Author: Nancy, PANews

The crypto earnings season is upon us, and major institutions have submitted their "mid-term reports" for 2025. Some have achieved soaring profits through skyrocketing valuations of their on-paper assets, while others are struggling to find transformation paths amid a slowdown in core business. The industry is gradually shifting from a reliance on single revenue streams to a diversification of assets and comprehensive financial services. This article by PANews will summarize the latest financial performance and strategic directions of representative institutions such as Strategy, Tether, Coinbase, Robinhood, Kraken, and Riot Platforms, which are either publicly listed or have voluntarily disclosed their Q2 financial reports.

Overview of the financial situation of six crypto institutions in Q2 2025

Strategy: Earned $10 billion in net profit from Bitcoin, plans to continue heavy buying

In Q2, Strategy's revenue reached $14.03 billion, a staggering year-on-year increase of 7106.4%. The company expects full-year revenue to reach $34 billion and forecasts diluted earnings per share (EPS) to rise to $80.

The significant increase in quarterly revenue was almost entirely due to unrealized fair value gains from Bitcoin assets, which amounted to $14 billion, accounting for the vast majority of quarterly revenue. This is the second quarter since Strategy adopted fair value accounting standards at the beginning of 2025. In contrast, the company's traditional software business generated only $114.5 million in revenue this quarter, accounting for about 0.8% of total revenue.

At the same time, Strategy's profitability surged in Q2, with net profit reaching $10.02 billion, a stark contrast to the net loss of $102.6 million in the same period of 2024. The company expects full-year net profit for 2025 to reach $24 billion.

As of the end of July 2025, Strategy's Bitcoin holdings had increased to 628,791 coins, with an additional 88,109 coins added in Q2. The total cost of these holdings reached $46.07 billion, with an average cost of $73,277 per Bitcoin. Year-to-date, its Bitcoin yield has reached 25%, having already met its original annual target, which has now been raised to 30%. To further expand its Bitcoin assets, Strategy announced plans to raise $4.2 billion through the issuance of STRC perpetual preferred shares to continue increasing its Bitcoin holdings.

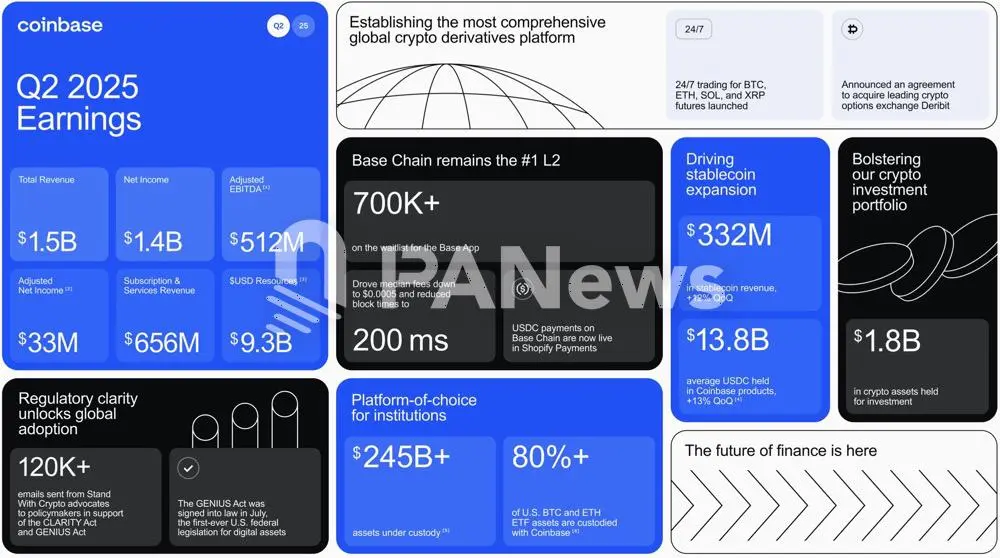

Coinbase: Core business weakens, investment income supports net profit

In Q2 2025, Coinbase achieved total revenue of $1.497 billion, a 26% quarter-on-quarter decline. Of this, trading revenue was $764 million, down 39% from the previous quarter; subscription and service revenue was $656 million, down 6%. Coinbase attributed the revenue decline to reduced volatility in the crypto market, adjustments in stablecoin trading pair pricing strategies, and decreased trading activity across the platform, with total trading volume for the quarter at $237 billion, a 40% quarter-on-quarter decline.

