The foundation of the industry starts in the field of cryptocurrency trading: it is from there that it began.

Written by: FXC Intelligence

Translated by: Will 阿望

2025 is the "year of stablecoin cross-border payments," with new announcements almost daily, and milestone regulatory documents officially pushing stablecoins into traditional financial terminals. "We are reaching a 'tipping point,' where everyone realizes this is a whole new upgraded payment technology, and real businesses and practical use cases are emerging. It is not some kind of cryptocurrency frenzy, but real applications," said Chris Harmse, co-founder of enterprise-grade stablecoin infrastructure BVNK.

However, enthusiasm also brings bubbles. Eric Barbier, founder of Triple-A, reminds us: "On LinkedIn and at conferences, stablecoins seem to be treated as a panacea, as if they could end world hunger, poverty, and cure cancer tomorrow—this is clearly an exaggeration."

Stablecoins and blockchain technology are evolving rapidly, and the landscape of the financial payment market is changing moment by moment, with the positioning of business collaborations also shifting accordingly. FXC Intelligence's comprehensive report on the frontline market of stablecoin payments, "The State of Stablecoin in Cross-Border Payments (The 2025 Industry Primer)," is a valuable practical manual for stablecoin payments, integrating FXC Intelligence's cross-border payment data, extensive research, and insights from 14 industry experts.

Therefore, we have compiled this into a document, aiming to provide the industry with a concise, solid, and actionable guide to stablecoin payments, including the current state of using stablecoins for cross-border payments, operational mechanisms, potential market size, application scenarios, challenges to overcome, potential opportunities, and the future.

The full text is 27,000 words; enjoy.

1. Stablecoin Ecosystem

Although stablecoins are still an emerging technology, they have completed a leap from the fringes of experimentation to mainstream visibility in just a few years.

"The changes in the past 18 months have been particularly dramatic," pointed out Chris Mason, co-founder and CEO of B2B stablecoin payment company Orbital. "The first to embrace stablecoins are often high-risk, high-growth players in emerging industries; now, the second wave has arrived—payment service providers and traditional banks are collectively awakening."

Iana Dimitrova, CEO of OpenPayd (a fiat financial infrastructure provider), added: "The current explosion is not an overnight success, but rather the result of over 15 years of trial and error and iteration. The market has finally reached a consensus on the practical value of stablecoins, and the technology itself has reached a critical point for scalable commercial use."

The foundation of the industry starts in the field of cryptocurrency trading: it is from there that it began. Soon after, we began exploring new use cases for stablecoins. —Nikhil Chandhok, Chief Product and Technology Officer at Circle

1.1 Brief History of Stablecoins

Stablecoins originated with the launch of cryptocurrency in 2008: a tokenized, decentralized, and immutable digital currency that operates on a blockchain based on distributed ledger technology. Stablecoins were initially born alongside Bitcoin, which was introduced to the world in October 2008 by an anonymous researcher (pseudonym Satoshi Nakamoto) through a paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System."

From the beginning, Bitcoin was positioned as an online payment method that did not require financial intermediaries. Although early adopters conducted some limited payment experiments, it became popular among internet natives and technologists speculating with cryptocurrency. As interest in Bitcoin grew over the following years, some began to experiment with its underlying technology for cross-border payments. However, due to the extreme price volatility of cryptocurrencies, lack of regulation, and associations with illicit activities, many found it difficult to view it as a payment technology.

The situation changed with the emergence of stablecoins: they represent a key moment in the development of blockchain technology, and we are currently witnessing their transition from the early internet era to the dawn of the modern digital age. Stablecoins are akin to the birth of the P2P file-sharing platform Napster. —Teymour Farman-Farmaian, Co-founder & CEO of Higlobe, a company providing dollar collection accounts for emerging market businesses.

The first digital currency issued in stablecoin form was BitUSD, which introduced the concept of pegging cryptocurrency to fiat currency (in this case, the US dollar) at a 1:1 ratio in 2014. However, since it was backed by cryptocurrency, it did not fully align with our current understanding of stablecoins.

Other companies quickly followed suit, but it was Tether that truly introduced the concept of fiat currency reserves, launching USDT later that year. In the following years, USDT's popularity and attention continued to rise, but it also faced scrutiny regarding transparency and regulation, ultimately leading Tether to take significant steps to address these issues.

In the early days of stablecoin development, developers were gradually understanding the meaning and usage of stablecoins. In 2018, more regulated stablecoins began to emerge, with Paxos launching the now Pax Dollar (USDP) and Circle launching USD Coin (USDC) through a partnership with Coinbase. These regulated, US-based stablecoins began to gain popularity not only in the cryptocurrency space but also attracted interest from the mainstream financial industry. Meanwhile, participants in the financial infrastructure built on stablecoins also began to emerge, including Fireblocks in 2018 and BVNK in 2021.

However, in 2022 and early 2023, stablecoins faced a significant trust crisis, marked by several shocking events in the industry. The first was the sudden collapse of TerraUSD (UST), an unconventional algorithmic stablecoin whose support mechanism was not cash reserves but an algorithmic mechanism. When its value significantly dropped from the pegged rate of $1, panic trading triggered by the "death spiral" also caused the value of other stablecoins to briefly fluctuate in major markets. Although UST was not a traditional stablecoin and Circle, Paxos, and other companies attempted to distance themselves from algorithmic stablecoins, the damage to the reputation of the entire industry was still significant.

Despite many participants claiming their asset reserves could protect them from the aforementioned issues, providing a sense of security, the collapse of Silicon Valley Bank (SVB) in early 2023 raised new concerns. At the time of the collapse, Circle had approximately $3.3 billion in reserves at SVB, and there was uncertainty about whether these deposits would be guaranteed. This led to what is known as a "shadow run," as holders worried they could not redeem the stablecoin at a 1:1 price, causing its trading value to drop to historic lows. Although the US government ultimately did guarantee SVB's reserves, and Circle never faced a real risk of being unable to redeem its USDC, the reputational damage was more severe, especially for institutions that needed to have US reserves and strong backing.

During this crisis, the adoption rate of USDT overseas continued to rise, while the circulating supply of USDC in the US steadily declined during 2023. As a result, a streamlined and more robust version of the industry began to slowly rise from the ashes of this crisis. Driven by genuine demand in key channels and vertical industries, the trading volume and adoption rates of infrastructure companies continued to climb, and products were improved accordingly; while other companies launched products focused on the true utility of their technology. In the second half of 2023, PayPal launched PayPal USD (PYUSD), casting a crucial vote of confidence for the industry; while other companies worked to educate those uncertain about stablecoins to establish regulatory frameworks and increase adoption rates. Orbital CEO Mason stated, "Education is indeed challenging, but people are really starting to understand it."

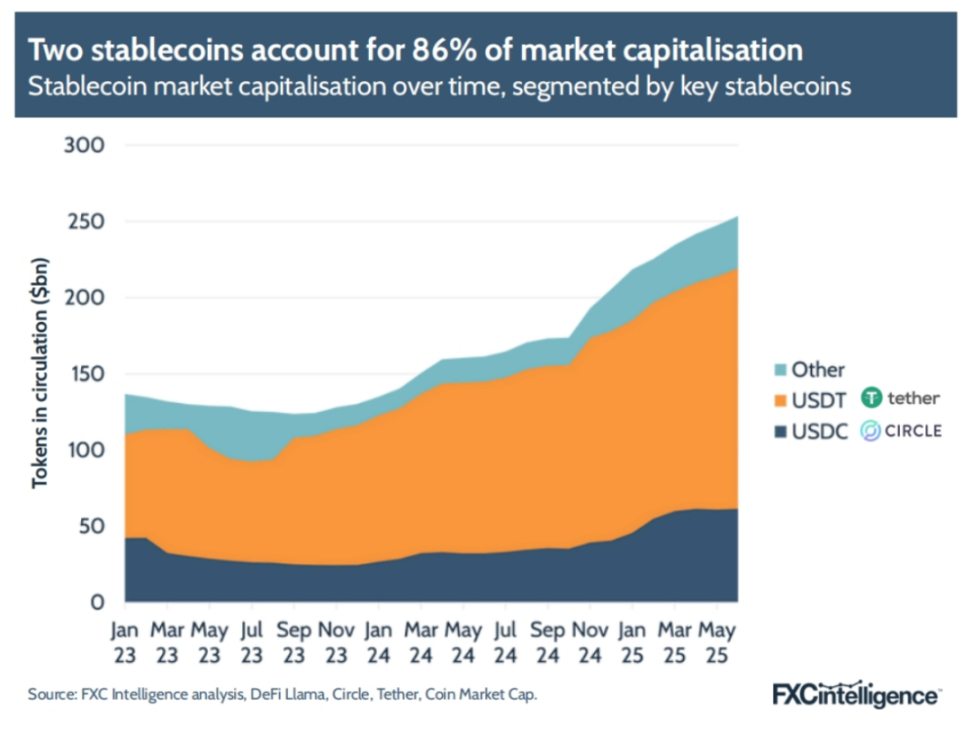

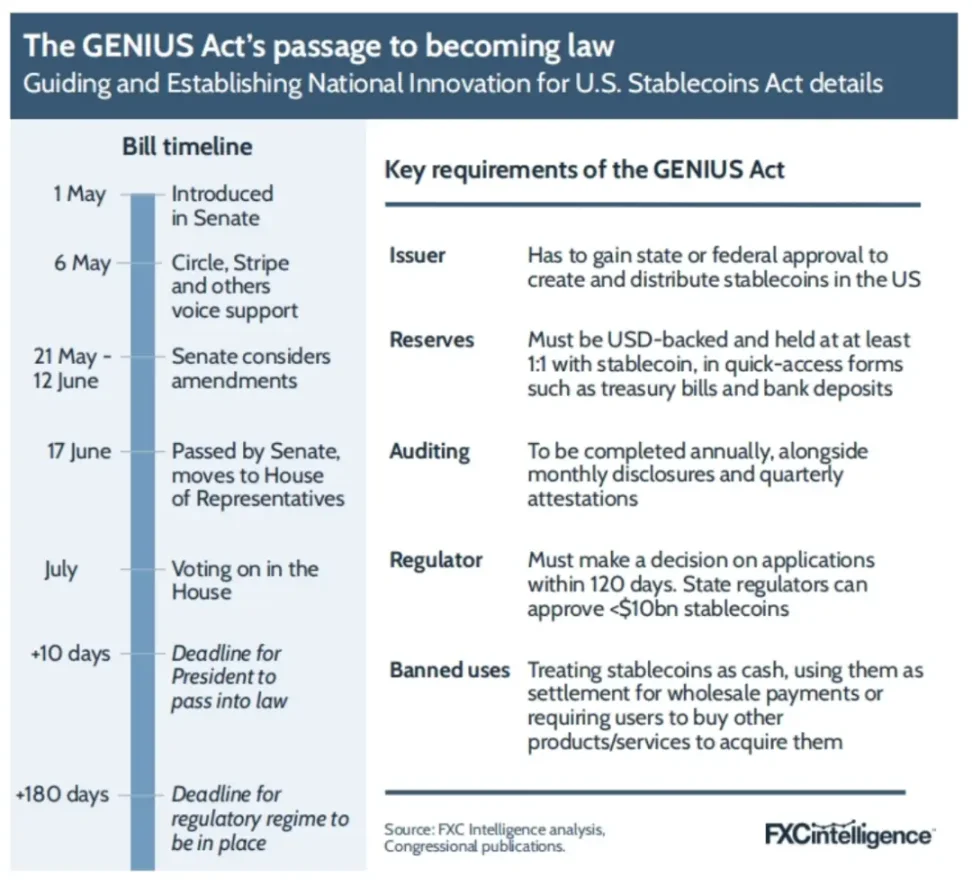

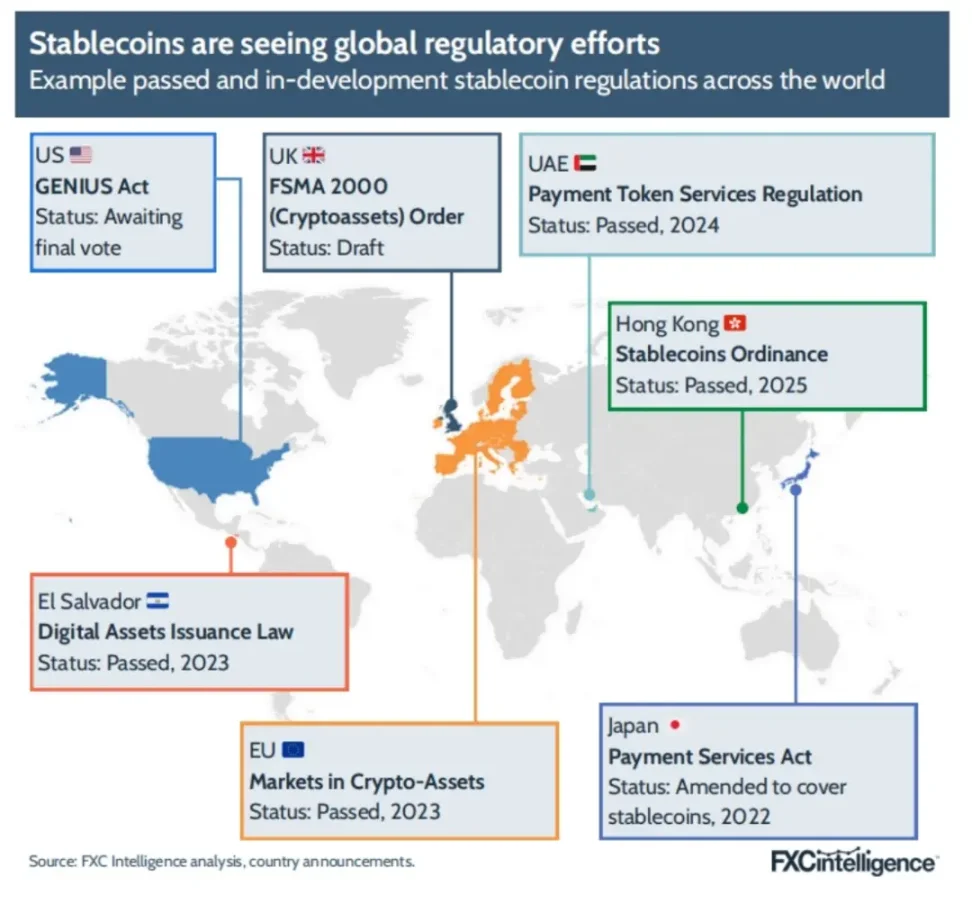

Starting in early 2024, the circulating supply of USDC began to rise again, and the number of newly issued tokens focused on payments continued to grow. Recently, Trump's return to the presidency has also increased institutional support for the technology, and regulatory measures such as the "GENIUS Act" have emerged.

Since the change of government in the US, major financial institutions have been seeking help from companies like ours to understand where and with whom they can collaborate to conduct stablecoin business in a compliant manner. —Guillaume C, EMEA Business Development Director, stablecoin issuer Paxos

Today, as adoption rates rapidly climb, the cross-border payment industry is also showing strong interest, with further growth potential ahead, but the fundamental principles of stablecoins remain largely the same as the premises originally set by Satoshi Nakamoto in the Bitcoin paper.

We are solving the cash problem on the internet. —Nikhil Chandhok, Chief Product and Technology Officer at Circle

1.2 Growing Interest in Stablecoins in Cross-Border Payments

With the rise of stablecoin technology, its application cases in the field of cross-border payments are gradually increasing. As Kendall from Paxos explained, although the current use of stablecoins is still mainly concentrated in "crypto-native activities," interest in this area is continuously growing, largely driven by the most fundamental needs of end users.

The development of stablecoins began in the trading and investment space, and then gradually established a foothold in the cross-border payment sector during 2022 and 2023. —Michael Shaulov, Co-founder & CEO, digital asset infrastructure provider Fireblocks

This experience is reflected in many companies in the field, including Conduit, which focuses on B2B inter-company payments. However, the situation has begun to change in the past year or two.

Initially, it was mainly those crypto-native payment companies that helped their end businesses transfer funds more efficiently between these channels. Now, I see a significant shift, with many companies, especially large multinational corporations, beginning to enter this space. They want to understand how to use stablecoins, especially in challenging regions like Africa, Latin America, and Asia. —Kirill Gertman, Founder & CEO of Conduit, a B2B stablecoin payment company

This has also prompted some cross-border payment infrastructure providers that previously focused on fiat currency to enter the market, such as OpenPayd, which added stablecoin functionality earlier this year.

"For us, this evolution is completely natural, as we already have some existing clients using us for cross-border fiat payments who come to us saying, 'We are already accepting stablecoin payments through other providers. Can we incorporate these assets into your platform?'" said Dimitrova from OpenPayd. "In the past 18 months, we have been receiving such requests continuously. We realized that if we did not provide this interoperability, we would not be able to meet the growing demands of these clients."

Such requests mainly come from companies with global trade needs, but the adoption of stablecoins is also continuously increasing in other aspects of cross-border payments, including MoneyGram, which has begun offering stablecoin payment functionality. In 2022, MoneyGram started sending remittances using USDC, and since then, its capabilities in this field have been expanding, including the launch of the white-label digital wallet deposit and withdrawal solution MoneyGram Ramps, as well as meeting its own cross-border fund management needs.

