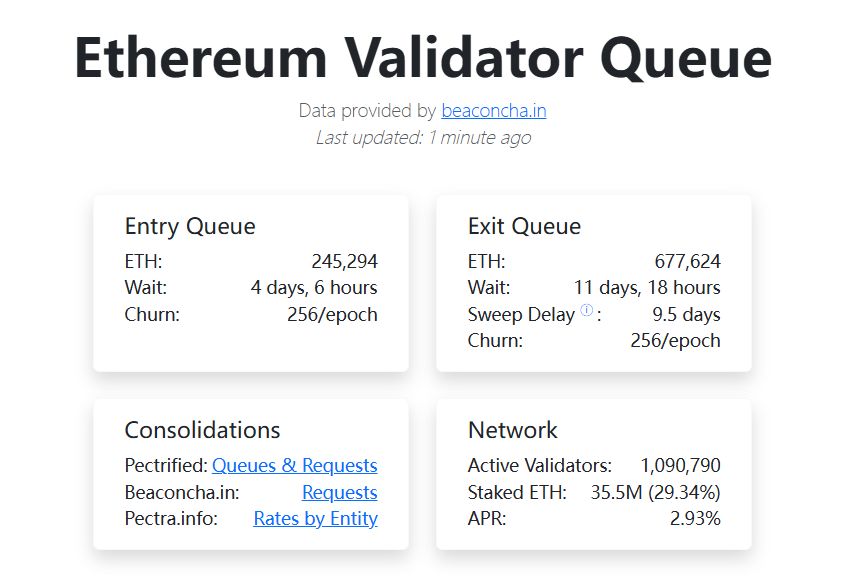

⚡️Someone sent me this, the validator queue data shows that 677,000 ETH are queued to exit the staking queue. Does this mean Ethereum is unstable?

After some analysis, the surge in the queue is due to multiple factors—

1️⃣ Profit-taking: ETH has rebounded over 160% from the low in April, rising from about $1,500 to over $3,800.

Many early stakers have chosen to cash out.

2️⃣ Strategy failure: From July 16-21, Aave's borrowing rate skyrocketed from 3% to 18%, leading to an inverted yield on LST/LRT circular strategies, forcing large-scale redemptions.

3️⃣ Sun's intervention: A single individual withdrew 60,000 ETH from Lido and Aave, amplifying market sentiment through the demonstration effect of a whale.

This backlog of ETH will take about 15 days to digest, which indeed has a short-term impact on liquidity. However, we cannot only focus on the exit data; the inflow data is also worth noting—

Currently, there are 245,000 ETH queued for staking, with strong demand and institutions gradually buying in. This indicates that the market is not in a full-scale exodus; rather, some funds are seizing the opportunity to enter.

Moreover, from a broader perspective, Ethereum's staking structure is entering a new phase of "more active rebalancing and higher liquidity":

Previously, it was a locked staking model; now it is dynamic, chasing yields and strategies.

This is not a bad thing; this is how mature assets should behave.

Therefore, I believe the fundamentals have not actually deteriorated. Once the technical backlog is cleared, net staked ETH will resume its growth trend.

If you are really afraid, just sell off your small holdings quickly; the market can definitely handle it. I am willing to buy back at a low price of 2888 each!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。