Author: Nancy, PANews

On July 30, 2015, as the block height reached the preset 1028201, a decentralized world computer quietly launched in a small office in Berlin. Today, ten years later, Ethereum has grown from an experimental project into a crucial cornerstone that supports thousands of applications, connects tens of thousands of developers, and leads innovation in the cryptocurrency space.

At this historic juncture, the Ethereum Foundation initiated The Torch NFT relay event to pay tribute to the developers, users, and ideas that have shaped Ethereum over the past decade. Ultimately, this NFT will be destroyed to commemorate Ethereum's ten-year journey.

This article by PANews will review ten key historical moments in Ethereum's development, covering technological breakthroughs, policy battles, ecological development, and market turning points.

2013-2014: Release of the Ethereum White Paper and Launch of the ICO

In November 2013, 19-year-old Vitalik Buterin released the first draft of the Ethereum white paper and shared this concept for the first time through an email titled "Introducing Ethereum: A General Purpose Smart Contract/Decentralized Autonomous Organization Platform." He later recalled in a blog post, "This draft was the culmination of months of thought and work in the field of 'cryptocurrency 2.0.'"

Within months of the white paper's release, Vitalik quickly assembled a founding team of eight, including Anthony Di Iorio, who was responsible for early funding support, Charles Hoskinson, founder of Cardano, Mihai Alisie, co-founder of Bitcoin Magazine, Amir Chetrit, an early participant in the Colored Coins project, Gavin Wood, founder of Polkadot, Joseph Lubin, founder of ConsenSys, and Jeffrey Wilcke, a developer of the Go language client.

In January 2014, at the North American Bitcoin Conference in Miami, Vitalik formally introduced Ethereum to the public for the first time. This presentation generated a huge response, quickly attracting the attention of numerous developers, investors, and early evangelists. Shortly thereafter, Gavin Wood published the Ethereum Yellow Paper, serving as the technical specification for the Ethereum Virtual Machine, referred to as "the technical bible of Ethereum."

On July 22, 2014, Ethereum officially launched its ICO, raising over 30,000 bitcoins in just 42 days, equivalent to about $18 million at the time, issuing a total of 72 million ETH at an average price of $0.3. Such a large fundraising scale also sparked considerable skepticism and controversy.

2015: Ethereum Mainnet Launches, Genesis Block Created

In March 2015, the official Ethereum blog systematically announced the four development phases of Ethereum, clarifying the evolution path from underlying technology construction to widespread user applications: Phase One is Frontier, with the main goal of starting mining operations, establishing a trading circulation mechanism between Ethereum and Bitcoin, launching DApp testing, and helping early users upload smart contracts with Ether; Phase Two is Homestead, the formal phase following Frontier; Phase Three is Metropolis, marking the phase where Ethereum officially introduces a graphical user interface to the general public; Phase Four is Serenity, with the core goal of transitioning from Proof of Work (PoW) to Proof of Stake (PoS).

On July 30, 2015, the Frontier phase officially launched, and the Ethereum mainnet went live, producing the genesis block, with a block reward of 5 ETH.

2016: The DAO Hack Incident and Ethereum Hard Fork

In June 2016, Ethereum experienced a major security incident known as The DAO attack. The DAO was a decentralized autonomous organization developed by a German startup, which raised over 11.5 million ETH in just 28 days through crowdfunding on Ethereum, equivalent to about $149 million at the time.

However, due to vulnerabilities in The DAO's code, hackers launched an attack on June 17, successfully transferring approximately 3.64 million ETH, directly causing Ethereum's price to plummet by over 50% that day. Although the funds were stolen, the contract had a 28-day fund lock-up period, preventing the hacker from immediately withdrawing these assets.

This incident sparked intense controversy within the crypto community, and ultimately, the Ethereum community executed a hard fork to roll back the transactions and recover the stolen funds. On July 20, 2016, Ethereum officially implemented the hard fork plan at block height 1920000, resulting in the split between Ethereum and Ethereum Classic.

2017: ICO Frenzy and Regulatory Storm

In 2017, with the popularity of the Ethereum smart contract platform, more and more startup projects began to adopt the ICO (Initial Coin Offering) model to raise funds from global investors. This model quickly became a trend, with total fundraising reaching billions of dollars throughout the year, with typical projects including EOS, Tezos, Filecoin, and Bancor.

This ICO boom greatly propelled the development of the Ethereum ecosystem. Driven by growing market demand and investment enthusiasm, the price of ETH skyrocketed from about $8 at the beginning of the year to over $700 by the end of the year. However, alongside the influx of speculative money, the market quickly showed signs of a bubble, with varying project quality; many projects raised tens of millions of dollars based solely on a "white paper," and some projects were suspected of fraud, leading to significant losses for investors.

