Michael Saylor Bitcoin Plan Drives Strategy’s $24B Profit Goal

Strategy’s Record-Breaking Q2 Earnings Driven by BTC Surge

Today, Strategy, the largest BTC holder, reported a blockbuster second quarter for 2025 fueled by significant gains in its digital asset portfolio and expanded capital market activities.

Michael Saylor Bitcoin has posted a press release on its X handle by sharing that the Strategy has made $14 billion in operating income and $10 billion in net profit with each share earning $32.60.

For the whole year the firm expects $34B in operating income, $24 billion in net profit and $80 EPS. Michael Saylor Bitcoin strategy also remains bold and aiming for a 30% return from it and $20B in gains at the end of the year as digital asset's price continues to rise.

Source: X

Q2 Earnings Set New Records

Strategy reported an operating earnings of $14.03 billion and $32.60 per diluted share and is marketing its best quarter yet. The net income of the firm jumped to $10.02 billion which is a sharp recovery from the $102.6 million loss reported in the same period last year.

The gains were driven by a 30% increase in prices with an average price of $107,752 in Q2.

Michael Saylor Bitcoin Holdings Reach All-Time High

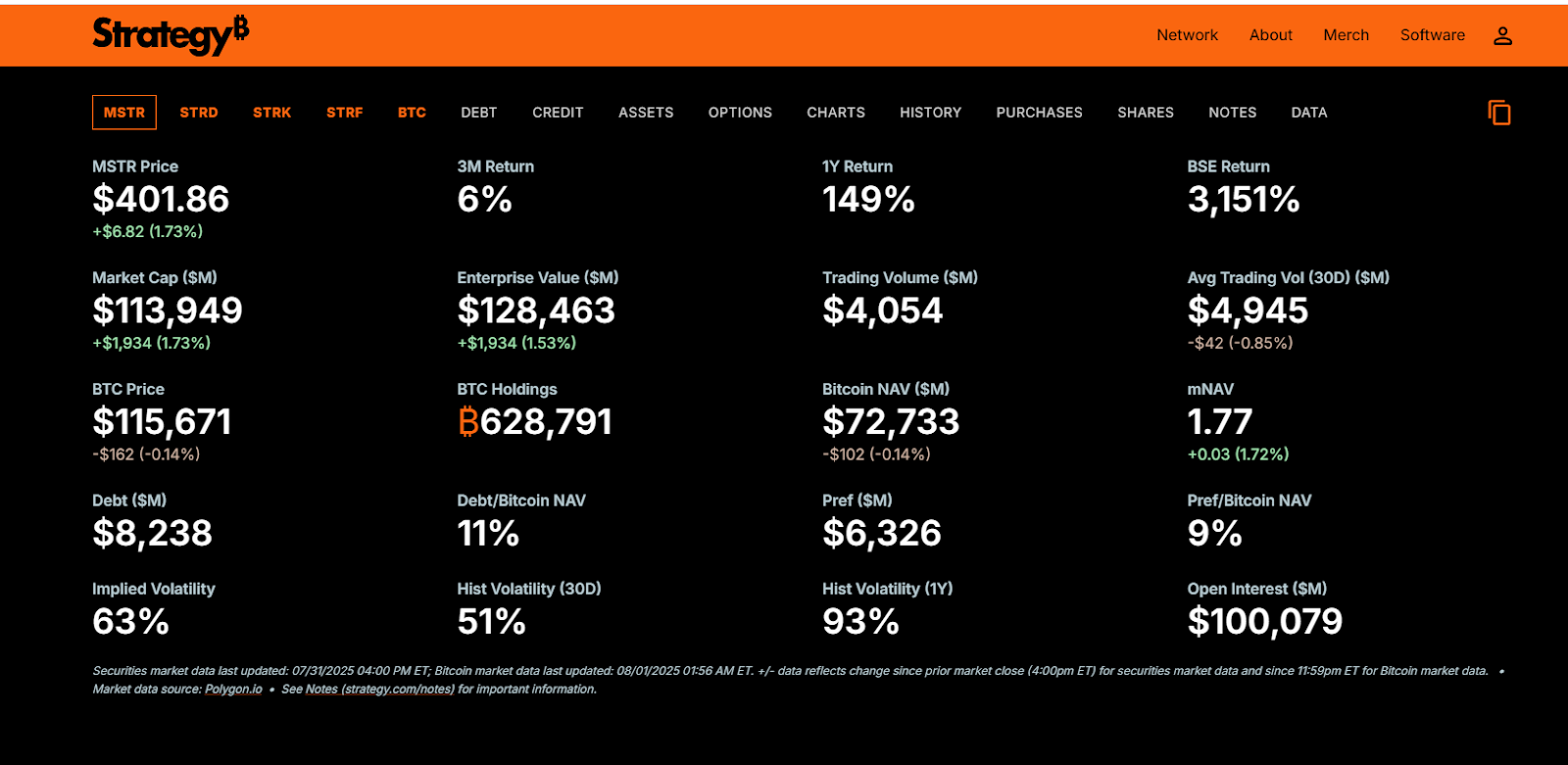

Strategy’s asset stack climbed to 628,791 BTC by July 29, 2025 and was acquired at a cost of $46.07B that is showing a 51.9% unrealized gain. The company’s every year it yield stands at 25% with a revised target of 30% by the end of the year. Currently the digital coin is trading at $115,673.

Source: Official site

Despite the positive earnings report, the firm shares closed at $401.86 but fell slightly to $397.65 in after hour trading. Investors remain optimistic about the firm’s potential growth particularly with its forecast of $34 billion operating income and $24B net income by the end of the year, assuming it will hit $150,000.

Recently, a Magazine has shared a BTC guide of Strategy on its X platform .

Source: X

What Happens If BTC Price Crashes?

Even if the prices crashes and the market faces a downfall, the company's confidence doesn’t shake, Michael Saylor Bitcoin has made it clear that they are in this for a long haul.

For him the coin is not just only an asset but it is the foundation of their financial strategy. No matter the price dip he will keep strengthening his BTC treasury .

Every dollar, every profit it makes is being reinvested back into golden asset only. A short price crash does not trigger Michael Saylor Bitcoin confidence.

Conclusion

Michael Saylor Bitcoin Q2 result highlights how its aggressive investment masterplan always continues to pay off, setting new financial records and strengthening the market position.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。