MoneyGram is a fintech company with a global digital and cash network. Stablecoins will play a very important role in MoneyGram's future. They help in every aspect of our business, from B2B back-end operations to B2C service delivery, and how we provide services to consumers. —Anthony Soohoo, Chairman and CEO, MoneyGram

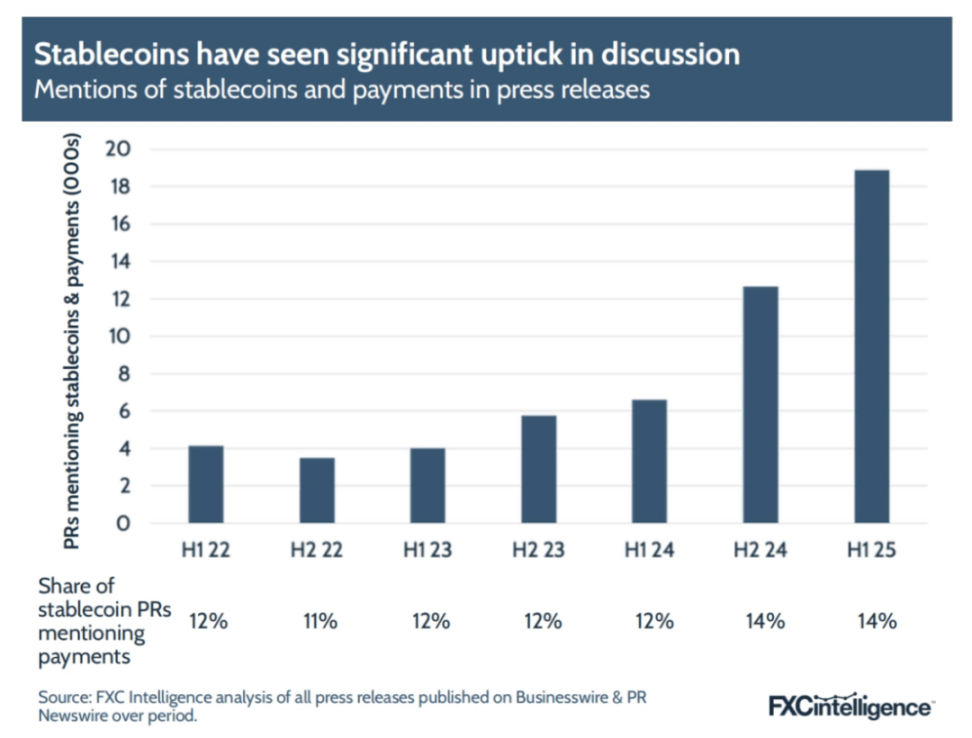

Today, although stablecoins hold a small market share, their attention has significantly increased. In the first half of 2025, the number of press releases related to stablecoins and payments grew by 186% compared to the same period last year, a growth rate that surpassed the overall increase in stablecoin press releases, with press releases involving cross-border payments and stablecoins surging by over 1000%. And this is just for companies publicly launching stablecoin solutions.

According to BVNK's Harmse, the vast majority of companies in the payment industry see the opportunities this technology brings, even if they have not publicly discussed it. "I believe 95% of companies see this," he said, "from the conversations we are having and potential collaborations, there are indeed many traditional payment companies actively getting involved, even some you wouldn't expect."

1.3 Surge in Stablecoin Payment Investments

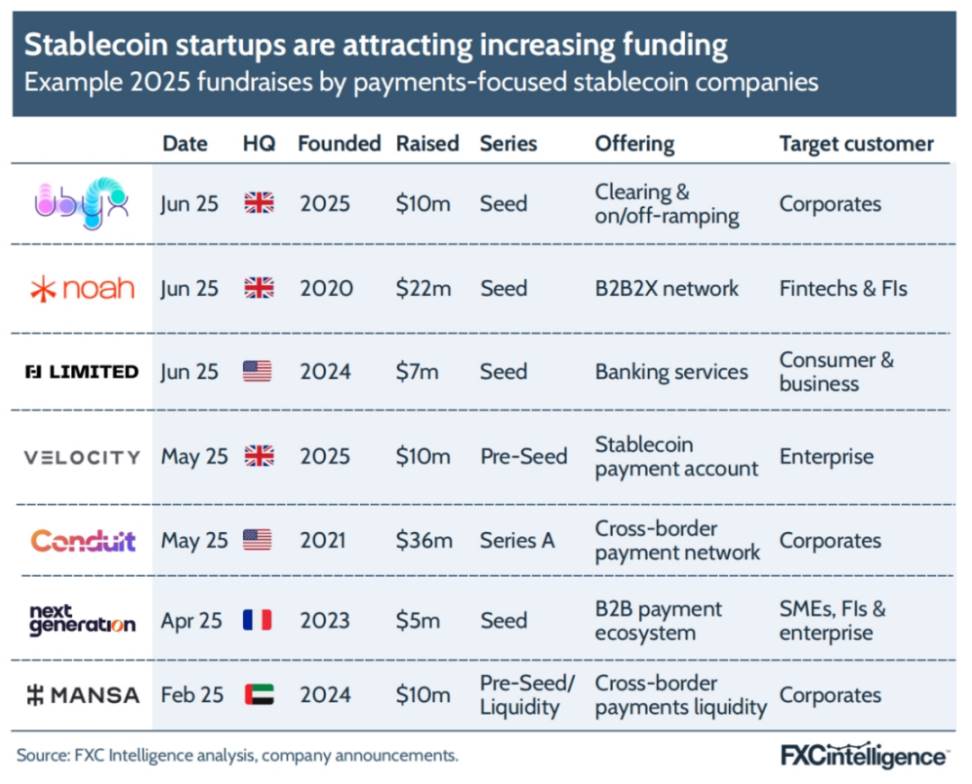

In addition to the strong interest from established companies, capital is also continuously pouring in. Despite a cooling overall venture capital environment, the stablecoin sector continues to attract investment, with numerous projects announcing funding in the past year.

Gertman from Conduit stated, "Investors are primarily focused on the return potential. When they see our revenue growth and how quickly our business volume is rising, they recognize that we have the opportunity to capture a much larger market than today." The company completed a $36 million Series A funding round in May this year.

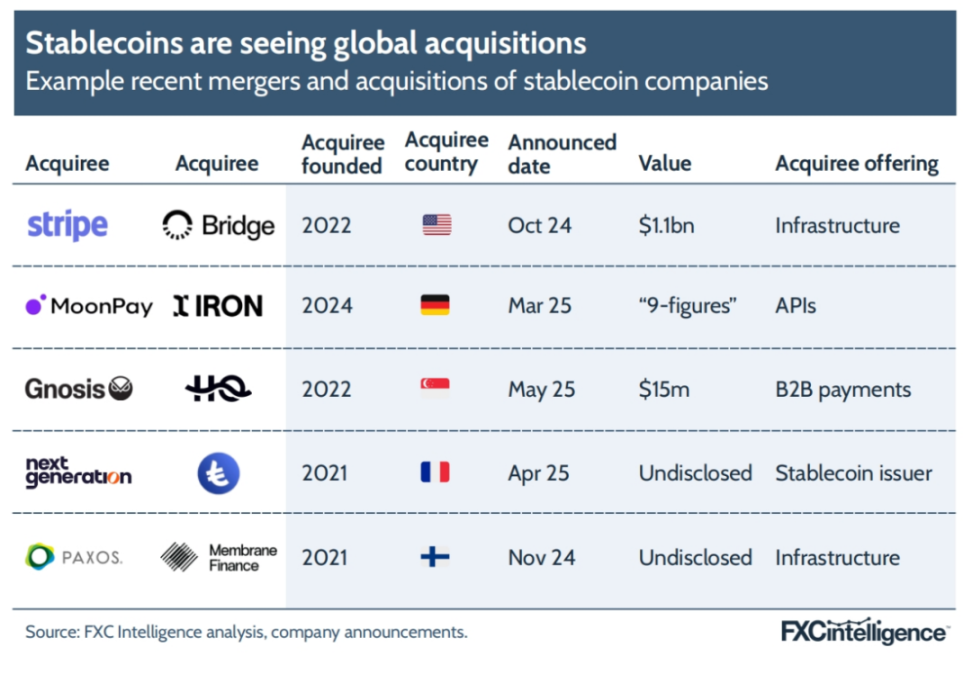

At the same time, a series of mergers and acquisitions are accelerating: traditional giants are looking to quickly fill their capabilities in this field through acquisitions. Despite the frequent activity, Stripe's acquisition of the stablecoin infrastructure company Bridge, announced in 2024 and completed in early 2025, is widely seen as a catalyst for the entire industry to "take this technology seriously."

Harmse from BVNK stated, "It forces everyone to reevaluate this sector. We were already in discussions with several top global payment companies, and this acquisition has directly accelerated the pace of those conversations several times over."

In the view of Jack Zhang, co-founder and CEO of Airwallex, the deeper meaning of Stripe's move goes beyond that: "Stripe is a master of narrative. They have created a super brand story through this acquisition, truly bringing stablecoins into the spotlight, and one could even say it has propelled the current wave of interest in stablecoins."

## Current State of Stablecoin Cross-Border Payments

The underlying logic of stablecoin payments is simple: theoretically, it outperforms existing mainstream solutions across multiple dimensions (speed, reliability, and transparency). Although there is still room for optimization in terms of costs (deposit and withdrawal acceptance), this depends on further improvements in liquidity.

However, reality is not all rosy. Despite the increasing number of success stories, stablecoin payments still face many complex steps when implemented; the overall scale of payment scenarios is relatively small, leaving some capabilities still in the validation stage.

The key to truly understanding the potential of stablecoins is to return to the user perspective—customers do not care about the term "stablecoin." Users do not care what currency you use. What they care about are three things: security, speed, and the best price—three things that have not changed in three thousand years. —Farman-Farmaian, Higlobe

Therefore, the real value of stablecoins is reflected in scenarios that can "practically and reliably improve the existing payment experience." At least for now, this improvement is most concentrated in emerging markets.

"As long as there is a cross-border element in payments, stablecoins can shine." —Chris Harmse, Co-founder & Chief Commercial Officer, BVNK

2.1 Emerging Markets: The "Main Battlefield" for Stablecoins

Whether it is early-stage payment infrastructure companies betting on stablecoins or new players entering the market recently, the consensus is surprisingly consistent: in countries where traditional payment systems are weak, stablecoins are not just "the best solution available now," but also the driving force behind the entire "stablecoin cross-border payment" sector.

Dimitrova from OpenPayd stated, "Global e-commerce platforms have long felt the pain points of receiving, disbursing, and retaining funds in countries with underdeveloped infrastructure. They have been quietly searching for alternatives in the background, only now are traditional financial institutions realizing this."

The pain points are not just about moving funds "cheaply and quickly," but also include: 1) businesses that find it difficult to obtain internationally usable payment tools; 2) institutions and individuals trapped in the quagmire of local currency fluctuations.

Some agents cannot even open bank accounts; we provide them with a B2B wallet that allows them to settle in stablecoins. —Luke Tuttle, Chief Product and Technology Officer, MoneyGram

However, the demand in emerging markets is not monolithic; the emergence of one scenario can give rise to more scenarios, with demand expanding layer by layer. What is certain is that a significant amount of cross-border capital flow through "niche channels" has formed a considerable and still expanding market. Stablecoin players are flocking in, and customer profiles are becoming increasingly "sophisticated."

Gertman from Conduit said, "We are serving an airline that needs to collect payments in multiple African countries and then remit them back to their headquarters in Europe. As long as they quickly clarify the use case, they will immediately test it."

Not only are client-side capabilities "upgrading," but local partners are also becoming increasingly professional. Mason from Orbital pointed out, "We have connected with 80-90 currency deposit/withdrawal partners locally. Under the stablecoin boom, partners in emerging markets are rapidly professionalizing."

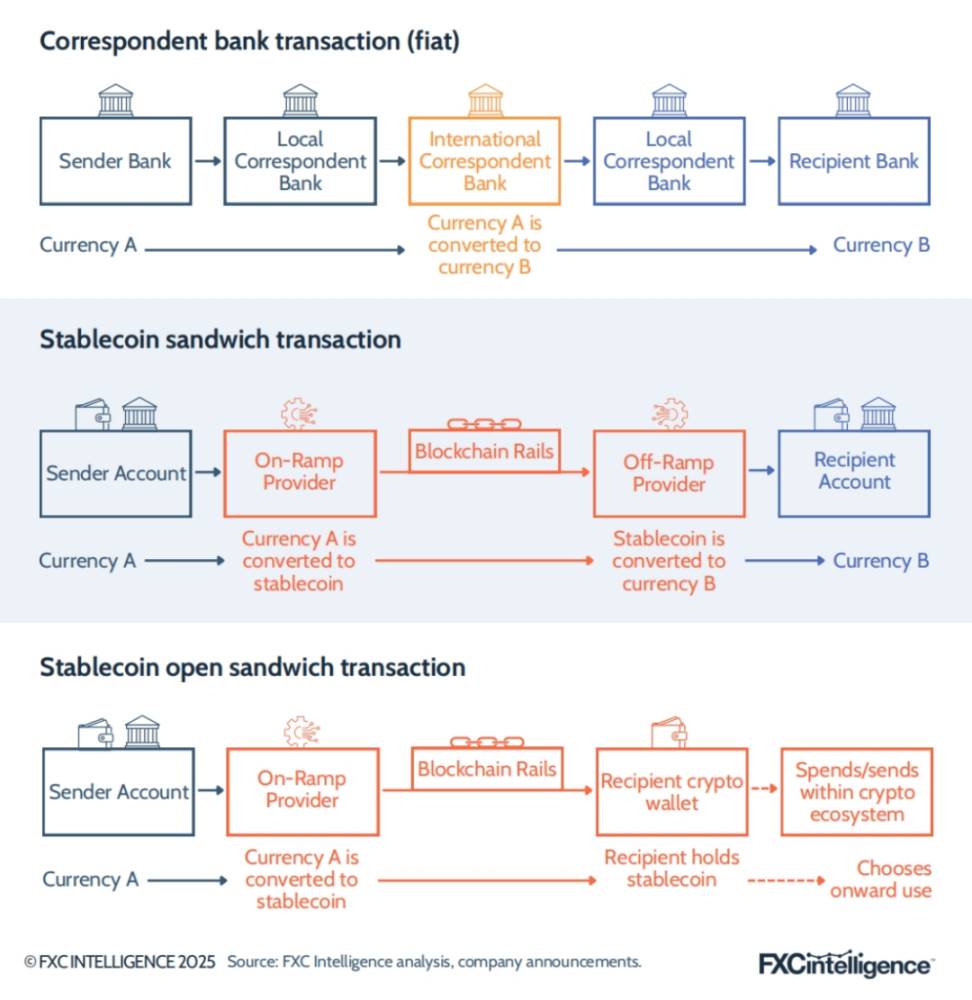

2.2 How Stablecoin Payments Work: The "Stablecoin Sandwich" and Technical Architecture

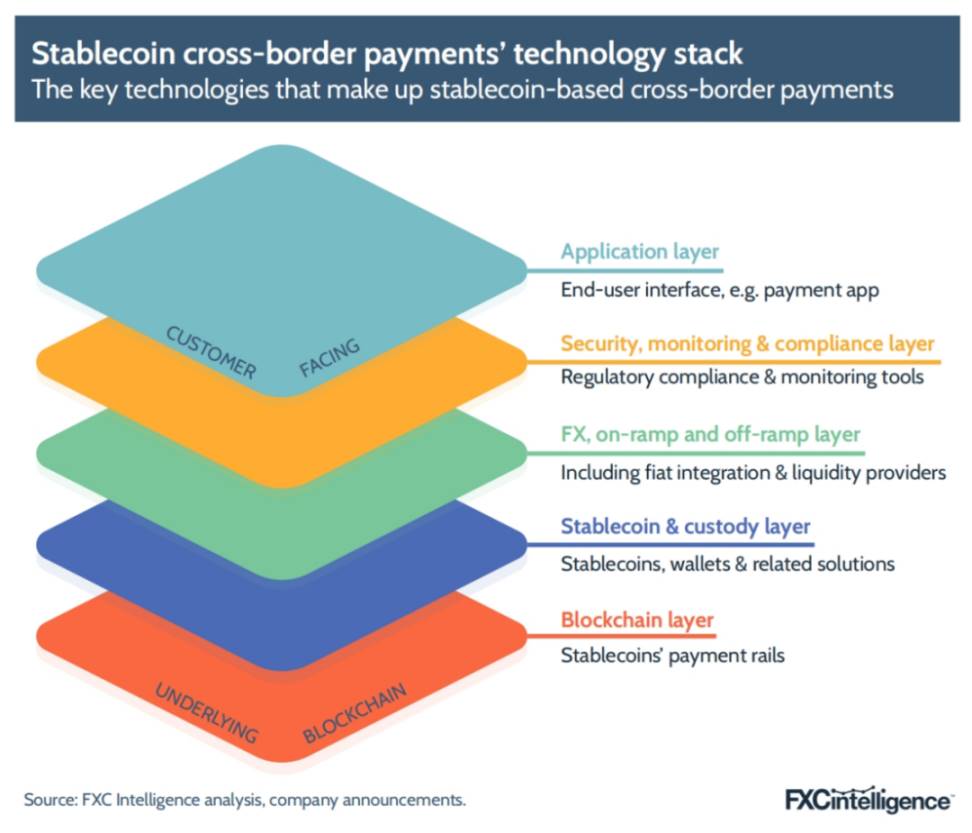

In the real payment process, stablecoins are just one layer in the entire tech stack; the entire architecture can be imagined as a "sandwich"—stablecoins are sandwiched in the middle, with multiple layers of capabilities above and below working together to complete cross-border value transfer.

At the custody layer, stablecoins circulate between different "wallets," which operate on a blockchain network. The blockchain serves as a digital ledger, forming the lowest layer of the "track."

Above the custody layer is the on/off-ramp layer, which truly enables seamless conversion between "fiat currency ⇄ stablecoin" for users, serving as the core for foreign exchange, fiat currency deposits, withdrawals, and other solutions. The approaches vary significantly among providers, often requiring integration with local banks. A liquidity pool is also needed to ensure users can convert stablecoins into the fiat currency they need at any time.

The compliance layer (Compliance Layer) KYC/AML tools are almost sourced from the same origin as fiat products and sometimes directly reuse existing systems.

The application layer (Application Layer) includes the apps, websites, APIs, and embedded interfaces that users ultimately see, encapsulating all four layers above, allowing the experience of "cross-border instant arrival" to be reduced to just one click.

2.3 The "Stablecoin Sandwich" Model

Despite differences in details, the conventional approach to stablecoin cross-border payments is typically referred to as the "stablecoin sandwich." This term was first proposed by Ran Goldi, Senior Vice President of Payments and Networks at Fireblocks, in 2021.

In the traditional correspondent banking model, cross-border payments must go through a chain of local banks—international banks—receiving local banks, completing currency exchanges along the way; whereas the "stablecoin sandwich" simplifies the process to:

First, convert the sending fiat currency into stablecoins,

Then complete the international transfer via blockchain,

Finally, convert the stablecoins into the target fiat currency at the receiving end.

This approach is particularly attractive in certain markets because it significantly reduces the complexity of the correspondent banking system.

Mason from Orbital illustrated, "In the traditional payment path, making a payment to an emerging market might involve six institutions. Suppose my correspondent bank is Sberbank, which is underpinned by J.P. Morgan; there are already three banks on this chain that need to fulfill regulatory obligations; and there may be three more at the receiving end. Since the destination is Colombia, each institution requires visibility on the payment, and with different banking hours, the result could be that the money is stuck in the system for two weeks, and the recipient still hasn't received it."

