Trump Says, FED and BLS Replacements Coming Soon: Crypto Market Impact

In the coming days, President Trump will reveal his picks for the Fed and BLS replacement—a move that could reshape interest rate policy and jobs data reporting. With two top economic posts open, markets and policymakers alike are hanging on every detail. This fast-developing story promises high stakes and broad implications.

Source: Wu Blockchain

What’s Unfolding Now? Here’s the Snippet

-

Fed Governor seat opened by the surprise resignation of Adriana Kugler.

-

BLS chief fired: Post vacated after Bureau of Labor Statistics Commissioner Erika McEntarfer was dismissed following a weak jobs report.

-

He has a shortlist in mind and aims to fill both the positions within days.

Inside the Federal Reserve Vacancy: Who Could Be Trump FED Pick?

Kugler’s exit leaves an empty seat at the Federal Open Market Committee table, a spot that directly influences borrowing costs, inflation policy, and banking rules.

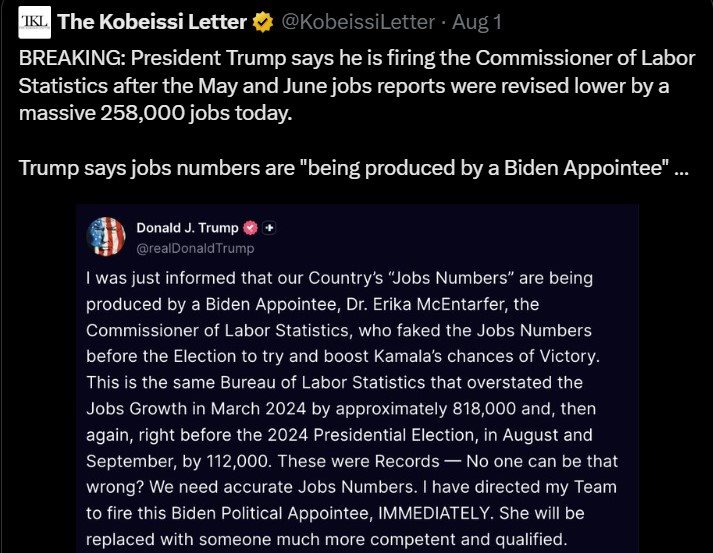

Source: The Kobeissi Letter X Account

Trump’s selection could lean toward aggressive rate-cut aligning with September hopes or those favoring cautious stability. Each path holds very different consequences for Wall Street and the cryptocurrency market.

Potential candidates remain unconfirmed, but market watchers believe he may favor voices aligned with his pro-growth, pro-market stance. Whoever gets the nod will hold a powerful vote capable of swaying the nation’s economic course.

Why Does It Matters?

| Position | Influence on Economy | Why It’s Crucial |

|---|---|---|

| Fed Governor | Sets interest rates, banking rules | Impacts inflation, borrowing cost |

| BLS Chief | Publishes jobs and labor statistics | Shapes how markets and analysts react |

Political and Economic Stakes: More Than Just Two Seats

The BLS role may seem technical, but its data drives trillions in financial decisions. This Trump fed news today firing of McEntarfer followed a weak July jobs report and a downward revision of earlier figures by hundreds of thousands. While revisions are common, Donald labeled them “the biggest miscalculations in over 50 years.”

Even, White House Economic Advisor Hassett confirmed that data from the Bureau of Labor Statistics has become very unreliable, and it cannot be trusted now.

His push for “modernized and transparent” labor statistics could change how markets react to employment updates—potentially altering investment flows and policy debates for years.

Market Reaction: Crypto Market Is Surging, But Volatility Remains

Cryptocurrency’s market cap, at the time of writing, was standing around $3.76T, reflecting a mild increase of 2%, however its trading volume was $127.53B.

In the crypto news today , Bitcoin is currently at $115,015, signaling high risk ahead, as other altcoins like Ethereum have seen an increase of around 6% today, currently standing at $3,668.83. This might confirm that the upcoming trump announcement will shape the forecast for both bitcoin and Ethereum for 2025. Yet volatility remains elevated until the actual names are announced.

Key Takeaways:

-

Expect fast-moving updates—two major nominations could arrive in days.

-

The Trump Fed and BLS replacement decisions may shift market expectations from rates to labor credibility.

-

Crypto and equities both remain on edge: pick signals could determine next direction.

Final Thoughts

With both critical posts vacant, Trump’s nominees will play a large role in shaping inflation control, financial stability, and trust in U.S. labor statistics. The Trump Fed and BLS replacement could very well define the economic narrative for 2026 and beyond. As investors and professionals wait anxiously, the question looms: will these picks calm markets—or spark fresh uncertainty?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。