Due to the recent frenzy of expansion and cryptocurrency buying among various listed companies, the two common financing methods, PIPE (Private Investment in Public Equity) and ATM (At-the-Market Offering), have been widely used in cryptocurrency concept stocks or companies with cryptocurrency asset reserves. These two financing forms have a direct and significant impact on shares outstanding and shareholder value. Meanwhile, the efficiency of traditional stock market data platforms is slow, requiring several days to update the newly issued shares and market capitalization, and there is currently no complete and accurate real-time data.

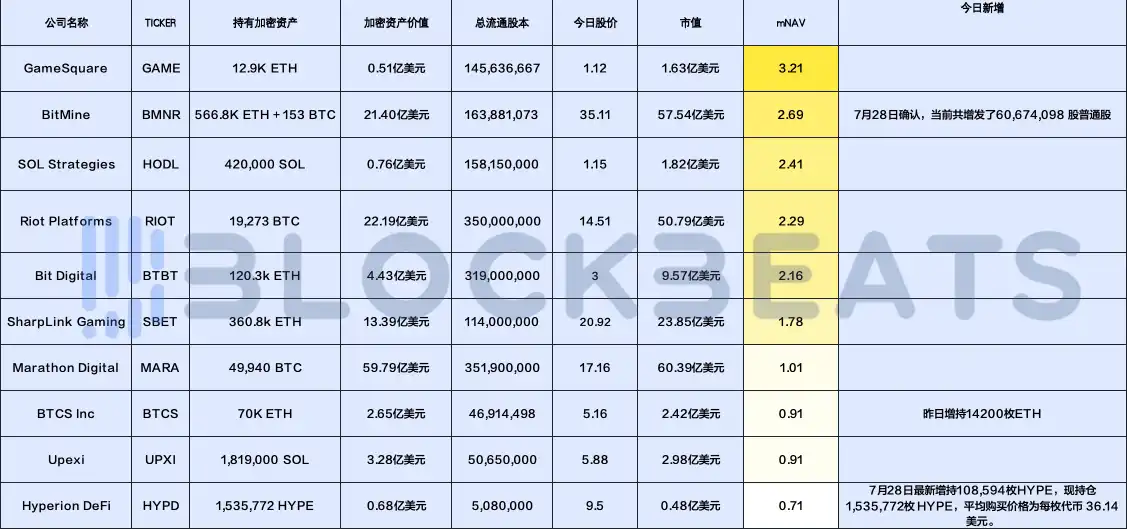

To help readers keep up with the market, Rhythm BlockBeats will continue to track the newly added share capital information of various popular cryptocurrency stock concept companies in financing, manually calculate the market capitalization and cryptocurrency holdings of each company, and provide a more accurate basic mNAV value for reference.

Today's Cryptocurrency Stock Company Event Updates

CEA Industries (VAPE)

CEA Industries, supported by 10X Capital and YZi Labs, announced a $500 million private placement to establish the world's largest publicly listed BNB financial company. The news leaked early, causing the stock to surge over 1800% in pre-market trading. The company's stock price closed at just $8.88 last Friday, with a market capitalization of only $7.4669 million. After opening, the stock price jumped from Friday's closing price of $8.88 to an intraday high of $82.88.

This table will now include Vape.

BitMine (BMNR)

Due to the disclosure of early investors' costs and unlocking times in the S-3 filing published on July 28, BitMine (stock code BMNR) fell nearly 12% yesterday. This document revealed that after BitMine transformed into an Ethereum reserve company, it issued an additional 60,674,098 shares of common stock (assuming full exercise), resulting in a potential dilution of 58.8% compared to its original issued shares.

Among them:

45,113,714 shares of common stock.

11,006,444 pre-funded warrants (each exercisable for one share of common stock at an exercise price of $0.0001 per share. Pre-funded warrants can be exercised immediately after issuance or according to the terms of the pre-funded warrants and can be exercised at any time until all pre-funded warrants are exercised).

3,192,620 strategic advisor warrants, each exercisable at a price of $5.40 per share of common stock. Strategic advisor warrants can be exercised immediately after issuance or according to the terms of the strategic advisor warrants in other ways.

1,231,945 placement agent warrants, each exercisable for one share of common stock at an exercise price of $5.40 per share. Placement agent warrants can be exercised immediately after issuance or according to the terms of the placement agent warrants in other ways.

129,375 representative warrants, each exercisable for one share of common stock at an exercise price of $10.00 per share. Representative warrants can be exercised immediately on or after December 1, 2025.

Cryptocurrency Stock Company Market Capitalization and Premium Rate

The above data is as of July 29.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。