-day increase of 1.73%, of which USDT accounts for 61.8%.

Total Market Cap and Mainstream Coin Trends (July 21-25)

| Indicator | Value | Weekly Change | Key Drivers | |------------------|----------------|----------------|--------------------------------------| | Total Market Cap | $3.79 trillion | +3.2% | Acceleration of altcoin rotation | | BTC Dominance | 60.7% | -3.5% | Fund flow into ETH and altcoins | | BTC Price | $115,376 | -1.53% | Short-term profit taking | | ETH Price | $3,655 | +12% | ETF fund inflow + staking yield demand |

Among the top 200 projects on CoinMarketCap, a small number increased while most decreased, including: CFX with a 7-day increase of 64.49%, ENA with a 7-day increase of 26.03%, PENGU with a 7-day increase of 25.49%, and ZBCN with a 7-day increase of 38.53%.

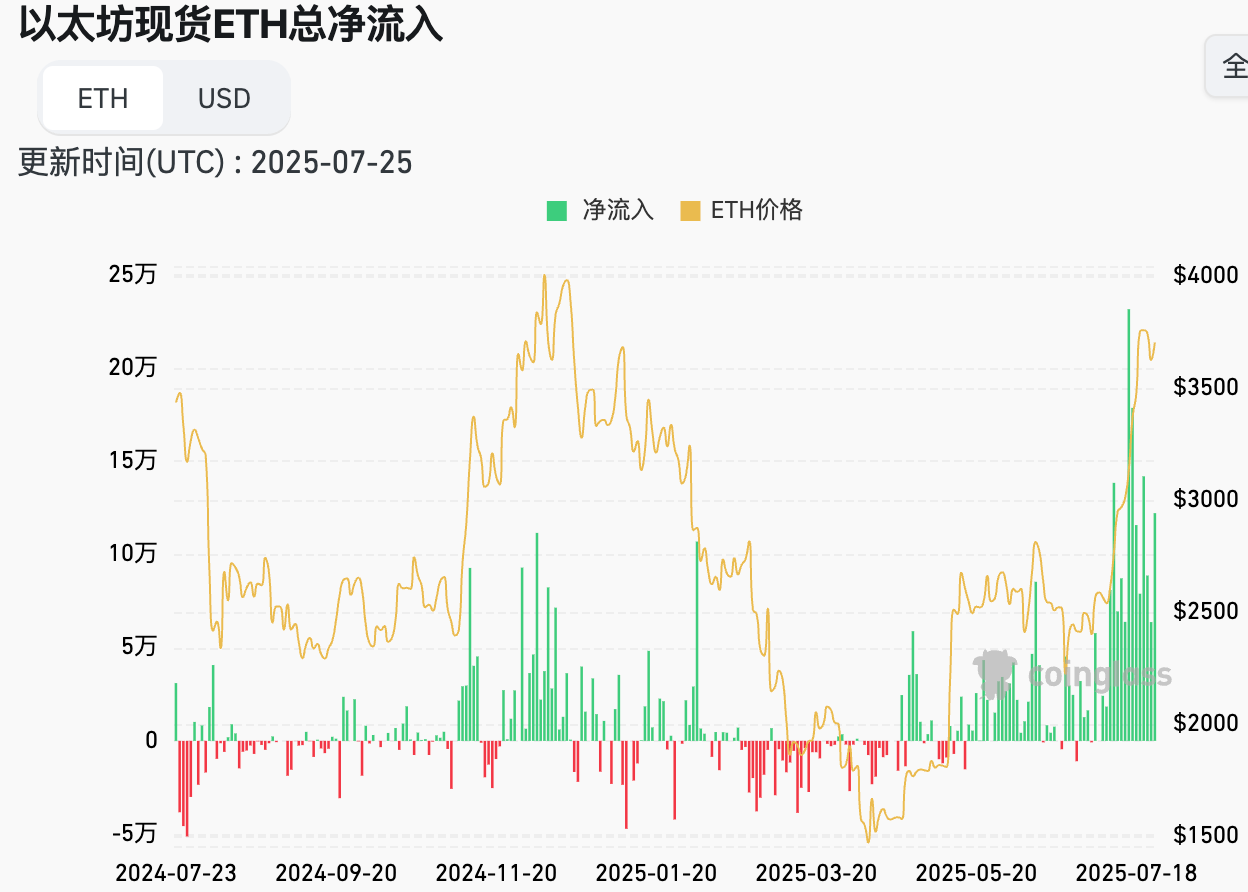

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $73.2 million; the net inflow for Ethereum spot ETFs was $1.846 billion.

Market Forecast:

This week, stablecoins continued to be issued, and there was a significant net inflow into U.S. Ethereum spot ETFs, with altcoins continuing the upward trend from last week. Both BTC and ETH are in a range-bound consolidation. The RSI index is at 40.29, indicating weakness. The Fear and Greed Index is at 71 (lower than last week).

Market Forecast (July 28 - August 1)

BTC: If it breaks above $120,000, the target is $125,000; if it falls below $115,000, it will test the support at $112,000.

ETH: Pullback support at $3,500, with an upward target of $4,000.

If BTC and ETH maintain their strength, altcoins may see another wave of upward movement.

Understanding Now

Review of Major Events of the Week

- Trump signed the "Genius Act," requiring stablecoins to be pegged to U.S. Treasury bonds and banning CBDCs;

- Deutsche Bank report: Stablecoins may become a new pillar for U.S. Treasury bonds, with demand potentially reaching $1 trillion by 2028;

- Surge in demand for ETH staking yields, with an annualized return rate of 4.2%;

