Stablecoin On-Chain Usage Grows Despite Reserve Decline

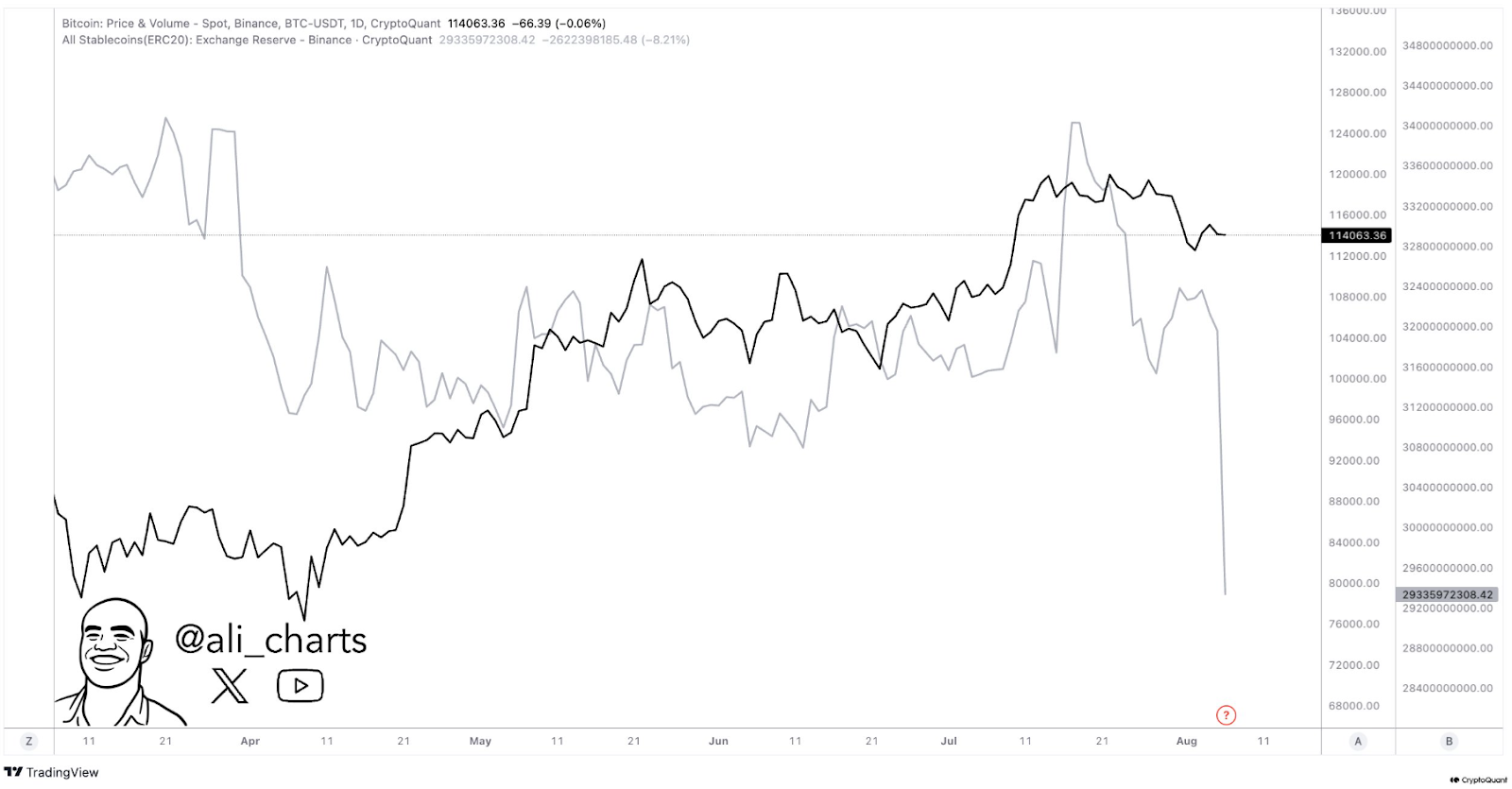

Stablecoin exchange reserves have dropped by over 8% this month, which is approximately $3 billion in capital moving off centralised platforms. Nevertheless, stablecoin on-chain volumes have reached a new all-time high of more than $1.5 trillion in a single month.

