Justice or Interest? This is the key question to understanding Ackman.

Written by: David, Yanz, Deep Tide TechFlow

April 7, 2025, Sunday.

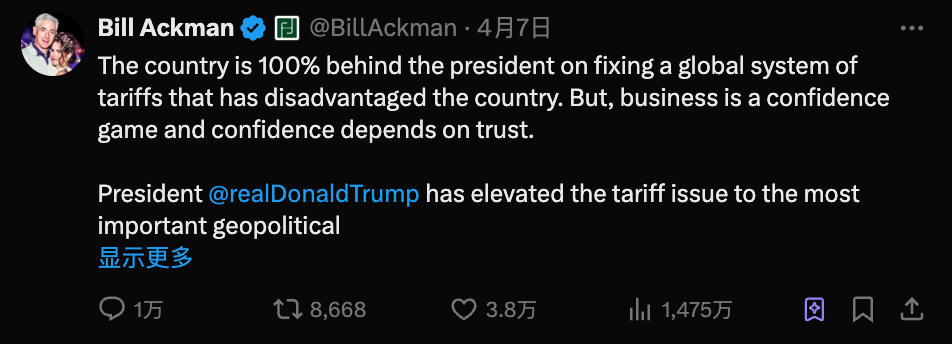

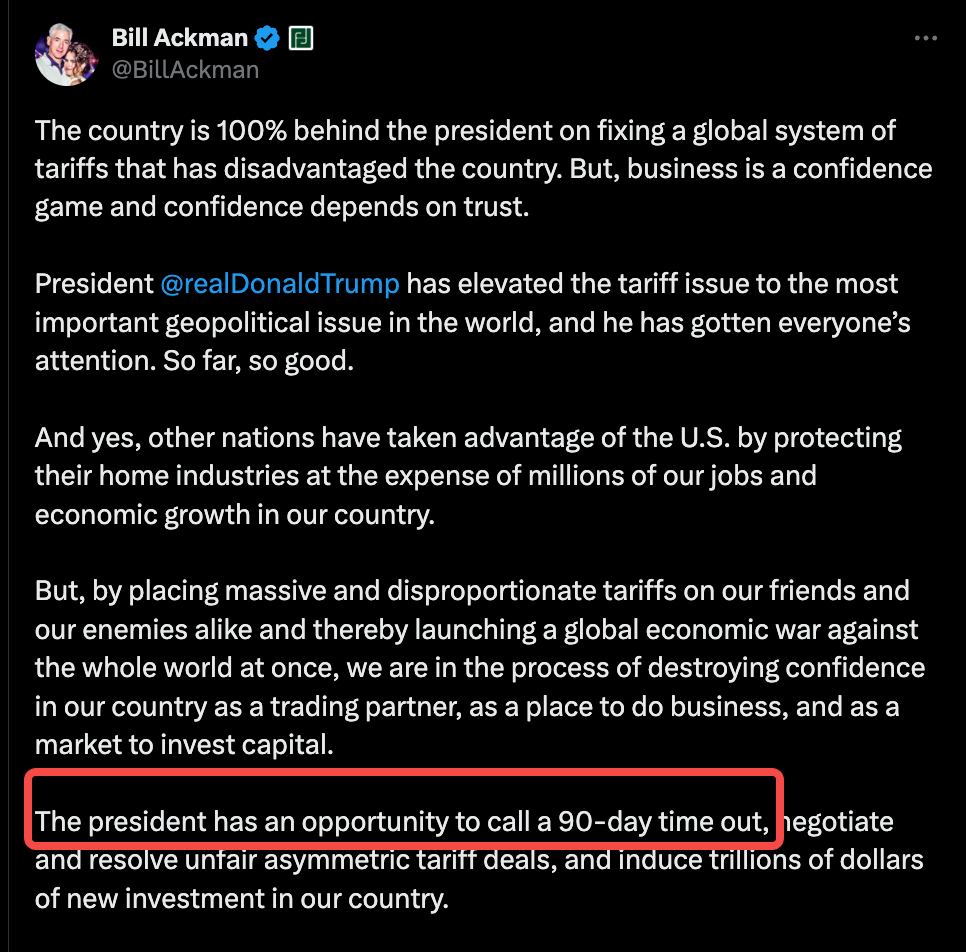

Bill Ackman tweeted, hoping to pause the tariff plan for 90 days, and tagged Trump. Directly naming the president is a taboo on Wall Street. But Ackman didn’t care.

Seventy-two hours before this tweet, Trump announced "reciprocal tariffs" on almost all trading partners; global stock markets plummeted, and panic spread.

Then, a miracle happened.