- U.S. House of Representatives advances ETF physical delivery reform, reducing operational friction costs by 40%;

- On July 20, the stablecoin USDe issued by Ethena Labs exceeded 6 billion in supply, currently around 6,038,318,478, setting a new historical high;

- On July 22, the new chair of the U.S. Securities and Exchange Commission, Paul Atkins, stated in an interview with CNBC that ETH is not a security;

- On July 22, FTX's freezing of $470 million in overseas claims sparked intense opposition, applying for an extension to respond to creditors;

- On July 23, the SEC approved the Bitwise 10 Crypto Index Fund to convert to an ETF, covering assets including BTC, ETH, XRP, SOL, ADA, SUI, LINK, AVAX, LTC, DOT;

- On July 24, the number of initial jobless claims in the U.S. for the week ending July 19 was 217,000, expected 226,000, previous value 221,000;

- On July 25, a subsidiary of Christie's established a cryptocurrency real estate trading department, allowing buyers to use digital currency to purchase real estate.

Macroeconomics

- On July 21, according to CME's "Fed Watch": The probability of the Federal Reserve maintaining interest rates in July is 95.3%, with a 4.7% chance of a 25 basis point cut;

- Trump called for a rate cut to 1%, even threatening to replace Powell, increasing policy uncertainty;

- On July 24, the European Central Bank kept the deposit facility rate unchanged at 2%, in line with market expectations, after cutting rates in seven consecutive meetings. The main refinancing rate and marginal lending rate remained at 2.15% and 2.40%, respectively.

ETF

According to statistics, from July 21 to July 25, the net inflow for U.S. Bitcoin spot ETFs was $73.2 million; as of July 25, GBTC (Grayscale) had a total outflow of $23.54 billion, currently holding $21.329 billion, while IBIT (BlackRock) currently holds $86.111 billion. The total market cap for U.S. Bitcoin spot ETFs is $152.202 billion.

The net inflow for U.S. Ethereum spot ETFs was $1.846 billion.

