Author: momo, ChainCatcher

Exchanges like Robinhood and Kraken have successively entered the "tokenization of US stocks," sparking a new wave of integration between cryptocurrencies and stocks. Coinbase has taken it a step further, with CEO Brian Armstrong recently announcing plans to move all assets, including stocks, derivatives, and prediction markets, onto the blockchain for trading, creating an "exchange for everything." The boundaries between traditional finance and crypto finance are becoming blurred.

However, even before this wave of integration began, the crypto derivatives exchange CoinUp.io, established in 2021, proposed the vision of "one account to trade global crypto and financial products." Last September, it was one of the first to launch various traditional financial products such as foreign exchange and stocks, becoming an early explorer in the RWA (Real World Assets) sector.

With its early layout in RWA and the benefits of the derivatives sector, CoinUp.io has maintained strong growth this year, with its derivatives and spot trading volumes rapidly climbing the rankings on CoinMarketCap, emerging as a new dark horse in the exchange sector this year.

Breaking Down Asset Barriers, Initiating a "One-Stop" Trading Revolution

CoinUp.io founder Queenie Li comes from a traditional finance background and has years of experience in derivatives trading.

In 2021, when Queenie Li founded the crypto exchange CoinUp.io, her years of experience dealing with financial users told her that investors need not a single investment platform, but a platform that allows for diversified asset allocation.

She also understood that in mature financial markets, the trading volume of derivatives can reach 6-8 times that of spot trading, which is the future growth engine. Therefore, while most exchanges were still crowded in the spot trading sector, CoinUp.io decisively chose a differentiated path, focusing on building a comprehensive trading platform for diverse derivatives.

This strategic foresight was quickly validated by the market: with the approval of the Bitcoin spot ETF in 2024 igniting a bull market, the daily trading volume of crypto derivatives surpassed $100 billion, exceeding that of the spot market; and as institutions collectively entered the crypto-stock integration sector this year, CoinUp.io's core value of "one account to trade global assets" was unleashed, accommodating massive demand. Its precise grasp of the derivatives benefits and the trend of financial market integration further helped CoinUp.io achieve a strong breakout.

Backed by Millions of Users, CoinUp.io Emerges as an Industry Dark Horse

After four years of development, CoinUp.io has built a complete ecosystem connecting global Web2 and Web3, becoming one of the most noteworthy dark horses in the exchange sector this year.

The platform not only supports mainstream cryptocurrency trading but also integrates traditional financial assets such as foreign exchange, stocks, commodities, and indices. Through a unified settlement mechanism using USDT, investors can seamlessly switch investment targets: after trading Bitcoin, they can immediately invest in tech stocks like Nvidia or the foreign exchange market, achieving 24-hour uninterrupted global asset allocation.

With its differentiated strategy and comprehensive refinement of product architecture, user experience, and risk control mechanisms, CoinUp.io has become a super connector for global digital assets and users:

Over 1000 listed cryptocurrencies, covering almost all mainstream and popular community assets;

Global user base surpassing 10 million, covering over 200 countries and regions, with established regional strategic features;

Derivatives and spot trading volumes ranked 29 and 43 on CMC, showing strong growth momentum;