As chaos ensued, global regulatory agencies began to closely monitor and take corrective measures, with countries like China, the United States, South Korea, and Singapore issuing policies in succession. On September 4, 2017, the People's Bank of China, the Central Cyberspace Affairs Commission, the Ministry of Industry and Information Technology, and other seven ministries jointly issued a notice on preventing risks of token issuance and financing, clearly stating that ICOs were illegal fundraising activities, ordering all ICO projects to cease immediately, and requiring the return of investors' funds. Following the announcement, nearly all ICO projects and trading platforms in China quickly shut down, causing market panic. Subsequently, the U.S. SEC also classified some ICO tokens as securities, emphasizing that related projects must comply with U.S. securities laws regarding registration and disclosure obligations, and launched investigations and prosecutions for violations.

Under the global regulatory pressure, many ICO projects and platforms were forced to close, funds rapidly withdrew, project valuations plummeted, and the crypto market accelerated into a cooling period. Nevertheless, this ICO wave, to some extent, established Ethereum's core position as a platform for DApps and smart contracts.

2020-2021: The Feast of DeFi and NFTs

The years 2020 to 2021 marked a critical turning point for explosive growth in the Ethereum ecosystem. During this period, DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) rapidly emerged, becoming significant driving forces in bringing blockchain technology into the mainstream, solidifying Ethereum's position as the central infrastructure of cryptocurrency.

The rise of DeFi began in the first half of 2020, with Compound launching its liquidity mining mechanism in June, allowing users to earn governance tokens (COMP) by depositing assets, sparking a yield farming craze. This mechanism was quickly emulated by other protocols, leading to a flood of funds and users into various sectors such as DEX, lending, synthetic assets, and insurance protocols, with representative projects including Compound, Uniswap, Curve, Aave, Sushiswap, and Synthetix. The total value locked (TVL) in the DeFi sector surged from less than $1 billion at the beginning of 2020 to over $200 billion by the end of 2021, setting a historical high. Despite the innovation and wealth effects brought by the DeFi boom, security incidents such as smart contract vulnerabilities, hacker attacks (like the bZx flash loan attack in 2020), and the liquidation risks of highly volatile assets also frequently occurred.

Almost simultaneously with DeFi, NFTs experienced an explosive breakout in 2021, evolving from niche crypto art into a global cultural phenomenon. Popular NFTs like CryptoPunks and Bored Ape Yacht Club (BAYC) became star assets, with floor prices repeatedly setting records, and celebrities accelerated their entry; digital artist Beeple's NFT work "Everydays: The First 5000 Days" sold for $69 million at Christie's auction house, becoming the third most expensive work by a living artist; NFT trading platforms like OpenSea, Rarible, and Foundation rapidly emerged, with monthly trading volumes skyrocketing from millions of dollars to billions; traditional brands like Adidas, Nike, and Pepsi launched NFT series, integrating NFTs with brand marketing; GameFi projects like Axie Infinity combined NFTs with blockchain gaming, driving the Play to Earn craze.