Coinbase's net profit for the quarter reached $1.429 billion, far exceeding the $36 million from the same period last year. This profit growth was primarily driven by $1.5 billion in earnings from Circle investments and $362 million in unrealized appreciation from its crypto portfolio. However, a prior user data breach incident resulted in a loss of $308 million, pushing total operating expenses to $1.5 billion (a 15% quarter-on-quarter increase), which exerted significant pressure on net profit. After excluding strategic investments and crypto asset investment income, the adjusted net income was only $33 million, indicating that its core trading business has fallen into a growth dilemma.

In response to this predicament, Coinbase is actively promoting a strategic transformation. Its VP of Product, Max Branzburg, announced the expansion of trading categories, with new products including tokenized real-world assets, stocks, derivatives, prediction markets, and early token sales, which will first launch in the U.S. and then gradually expand to international markets based on regulatory approvals. Coinbase aims to build an "all-in-one exchange" to facilitate on-chain trading of all assets, directly competing with platforms like Robinhood, Gemini, and Kraken.

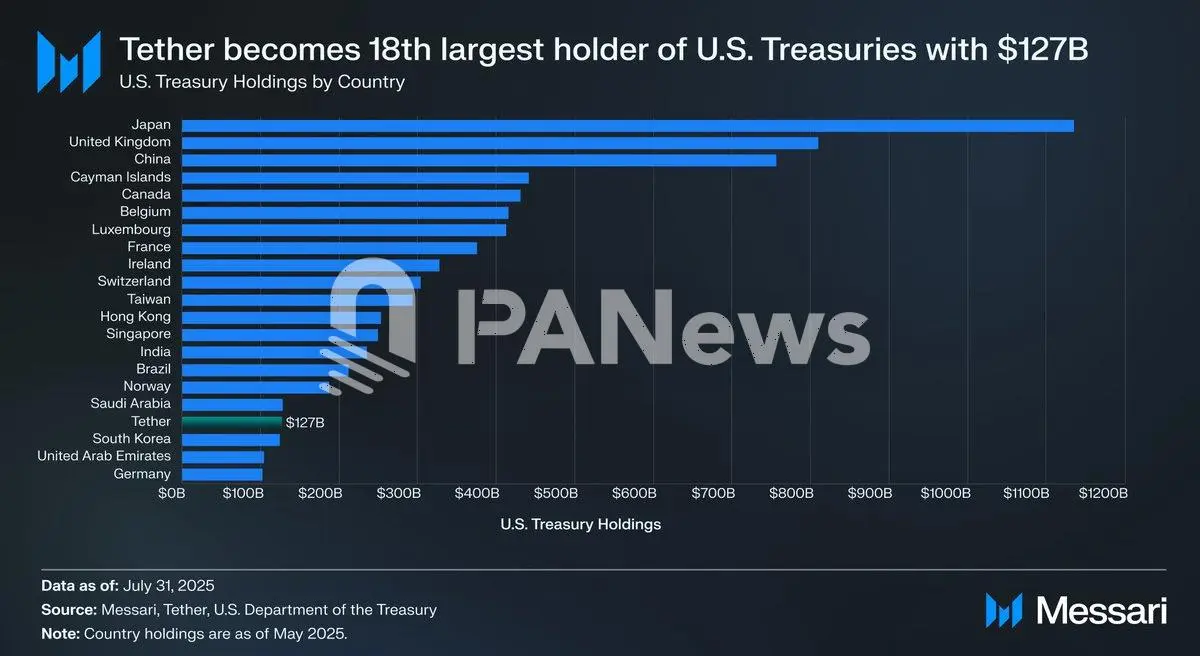

Tether: Quarterly net profit of $4.9 billion, U.S. Treasury holdings exceed $127 billion

As of Q2 2025, Tether's total assets reached $162.575 billion, surpassing its liabilities of $157.108 billion, achieving an excess reserve of $5.467 billion (slightly down from $5.6 billion in the previous quarter); the circulation of USDT exceeded $157 billion, increasing by $20 billion year-to-date.

In terms of asset composition, Tether holds over $127 billion in U.S. Treasury securities (including $105.5 billion directly held and $21.3 billion indirectly held), an increase of about $8 billion from Q1, making it one of the world's 18 largest holders of U.S. Treasuries. It also holds $8.9 billion in Bitcoin and $8.7 billion in precious metals (gold), among other assets.

Tether's net profit for Q2 was approximately $4.9 billion, significantly higher than the $830 million in Q1. Year-to-date, Tether has accumulated a net profit of $5.73 billion, of which $3.1 billion is from recurring income and $2.6 billion from the market value growth of Bitcoin and gold.