If the payment is for perishable goods or other time-sensitive products and services, such delays can be particularly fatal, ultimately causing unnecessary friction for local businesses, limiting their growth potential, and becoming an obstacle to their internationalization. The "stablecoin sandwich" eliminates this lengthy chain but still requires the institutions or individuals at both ends of the chain to be willing and able to quickly complete the conversion between fiat currency and stablecoins. Initially, this was a significant challenge; as stablecoins gain attention in multiple emerging markets, local demand for stablecoins is rising, providing better liquidity for such transactions.

Mason added, "Although some local banks in certain markets are not technically proficient, we can see that the capability for 'executable exchange rates in the stablecoin sandwich' is improving. For example, if someone gives me euros, I can immediately buy USDT in real-time from a European liquidity provider, then sell USDT in real-time in Mexico, and remit Mexican pesos through my Mexican banking partner. The entire process can be completed in 5-10 minutes or even less. In my view, this is the 'golden egg' in the field of cross-border payments. Although it still depends on the capabilities of emerging markets, everyone is quickly catching up."

Whether fast and low-cost stablecoin payments can truly take off depends critically on the efficiency of the "deposit and withdrawal currency acceptance" process, with the "last mile" being particularly crucial. This also means that institutions with deep roots in the fiat currency world find it easier to pivot into this space.

We started from traditional finance and have established the "first and last mile" fiat currency channels for receiving and making payments—these channels are still indispensable to the entire process. Now we just need to introduce new technology in the middle segment to make payments faster and more streamlined. —Dimitrova, OpenPayd

However, the last mile is not always necessary. As the use of stablecoins expands, more and more people want to receive stablecoins directly instead of converting them back to fiat currency. Shaulov from Fireblocks revealed, "We have already seen one side of the 'sandwich' starting to disappear." This type of transaction is referred to as the "open stablecoin sandwich," and some believe it will eventually become mainstream.

Mike Hudack, co-founder and CEO of Sling Money (a consumer-focused stablecoin remittance company), bluntly stated, "People need to slowly accept a reality: one day, there will be no more deposits and withdrawals; what exists on the chain is money itself. No one will care about the underlying; your Visa debit card is actually driven by stablecoins or tokenized deposits in your wallet."

However, when this day will come is still uncertain. Although there is demand for "open sandwiches" in certain scenarios, most people believe that the fiat currency channels at both ends of the market will not disappear in the next few years.

Dimitrova summarized, "In the coming years, the need for interoperability between fiat and stablecoins will still exist."

## Opportunities in the Data

Quantifying the current market size of stablecoin cross-border payments is not easy: while the total volume of stablecoin transactions is publicly available, it is unclear how much of it is used for cross-border payments.

Data from Visa and Allium shows that the total transaction volume of all stablecoins on all blockchains in 2024 is approximately $5.7 trillion, with 1.3 billion transactions. In the first half of 2025 alone, it reached about $4.6 trillion and 1 billion transactions, with the annual figure expected to be significantly higher than last year. However, the vast majority of these transactions belong to the movement of funds in trading scenarios, as investors often use stablecoins as a "stable harbor" between buying and selling highly volatile cryptocurrencies.

Internal data from leading companies can better reflect the scale of the segmented market. According to Harmse, BVNK (considered one of the largest players in this field) processes about $15 billion annually, with approximately half coming from B2B payments—this is also the largest segment in cross-border payments. Gertman stated that Conduit has an annualized transaction volume of $10 billion, which the company estimates accounts for about 20% of the global B2B stablecoin cross-border payment market; Orbital reported an annualized scale of $12 billion.

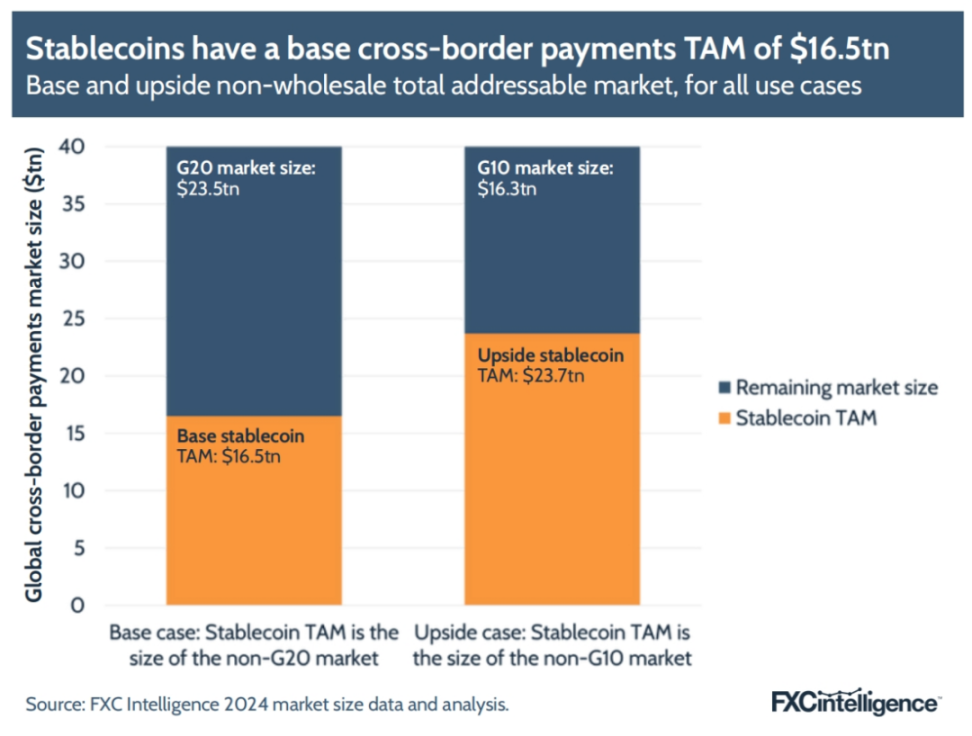

3.1 Total Addressable Market (TAM) for Stablecoins in Cross-Border Payments

Data previously released by FXC Intelligence indicates that the total global cross-border payment scale (including wholesale business) is about $194.8 trillion in 2024, with the non-wholesale portion being $40 trillion. Currently, the actual scale of stablecoins in cross-border payments remains at the "tens of billions" level, accounting for less than 1% of the overall market. However, its addressable market (TAM) is much higher than this.

Kendall from Paxos pointed out, "The total market capitalization of stablecoins is now about $250 billion—this is hardly anything. Once fully scaled, I believe it will result from regulated institutions like ours collaborating with trillion-dollar capital providers."

To define the addressable market for stablecoin cross-border payments, it is essential to focus on the regions where companies report fund flows: emerging markets. Mason from Orbital summarized, "The most profitable segments globally are the three funding channels below. Traditional transaction banks make a fortune in these channels, with opaque fees and slow processing times, leading to significant pain points:

From developed markets to emerging markets;

From emerging markets to developed markets;

Interflows between emerging markets.

This opportunity is also reflected in Fireblocks' own business landscape. Shaulov stated that the primary regional channels the company currently serves include: bidirectional flows between Latin America and the United States, Europe; bidirectional flows between Africa and Europe and parts of the United States; and exchanges between the Asia-Pacific region and the United States, Europe.

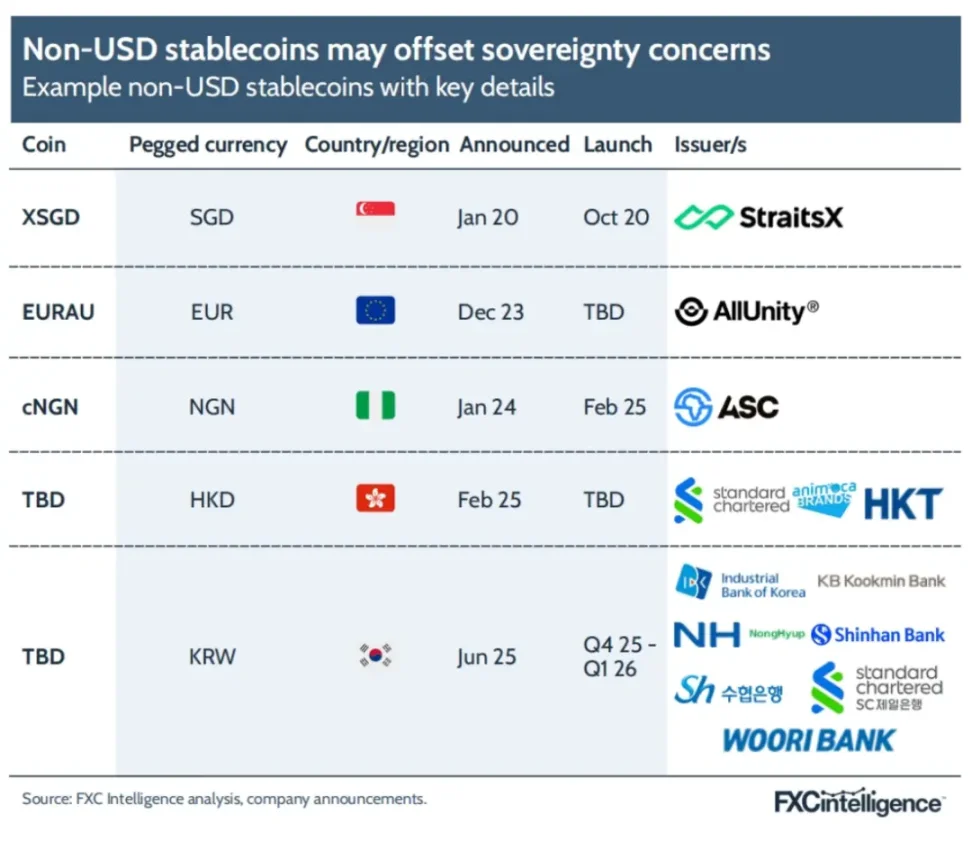

Based on this, a reasonable framework is to lock in the main opportunities for stablecoins in markets outside the G20, followed by markets outside the G10 (Belgium, Canada, France, Germany, Italy, Japan, Netherlands, Sweden, Switzerland, the United Kingdom, and the United States).

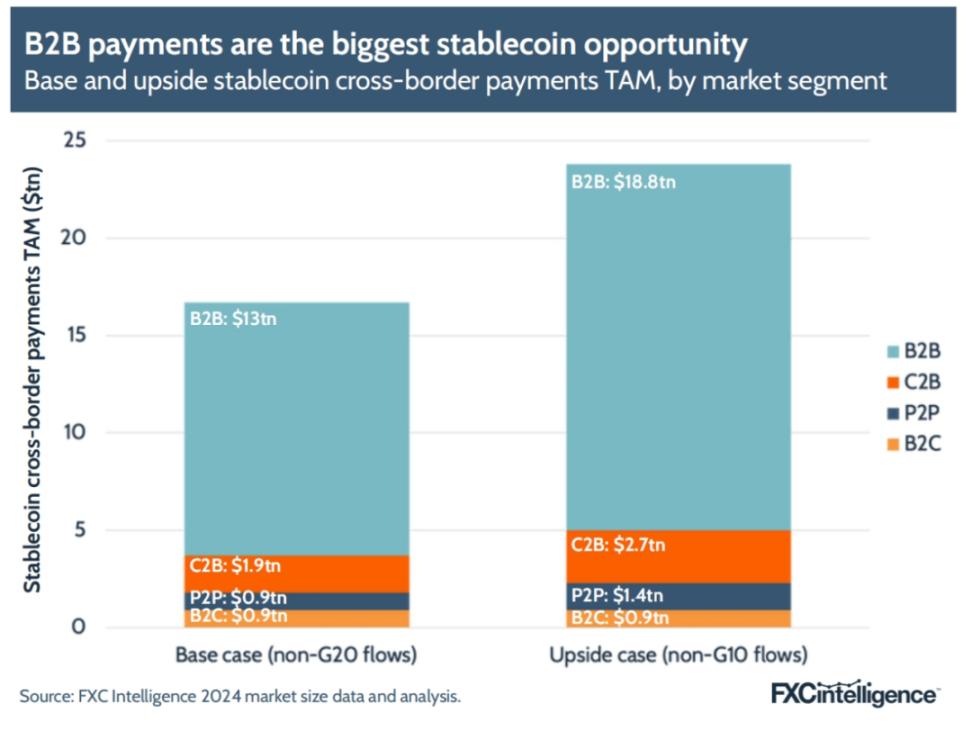

Therefore, we consider the "non-G20 market" as the baseline addressable market (base TAM) and the "non-G10 market" as the optimistic addressable market (upside case). Within this framework, the baseline addressable market size for stablecoin cross-border payments is currently $16.5 trillion, covering 41% of the total non-wholesale market; while the optimistic addressable market size reaches $23.7 trillion, accounting for 59% of the non-wholesale market.

In terms of segmented scenarios, B2B is undoubtedly still the largest opportunity, which is also true in fiat cross-border payments; however, the differences between G10 and G20 lead to a significant gap between the baseline and optimistic scenarios.

Although China belongs to the G20 rather than the G10, it is one of the main capital-exporting countries, making it a key contributor to the optimistic scenario. Besides China, several other countries have significantly raised the TAM for specific scenarios. For example, in C2C remittances, the gap between the baseline and optimistic scenarios is the largest because the G10 does not include the core C2C exporting countries in the G20—besides China, there are Saudi Arabia, Russia, the UAE, and India.

However, although emerging markets are currently the main addressable market, this situation may not last forever. Some participants, like BVNK, have found that other markets are also beginning to contribute a small amount of flow.

Harmse from BVNK said, "We have observed flows in the 'East-West' direction, for example, sending money from Hong Kong to the United States can sometimes be very difficult, even though the financial infrastructure in both places is quite developed. A lot of our business volume actually comes from B2B payments between global companies, and these transactions do not always involve emerging markets."

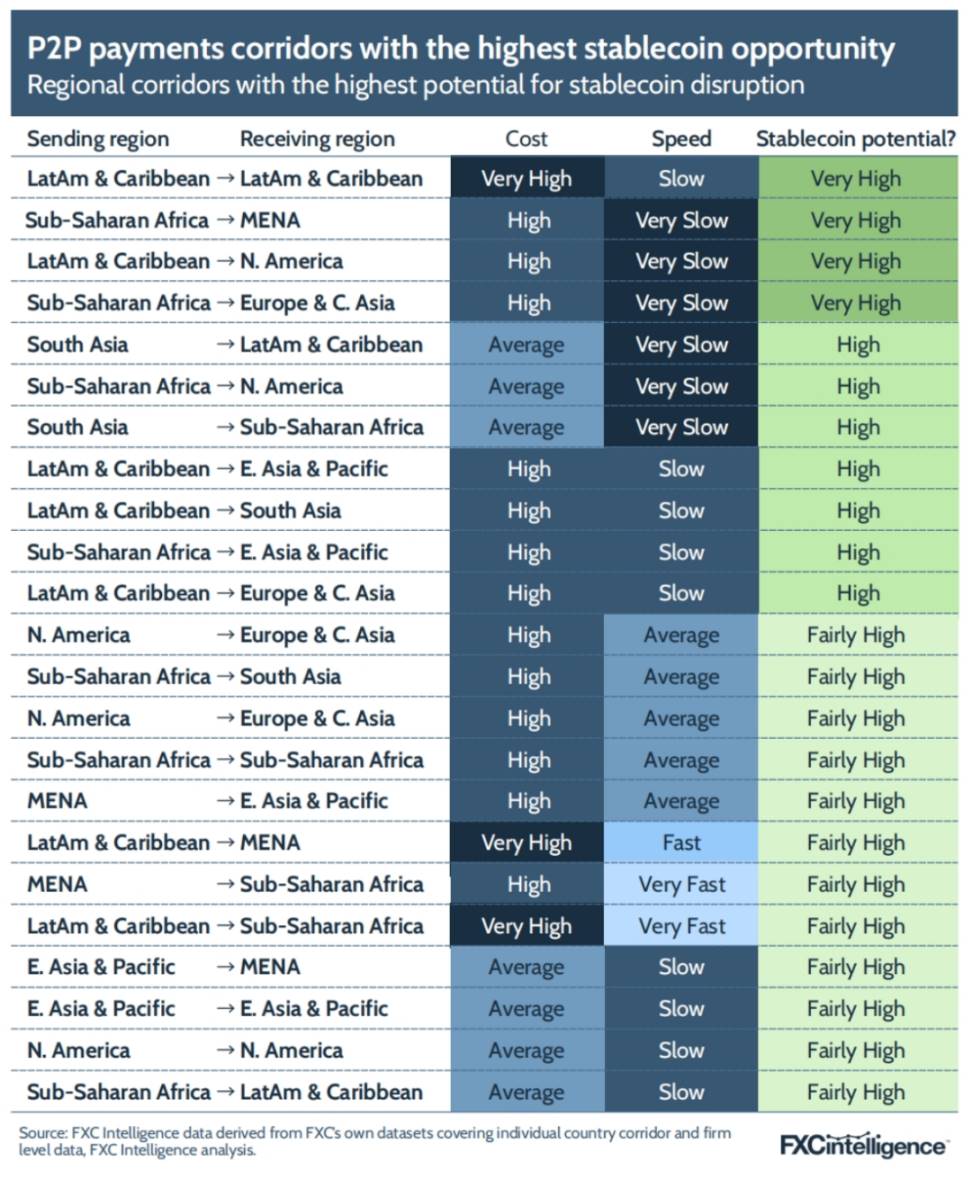

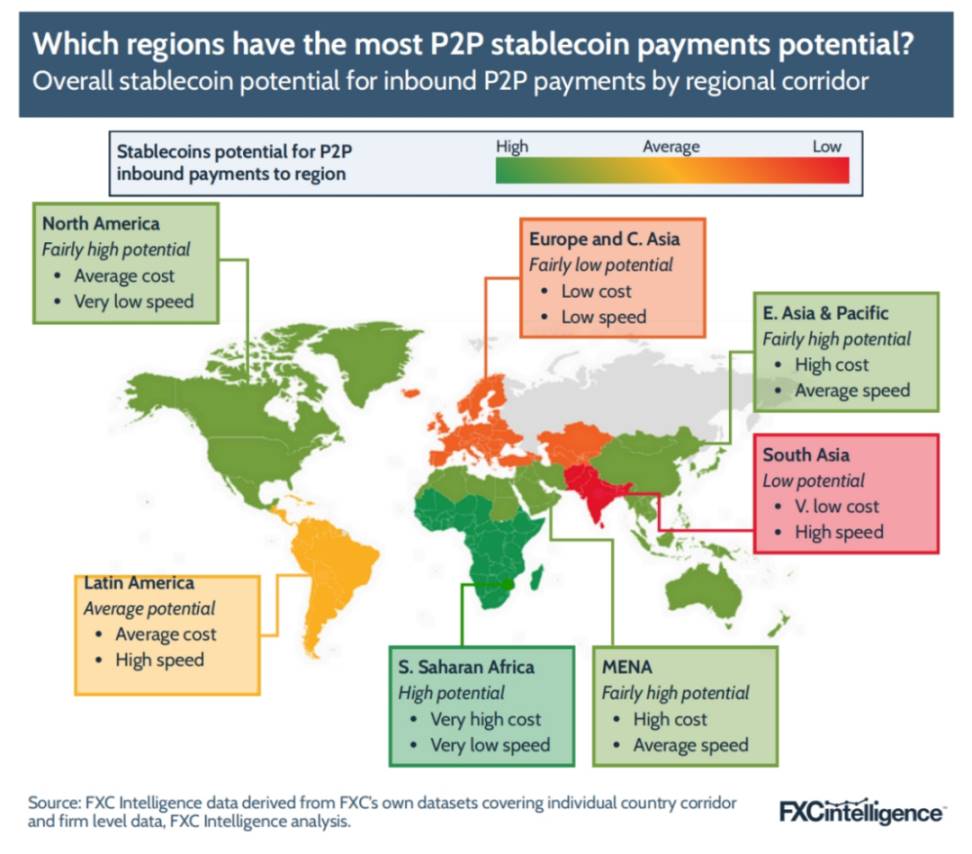

3.2 Regions with the Highest Potential for C2C Stablecoin Payments

The global opportunities have provided a rough outline, but when segmented by region, it becomes clearer where stablecoins can specifically land in cross-border payments.