2020: Launch of Ethereum 2.0 Beacon Chain

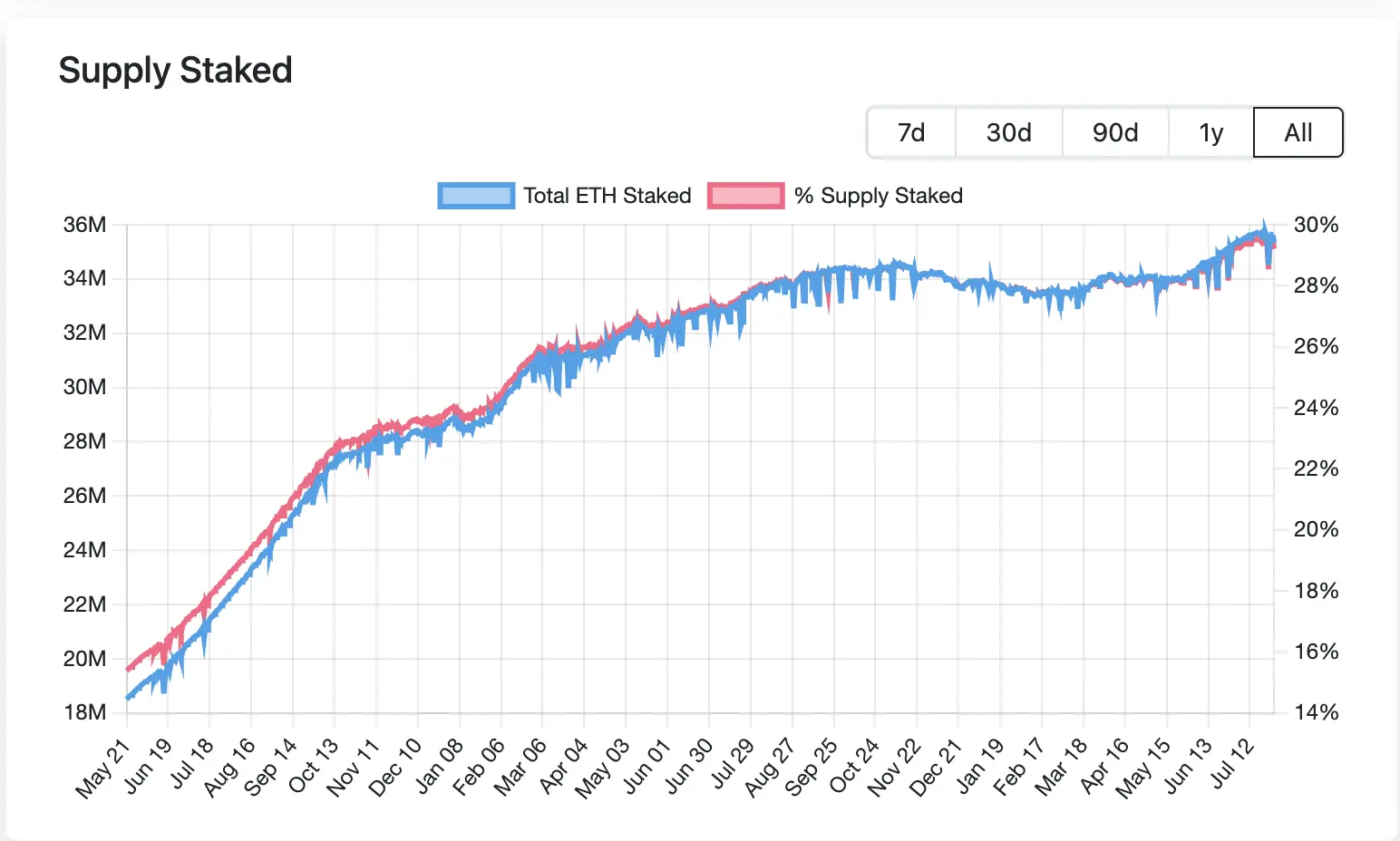

The year 2020 was a significant turning point in Ethereum's development. On December 1, the Beacon Chain officially launched, marking the first phase of the Ethereum 2.0 upgrade and signifying Ethereum's transition from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism.

Ethereum 2.0 is a major upgrade of the Ethereum network aimed at addressing issues of scalability, security, and energy consumption that Ethereum faces, primarily divided into three phases: the Beacon Chain, shard chains, and the merge. The Beacon Chain is the core component of the Ethereum 2.0 architecture, mainly responsible for managing validators, coordinating consensus, and laying the technical foundation for future shard mechanisms, with key functions including validator management, block generation, and reward and punishment mechanisms.

As of July 2025, over 35.3 million ETH are currently staked, accounting for 29.17% of Ethereum's circulating supply, with over 1.09 million active validators, demonstrating Ethereum's strong network security and user participation.

2022: Ethereum Fully Transitions from PoW to PoS

On September 15, 2022, Ethereum officially completed the merge of the mainnet and the Beacon Chain, marking the full transition of the Ethereum network from PoW to PoS. After the merge, the computational competition relied upon by the PoW mechanism was no longer the means to obtain block rewards, and the issuance of new ETH significantly decreased. Additionally, since PoS no longer relies on large-scale GPU devices for mining, the overall energy consumption of the Ethereum network dropped by over 99%.

"We have finally confirmed that the Ethereum merge is complete, marking an important moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today," Vitalik celebrated in a post at the time.

However, this transformation also had a significant impact on the existing Ethereum miner community. The GPU mining rigs used by miners were no longer suitable for mining on the Ethereum mainnet, leading some miners to switch to other cryptocurrency projects that use the PoW mechanism, while others exited the mining industry or shifted to fields like AI and gaming.

2024: Approval of Ethereum Spot ETFs

After years of regulatory negotiations and multiple rounds of registration document revisions, the U.S. Securities and Exchange Commission (SEC) officially approved several issuers' applications for Ethereum spot ETFs on July 23, 2024. The first products approved for listing came from well-known institutions such as Grayscale, Bitwise, iShares, VanEck, and Ark Invest.