On Wednesday morning, Trump announced an unexpected decision: to pause the tariff plan for 90 days, allowing room for negotiations. The idea of this "90-day pause" came directly from Ackman's tweet three days earlier.

This coincidence also sparked speculation on social media: Did someone in the White House see this tweet and present it to the president?

This wasn’t Ackman’s first time successfully "remote-controlling" the White House. In fact, during the Trump era, this hedge fund manager with 1.8 million Twitter followers was practicing a brand new model of political-business relations—no formal position, no secret meetings, just enough followers and the right public shout-out.

From a loyal Democratic donor to Trump’s "Twitter strategist," this is a story about social media, money, and power.

The Tariff Storm: A Major Scene of Donor "Correction"

Before things actually happened, no one expected that a tweet could influence a shift in tariff policy.

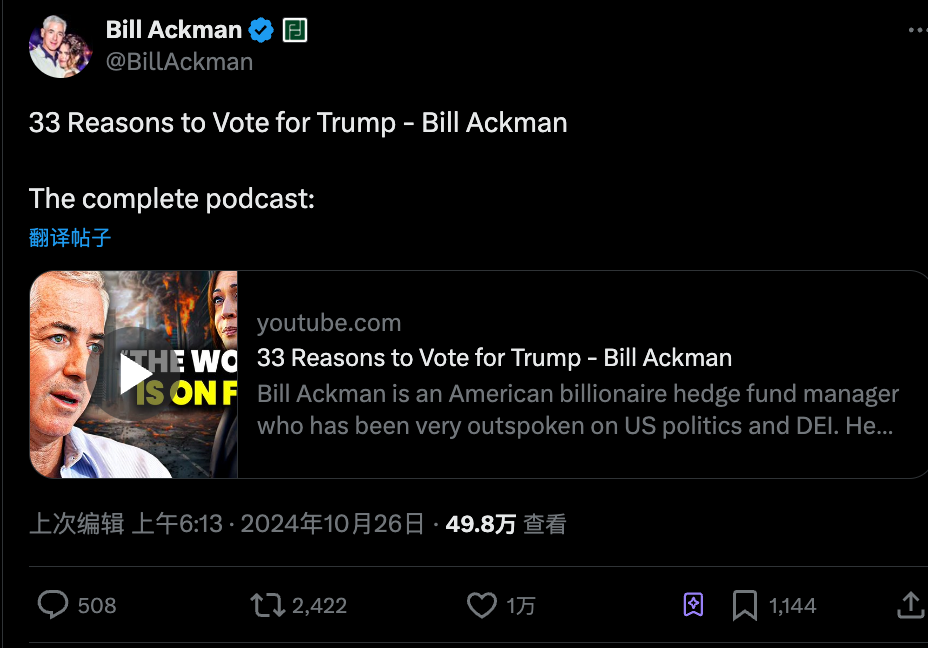

When Ackman issued a warning that Trump’s tariff policy could lead to an "economic nuclear winter," he was actually taking a dangerous gamble—having previously listed 33 reasons to support Trump, he now unusually came out against Trump’s tariff policy.

Is this betrayal or awakening?

Just three months prior, he had publicly praised Trump’s economic vision on Twitter. Now, openly singing a different tune and tweeting for a 90-day tariff pause, the risks were evident—his previously built goodwill and influence over the White House could both vanish.

But Ackman was right.

He accurately grasped Trump’s psychology; this president cared more about the performance of the stock market and public opinion than anything else. Trump just needed a dignified way to pivot, without appearing to yield to pressure.

The cleverness of the "90-day pause" plan was that it provided Trump with an exit; he could say it was for "better negotiations"; it also reassured the market that there would be no tariff shocks for at least three months.

That day, when Trump announced the 90-day tariff pause, U.S. stocks recorded their largest single-day gain in 16 years. The S&P 500 index rose by 4.2%, and the Dow Jones Industrial Average surged by over 1200 points.

Ackman kept a low profile about his victory. He simply tweeted: "Wise decision. America needs trade, but it must be fair trade."

The tariff storm lasted a full week, but what it revealed would last much longer.

In the Trump era, donors are no longer silent check signers; they are vocal partners, and when necessary, even opponents. And when the opposing voices are loud and unified enough, even Trump must listen.

Twitter Governance: A New Political-Business Relationship

Bill Ackman is handling political-business relations in a more straightforward and blunt way: tweeting and tagging the president.

Traditional political-business relations happen in the shadows, through private club dinners, golf course deals, and messages relayed through intermediaries. The public never knows how policies are made, who influenced whom, and at what cost.

Ackman’s model is completely the opposite—no hiring lobbyists, arranging private dinners, or even formal meeting requests. He simply tweets, letting his 1.8 million followers help him convey his voice to the White House.