Source : X

The decline in exchanges has not lowered the usage, with stablecoin remaining the dominant force in on-chain transactions. In total, more than $26 billion in cumulative fees paid by users of Ethereum are still contributed by USDT and USDC.

The fee generation by stablecoin issuers has taken over, beating Layer 1 blockchains and decentralized exchanges.

Meanwhile, in July 2025, the U.S. enacted the GENIUS Act: a groundbreaking legislation that presents a comprehensive framework on payment Altcoin.

Regulatory Shifts Drive Institutional Confidence

The GENIUS Act provides a definite deadline of January 18, 2027, or 120 days following the publication of the final rule, whichever is earlier. It is aimed at authorized payment Altcoin and does not regulate algorithmic or investment-oriented types of Altcoin.

The regulation is similar to international systems and is close to the European MiCA and Singapore Payment Services Act. Consequently, there has been an increase in the use of stablecoin like USDC and PYUSD.

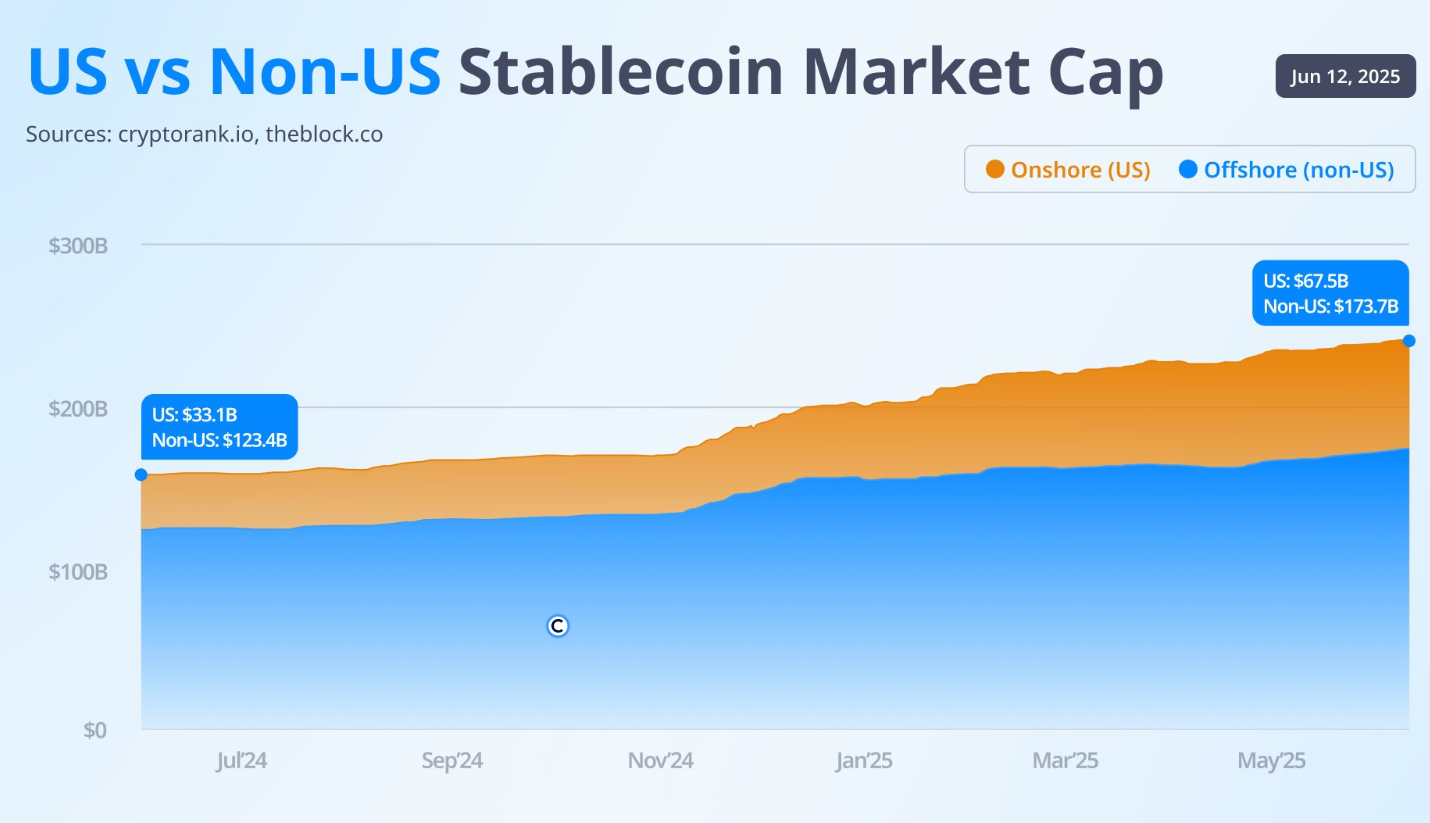

US vs Non-US Stablecoin Market Cap : Source : CryptoQuant

According to CryptoRank statistics, the supply of stablecoins issued in the U.S. increased by 104% during the last year to reach $67.5 billion. By contrast, offshore stablecoins such as USDT and DAI grew by 41% over the same time, though they remain dominant in total supply.

Ethereum and Tron Lead Stablecoin Settlements

Ethereum remains the most popular blockchain in terms of Altcoin activity, USDC in particular, which has 62% of its volume. In the meantime, Tron has been the main chain of USDT, with approximately 80% of the circulating supply.

The issuers of stablecoins have become the leading earners of fees in the crypto industry. In the last 7 days, they earned $170.7 million in fees, as compared to $121.8 million earned by Layer 1 blockchain such as Ethereum and Solana, and $103 million earned by DEXs.

Source : X

The recent inclusion of USDG to the platform of Gate is also beneficial to the overall growth of the PayFi ecosystem. Paxos Digital Singapore issues USDG and is regulated in Singapore as well as Europe.