Overall, Tether demonstrated strong asset growth capabilities and profitability this quarter, with its diversified asset allocation (such as gold and Bitcoin) providing flexibility to its profit structure.

Robinhood: Revenue approaches $1 billion, crypto business drives profit doubling

As of the end of Q2 2025, Robinhood's balance sheet held $4.2 billion in cash and cash equivalents, providing ample "ammunition" for global expansion and new business ventures.

In this quarter, Robinhood achieved revenue of $989 million, a 45% year-on-year increase; net profit reached $386 million, doubling year-on-year and setting a new historical high. Adjusted EBITDA reached $549 million, with a profit margin rising to 56%. The core drivers of this growth were the strong rebounds in crypto trading and options trading. Specifically, options trading revenue reached $265 million, a 46% year-on-year increase, remaining the most significant source of income; crypto trading revenue reached $160 million, a 98% year-on-year increase, becoming a new growth driver; while stock trading revenue also recorded $66 million, a 65% year-on-year increase.

Robinhood also maintained strong performance in user scale and asset retention. The platform currently has 26.5 million funded accounts, a 10% year-on-year increase; total platform assets surpassed $279 billion, nearly doubling; active investment accounts reached 27.4 million, a 10% year-on-year increase; high-value users (subscribing to Robinhood Gold) grew by 76%, reaching 3.5 million. Notably, the average revenue per user (ARPU) has reached $151, a 34% year-on-year increase, reflecting the platform's enhanced user monetization capabilities.

From a strategic perspective, the most noteworthy development this quarter is Robinhood's aggressive expansion in the crypto business, including the completion of the acquisition of the established European exchange Bitstamp; obtaining over 50 crypto compliance licenses and launching crypto services in 30 European countries; launching stock token products; opening crypto staking features in the U.S.; and planning to complete the acquisition of Canadian company WonderFi in the second half of the year. Additionally, Robinhood is gradually building its own financial supermarket, with its Robinhood Strategies digital advisory service AUM reaching $500 million, retirement account assets reaching $20 billion, and Gold credit card users reaching 300,000.

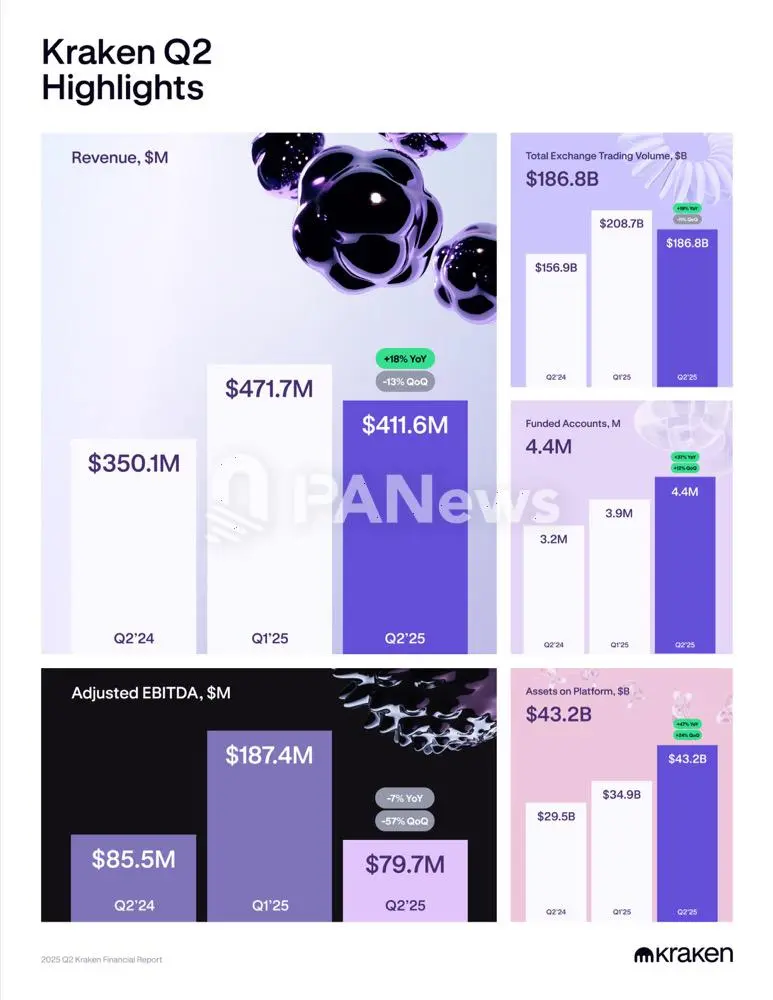

Kraken: Profits halved, plans to accelerate diversification

In Q2 2025, Kraken continued to advance in multi-asset trading and global expansion, but the overall market trading activity slightly slowed, leading to a decline in some key metrics quarter-on-quarter.

