Written by: Luke, Mars Finance

In the first weekend of August, the crypto world felt a chill overnight. In just 24 hours, over $600 million in long positions vanished in a series of cascading liquidations. The market's panic spread rapidly, like ignited wild grass. Bitcoin's price dropped from a high of nearly $119,000, briefly losing the $114,000 mark. Social media was filled with wails, confusion, and blame. People were eager to know where this sudden storm came from.

This was not an isolated "crypto-native" event, but a chain reaction ignited by external macroeconomic shocks that exposed the internal structural weaknesses of the market. The sparks of geopolitical tensions and the paradox of economic data together lit the fuse, detonating a market already saturated with dangerous high leverage. The entire path of the liquidation waterfall seemed to be precisely guided by the gravitational pull of a long-existing gap in the Chicago Mercantile Exchange (CME) futures. This was a "perfect storm" of macro, micro, and technical factors resonating perfectly.

External Shock: The Trigger of Global Risk Aversion

The root of this crash is deeply embedded in the soil of the traditional financial world. Two nearly simultaneous macro events served as catalysts for a comprehensive market sell-off, clearly demonstrating the increasingly tight linkage between crypto assets and the pulse of the global economy.

First, there were the clouds of geopolitical tension. On August 1, the Trump administration suddenly announced broad new tariffs on imports from 92 countries and regions, with rates ranging from 10% to over 40%. This move immediately triggered a classic "risk-off" mode globally. Capital fled risk assets and surged into gold, which was seen as a "safe haven," pushing gold prices to briefly soar above $3,350 per ounce. The Chicago Board Options Exchange Volatility Index (VIX), known as Wall Street's "fear index," also jumped significantly. In this environment, institutional capital did not view Bitcoin as "digital gold," but rather categorized it as a high-beta risk asset similar to tech stocks. Therefore, the tariff news directly pressured cryptocurrency prices, becoming a key external factor for Bitcoin's drop below $115,200.

Compounding the issue, the U.S. Bureau of Labor Statistics released the July Non-Farm Payroll (NFP) report on August 2, showing only 73,000 new jobs added that month, far below the market's expectation of 106,000. More shockingly, as noted by New York Fed President John Williams, the "real news" in the report was the "abnormally large" downward revisions to the May and June data, indicating that the actual state of the U.S. labor market was much weaker than previously thought.

This weak report triggered a contradictory market reaction. On one hand, it heightened fears of an economic recession, directly fueling sell-offs under risk-averse sentiment. On the other hand, it dramatically changed market expectations for the Federal Reserve's monetary policy. According to CME's FedWatch Tool, the market's prediction of a 25 basis point rate cut by the Fed in September soared from less than 40% a day earlier to 89.8%.

This formed the most subtle core driving mechanism of this event: the market was forced to price between two completely opposing narratives. The first is the "fear narrative": tariffs and weak employment data both point to recession risks, prompting fund managers to instinctively reduce risk exposure and sell off high-volatility assets like Bitcoin. The second is the "hope narrative": the same weak data is interpreted by another group of algorithms and analysts as forcing the Fed to act, stimulating the economy through rate cuts. The liquidity increase from rate cuts has historically been "rocket fuel" for risk assets. The market thus fell into a dilemma, and this profound uncertainty gave rise to extreme volatility, laying the groundwork for the subsequent large-scale liquidations.

Internal Ignition: A Market Prepared for Collapse

If the macro shock is the match that ignites the fire, then the internal structure of the crypto market is a barrel full of gunpowder. In the days leading up to the crash, extreme optimism and rampant leverage had created perfect conditions for a catastrophic implosion.

In the days before the crash, the derivatives market had already issued clear red alerts. The total open interest (OI) in Bitcoin futures surged to its highest level since the end of 2024, exceeding 300,000 Bitcoin, with a nominal value of up to $42 billion. This indicated that massive capital was locked in futures contracts, and the market's leverage level was extremely high. More critically, the funding rates on major exchanges remained persistently positive, a clear signal that the market was dominated by leveraged long positions. Bullish traders were so confident that they were willing to continuously pay fees to bearish shorts to maintain their long positions.