Envisioning the Future

Event Preview

- Wanxiang Blockchain Lab will hold a themed gathering on "Ethereum's Decade: Glorious Years" on July 30 at 14:00 in Hongkou, Shanghai. This event will invite Ethereum technical experts, industry opinion leaders, and academic scholars to deeply summarize and review the decade's brilliance and challenges while discussing recent hot topics such as stablecoins and RWA;

- The GOAT Network Global Tour will hold an offline event themed "Finding Sustainable BTC Native Yield Paths" on July 31 at 14:00 in Chengdu;

- MEET48 announced a global strategic partnership with SNH48 GROUP for the annual youth gala, hosting the first Web3.0 Global Idol Annual Popularity Finals on August 2 at the AsiaWorld-Expo in Hong Kong;

- WebX Asia 2025 will be held from August 25 to 26, 2025, in Tokyo, Japan;

- Coinfest Asia 2025 will be held from August 21 to 22, 2025, in Bali, Indonesia;

- Bitcoin Asia 2025 will be held from August 28 to 29, 2025, at the Hong Kong Convention and Exhibition Centre.

Project Progress

- Hashdex will launch a mixed Bitcoin and gold ETF, GBTC11, in Brazil on July 29. GBTC11 will track the FTSE Bitcoin and Gold Risk-Weighted Index and dynamically allocate between the two;

- Binance announced it will support the token swap and rebranding of League of Kingdoms (LOKA) to Arena-Z (A2Z), with all LOKA tokens being exchanged at a ratio of 1 LOKA = 1 A2Z. Binance will open trading for the A2Z/BTC and A2Z/USDT trading pairs on July 30 at 16:00;

- The new USDe pool launched by Ethena Labs in collaboration with Pendle will expire on July 31, with a maximum Ethena reward ratio of 60 times;

- The Kinto modular trading platform in the Arbitrum ecosystem stated that if stolen funds are tracked or raised in the future, the team will restore the K token balance to the snapshot state before the hack and restart trading on CEX at the price before the attack by July 31;

- The second XP season of the decentralized perpetual derivatives Layer2 application chain Paradex will run from January 3, 2025, to July 31, 2025, with token distribution planned at the end of the second season. In the DIME token economic model, 20% of tokens will be allocated for the genesis airdrop;

- Worldcoin will extend the claim period for unclaimed WLD reserved tokens by one year to July 31, 2025;

- The final voting for MEET48's first global idol annual popularity finals (WIPA) will close on August 2, with results announced at the AsiaWorld-Expo in Hong Kong.

Important Events

- On July 30 at 20:15, the U.S. will announce July ADP employment numbers (in ten thousand);

- On July 30 at 21:45, the Bank of Canada will announce its interest rate decision and monetary policy report;

- On July 31 at 0:20, the U.S. will announce the Federal Reserve's interest rate decision (upper limit) as of July 30;

- On August 2 at 20:30, the U.S. will announce the unemployment rate for July;

- On August 2 at 20:30, the U.S. will announce the seasonally adjusted non-farm payrolls for July (in ten thousand).

Token Unlocking

- Artificial Superintelligence Alliance (FET) will unlock 3.05 million tokens on July 28, valued at approximately $2.4 million, accounting for 0.12% of the circulating supply;

- Jupiter (JUP) will unlock 53.71 million tokens on July 28, valued at approximately $30.62 million, accounting for 1.78% of the circulating supply;

- Optimism (OP) will unlock 31.37 million tokens on July 31, valued at approximately $22.75 million, accounting for 1.79% of the circulating supply;

- Sui (SUI) will unlock 44 million tokens on August 1, valued at approximately $186 million, accounting for 1.27% of the circulating supply;

- Ethena (ENA) will unlock 40.62 million tokens on August 2, valued at approximately $24.78 million, accounting for 0.64% of the circulating supply;

About Us

Hotcoin Research, as the core research and investment center of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We build a "trend judgment + value excavation + real-time tracking" integrated service system, providing precise market interpretations and practical strategies for investors at different levels through in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-day market volatility monitoring, combined with weekly live broadcasts of "Hotcoin Selected" strategy and daily news updates of "Blockchain Today." Relying on cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, jointly seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。