In providing retail pricing data for the Financial Stability Board (FSB) "Annual Progress Report on Cross-Border Payments" to monitor the progress of the G20 cross-border payment roadmap, FXC Intelligence calculated the average costs and timeliness of different payment types across global regional channels. By mapping prices and speeds, it is possible to determine which channels offer the greatest opportunities for stablecoin payments.

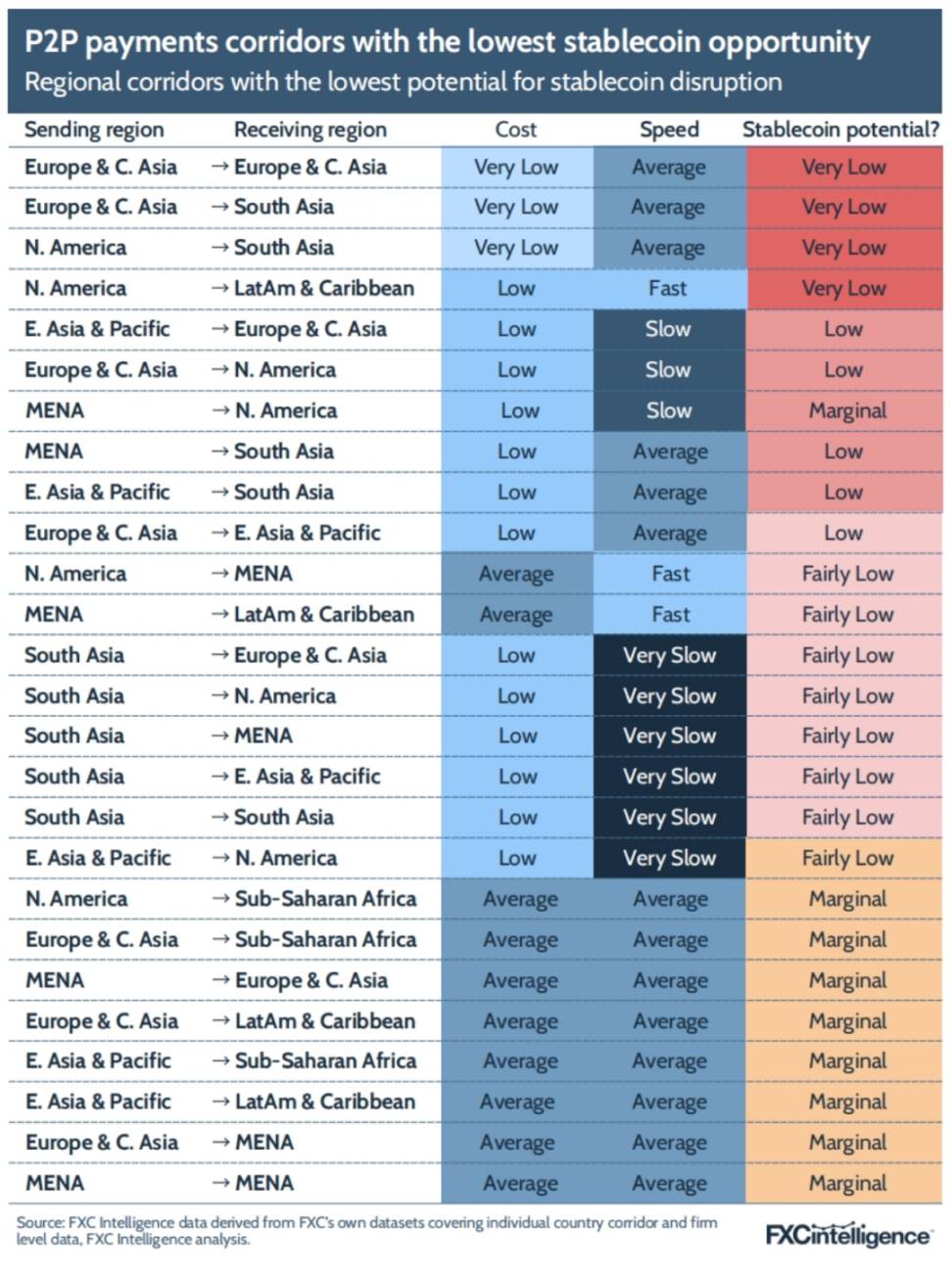

In the C2C sector, the following regions stand out due to their high average costs and slow average timeliness:

Cross-border remittances within Latin America and the Caribbean;

Sub-Saharan Africa → Middle East and North Africa (MENA);

Latin America and the Caribbean → North America;

Sub-Saharan Africa → Europe and Central Asia.

However, there are also some channels where C2C payments currently have low potential for stablecoins, due to their already low or very low costs and average speeds that are at or above average. These channels include: cross-border remittances within Europe and Central Asia, remittances from Europe and Central Asia to South Asia, and remittances from North America to South Asia or Latin America and the Caribbean.

From the global average remittance data, Sub-Saharan Africa has the highest overall potential—extremely high average costs and extremely low average speeds; South Asia, as a destination for C2C cross-border remittances, has lower potential.

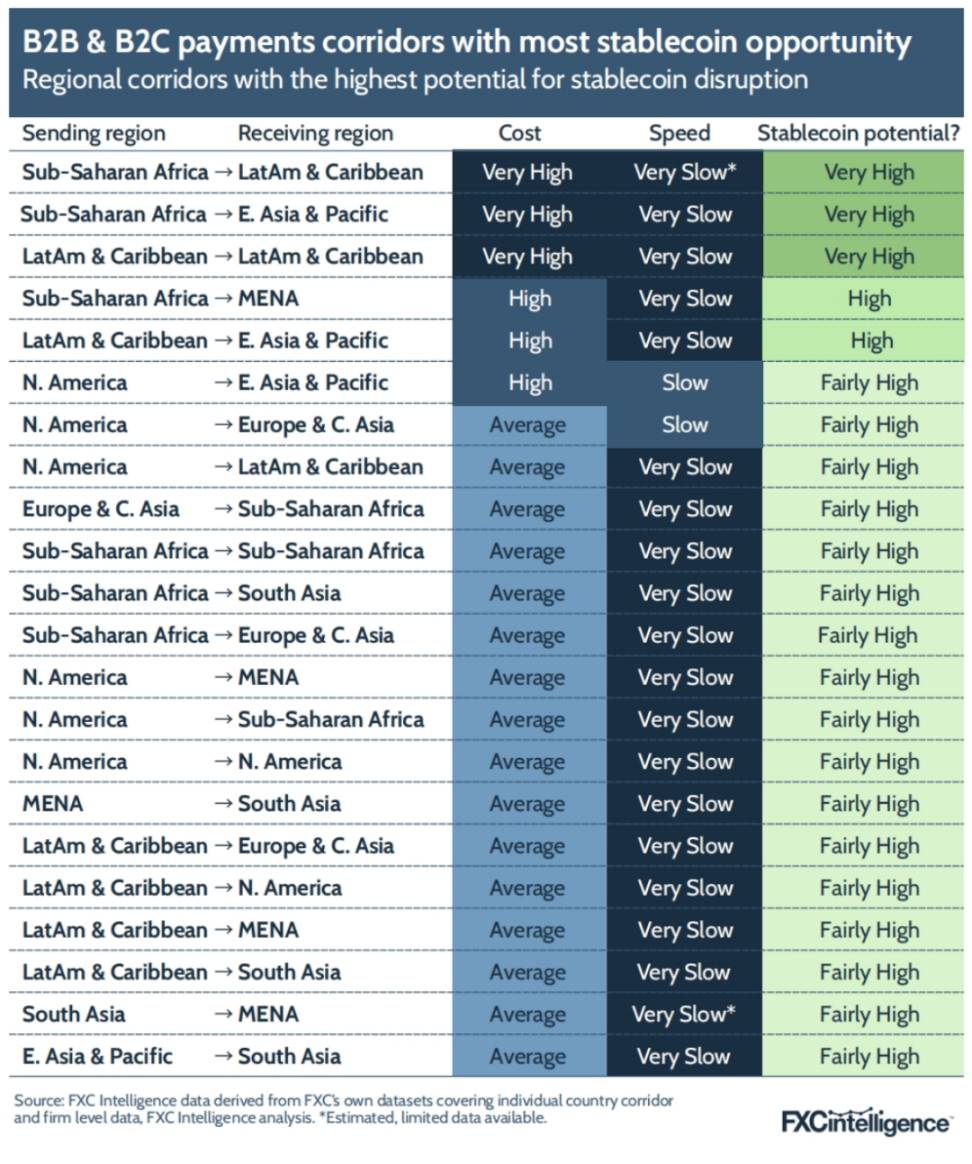

3.3 Regions with the Highest Potential for B2B Stablecoin Payments

However, if we combine the data for B2B and B2C payments, the situation may be slightly different—due to the different channels, costs and speeds can vary significantly. In terms of cross-border payments, the regions with the highest potential for stablecoins include:

Sub-Saharan Africa → Latin America and the Caribbean

Sub-Saharan Africa → East Asia and the Pacific

Internal channels within Latin America and the Caribbean

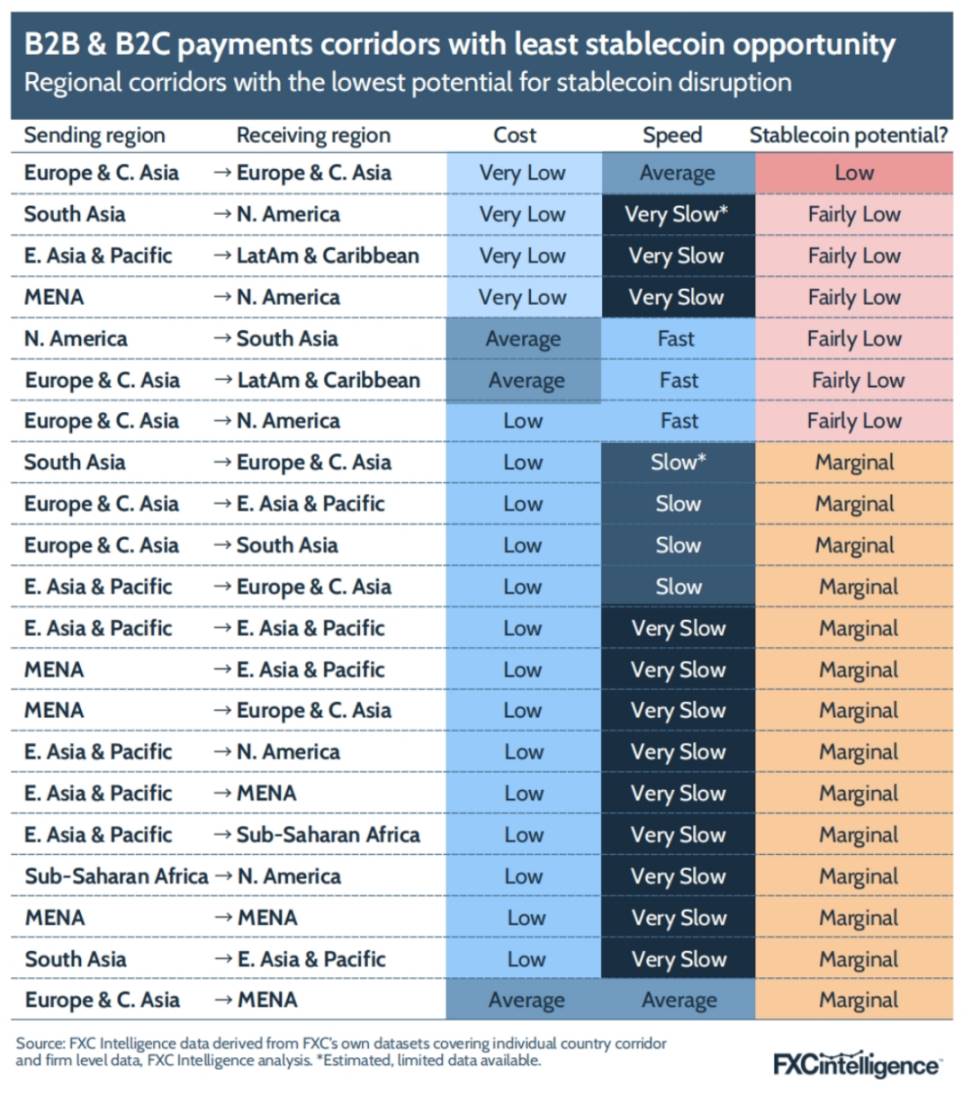

At the same time, very few regional channels have very low potential:

Payments within Europe and Central Asia, with the lowest opportunities;

Payments between South Asia and North America;

Payments from East Asia and the Pacific → Latin America and the Caribbean;

Payments from the Middle East and North Africa (MENA) → North America.

From a global perspective, Europe and Central Asia currently have the lowest potential as receiving markets for B2B and B2C cross-border stablecoin payments, although there may be exceptions in individual countries. In contrast, East Asia and the Pacific have the highest average receiving potential due to high costs and slow speeds.

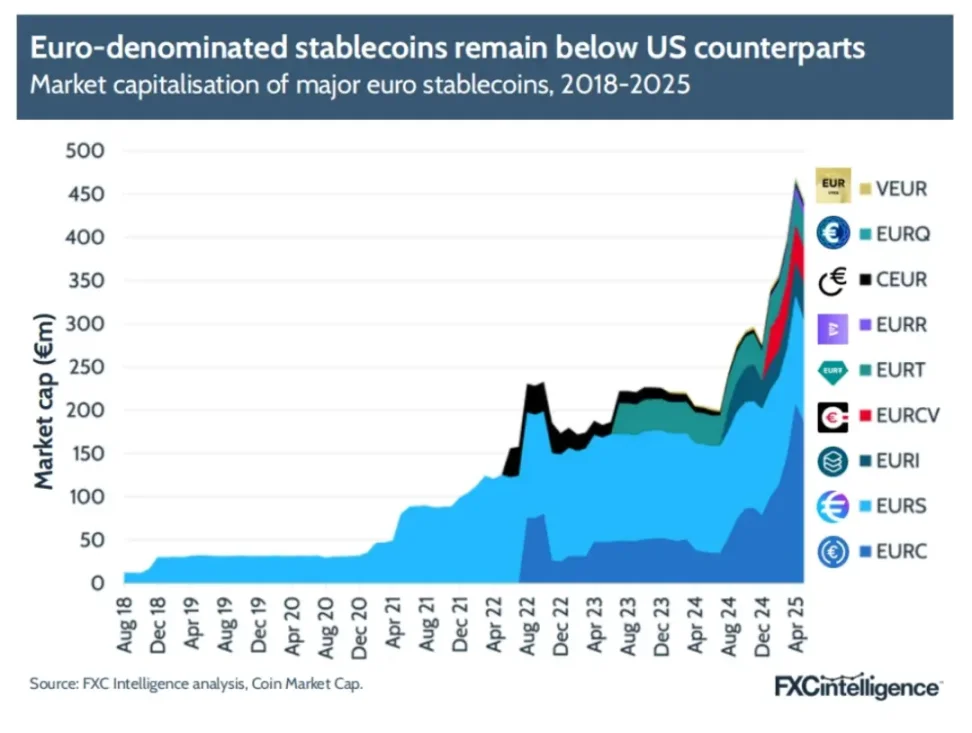

## Major Stablecoins in the Market

Although there are a variety of stablecoins available for purchase, holding, and trading in the market, not all are suitable for cross-border payments. The reasons partly lie in their design: the nature of the reserve assets, the level of transparency; and partly in liquidity—whether there are enough different currency counterparties; as well as whether they can be reliably integrated into automated technical processes and exchanged for the required fiat currency at any time.