Now it is available on Ethereum, Solana, and Ink blockchains with 1:1 fiat collateral and daily redemption assurances.

Stablecoins Fuel Real-World and DeFi Utility

Over the last 12 months, stablecoins have had a cumulative transaction volume of more than $33 trillion. They are currently being applied to real-life applications including cross-border payroll, e-commerce, game rewards, tokenized treasuries, and remittances.

Banks and fintech companies are also adopting stablecoins besides DeFi. Japanese Minna Bank has introduced a stable coin pilot with Fireblocks and Solana, demonstrating the introduction of digital dollars into the regulatory financial system.

Additionally, CryptoRank shows that stablecoins have become the 17th largest U.S. Treasury holder, with its reserves fully backed by liquid assets.

Liquidity Drop May Delay Altcoin Cycle

The decline in the reserve of stablecoin exchanges can slow wider altcoin rallies even as interest in altcoins increases in retail circles.

Google Trends data indicate that the search interest in altcoins exceeded that of Bitcoin in July 2025, the first time since the end of 2024. However, capital rotation into high-risk tokens typically requires consistent stablecoin inflows.

The present de-leveraging implies that there is not much liquidity to fund prolonged trends within small market-cap assets. Although the overall supply of stablecoins currently stands at above $268 billion, much of it has already entered the chain or the DeFi protocols.

Tether USDT continues to be the leader in daily volume, which exceeded $90 billion, and is more than both Bitcoin and Ethereum combined.

DAI and USDC are also close behind, which also supports the leading position of stablecoins as trading instruments. However, the altcoin markets could be limited in the short term unless reserves on exchanges recover.

Also read: Roman Storm Tornado Cash Verdict: Guilty on One Count, Two Left免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。