Ethena USDe 75% Monthly Growth Pushes It to Third Place in Stablecoins

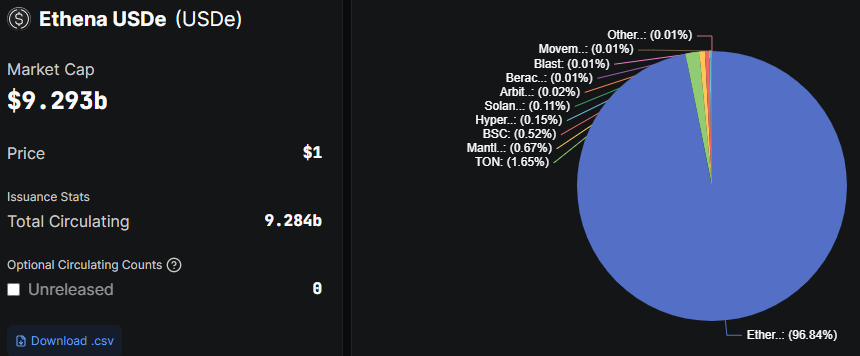

Ethena USDe Surge has made big news in the crypto world. According to DeFiLlama, the Ethereum USDe stablecoin surge pushed its supply up by 75% in just one month, reaching $9.3 billion. This move helped it pass FDUSD and become the third-largest stablecoin by market cap—only USDT and USDC are ahead.

Source: DefiLlama

USDe also jumped to the sixth-largest DeFi protocol by total value locked (TVL). Along the way, it overtook Dai (DAI) with a $5.3B market cap and World Liberty Financial USD (USD1) at $2.1B.

Can USDe Overtake USDT and USDC to Claim the Top Stablecoin Spot?

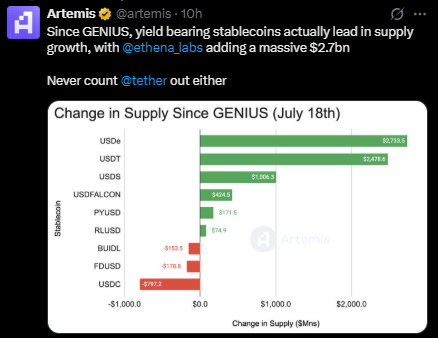

Data from Artemis shows that since the GENIUS Act passed on July 18, yield-bearing stablecoins have been leading supply growth. In this period, the news reports a massive $2.7B rise in supply—slightly ahead of USDT’s $2.4 billion increase.

Source: X

Still, catching up to the top two will be tough. USDT currently has a $163.8 billion market cap, and USDC sits at $64.1 billion, according to CoinMarketCap. For USDe to pass USDC, it needs about $54.8 billion more. To beat USDT, it would need $154.5B more—meaning nearly a 6x growth to overtake USDC and over 17x to pass USDT.

Is ENA Token Driving the Surge in USDe’s Market Value and Demand?

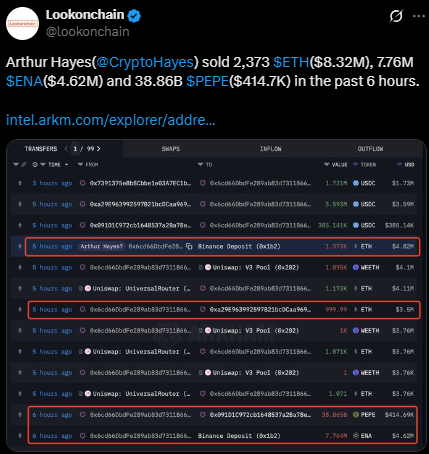

The Ethena crypto token, ENA, could be part of the story behind why is Ethena going up. Despite Arthur Hayes sells crypto news —where he reportedly sold 7.76 million ENA ($4.62M) on August 2—the price is climbing. As per Arkham Intelligence, ENA is trading at $0.6163 after a 15% daily jump, with a Ethena market cap of $3.91 billion and a $1.1 billion daily trading volume.

Source: X

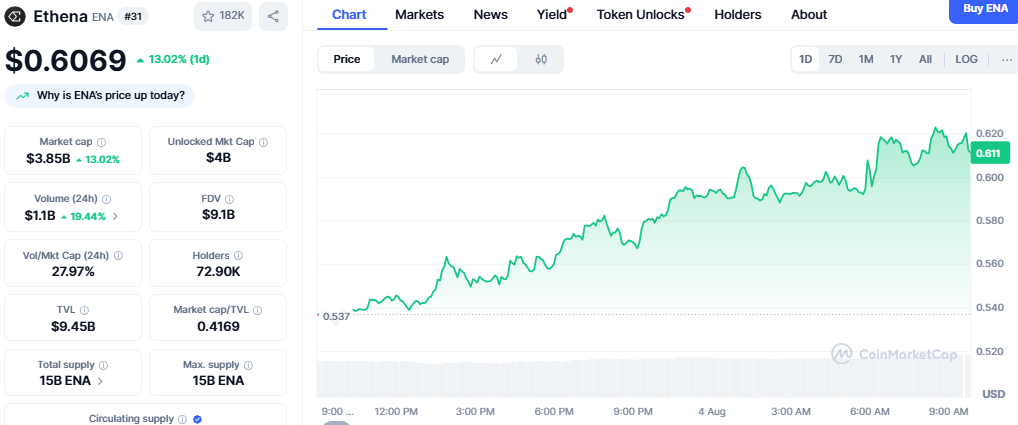

Technical charts show ENA holding above the key $0.50 level. On Sunday, it gained nearly 14%, and on Monday, it rose another 2%, moving towards last week’s high of $0.66. The RSI is at 62, pointing to bullish momentum. The 50-day and 200-day EMAs formed a “Golden Cross,” which often signals strong short-term growth.

Source: CoinMarketCap

However, the MACD indicator flashed a sell signal on Saturday. If MACD lines reverse and the histogram turns green again, it could spark another buying wave.

What’s Next for Ethena After USDe’s Rapid Rise?

Ethena price prediction charts show that a close above $0.66 could open the door to $0.79—last seen on February 1. If momentum stays, $1 can be the next target after $0.79 is hit. That gives rise to the question: will ENA price reach $1? The path is clear—hold $0.66, break $0.79, keep the RSI over 60, and continue maintaining high volume-this could see $1 realizes by late September 2025. However, if less, $0.48 should provide robust support.

Conclusion

Rapid progress of Ethereum USDe stablecoin and rising Ethena crypto news give an impression that the project is gaining trust from investors. While ENA price forecast under best-case scenarios leads to $1, market volatility will always be the risk factor. Stablecoin dominance is still far away, but the growth trend is hard to ignore.

Disclaimer: This article is for informational purposes only and is not financial advice. Cryptocurrency investments are risky—do your own research before investing.

Also read: Satoshi Statue stolen from Lugano park, 0.1 BTC Reward Offered免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。