The two truly important aspects of stablecoins are: liquidity—having enough participants in different currencies; and a non-failing API. —Farman-Farmaian, Higlobe

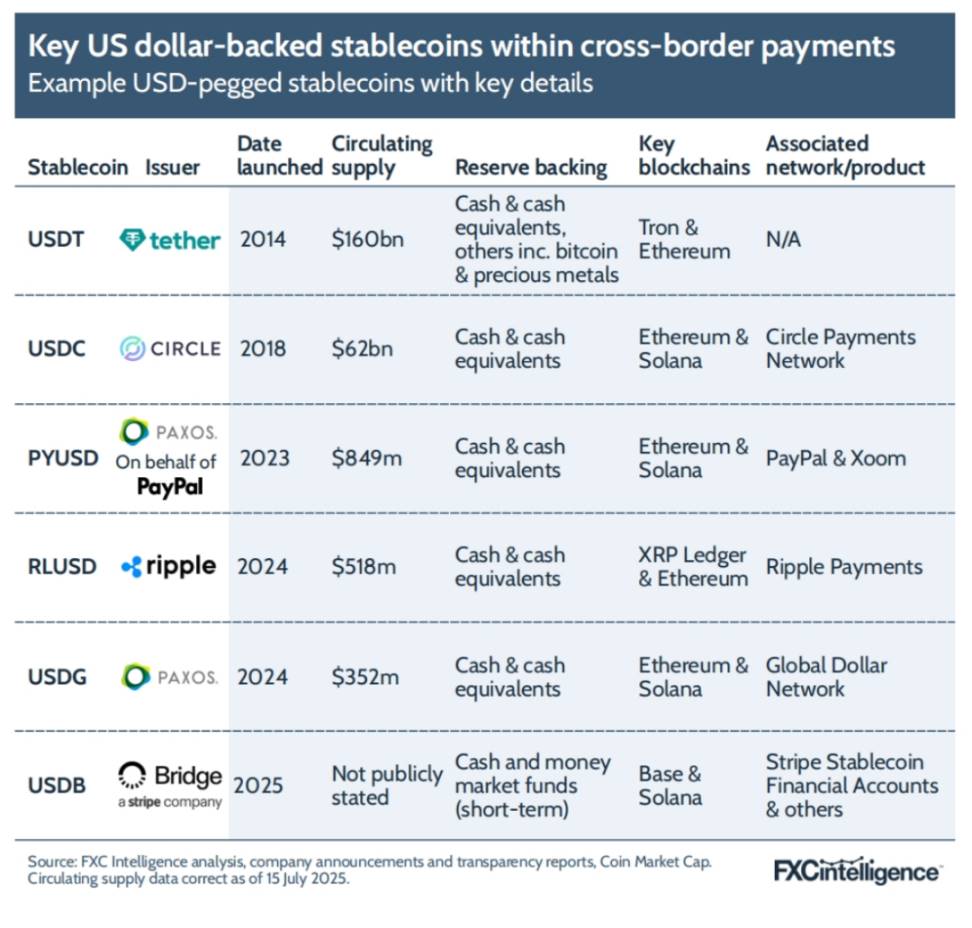

Different needs have led to different entities issuing stablecoins. In scenarios focused on cross-border payments, the overwhelming majority are pegged to the US dollar. The most well-known are Tether's USDT and Circle's USDC, both of which have the largest market capitalizations; there are also smaller circulating coins that attract attention due to the backgrounds of their issuers.

PayPal's PYUSD is still small in scale, but it has achieved steady growth due to its usability across multiple PayPal products, including Xoom remittances and PayPal checkout. Ripple launched RLUSD last year, primarily for its own blockchain network, which has long supported its cross-border payment business through the cryptocurrency XRP. The latest entrant is Paxos' Singapore branch, which issued the Global Dollar (USDG) in November. This coin aims to comply with multi-regional stablecoin regulatory frameworks and become the core of its newly launched "Global Dollar Network" payment network. Stripe's Bridge has also launched USDB, specifically for its cross-border payment solutions. Unlike other coins, USDB is not available for retail trading and is used solely as a settlement token within Bridge.

4.1 Which Stablecoins Dominate the Market?

Even in the payment sector, there are many types of stablecoins, but USDT and USDC still hold an absolute dominant position, together accounting for over 80% of the entire market capitalization. USDT remains significantly larger, making it the preferred choice for some service providers; while USDC's scale is also large enough to be the choice of many compliant institutions.

There are key differences in the reserve composition of the two, which may raise some concerns: USDT includes non-traditional assets such as Bitcoin and precious metals in a few reserves; USDC's reserves consist solely of cash and cash equivalents held by U.S. domestic banks. Additionally, USDT's reserves are held in offshore institutions, and the frequency of transparency reports is relatively low, leading some U.S. financial institutions to keep their distance. However, most institutions in the industry do not mind using USDT, and due to its large circulation, it remains necessary in certain scenarios.

Mason from Orbital stated, "I personally believe that Tether always has enough reserves to support USDT liquidity."

4.2 Differences Between Blockchains

While stablecoins are the technological core, the "track" on which they operate—blockchain—is equally critical; the capability differences between different chains directly affect their adaptability in payment scenarios.

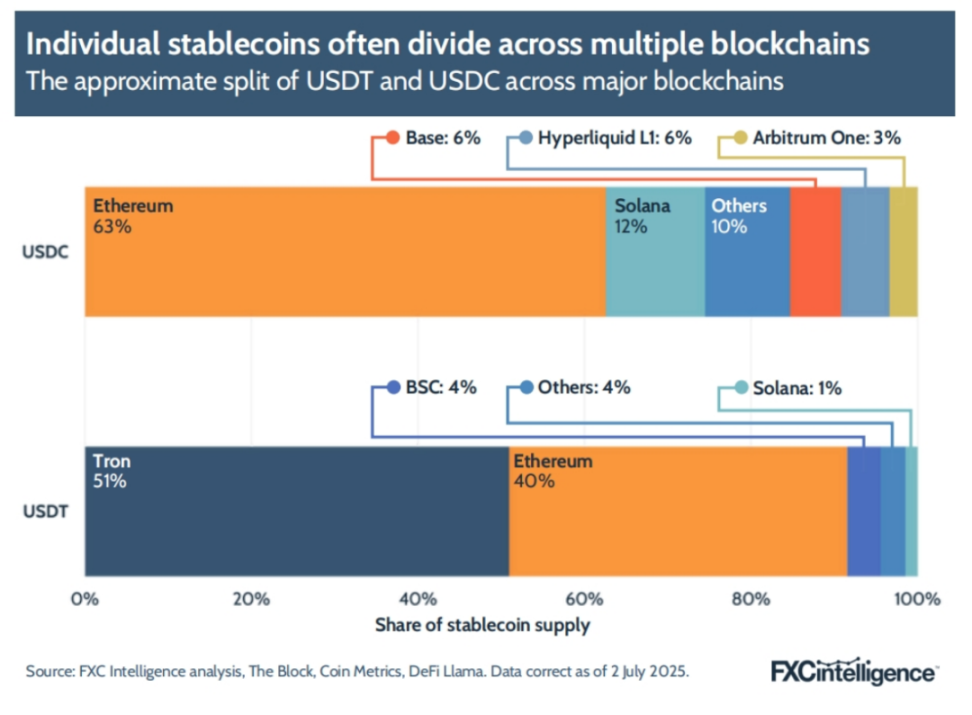

For Circle, its USDC is not limited to cross-border payments but is aimed at various uses, so the company has been promoting native issuance on as many chains as possible, currently covering 23 chains. Chandhok from Circle stated, "We have built a robust infrastructure to issue stablecoins on these chains and manage liquidity across chains." However, despite the wide coverage, USDC's circulation is still concentrated on a few chains: Ethereum accounts for 63%, followed by Solana at only 12%.

USDT is also heavily concentrated on Ethereum, with about 40% of its circulation on that chain; although this proportion is lower than USDC, the actual amount on Ethereum is greater due to USDT's larger total issuance. However, USDT's largest share is on TRON, accounting for about 51%. Circle previously issued stablecoins on TRON but decided to exit in early 2024 due to regulatory and compliance concerns.

Although companies using specific stablecoins for cross-border payments are not automatically restricted to a single blockchain, they often choose a relatively limited number of blockchains. This is because each blockchain needs to be integrated separately into their internal systems, each having different operational logic and technical standards; if stablecoins must be transferred between multiple chains, friction may arise in the process.

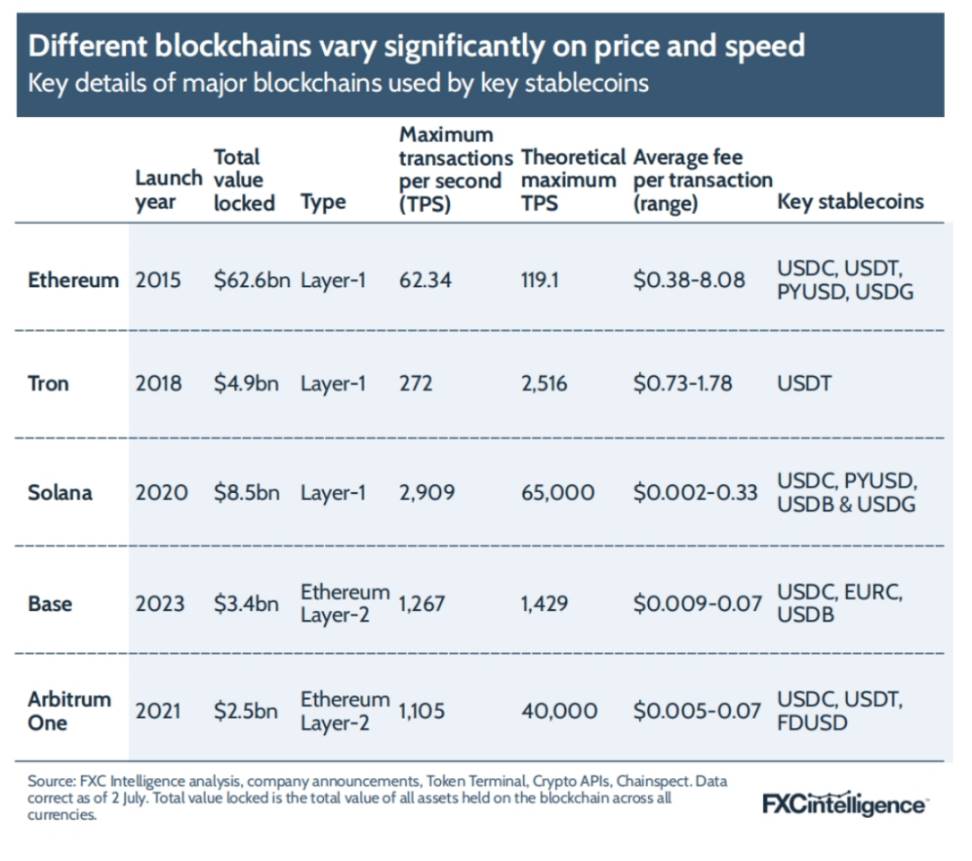

Among the blockchains favored by major cross-border payment stablecoins, they can be roughly divided into two categories: Layer-1 and Layer-2. Layer-1 is the underlying main chain, while Layer-2 is built on top of Layer-1, typically used to enhance speed and reduce costs.

In terms of "Total Value Locked" (TVL)—the total value of all digital currencies (including stablecoins and other crypto assets) on a chain—Ethereum leads by a wide margin, followed by Solana. However, there are significant differences between the two chains in terms of the number of transactions they can handle and the cost per transaction.

Ethereum's transaction speed is relatively slow: the reported maximum is about 62 transactions per second (TPS), with a theoretical limit of about 119 TPS (this number is only a rough estimate and is nearly impossible to achieve in reality due to network friction). In contrast, Solana has achieved a maximum TPS of about 2,900, with a theoretical limit believed to be as high as about 65,000. For reference, Visa's average TPS in fiscal year 2024 is about 9,600.

The differences in transfer costs between the two chains are even more pronounced. Average transaction fees fluctuate significantly over time and date, directly affecting the baseline costs for businesses. Data from Token Terminal shows that over the past year, Ethereum's average transaction fee (i.e., "Gas fee") ranged from just below $0.40 to over $8; while Solana's maximum was just above $0.03, with a minimum of less than a cent.

Despite Ethereum being relatively expensive and having a lower transaction limit, its token standard is widely supported, meaning that even without directly using Layer-1, there is still market demand for fund flows on some derivative version of Ethereum. As a result, multiple Layer-2 chains have emerged, such as Base and Arbitrum-One. They not only have higher maximum TPS and lower average fees but also offer various payment-friendly features, making them highly attractive to some service providers.

4.3 How the Use of Key Stablecoins is Evolving

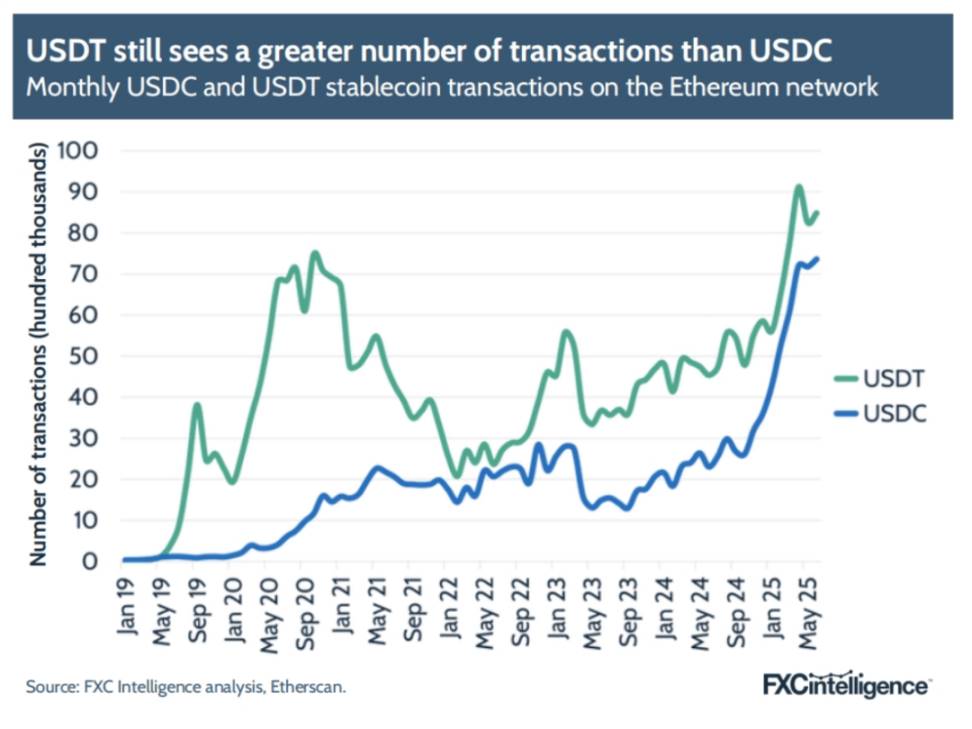

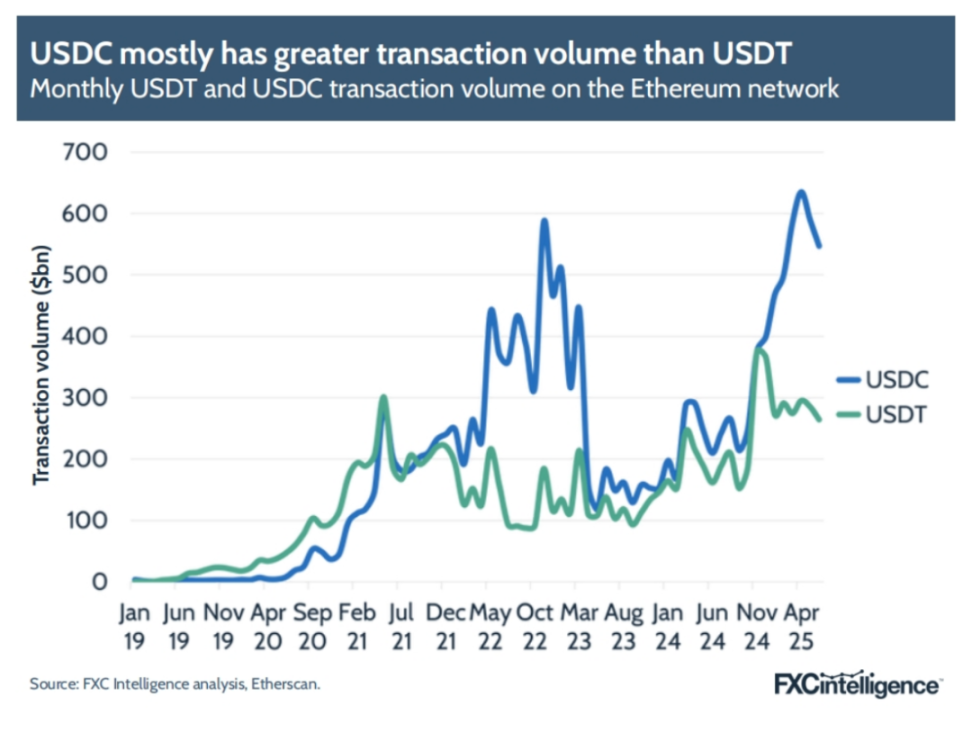

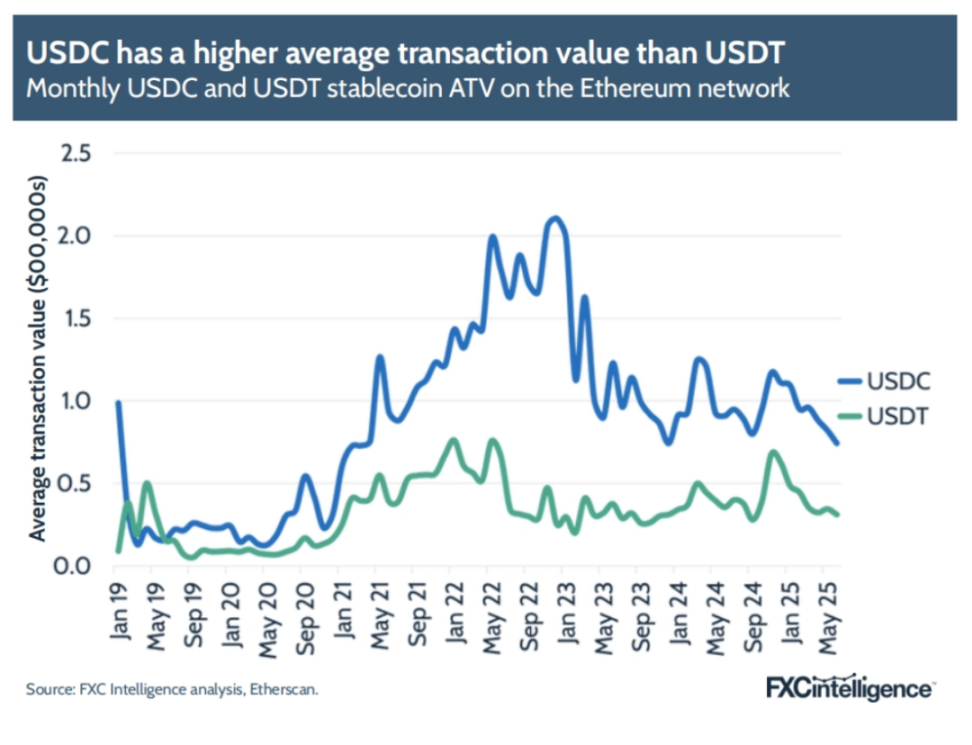

Although USDT's issuance is greater than that of USDC, transaction data from the Ethereum blockchain shows that there are differences in their usage.