In this quarter, Kraken achieved revenue of $412 million, an 18% year-on-year increase, but a quarter-on-quarter decline from $472 million. The adjusted EBITDA for the quarter was $80 million, a significant drop from $187 million in Q1. From an operational perspective, Kraken has approximately 15 million global customers, with total trading volume in Q2 at $186.8 billion, a 10.5% quarter-on-quarter decline, but still achieving a 19% year-on-year growth; the number of funded accounts at Kraken increased to 4.4 million, with a year-on-year growth of 37%; the platform's custodial assets reached $43.2 billion, with a year-on-year increase of 47%.

Moving forward, Kraken's global business will continue to accelerate, including the approval of new licenses, expansion of local funding channels, upgrades to multi-asset experiences, and the launch of innovative products such as international stocks, tokenized stocks, Kraken debit cards, and NinjaTrader development.

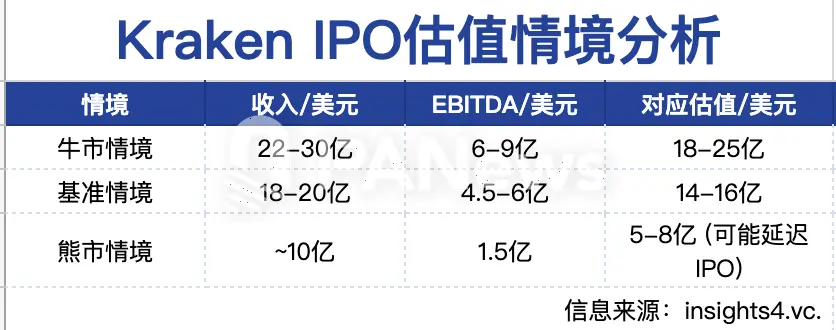

Notably, Kraken is seeking to raise $500 million at a $15 billion valuation and plans to go public in 2026. Insights4.vc analysis states that Kraken, with its high-quality user base and trading activity, is at the forefront of the industry and is continuously reducing its reliance on spot trading fees by expanding into derivatives, stock trading, and payment services, thereby enhancing its resilience to market cycles. Additionally, in the context of tightening regulations, Kraken has obtained compliance licenses in multiple regions, giving it significant advantages in compliance, security, and fiat entry services. In the face of fierce competition from Binance and Coinbase, Kraken has successfully established a "second-tier" brand positioning centered on product diversity and transparent compliance. If the crypto market continues to recover over the next year, Kraken is expected to become the next publicly listed crypto exchange company after Coinbase with stable profitability and compliance.

Riot Platforms: Revenue doubles year-on-year, BTC production increases by 69%

In Q2 2025, Riot Platforms achieved total revenue of $153 million, more than doubling from $70 million in the same period of 2024. This growth was primarily driven by the Bitcoin mining business, which contributed approximately $141 million in revenue, a year-on-year increase of over 150%. With the combined push of rising Bitcoin prices and capacity expansion, the company produced a total of 1,426 BTC during the quarter, an increase of about 69% compared to 844 BTC in the same period last year.

Due to the halving event in April 2024 and the continuous rise in global hash rate, Riot's average mining cost per Bitcoin (excluding depreciation) rose to $48,992, a 93% year-on-year increase, but still significantly lower than the average Bitcoin selling price during the same period (approximately $98,800). However, if Bitcoin prices decline in the future or mining difficulty continues to rise, gross profit margins may be squeezed, making cost control and hash rate efficiency critical. According to Riot, with the increasing demand for high-performance computing (HPC) and AI infrastructure, the company will continue to promote the diversified application of power resources, gradually transforming from a single Bitcoin mining company into an "infrastructure platform centered on Bitcoin, aimed at future computing needs."

In terms of profit performance, Riot recorded a net profit of $219.5 million, far exceeding the negative performance of $2024 in the same period. Adjusted EBITDA reached $495.3 million, reflecting the strong cash-generating ability and high operational leverage of its core business.

Additionally, the company continues to maintain a robust balance sheet. As of the end of Q2, Riot Platforms held a total of 19,273 BTC (valued at approximately $2.1 billion) and $255.4 million in unrestricted cash, providing ample financial support for its future expansion, high-performance computing transformation, or to cope with market fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。