This is not coincidental; it is a result of Ackman’s deep understanding of Trump’s media consumption habits.

According to several former White House officials, Trump’s first task every morning is to browse the X platform to see who is talking about him and what they are saying. He pays special attention to accounts with many followers, especially those who have supported him. When these people publicly criticize a policy, Trump takes it seriously.

Ackman’s Twitter strategy also appears to be carefully designed and operated—typically posted late at night and on weekends, with strong wording but not to the point of a break, and always tagged with the president.

Every lobbying effort is public, and every one of his arguments is subject to public scrutiny.

This is a form of honesty that doesn’t conform to the norm, yet is extremely reasonable:

Not hiding interests, but rather making them part of the argument—I have a stake in this, so I care more about the consequences of this policy than anyone else.

However, when billionaires can amplify their voices through follower counts, what are the interests behind the transparency?

A "Radical" with a $9 Billion Fortune

If three numbers were to define Bill Ackman, they would be:

58 years old, $9 billion fortune, 1.8 million X platform followers. These numbers sketch a typical portrait of a Wall Street success story. But Ackman is anything but typical.

In 2014, during a presentation about Herbalife, he passionately argued that the reason this health supplement company could survive was that salespeople were forced to buy its mediocre nutritional shakes, which they often found difficult to resell to real customers.

He accused the company of being a pyramid scheme, preying on the American underclass. In the days following his speech, Herbalife’s stock price rose by 25%. He ultimately lost $1 billion on this short trade.

Justice or interest? This is the key question to understanding Ackman.

In March 2020, when the world was still debating whether COVID would become a pandemic, Ackman spent $27 million on credit protection to hedge against market collapse. A month later, this investment successfully turned into $2.6 billion.

During the same period, he tearfully called on CNBC to "shut down America for 30 days," warning that hotel stocks would "go to zero."

Critics said he was deliberately creating panic to profit from his short position. Supporters said he was warning of risks and fulfilling social responsibility. The truth? Perhaps both.

But there’s no doubt he is smart. While other hedge fund managers were still working quietly, he had realized that the social media era required a new playbook.

He crafted himself into a "social media celebrity" in finance—not only tweeting frequently but also engaging in online arguments, and even participating in professional tennis matches at the age of 59 (though he was eliminated in the first round).

Some say he wants to be the "next Buffett." But Buffett never tweets at the president nor publicly confronts the president of Harvard University over political stances. He seems more like someone who will do whatever it takes to win, yet firmly believes he is doing the right thing.

This contradiction is precisely Ackman’s secret weapon to influence Trump.

An Italian Ravioli Dinner Changes Political Stance

Before May 2024, Bill Ackman’s political resume read like a standard Wall Street liberal list. At charity dinners in the Upper East Side of New York, he was a regular at Democratic fundraising events.

In the same month, a change occurred in Los Angeles.

During the Milken Institute Global Conference, Ackman met Elon Musk. The two billionaires, both active on the X platform, found common ground.

A few days later, back in New York, Ackman dined with Trump. According to Bloomberg, the main course was Italian ravioli. While the specific content of their conversation is unknown, the dinner clearly left a deep impression on Ackman.

In the 2024 presidential campaign, Ackman had supported several anti-Trump candidates; but after that Italian ravioli dinner, everything changed.

In October 2024, he posted a tweet on the X platform with an interview video, listing "33 reasons why I support Trump over Harris."

There were many reasons, but insiders noticed one detail: Ackman’s holdings in Fannie Mae and Freddie Mac had exceeded ten years. And Trump had pushed for the privatization of the two during his first term, but "ran out of time."

Ackman later wrote on Twitter, "I believe the Trump team will complete this work."

On July 14, when Trump survived an assassination attempt, Ackman publicly expressed his support. By January 2025, he even stated that he "no longer wanted any association with the Democratic Party."

From a Democratic donor to a MAGA supporter, Ackman’s transformation seems sudden, but it is actually traceable. Just as Wall Street practitioners prioritize interests, Ackman may have always been a trader. He simply made a political trade as well.

That Italian ravioli dinner may have been the starting point of this trade.

Privatization of the Two, A Decade of Harvesting

Ackman’s foray into Twitter governance can be traced back to a year ago when he called for the privatization of the two, hiding a painstaking gamble behind it.

Fannie Mae and Freddie Mac, these two government-sponsored enterprises control nearly half of the U.S. housing mortgage market. During the 2008 financial crisis, they received government bailouts and have since been under federal government oversight.

For most people, this is just a footnote in financial history. For Ackman, however, it is the biggest bet of his life.

Ackman’s Pershing Square fund began accumulating shares of the two in 2013, when their stock price was less than $2. His logic was simple: these two companies are essentially profitable, and government oversight is only temporary; one day they will be privatized again. When that day comes, stock prices will soar.