Despite USDT's circulation on Ethereum being over 60% higher than that of USDC, the number of transactions for both is quite close; since the end of 2024, USDC's transaction volume has been slightly lower than that of USDT.

Meanwhile, since November 2024, the total transaction value of USDC on the blockchain (i.e., the actual value transferred using this stablecoin) has surpassed that of USDT, and this gap has significantly widened in the first half of this year.

It is currently unclear what specifically drives this trend, which may involve multiple factors. However, the payment industry's growing interest in stablecoins, with many participants clearly favoring USDC, may at least play a part.

Notably, since 2020, the average transaction amount for USDC has consistently been higher than that of USDT, indicating that at least on the Ethereum blockchain, people tend to use USDC for transferring larger amounts of money. However, this does not mean that USDT is not used for high-value transfers—both have average transaction amounts exceeding tens of thousands of dollars—but it does reflect the differences in typical application scenarios for the two stablecoins.

## Key Participants in Stablecoin Cross-Border Payments

Mapping out the core players in the stablecoin cross-border payment space is a complex task: there are a large number of companies in this field, with new small companies emerging almost every other moment; at the same time, an increasing number of "traditional finance" (TradFi) institutions are incorporating this technology into their businesses. We attempt to present the overall landscape of the current market in the following diagram. This diagram does not exhaustively list all companies involved in stablecoins but focuses on key players, both large and small, that are active in this field.

Although companies like BVNK, Fireblocks, and Bridge are involved in multiple aspects of stablecoin cross-border payments, the industry can still be segmented into several key tracks:

Stablecoin issuance and white-label issuance services: There are companies that issue stablecoins themselves and those that provide white-label issuance solutions to others.

White-label payment infrastructure (B2B2X): An increasing number of service providers offer white-label payment capabilities to other participants within the industry. Their models range from "turnkey" complete networks to merely enhancing the functionality of existing networks of mainstream payment institutions; these solutions do not directly target end users but empower other payment service providers.

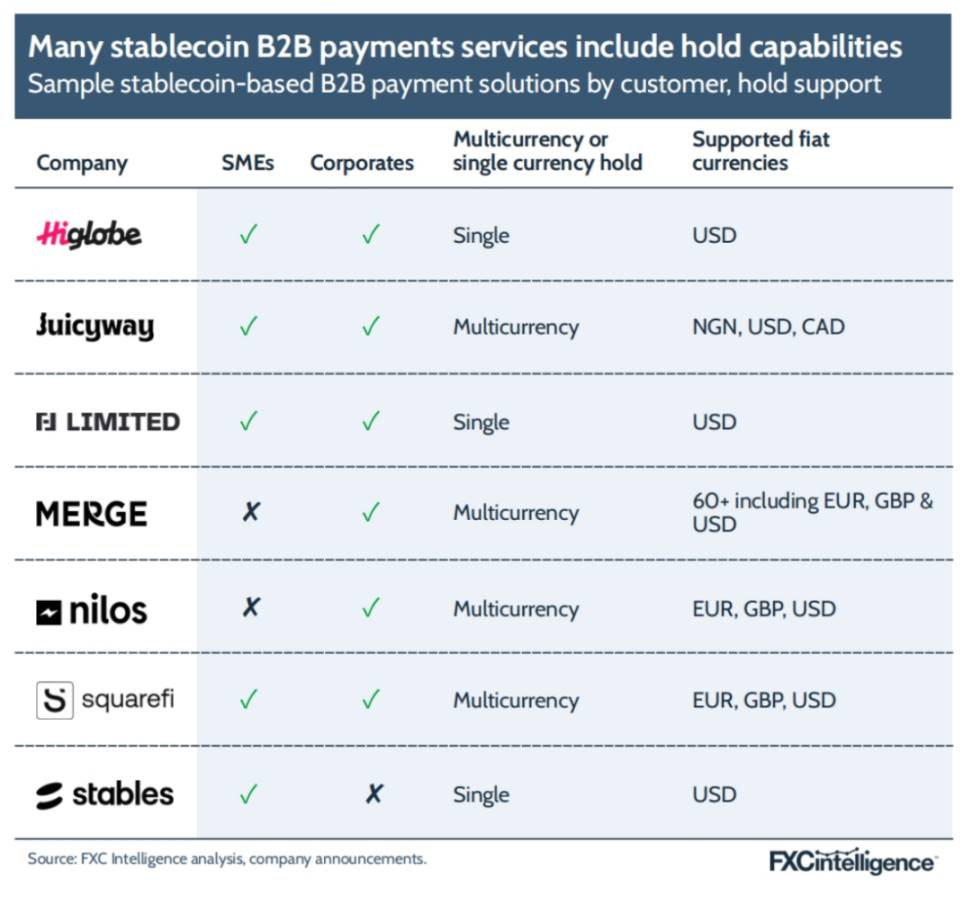

B2B payments for enterprises: Many companies provide B2B payment services directly using stablecoins, with significant variation in their customer scales.

Payroll and contractor payments: This includes service providers for payroll distribution, payments to contractors, and companies providing supporting services for freelancers receiving such payments.

Consumer remittances: Inevitably, there are also service providers focused on individual consumer remittance scenarios.

Stablecoin acquiring: This includes organizations that help merchants accept stablecoin payments, as well as a few companies providing solutions for issuing stablecoin prepaid cards and digital wallets.

## Key Opportunities and Application Scenarios

Although emerging markets are the core focus of opportunities for stablecoin cross-border payments, the wide variety of participant types reflects the emergence of increasingly diverse application scenarios, some of which derive from and promote each other.

6.1 Instant Settlement

Among the many advantages brought by stablecoins, "instant settlement" has been repeatedly mentioned by several interviewees in this report, primarily because it contrasts sharply with the settlement methods commonly used in current cross-border payments.

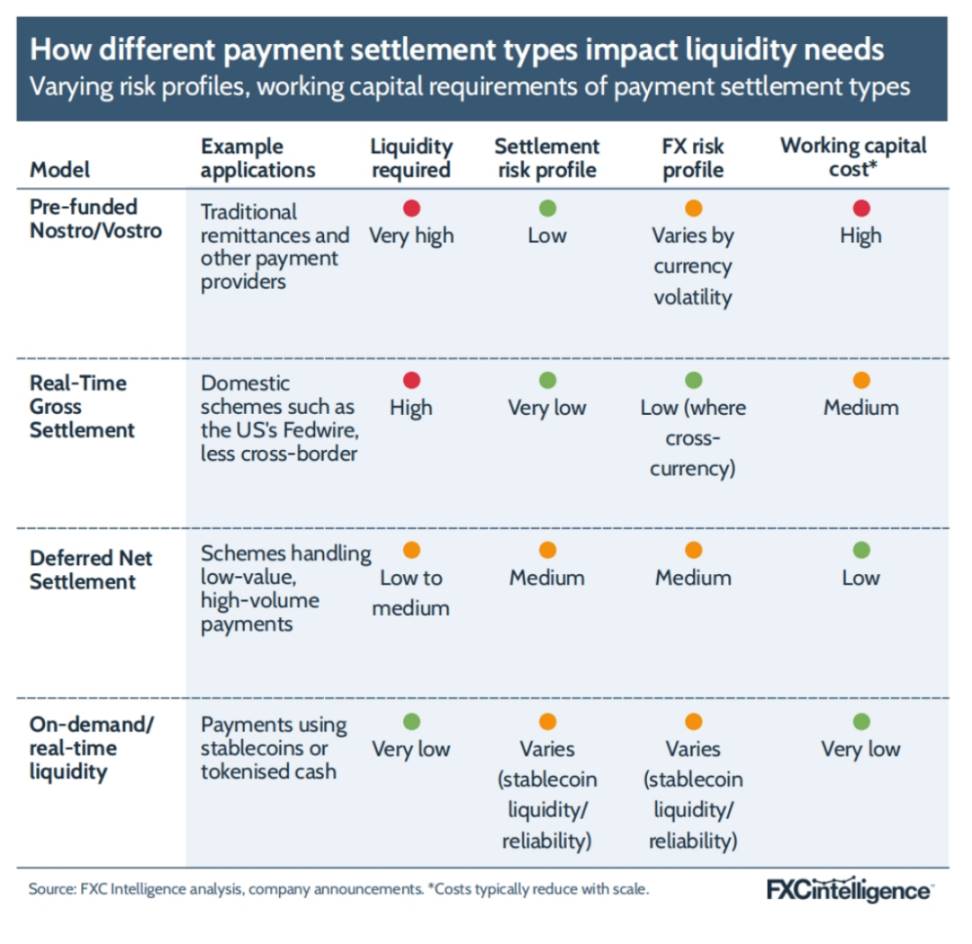

Gertman from Conduit explained, "The reason existing institutions can achieve 'instant payments' today is that they have pre-funded liquidity on both ends. If you remit money from Brazil to Europe today, as a customer, you might feel that the money arrives instantly. But underneath, there is actually a pool of euros already sitting in an account in Europe, waiting to be distributed to customers; or the European bank has provided an overdraft facility."

This common practice among traditional cross-border payment institutions typically relies on pre-funded "nostro" and "vostro" accounts—foreign currency accounts opened by domestic banks at foreign correspondent banks, referred to as "nostro" by domestic banks and "vostro" by foreign correspondent banks.

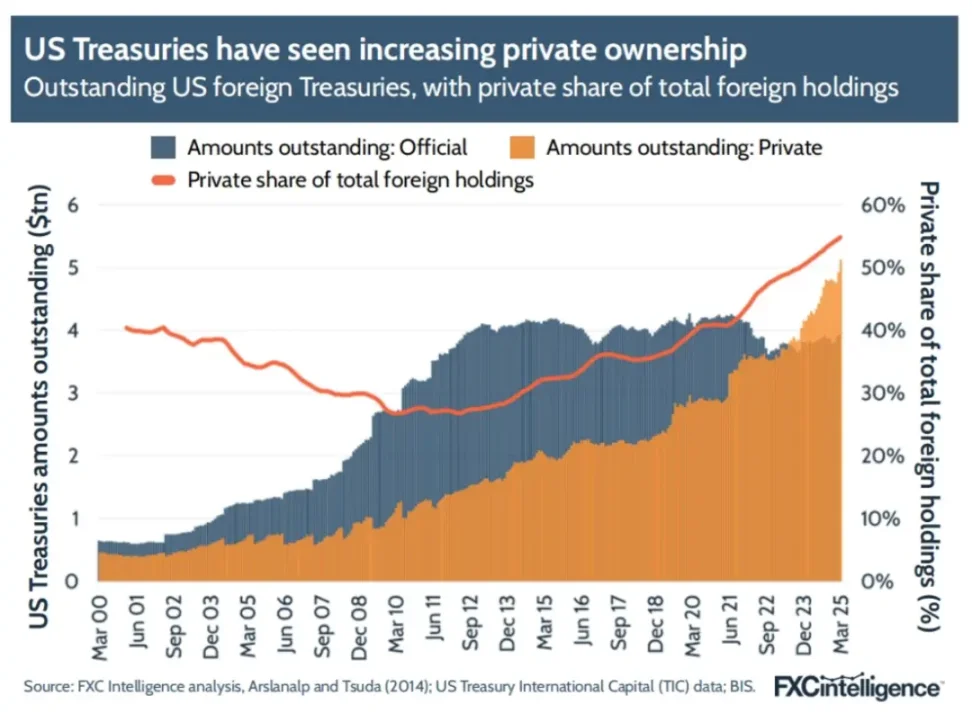

Stablecoins are often likened to "digital nostros." When you use stablecoins, you no longer need to expend effort on pre-funding. —Nikhil Chandhok, Chief Product and Technology Officer

This funding settlement solution is called "netting": it consolidates the clearing of multiple transactions, allowing companies to only cover the difference between payables and receivables. This method significantly reduces the operating capital that businesses must reserve, while stablecoins take it a step further by enabling instant settlement for each transaction.

You don't need to estimate the other party's liquidity or predict demand; you just initiate the transaction because Party A in Country A and Party B in Country B share the same ledger. —Chandhok, Circle

For industry participants, this means a substantial reduction in the working capital required for operations. Farman-Farmaian from Higlobe provided an example: "With instant settlement, I no longer need to freeze $1 million; I only need to keep $10,000 because Mastercard knows they can instantly withdraw from my account—our current working capital usage is zero."

Farman-Farmaian believes that as more institutions adopt this model, the ripple effect will be even more profound. "Currently, tens of trillions of dollars are locked in pre-funded accounts globally, which will be released in the next five years," he said. "I don't know where this money will ultimately flow, but if market efficiency improves exponentially, real financial innovation will occur." Harmse from BVNK bluntly stated, "Pre-funding has been a major problem in the payment sector that has not been effectively solved for 25 years." He defined it as "a stubborn issue at the technical level."

However, instant settlement also has potential downsides: the lack of delay means that transactions cannot be reversed during the process. Shaulov from Fireblocks pointed out, "When SWIFT was hacked, 80% of the funds were recovered because the clearing took three days, giving Deutsche Bank analysts time to roll back; but once a stablecoin wallet is compromised or sent to the wrong address, due to the instant and irreversible nature of the settlement, it becomes very difficult to recover."

At the same time, the characteristic of not needing to reserve collateral has attracted some companies to incorporate stablecoins into treasury management, with MoneyGram being one of them. However, not everyone is convinced: Wise is still observing this technology and has not yet used it for treasury operations.

6.2 Access to Dollars

While "instant settlement" is not limited to a specific market, one of the most striking use cases for stablecoins—and a major driver of their widespread adoption—is that stablecoins like USDC or USDT are essentially digital forms of the dollar. Since they are not actual dollar cash, many around the world who wish to avoid severe fluctuations in their local currency find it easier to hold them.

Mason from Orbital explained using Argentina as an example: "If you are in Argentina, you don't want to hold pesos; and due to local regulations, you may not be able to hold dollars directly, but you want exposure to dollars, so you would hold stablecoins."

Turkey is also frequently mentioned. A 2024 study by Chainalysis showed that Turkey has the highest per capita stablecoin holding rate globally, with local purchases amounting to 4% of GDP. Kendall from Paxos said, "Turkey has high inflation, and people want to immediately convert their salaries into dollars. Exchanging currency through banks is both expensive and cumbersome, so they use Tether. But they don't know it's Tether; they just see it as a cheaper dollar stored in their crypto wallets instead of bank accounts."

We may underestimate the extent to which stablecoins provide global users with exposure to dollars. The demand for dollars through stablecoins is like a faucet we just turned on. —Luke Tuttle, Chief Product Officer, MoneyGram

He described stablecoins as "democratizing the almost unlimited demand for dollars," and Chandhok from Circle shares the same view, calling access to dollar banking services "a superpower."

"Westerners don't understand this," he added, "For many businesses, especially those involved in cross-border operations, obtaining a dollar bank account is very difficult, and getting competitive foreign exchange rates is also challenging. The crypto infrastructure for dollar stablecoin exchanges, deposits, and withdrawals around the world solves these problems for them without relying on traditional banks."

However, another driver accelerating demand is the market of "remote service professionals" that emerged during the pandemic.

Farman-Farmaian from Higlobe said, "A group of high-paid individuals living abroad has emerged—not the wealthy Westerners traveling the world, but the most educated locals working remotely for Western companies, earning between local wages and U.S. wages, significantly higher than local levels."

His company provides dollar receiving accounts for contractors and businesses in emerging markets, but the key point is that funds are kept in stablecoin form until users need to spend, at which point they are instantly converted and paid through local payment networks (like Brazil's PIX). "It's like having an ATM in the air, where they can withdraw money anytime, and it arrives immediately." He explained that this liquidity available anytime and anywhere, rather than converting local currency in bulk monthly, fundamentally changes users' "relationship with money."

It's not just individuals who want to hold funds in stablecoin form. For emerging market businesses that frequently engage in cross-border transactions, retaining all or part of received funds as stablecoins is also attractive. Mason from Orbital explained, "Some companies only want to operate in the world of USDT or USDC. They don't want Mexican pesos; they prefer to hold stablecoins because they will need to make payments to others next; or they might only convert part of it to pay salaries."

6.3 B2C Payments and Stablecoin Payouts

Corresponding to the surge in demand for "holding stablecoins denominated in dollars" is the ability to "make cross-border payments with stablecoins." Shaulov from Fireblocks pointed out that this has become quite a common use case: suppose you have IT contractors in Colombia working for European or American companies, they often prefer to receive stablecoins rather than local bank wire transfers.

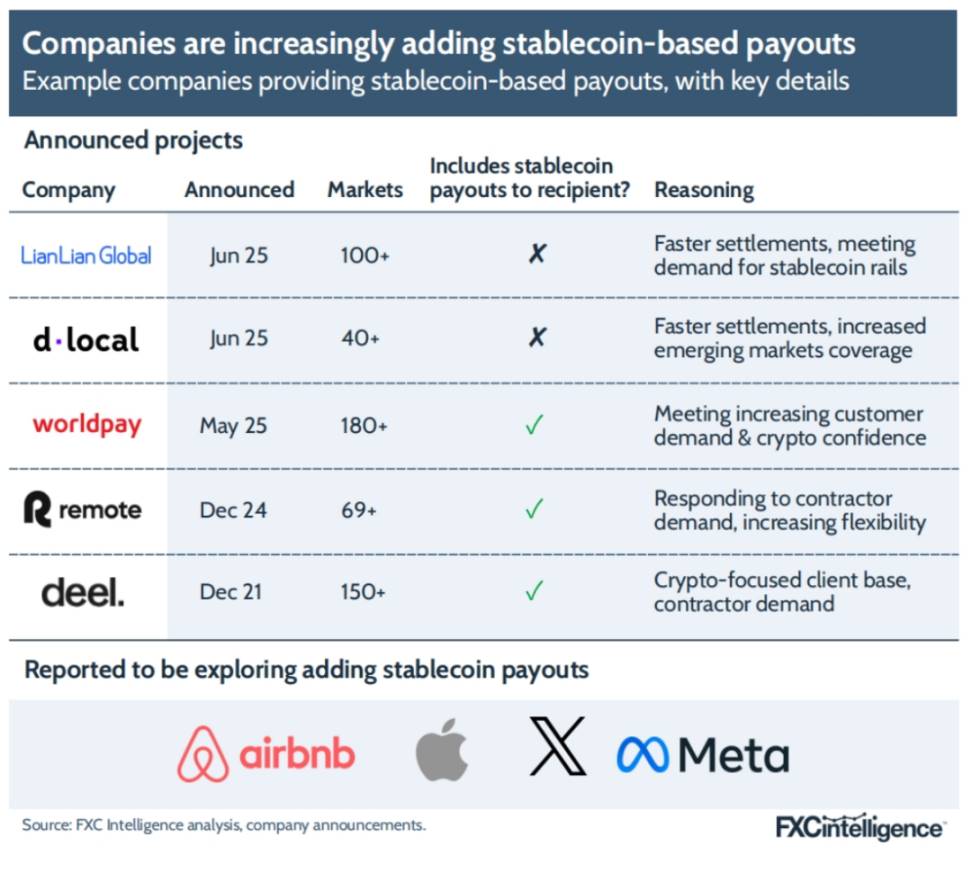

An increasing number of market platforms and payment service providers have incorporated stablecoin payments into their product stacks. One of the world's largest payment processors, Worldpay, recently launched this feature. Harmse from BVNK stated, "In fact, it is merchant demand driving PSPs to think: 'Hey, what else can we add to our payment stack?'" He added that the growing popularity of stablecoins in emerging markets is a key driver of this interest.

