U.S. Atkins Leads Project Crypto to Make USA the Crypto Capital

Project Crypto: U.S. Lays Down a New Blueprint for Global Crypto Dominance

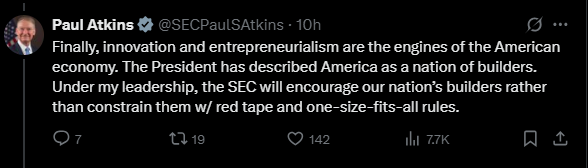

With the rollout of Project Crypto, SEC Chairman Paul Atkins is pivoting from enforcement to innovation. Backed by Trump’s broader push for a “golden age of digital assets,” the initiative outlines a strategy to modernize U.S. finance by clearing regulatory bottlenecks, legitimizing new asset types, and restoring faith among builders, But this is not just about reform, it is about reclaiming leadership in a field where US has lost ground.

Source: X

The Super-App Era and Developer Reversal

With Project Crypto, the state wants a future where a single firm, under one federal licence, can offer digital asset trading, lending, staking, tokenized stocks, and more, currently under multiple agencies.

If implemented, it could collapse traditional divisions between exchanges, broker-dealers, and custodians, much like China’s WeChat evolved into a financial ecosystem in itself.

Source: X

Walking back years of prosecutorial pressure, from the Tornado Cash case to Github bans, The U.S. was seen as hostile to open source innovation. Under the new vision, a wave of returning talent and tools could be triggered, especially in privacy and decentralized architecture.

Tokenized Assets and Institutional Firepower

Along with the SEC Project Crypto, tokenization is already gaining traction. Switzerland’s SIX Digital Exchange has approved tokenized equity. In Singapore , DBS Bank offers tokenised treasury bonds. Meanwhile, Hong Kong is piloting digital green bonds on blockchain.

With Atkins signaling openness to synthetic assets, stablecoins, and on chain ETFs, the US may finally give Wall Street the green light to adopt blockchain for capital markets. BlackRock, Fidelity investments , and KKR & Co. are already experimenting with tokenized funds and payment.

If SEC guidance aligns with this trend, we could see institutional DeFi go mainstream.

America’s Virtual Asset Treasury: Still a Giant Player

Despite regulatory ambiguity, the U.S. government holds over 198,012 BTC, worth more than $18 billion as of date 2025, although they are seized from criminal cases. Also US -based spot Ethereum ETFs collectively manage around 5.7 million ETH, with an estimated value around $22 billion, which accounts for almost 4.5% of total supply in circulation.

This silent stash gives the government unusual leverage in global Virtual Currency markets, whether it is through auctions, on-chain movements, or strategic policymaking.

With Project Crypto it is also possible that the state will now pay more attention to NFTs and different Altcoins, as it already has a stablecoin law now.

The Road Ahead

With Congress preparing to elevate the Commodity Futures Trading Commission (CFTC) as the main overseer for spot markets, regulatory clarity may finally emerge. If it works in coordination rather than colliding, the nation could see a more stable, innovative, friendly environment by 2026.

Meanwhile, Europe’s MiCA framework and the UAE’s VARA regime is live and attracting big capital. The race is no longer just about innovation, it is about providing the clearest and most credible legal environment for the future of finance.

Also read: Michael Saylor Bitcoin Bet Leads to $10B Q2 Net Income免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。