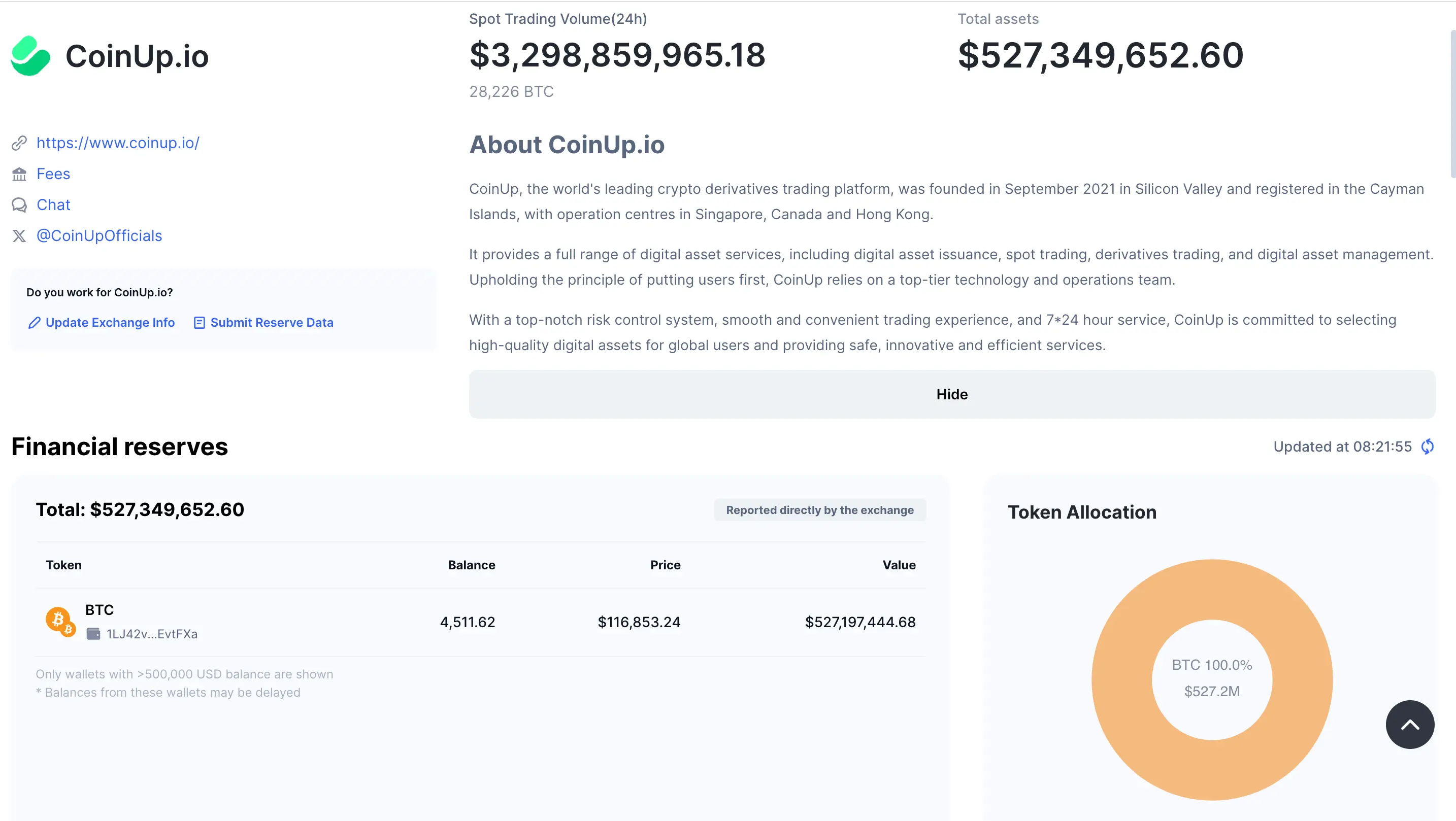

Over $500 million in reserves publicly disclosed on CoinMarketCap, ensuring user asset safety through a transparent mechanism;

Established a global compliance system to meet major market regulatory requirements, demonstrating robust operational capabilities.

It is worth mentioning that CoinUp.io only recently issued its platform token CP after four years of establishment, much later than industry norms. Founder Queenie Li emphasized on the X platform that the platform adheres to long-termism, thus launching CP only after ensuring robust infrastructure and mature token models, to ensure users share in growth dividends and profits. Based on a solid ecological foundation and CP's value capture ability, CP surpassed $1 within two weeks of its launch, increasing over 34 times from its opening price, with a total market capitalization exceeding $1 billion.

It is worth mentioning that CoinUp.io only recently issued its platform token CP after four years of establishment, much later than industry norms. Founder Queenie Li emphasized on the X platform that the platform adheres to long-termism, thus launching CP only after ensuring robust infrastructure and mature token models, to ensure users share in growth dividends and profits. Based on a solid ecological foundation and CP's value capture ability, CP surpassed $1 within two weeks of its launch, increasing over 34 times from its opening price, with a total market capitalization exceeding $1 billion.

Beyond Trading, Building a "CEX + Public Chain" Dual-Engine Financial Ecosystem

In addition to its firm commitment to RWA and derivatives, CoinUp.io has recently officially launched the public chain CP Chain, fully initiating its on-chain ecological strategy. The launch of CP Chain marks a key step in CoinUp.io's transformation from a centralized exchange to a comprehensive Web3 financial ecosystem.

In the past year or two, from the exchange wallet wars to the rise of Hyperliquid, the on-chain expansion of centralized exchanges has reached a critical window period. However, the competitive landscape of on-chain ecosystems for exchanges has not yet fully solidified, even leading exchanges like Binance and OKX are still in early exploration, providing breakthrough opportunities for emerging players like CoinUp.io.

CP Chain not only carries CoinUp.io's grand vision of "one account to trade global assets," but also builds a financial closed loop that empowers both CEX and public chain ecosystems through deep collaboration with exchanges.

Empowering CEX users: CP Chain attracts developers with high performance and low fees, enriching on-chain applications (such as DeFi), enhancing trading experience and user stickiness.

Feeding back into the public chain ecosystem: CoinUp.io's large user base, abundant liquidity, and brand effect inject strong vitality into CP Chain, accelerating ecological prosperity.

The CP token serves as a connector, linking the exchange and on-chain ecosystem, allowing users to enjoy more trading benefits while participating in DeFi and on-chain governance to earn additional profits. This "CEX + public chain" collaborative model not only solidifies CoinUp.io's trading foundation but also opens up a second growth space in on-chain finance.

Comprehensive Ecosystem Upgrade, Aiming for Global Top 10 Exchanges

With its differentiated strategy and solid platform infrastructure, CoinUp.io has achieved multiple milestones.

At this historical intersection of accelerated integration between crypto finance and traditional finance, CoinUp.io also plans to initiate a comprehensive upgrade of its ecosystem. Queenie Li stated that CoinUp.io's next goal is to rank among the global top 10 cryptocurrency exchanges, competing alongside leading exchanges like Binance and Coinbase.

By the end of September this year, CoinUp.io is expected to complete a comprehensive product upgrade and brand rebranding, providing users with a safe, efficient, and diversified new trading experience.

At the same time, CoinUp.io plans to further advance its global compliance layout to meet regulatory demands in core regions, attracting a larger user base.

To support its global vision, CoinUp.io will also expand its team, recruiting blockchain, AI, and compliance experts, establishing regional strategies to accurately capture regional demands and achieve sustained growth.

According to Queenie Li, to further enhance the platform's compliance transparency and influence in the global financial market, CoinUp.io is also exploring plans for a U.S. listing.

From a long-term development perspective, the integration of traditional finance and crypto finance provides a high ceiling for CoinUp.io's growth. The Boston Consulting Group predicts that by 2030, the global RWA market size will exceed $16 trillion.

CoinUp.io has already gained a first-mover advantage in its RWA strategy, with a team composed of elites from traditional financial giants like Goldman Sachs and JPMorgan Chase, providing long-term advantages for building a technically robust and compliant diversified financial ecosystem.

As the ecosystem continues to upgrade, CoinUp.io is expected to achieve a leap from a "trading platform" to a "global comprehensive financial ecosystem."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。