"Now you have a new payment technology, and users in emerging markets are expressing demand—whether it's gig economy platforms wanting to receive payments or market platforms needing to pay users or sellers." Despite the diverse payment scenarios, Barbier from Triple-A believes that paying content creators with stablecoins holds particular potential. "The beauty of stablecoins is that even very small amounts can be economically viable to receive," he said, "For example, a gamer or content creator who only earned a dollar can actually receive it—because transferring with stablecoins costs almost nothing."

6.4 B2B Payments and Trade Financing

While B2C payments are highly visible and indeed offer significant potential for many participants, in terms of funding volume, they still pale in comparison to B2B payments. Harmse from BVNK pointed out, "B2C may occupy a disproportionate amount of exposure time, but the real high volume actually occurs on the B2B side."

The adoption here also presents a ripple effect: a use case in one market can spawn more use cases.

Gertman from Conduit provided an example: some emerging market companies that primarily import choose to hold funds in stablecoins to avoid foreign exchange controls associated with fiat dollars, and then they hope to use these stablecoin balances for more transactions. "We are providing such services for them, and they are very excited. Because payments to China, for many countries globally, usually take three, four, or five business days; I've seen it take as long as seven days. But with stablecoin payments, it can arrive in minutes—though not necessarily instant, but very fast."

We are starting to see some companies that have nothing to do with Web3 or the tech industry begin to make payments using USDT or USDC. —Eric Barbier, Founder and CEO, Triple-A

Shaulov from Fireblocks also believes that the increase in the number of locally held stablecoins is a key factor driving the adoption of this technology in B2B cross-border payments. "There is now ample stablecoin in Colombia, and local importers, when sourcing from Hong Kong, find that the funding transfer method is: exporters in Hong Kong or mainland China prefer to receive USDT," he said. "Due to the large inflow, buying USDT with pesos in Colombia is actually cheaper, thus entering the trade financing scenario."

This phenomenon ultimately allows the technology to penetrate fields unrelated to early adopting industries, creating new opportunities for service providers. Barbier from Triple-A provided an example: "Some large consumer goods companies received feedback from African distributors: 'We find it difficult to obtain dollars to pay you, but we can easily get stablecoins—can we settle in stablecoins instead?' These giants naturally do not want to deal directly with crypto assets, so Triple-A comes into play."

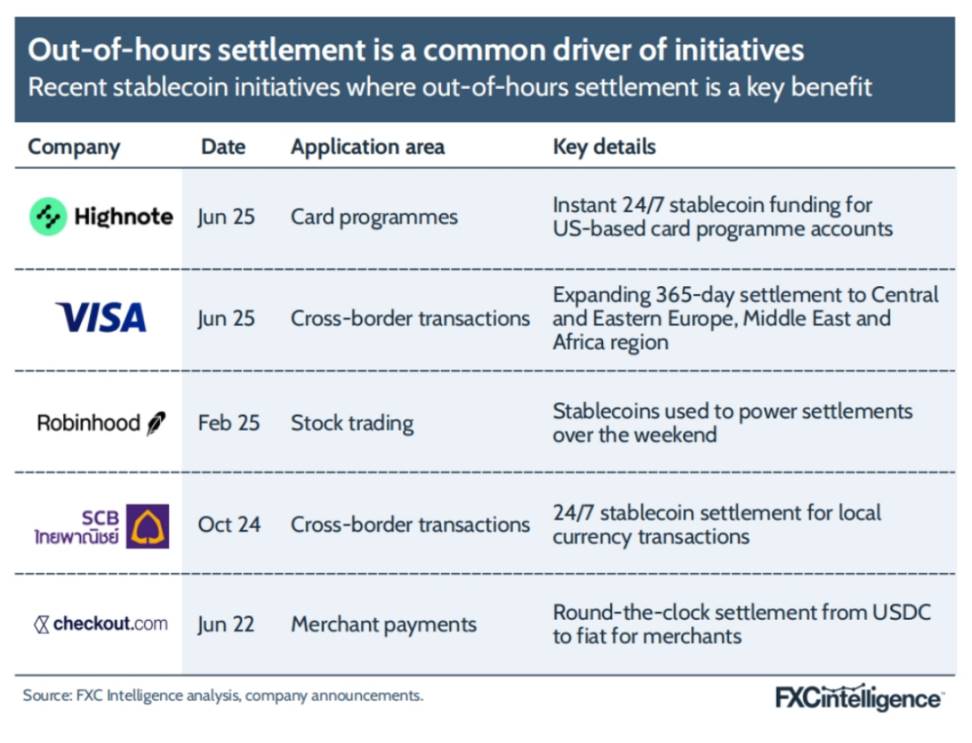

6.5 24/7 Settlement

While speed is not an issue during bank operating hours on weekdays in many regions, challenges arise on weekends, even in developed markets, especially during the settlement phase. "For some businesses, being able to settle 24/7 on weekends and holidays is a huge impact," Barbier from Triple-A stated. "For example, in the remittance industry, they need to pre-fund with outgoing partners; if they can transfer in real-time on weekends and bank holidays, it will significantly improve their working capital position."

This is one of the key reasons why MoneyGram decided to manage its treasury with stablecoins. In certain markets and scenarios, stablecoins allow for faster movement between different currencies. We often need to allocate funds to specific markets and predict the amount of currency needed over a certain period. When faced with bank channel closures on weekends, stablecoins enable us to operate around the clock, facilitating more frequent settlements and currency exchanges. —Tuttle, MoneyGram

This advantage also benefits other segments of the payment industry, including card issuing programs. The card issuer Highnote has recently adopted a stablecoin solution to address the settlement challenges during non-business hours. "In the global payment system, whether it's card organizations or projects like Highnote, we need to pre-fund four days' worth of collateral for weekends, and pre-funding is a significant challenge," said Harmse from BVNK. "The ultimate goal is to move the entire card organization settlement process onto the blockchain—from the issuing bank, processor, to Visa, acquiring banks, and merchants—using technology to solve the pre-funding issue, rather than forcing parties to lock funds in accounts for risk mitigation."

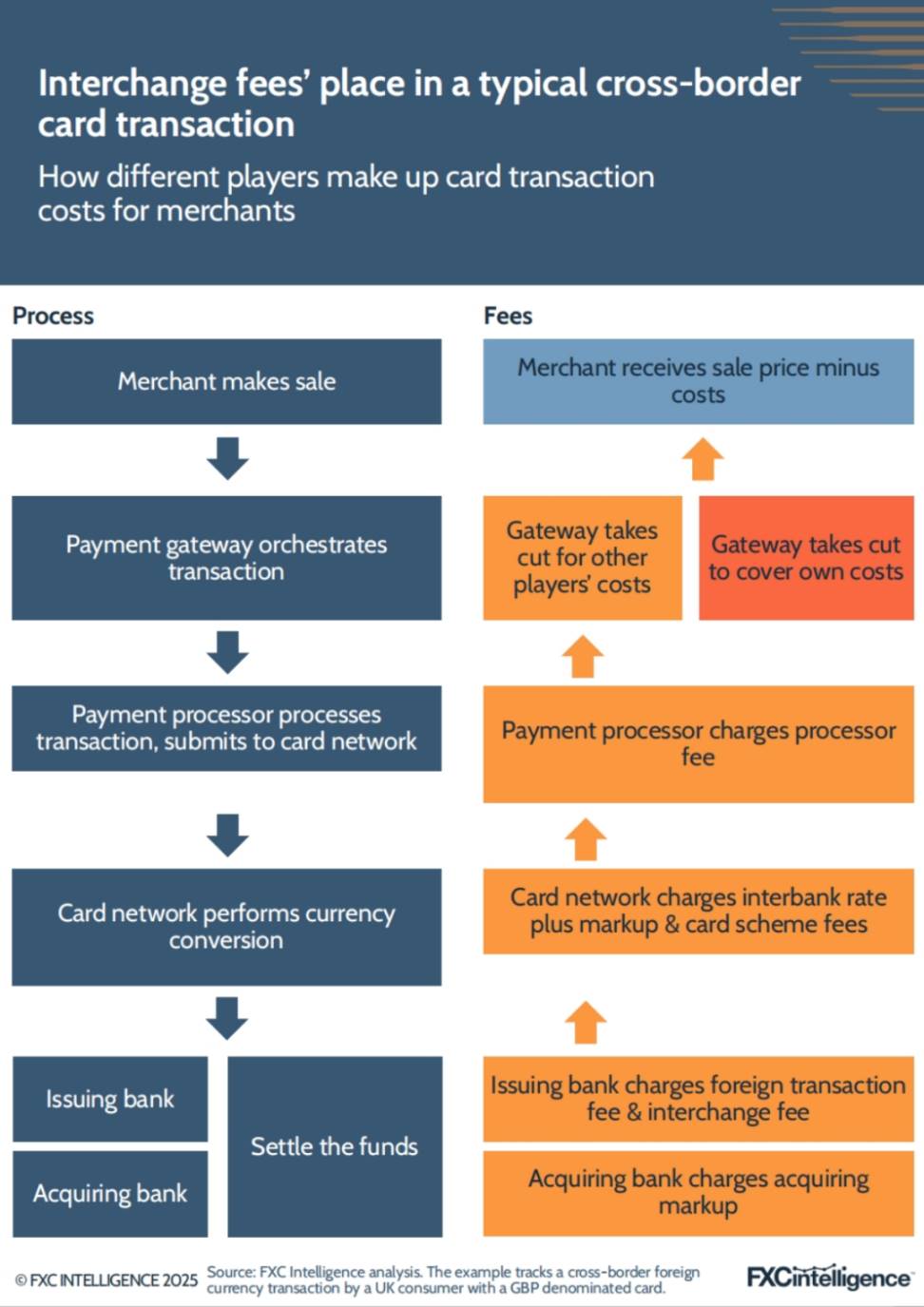

6.6 Alternatives to Credit Cards

Meanwhile, a potential application scenario emerging in certain markets is the use of stablecoins to replace credit card payments, especially in regions where payment costs are high—such as the United States, where interchange fees are particularly prominent. It is believed that this is one of the key factors driving some U.S. companies to consider launching their own stablecoins after the passage of the GENIUS Act. Amazon, in particular, has been reported to be exploring the issuance of its own stablecoin for users to hold and use for online shopping, thereby avoiding the interchange fees associated with these transactions.

In this context, stablecoins would effectively replace bank credit cards. However, not everyone agrees with this outlook.

Jack Zhang from Airwallex stated, "I still find it hard to understand why consumers would want to hold stablecoins. I earn quite a few rewards with AmEx, and Apple Pay is just a swipe away. Will Apple support stablecoins? Will all acquiring institutions accept stablecoins overnight? I think this is a trend that may happen in 5 to 10 years, or it may not happen at all."

However, Farman-Farmaian from Higlobe holds a different view, stating that the company has seen relevant signs. He pointed out that compared to card payments, QR code payments are cheaper, prompting merchants to encourage consumers to use them by offering additional drinks or food. "We believe stablecoins will erode the use of bank cards," he said, "and this is already happening in some offline, non-refundable, non-exchangeable retail scenarios."

6.7 C2B Merchant Acquiring

If stablecoins want to capture market share from bank cards, businesses must be able to accept payments in stablecoins. Some companies are building their business around this—simplifying processes to allow merchants who do not want to directly engage with stablecoins or other crypto assets to easily connect.

Barbier from Triple-A provided an example, stating that the company's initial concept was "to enable merchants to sell goods to 500 million stablecoin or digital currency holders, but ultimately settle in dollars or euros to their bank accounts. Our merchants choose us because they never actually hold digital currency on their balance sheets."

BVNK launched its stablecoin acquiring product "in the past two to three years." Harmse noted that while this product was relatively niche in vertical markets before, it has recently begun to "accelerate penetration." "The acquiring side is a sleeping giant. It used to be a non-mainstream use case that could only scale by delving into e-commerce," he said, adding that recent growth is partly due to the popularity of stablecoins in key markets. "We have seen that because Argentine users have stablecoins, they want to spend, which in turn drives the demand for deposits."

This growth is also supported by several recent developments, including Shopify adding stablecoin payment functionality to its platform and a shift in the industry's overall attitude toward crypto technology.

The reputational risks associated with stablecoins and crypto assets are fading, making it easier to persuade merchants; meanwhile, the actual adoption rate among end users is rapidly climbing. The demand for accepting stablecoin payments is increasing quickly. —Barbier, Triple-A

While users from developed markets account for a significant proportion due to their high spending power, most transactions still come from users in emerging markets—who often face obstacles when using traditional payment tools for international payments.

"There is no fraud risk, and no chargeback risk, so accepting stablecoins is safer compared to credit cards—especially in cross-border scenarios targeting emerging markets," Barbier cited the luxury e-commerce platform Farfetch, which is using Triple-A's stablecoin payment service. "Luxury goods are considered high-risk categories by card organizations; if you are in Kenya and want to make a payment, the card gateway will likely reject the card due to concerns about chargebacks. Thus, the only option for this Kenyan user is to pay international merchants with stablecoins—this is precisely the problem we aim to solve."

However, like many other stablecoin scenarios, this use case has not yet seen widespread demand globally, and some remain skeptical about its development potential. Jack Zhang from Airwallex stated, "I have not seen the mainstream population willing to hold stablecoins unless they can spend the money; currently, only Visa and Mastercard have strong enough network effects to issue stablecoin-based cards for consumption. I have not seen widespread adoption of 'spending anywhere.' There may be some closed-loop use cases, but closed channels have existed for twenty years."

6.8 Stablecoin Debit Cards

Finally, although stablecoins are seen as alternatives to bank cards, many stablecoin wallets still come with virtual or physical cards, typically allowing users to directly spend their wallet balances on e-commerce platforms and in offline retail.

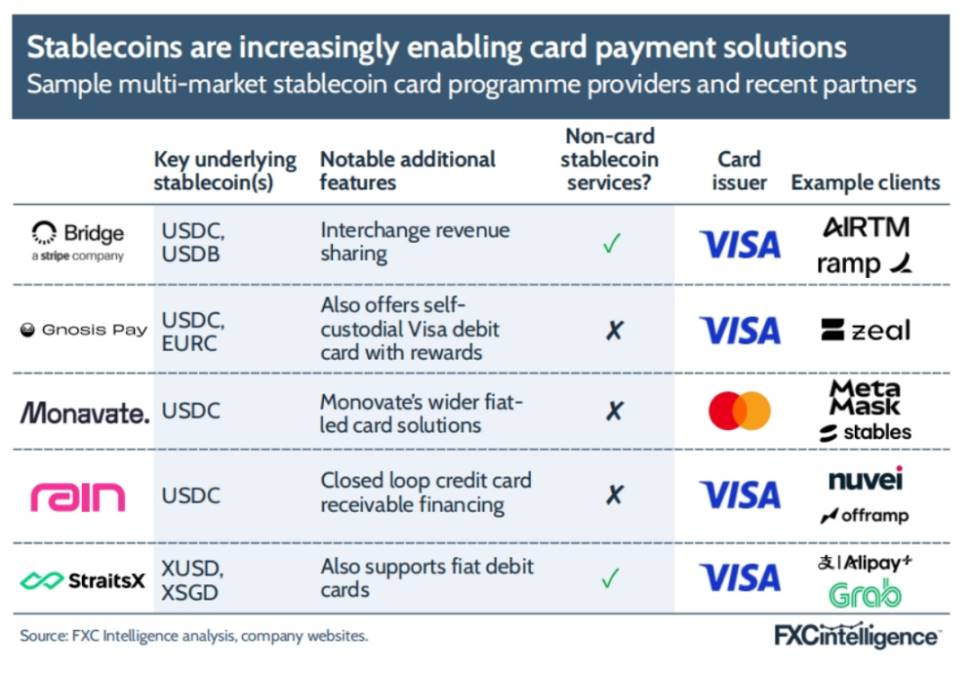

This has given rise to an expanding multi-market card project market, with providers like Bridge, Rain, and StraitsX offering such solutions, becoming a core product for consumer brands. Currently, the types of customers for these projects are diverse: many are institutions providing services around stablecoins, such as account products for individuals or businesses, usually accompanied by deposit and withdrawal functions; at the same time, an increasing number of traditional fiat currency-dominated brands are looking to incorporate stablecoin capabilities, and card projects provide users with a familiar and convenient entry point.

7. Challenges to Overcome for Stablecoin Payment Applications

Although we can see many use cases of stablecoin payments in real scenarios above, this is still a glimpse based on the current $250 billion stablecoin supply market. Imagine in the coming years, if the stablecoin supply reaches $2 trillion, what challenges will we need to overcome in this process?

First and foremost, it is essential to integrate or complement traditional payment pathways, which brings us back to the question of whether stablecoins have a price cost advantage. Secondly, the emergence of large-scale payment scenarios depends on whether the market has sufficient liquidity to support it. Then, we return to compliance issues: how to address traditional companies' concerns about entering stablecoin payments?

7.1 Price Cost Advantage of Stablecoins

In terms of pricing, some claim that stablecoins are inherently cheaper than existing cross-border payment systems, but the reality is more complex. Current evidence suggests that stablecoins are indeed cheaper in certain markets. However, due to the relatively small scale of current participants and some companies still using subsidies to acquire customers, it remains unclear whether this cost advantage can be sustained across all regions as the market develops—or whether costs can be further reduced as scale increases.