This approval not only marks a significant breakthrough for Ethereum on the compliance front but also greatly enhances its market legitimacy and liquidity, becoming an important milestone for Ethereum's move toward mainstream finance.

Nevertheless, the staking feature of Ethereum has not yet been included in these ETF products, and related applications are still in progress, with multiple issuers seeking to incorporate staking yield mechanisms in future versions.

As of now, the total net asset value of Ethereum spot ETFs has exceeded $20.66 billion, accounting for approximately 4.64% of Ethereum's total market capitalization, and has achieved net inflows for four consecutive months, demonstrating strong market demand and institutional participation enthusiasm.

2024: Ethereum Cancun Upgrade

On March 13, 2024, after multiple delays and tests, Ethereum finally completed the highly anticipated Cancun (Dencun) upgrade. This upgrade is not only an important milestone in the technical roadmap but is also seen as a key step in advancing Ethereum toward large-scale scalability.

The core technical improvement of the Cancun upgrade is the introduction of EIP-4844 (also known as Proto-Danksharding), which is the initial phase of Ethereum's transition to full data sharding (Danksharding), introducing the concept of blobs (data blocks) for the first time. By temporarily storing transaction data generated by L2 scaling solutions in blobs, it significantly reduces data storage costs. The introduction of EIP-4844 brings important changes, including a substantial reduction in L2 transaction fees, improved network scalability, and enhanced developer and user friendliness.

2025: Emergence of Ethereum Treasury Arms Race

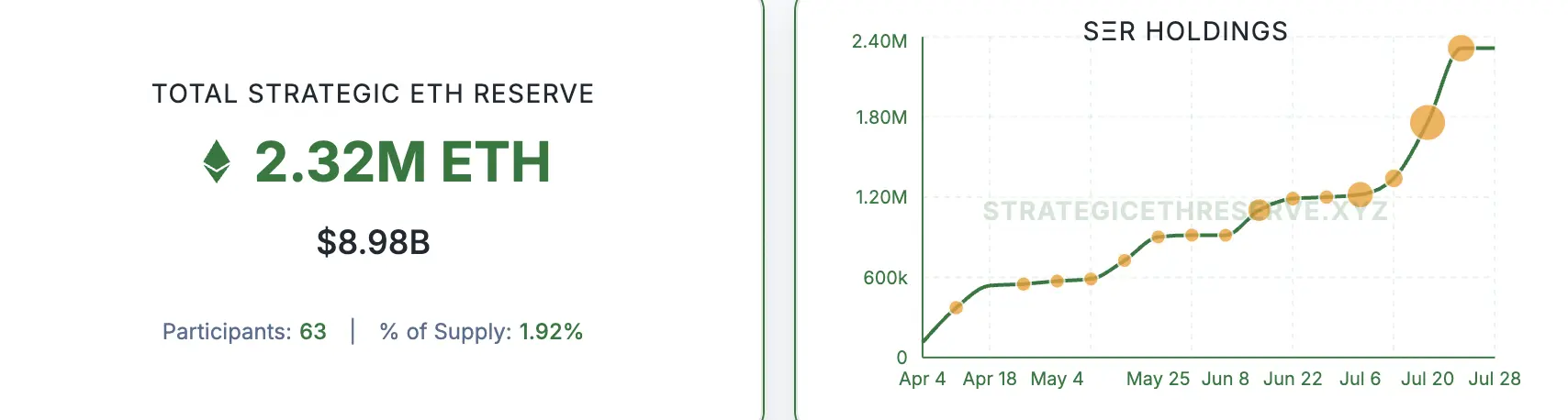

This year, crypto treasury reserves have become increasingly popular worldwide. In the Ethereum ecosystem, more and more "Ethereum micro-strategies" are allocating ETH as a strategic asset reserve.

According to the latest data from Strategic ETH Reserve, as of July 28, the total amount of strategic ETH reserves has reached 2.32 million ETH, equivalent to approximately $8.98 billion at current prices, with a total of 63 institutions or entities participating, accounting for about 1.92% of Ethereum's circulating supply. Among these holding institutions, BitMine and SharpLink Gaming are currently the two largest publicly traded companies holding Ethereum. BitMine, led by "Wall Street legend" Tom Lee and supported by Cathie Wood's Ark Investment Management, holds over 566,800 ETH, valued at approximately $2.2 billion, making it the largest Ethereum treasury institution; SharpLink Gaming, supported by Ethereum core ecosystem companies like ConsenSys and co-CEO Joseph Chalom, a former BlackRock executive, currently holds over 360,000 ETH, valued at approximately $1.4 billion, becoming the second-largest institutional holder.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。