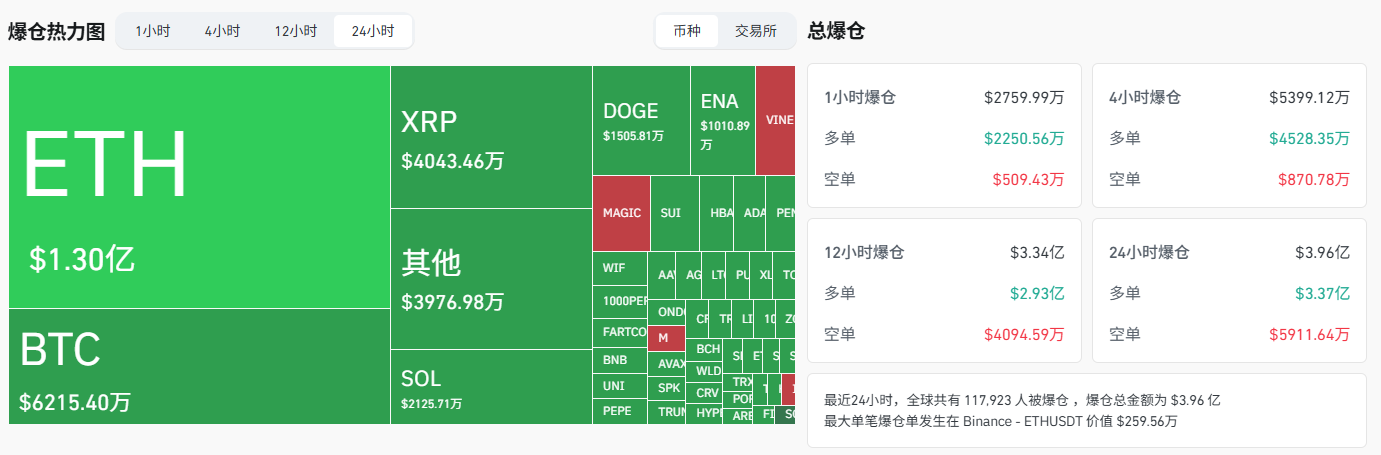

When the macro-driven sell-off began, it triggered a domino effect. Data from Coinglass showed that a total of $396 million in leveraged positions were liquidated, of which $338 million (85%) were long positions. Other sources indicated that the total liquidation amount reached between $635 million and $726 million, with longs accounting for nearly 90%. This liquidation waterfall was not coincidental but rather a brutal yet necessary self-correcting mechanism of the market. The logic of its occurrence is as follows: first, the market accumulated a massive "leverage imbalance." Second, an external shock arrived, leading to an initial price drop. This drop triggered the forced liquidation of the first batch of highly leveraged long positions. These forced sell orders injected more supply into the market, further depressing prices, which in turn triggered the liquidation of the next tier of slightly less leveraged longs. Ultimately, a vicious cycle formed: each wave of liquidation led to further price declines, triggering the next wave of larger-scale liquidations.

Technical Destination: The Gravitational Pull of the CME Gap

The initial judgment of users—that the market drop was to "fill the gap"—touched on a key technical aspect of this event. The CME futures gap played a black hole-like role in this chaotic market, providing a clear destination for the price's free fall.

As a regulated traditional financial exchange, the CME's Bitcoin futures products close on weekends. However, the cryptocurrency spot market trades continuously 24/7. This leads to a blank area on the CME charts between Friday's closing price and the following Monday's opening price, known as a "gap." A widely circulated theory among traders is that market prices tend to "fill" these gaps.

In a chaotic market, the CME gap acted as a "Schelling Point"—a natural focal point that parties can find without communication. For sellers and liquidity-hunting algorithms, it was a predictable and perfect target for attack. When macro news provided a catalyst for selling, the selling behavior of these algorithms was not random. They would apply pressure along the path of least resistance and greatest impact. Targeting a known gap ensured they could precisely trigger stop-loss and liquidation orders clustered around that level. As prices were pushed toward the gap by algorithms, human traders also focused on the gap, fearing it would be completely filled, which further enhanced the downward momentum. Thus, the gap was not the cause of the crash, but it became the destination of the crash.

Capital Game: Whale Sell-offs and ETF Accumulation

Beneath the surface price plunge of the market, a silent war over capital flows was unfolding. On-chain data evidence revealed starkly different behavior patterns among various market participants.

Data from on-chain analysis platforms like CryptoQuant and Lookonchain showed that in the hours and even days leading up to the crash, "whales" holding large amounts of Bitcoin were actively transferring tokens to exchanges. A notable example is the well-known trading firm Galaxy Digital, which deposited over 10,000 Bitcoin (worth about $1.18 billion at the time) into exchanges like Binance, Bybit, and OKX in less than 8 hours. This behavior is a typical signal of "smart money" distribution.

In stark contrast to the distribution behavior of whales, newly established spot Bitcoin ETFs continued their systematic buying pace. Analysts pointed out that "institutional demand continues to absorb supply," and these ETFs played a crucial supporting role during the market downturn, preventing further price collapse. This represented a powerful, non-discretionary buying force in the market. Unlike whales trading based on tactical needs, ETF purchases depend on client capital inflows, creating a stable and continuous demand flow that provides solid bottom support for prices. This short-term tactical selling by whales versus long-term systematic buying by ETFs clearly revealed the market's inherent resilience and answered a key question: "Why didn't prices drop even lower?"

A Long Road Ahead: Navigating the Crossroads

After this storm, the market did not welcome calm but instead entered a crossroads filled with confusion and divergence. Analysts' comments also showed severe disagreement. Some, like Nathan Peterson from Charles Schwab, advised investors to "sell on rallies." Others believed the market was in a "healthy buy-the-dip zone." Ran Neuner, founder of Crypto Banter, even predicted that Bitcoin could still reach $250,000 by the end of the year, while Michael Saylor, founder of MicroStrategy, called this drop "a gift from God."

Currently, the market is weighing short-term fears of an economic recession against medium- to long-term bullish expectations for Fed rate cuts and a new round of liquidity injections. This crash fundamentally reset market dynamics, forcing every participant to re-examine their investment logic. The future direction will depend on which group of capital—short-term traders scared off by macro fears or institutional investors committed to long-term accumulation—can exert greater influence. The large-scale liquidation event has washed away the most reckless leverage in the market, making the market structure "cleaner" but also more cautious. This post-crash era is a high-risk test of the maturity and institutionalization of the crypto market.

Conclusion: Lessons from the Storm

The "August Storm" of 2025 is a multi-act drama. It began with shocks from macro politics, was infinitely amplified by a fragile and over-leveraged derivatives market, and ultimately found its technical destination at a CME gap. This event provides profound lessons about the modern crypto market, revealing its inherent duality. On one hand, its increasingly tight integration with the global financial system provides long-term growth momentum and potential price floors. On the other hand, the same integration makes it highly susceptible to shocks from traditional markets and geopolitical events. The "August Storm" is the ultimate manifestation of this tension—it is a direct collision between old-world macro fears and new-world digital asset accumulation. The future of cryptocurrency will be defined by how it navigates between these two powerful and often opposing forces.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。