For consumer-facing companies like Sling Money, the goal remains to continuously lower prices. "We want to bring remittance fees down to nearly zero and make the entire process extremely simple," said Hudack from Sling Money. "Whether you are sitting next to me or 3,000 miles away, I should be able to send you money for free or almost free with just a few clicks. Stablecoins make this possible: this is a true underlying technological revolution."

However, this goal aligns with the fiat platform Wise. Wise is a global remittance and payment giant, and its CFO Emmanuel Thomassin does not believe stablecoins can outcompete Wise in its key markets. "The reality is that remitting with stablecoins is still more expensive than using Wise on most routes," Thomassin stated. "Of course, there may be exceptions for certain currency corridors considered 'high risk' by traditional financial institutions; similarly, in markets facing hyperinflation and continuous currency depreciation, this technology may have advantages."

Stablecoins work well for certain markets, but they are not universally applicable; in more liquid markets, the gap is gradually narrowing. —Chris Harmse, BVNK

Meanwhile, other practitioners believe the current situation is "mixed": not all corridors are cheaper, but some stablecoin corridors do indeed offer benefits. Dimitrova from OpenPayd stated, "I can't assert that all corridors are cheaper all the time. But in the corridors where we observe advantages, most of the time they are indeed more efficient."

Our own research also confirms this disparity. We selected three stablecoin-based providers and compared their "bank-to-bank" personal remittance costs on major corridors with the exchange rate data from non-stablecoin service providers during the same period. The results showed:

In many corridors, there is indeed a stablecoin solution that is cheaper than the average price of non-stablecoin options;

However, not all corridors have stablecoin average prices lower than non-stablecoin average prices;

Only a very few corridors have stablecoin average prices lower than the average price of "the cheapest non-stablecoin player";

Overall, emerging market corridors are more likely to show a price advantage for stablecoins.

This aligns with the observations of white-label service providers.

As transaction volumes move on-chain, costs have significantly decreased. In some exotic markets, traditional channels remain slow and expensive, while stablecoin solutions have already matched or even surpassed them in many cases. Currently, they can almost compete with ultra-large liquidity markets like the euro to dollar exchange—though not yet fully equivalent, they are very close. —Chris Harmse, BVNK

7.2 Composition of Stablecoin Costs

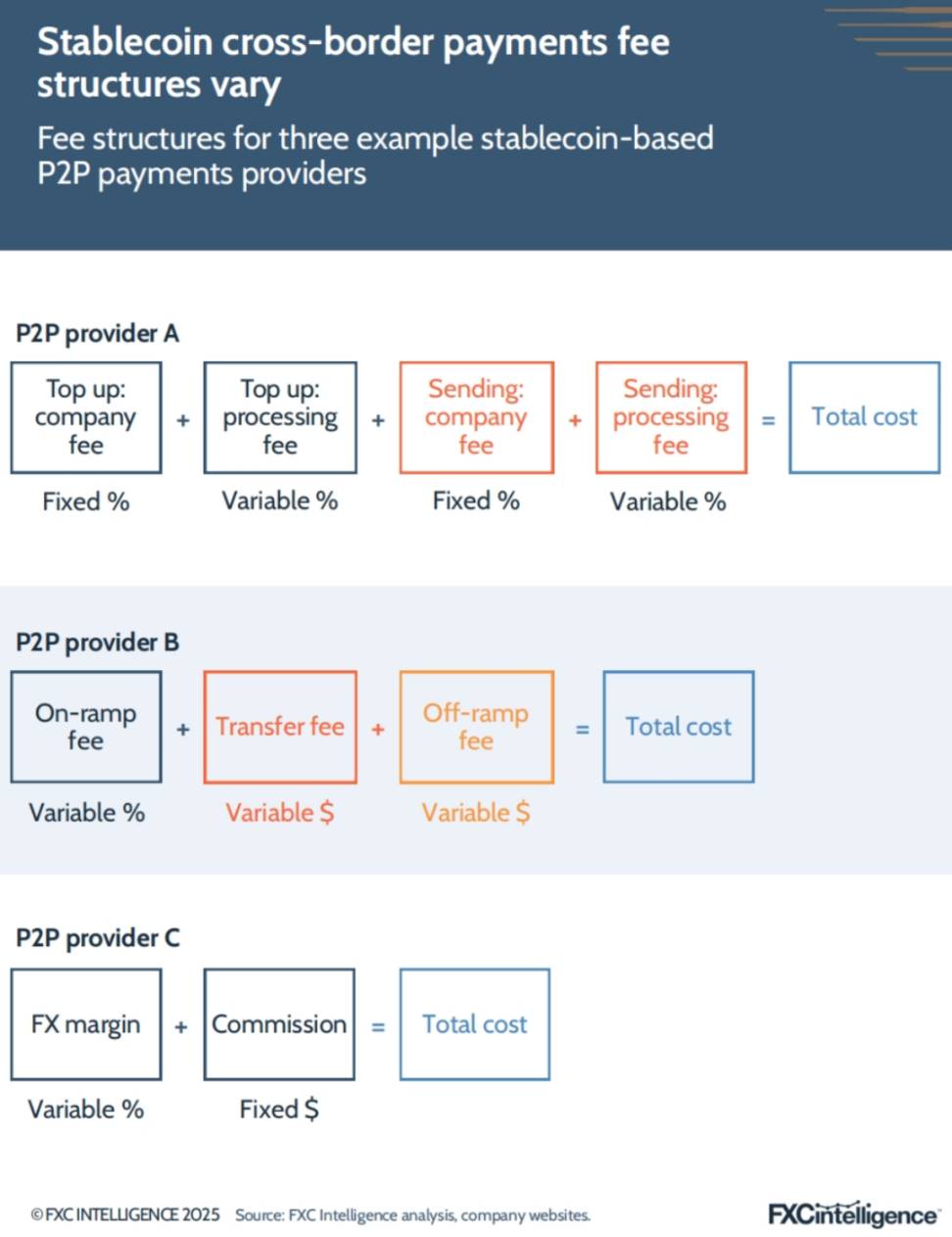

For consumer remittance service providers, how to disclose the cost structure of using stablecoins to customers varies significantly among companies. Some continue to use the pricing methods of traditional fiat service providers, breaking down costs into "exchange rate markup + fees"; others decompose the price further, directly corresponding to the costs of each step in cross-border stablecoin payments.

In short, the costs of cross-border stablecoin transfers can be divided into three segments:

On-Ramp Cost: Converting the sending country's currency into stablecoins;

On-Chain Transfer Cost: Sending stablecoins on the blockchain to the receiving country;

Off-Ramp Cost: Converting stablecoins into the recipient's local currency.

The on-chain transfer itself can be very low-cost if the right blockchain is chosen—this is the main source of the claim that "stablecoins are cheaper." However, the real cost burden lies at the "on-ramp" and "off-ramp" ends. In the past, these two steps were inefficient and expensive, often undermining the promotion of "ultra-low costs."

"The last mile must be fast and cheap, ideally instant. But until recently, this step was actually very inefficient," explained Gertman from Conduit, noting that the crux of the issue is that most companies can only rely on exchanges to complete the off-ramp, "exchanges are almost the only channel that can directly convert stablecoins into local fiat." Our research found that the rates using exchanges often match or even exceed those of traditional remittance companies, becoming a roadblock to lowering stablecoin prices.

Now, more and more companies are beginning to collaborate with local banks to make the on/off-ramp processes faster, cheaper, and more transparent.

"We are now directly connecting with local banks, which provides more liquidity," Gertman cited an example: Conduit collaborates with the Brazilian bank Braza, where users initiate payments in Brazilian Reais (BRL), which are immediately minted into the BRL-pegged stablecoin BBRL; then, it is exchanged on-chain for a Euro-pegged stablecoin, almost instantaneously; finally, the Euro stablecoin is destroyed, and the Euros are directly transferred to the recipient's account. The entire process takes 120 seconds, end-to-end two minutes.

Instant settlement also eliminates the cost of maintaining a liquidity pool, which many believe is key to achieving low prices.

"Compared to traditional fund flows, there are fewer steps: the blockchain itself is the ledger, eliminating the need to maintain a centralized ledger; client software interacts directly on-chain," said Hudack from Sling Money. However, he also acknowledged that the "last mile" costs of fiat channels like ACH or RTP are "the same as everyone else's." "Viewing funds as a native digital commodity inherently brings great efficiency."

However, once this low-cost strategy becomes widespread among consumers, Farman-Farmaian from Higlobe believes a "price war to the bottom" will ensue. Higlobe's mission is "to enable global funds to flow instantly and at zero cost," but where will the profits come from? He anticipates that the industry will shift to a service model: instant transfers will become "the standard," and real revenue will come from value-added services like loans.

The industry will ultimately resemble Amazon: instant fund flows will become a zero-profit foundational service, with profits derived from other value-added services within the ecosystem. —Farman-Farmaian, Higlobe

7.3 Liquidity Dilemma

Despite the industry's overwhelming optimism about the potential of stablecoins, there are still recognized challenges that need to be addressed. One of the core issues is sufficient liquidity: ensuring that funds can be quickly moved on and off the chain in the target market. In other words, it is essential to guarantee that there is enough demand for stablecoins on the other end to both "on-ramp" and "off-ramp" funds in the desired market.

Mason from Orbital pointed out, "Every buy order must have a sell order, and vice versa. Currently, the most liquid stablecoin globally is USDT. If I want to make a $20 million transaction in Vietnam, USDT is the only currency with sufficient depth."

Insufficient liquidity directly affects companies' choices regarding which stablecoin to use for large transactions—high-value payments often can only be made with USDT due to the lack of depth in other currencies. He added, "Tether has actively improved this situation in certain scenarios, especially in commodity trading where there is a high demand for capital, providing substantial proprietary capital for trade financing and other uses."

Of course, there are still more use cases that require larger-scale liquidity, but overall market growth is gradually making liquidity more accessible.

Currently, the number of stablecoins in various markets may not be sufficient to support corporate treasury-level fund movements for companies like Coca-Cola.

As the next wave of adopters joins, liquidity will continue to grow—especially with giants like Glencore, Rio Tinto, or Trafigura starting to use stablecoins, which will naturally drive more liquidity. —Mike Hudack, Co-founder & CEO, Sling Money

In addition to the entry of large fund movers, the market's shift in perception of "stablecoins = dollar equivalents" is also seen as key to further expansion. "Stablecoin must be viewed as cash to stimulate demand for dollar stablecoins in these countries, thereby creating a highly liquid foreign exchange trading market," pointed out Chandhok from Circle.

7.4 Regulation and Compliance

At the same time, there are still potential challenges regarding regulation and compliance, especially since many core regulatory frameworks are still being developed or have just been implemented. The issue lies not in the regulatory requirements themselves, but in the lack of experience many institutions have regarding "how to compliantly use stablecoins in practice," leading to uncertainty.

Shaulov from Fireblocks stated, "From an adoption perspective, the biggest obstacle is: 'If I want to incorporate it into my internal systems, how can I reassure my compliance team? How do I identify the receiving wallet? What are the specific obligations under the Travel Rule? How should transaction monitoring be conducted?' The regulatory guidance hasn't changed, but the implementation methods differ, so the core issue is education."

He cited the Travel Rule as an example: multiple jurisdictions require that when blockchain digital currency transactions exceed a certain amount, customer personal information must be attached to curb money laundering and terrorist financing. This differs from SWIFT, where the screening is done by the sending and receiving institutions, and confusion often arises in practice due to unclear details.

"For example, if you send money to a non-custodial wallet, the recipient may not know how to respond to the Travel Rule," Shaulov added. "Under certain interpretations, sending funds to a non-custodial wallet does not require strict compliance, but you cannot confirm whether the recipient is indeed a non-custodial wallet. Therefore, the relevant agreements and processes differ from traditional practices."

At the same time, others have pointed out that other steps in the process may pose compliance risks. Jack Zhang from Airwallex believes that the on-ramp stage itself presents challenges. "In the on-ramp phase, tracing the source of funds for stablecoins remains very difficult," he said. This refers to the fact that stablecoins are not directly issued by the issuer in fiat currency but are obtained through transactions with other entities. "You can convert clean money into stablecoins and then complete the off-ramp; but if a stablecoin appears out of nowhere and lacks an e-commerce transaction background, it will trigger a lot of regulatory issues. One of the biggest challenges is how to trace the source of funds." "Therefore, a distribution network is crucial: when you have a large number of quality customers and sufficient clean funds, you can smoothly convert fiat into stablecoins and build various financial services around stablecoins."

However, Circle's view is quite the opposite: compared to fiat, stablecoins offer greater transparency, which actually reduces systemic risk. "Stablecoins are inherently more reliable and have lower counterparty risk," Chandhok said. "Every transaction is on-chain and fully visible. From the perspective of combating financial crime, the data available is far greater than in the past—when you could only rely on bank private accounts and on-site inspections."

## The Rise of Stablecoin Payment Networks

While some companies' entire business strategy is to provide stablecoin-based cross-border payment services directly to end users (whether businesses or individuals), more companies are offering white-labeled "stablecoin network" capabilities to other businesses. This is actually one of the reasons for addressing the challenges of stablecoins, as a single "stablecoin network" can achieve lower costs, stronger liquidity, and more compliant operations.

For many companies that have been deeply engaged in the cross-border payment space, a complete shift to stablecoins is not realistic; however, embedding stablecoin solutions into their existing networks and using them "partially or fully" for payments in specific corridors is an extremely attractive path—likely to become the dominant way for stablecoins to penetrate the cross-border payment field.

In this model, customers often neither know nor care whether their funds are circulating through stablecoins; it is also difficult for outsiders to see which institutions have adopted stablecoins in which corridors. Currently, there are likely more players using this technology in secret than are publicly disclosed, with even more observing and testing the waters, but we cannot accurately quantify their industry share.

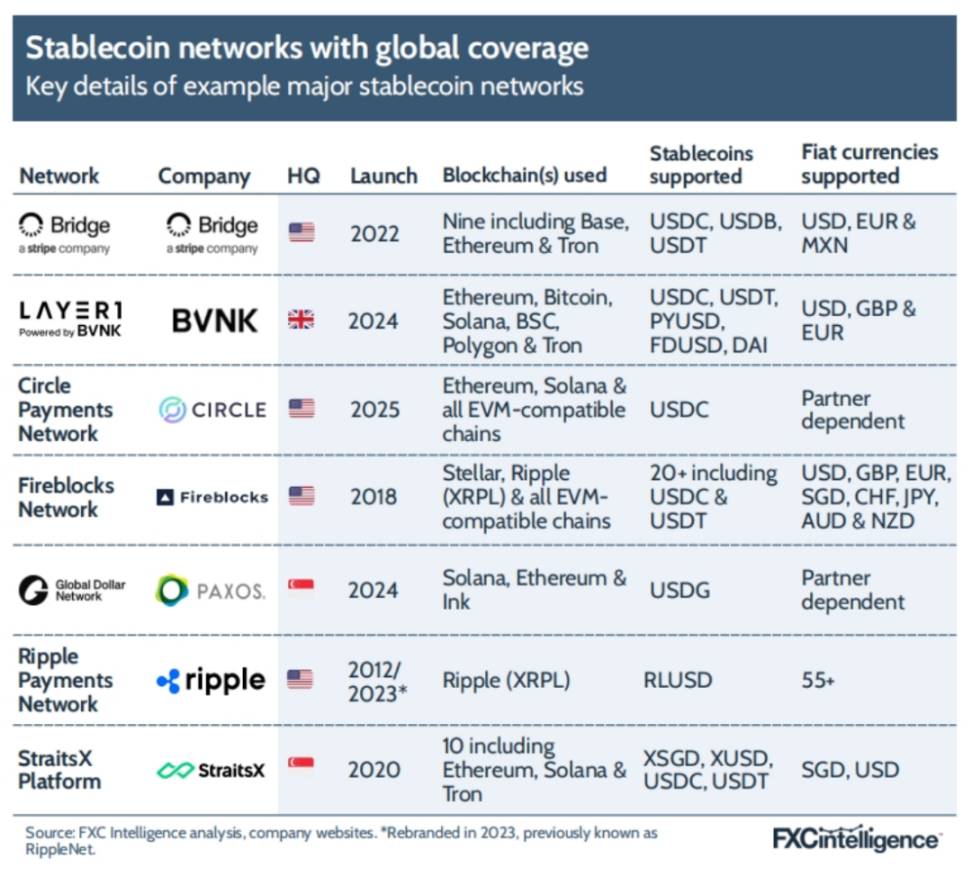

However, solutions targeting this market are emerging one after another, indicating that the field is expanding. Stablecoin service providers centered around B2B2X (such as BVNK, Fireblocks, StraitsX) have existed for some time; recently, more formal, plug-and-play network-level solutions have also begun to appear.

For example, BVNK launched Layer1 last year—a self-custodied, self-managed digital asset payment infrastructure that automates key processes. Harmse from BVNK stated, "Many fintech companies are using solutions like Layer1 to build different payment scenarios on top of stablecoins. We have unlocked a new type of customer—enterprise-level payment service providers: they start by collaborating with us on the regulated side, but they know they will eventually obtain their own licenses, so they want to build on a highly optimized global stablecoin payment stack now. This is exciting."

At the same time, traditional institutions known for issuing stablecoins are also beginning to launch networks focused on stablecoins. For example, Paxos has released the Global Dollar Network, and Circle has launched the Circle Payments Network (CPN).

The Circle Payments Network targets financial institutions, acting as a "market matching layer": Circle establishes unified rules and protocols that allow different participants to interconnect and interact as local channels, eliminating the need for separate risk assessments for each partner. The CPN network charges basis point-level fees for each transaction, designed for institutions that are optimistic about the technology but have concerns about risks and technical processes, helping them enter the market as fund senders and create additional revenue as recipients. In Europe, CPN is supported by Deutsche Bank, Santander Bank, Société Générale, and Standard Chartered Bank, built on USDC and Circle's smaller Euro stablecoin EURC.

We are essentially building a technical layer that allows both parties to transact through stablecoins without prior acquaintance. Although CPN members will still assess based on their own risk frameworks, we show both parties the due diligence standards of CPN and inform them: Party A and Party B have both passed our due diligence process, and we consider them trustworthy. —Chandhok, Circle

So far, Circle has attracted a large number of institutions to join its network. On the stablecoin side, there are both native crypto companies and regionally or sectorally specialized institutions, such as Yellow Card focusing on Africa, as well as BVNK, Conduit, Triple-A, Fireblocks, etc.; on the fiat side, there are Nuvei, Zepz, Onafriq, dLocal, OpenPayd, and others.