That "one day," he waited for ten years.

During this period, the stocks of the two remained stagnant. Other investors fled, but Ackman kept adding to his position. By 2024, he held over 115 million shares, becoming one of the largest external shareholders.

On December 30, 2024, Trump was elected but had not yet taken office. Ackman launched his Twitter blitz.

He directly @ Trump in a tweet, stating, "There is a credible path for the two to end federal oversight within the next two years."

He carefully crafted his rhetoric, focusing on national interests rather than his own. "This will bring over $300 billion in additional profits to the federal government," and "remove $8 trillion in liabilities from the government’s balance sheet."

The most critical line: "Trump likes big deals, and this will be the biggest deal in history. I believe he will get it done." This tweet was viewed nearly 3 million times. Wall Street analysts began to reassess the stocks of the two.

In February 2025, signals emerged.

Scott Turner, the new Secretary of Housing and Urban Development, stated at a confirmation hearing that assisting in the privatization of the two was his "priority"; upon hearing this, the stocks of the two surged. Over the past 12 months, the stock prices of both companies had increased more than sixfold.

Ackman believed that his ten-year wait was about to end.

"You don’t need to be old to prove yourself right." He wrote in a recent tweet, "This was the most inspiring thing I heard when I was 25."

The Trump era changed the rules of the game for donor politics. In this new game, Bill Ackman has scored two victories and is patiently waiting for more.

I "just happen" to care about crypto

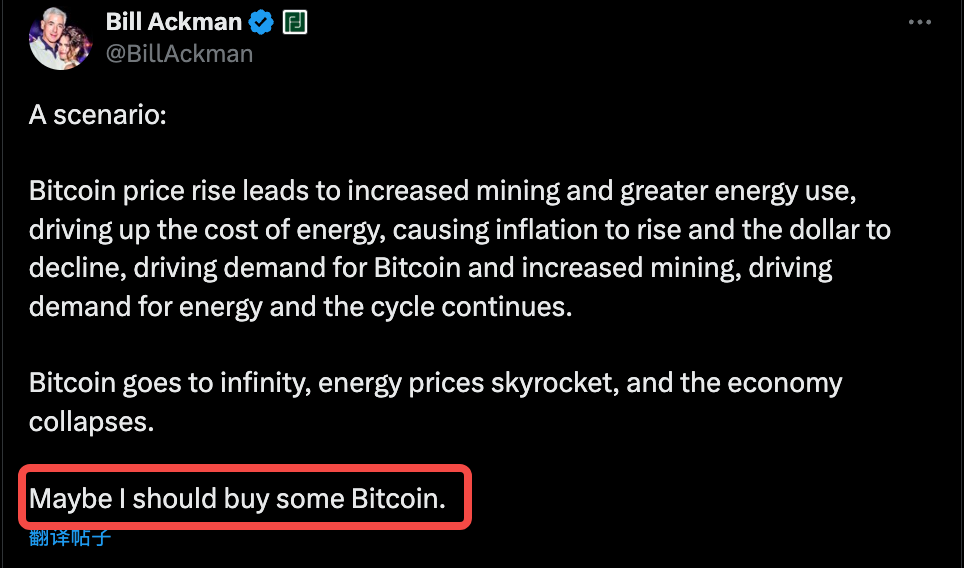

On March 9, 2024, Bitcoin was surging towards an all-time high, nearing the $70,000 mark; Ackman tweeted: maybe I should buy some.

In fact, Ackman’s attitude towards cryptocurrency has always been nuanced. In 2022, after the collapse of FTX, he revealed that he had "small investments" in some crypto projects and seven crypto venture funds, accounting for less than 2% of his assets. He said these investments were "more like a hobby, a way to learn."

What’s more noteworthy is the timing.

Ackman’s Bitcoin tweet came after Trump explicitly expressed support for cryptocurrency. Trump had promised to make America the "global cryptocurrency capital," opposing central bank digital currencies, positions that aligned with Ackman’s free-market ideology.

In addition to Bitcoin, Ackman has also been frequently discussing artificial intelligence. He has invested in several AI-related startups, though the specific names are kept confidential; interestingly, these emerging fields "just happen" to be priorities for the Trump administration—Vice President Vance is a well-known tech supporter, and several Silicon Valley elites have entered the government.

Ackman’s positioning seems to be both a business judgment and a political stance.

Looking back, he always finds the intersection of money and power. Where will the next battlefield be? Perhaps in cryptocurrency regulation, or maybe AI.

But one thing is certain: when that battlefield emerges, Bill Ackman will be suited up, waiting there early, saying to everyone: hey, you made it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。