Berachain itself is a distinctive Layer 1 blockchain project, with its most recognizable innovation being the adoption of the PoL (Proof of Liquidity) block reward distribution mechanism. This mechanism transforms the chain's block rewards into an economic mechanism within the protocol that drives ecological growth by directly distributing the vast majority of rewards to users and liquidity providers within the ecosystem, thereby driving application growth and liquidity accumulation on the chain.

In this model, all staked ecological assets directly provide on-chain liquidity support for Berachain. The rewards generated from PoL liquidity mining come from the chain's native incentive mechanism, which aims to build a more capital-efficient and incentive-oriented underlying structure.

Recently, Berachain upgraded its PoL consensus mechanism and officially released the new V2 version. This upgrade primarily introduces a new token economic model, further clarifying the rights to earnings and value support for the $BERA token.

1. Let's first talk about the PoL consensus mechanism

In fact, the operational logic of PoL is both simple and interesting. It integrates the PoS consensus mechanism, liquidity mining, and the veCRV liquidity game model introduced by Curve, creating a new paradigm for on-chain governance and incentive distribution.

Berachain currently has two core types of on-chain native assets:

BGT: As the native governance token and the dominant asset for incentive distribution;

BERA: As the staking asset for validators, which also serves the function of covering on-chain gas fees.

Meanwhile, the main participant roles in the PoL model include: on-chain protocols on Berachain, validators in the network, and liquidity providers (LPs).

In this mechanism, any protocol or DApp wishing to receive BGT incentives must first apply to join the PoL reward treasury whitelist pool and provide sufficiently attractive bribes to attract BGT distribution from validators. Berachain's validators are the block-producing roles in the network (to become a validator, one must stake BERA tokens). When a validator successfully produces a block, the system provides them with BGT token rewards, which consist of two parts:

One part is the basic block reward for the validator,

The other part is called the "variable reward," where the system allocates different amounts of BGT tokens to the validator based on their "Boost" value (calculated as the percentage of $BGT delegated to the validator out of the total delegated $BGT across all validators). The higher the "Boost" value, the more BGT token rewards are allocated, which will decay after reaching a peak to ensure fair distribution of BGT.

After successfully producing a block and receiving rewards, the validator will distribute most of this variable reward according to their own strategy through the BeraChef contract to the approved whitelist PoL pool. In fact, for validators, when distributing variable BGT rewards to Reward Vaults, they will also receive incentives at a rate set by the vault owner, such as HONEY, USDC, or yields provided by the vault.

Typically, protocols that can offer higher yields to LPs will provide better returns for validators, so validators tend to allocate more BGT rewards to PoL pools that can offer higher protocol incentives.

The PoL pool of the protocol, upon receiving BGT rewards, will distribute them to LP users. Therefore, you will see that becoming an LP in some PoL pools on Berachain not only yields regular farming rewards (such as fee sharing, governance token rewards from the protocol, etc.) but also natively earns BGT token incentives from the underlying protocol, with APYs usually being quite high.

For BGT stakers, they can delegate BGT tokens to validators to help increase their "Boost" value, and in return, validators will periodically distribute the aforementioned protocol bribes to their BGT delegators according to a predetermined ratio.

Thus, we see that under the PoL model:

First, protocols typically engage in long-term games to achieve better circulation, continuously attracting liquidity through yields. This "yield arms race" will bring better liquidity foundations to Berachain.

Second, validators are also competing, hoping to attract more BGT holders to support them for better "Boost" values and potential returns, so validators are continuously helping the network optimize liquidity.

Third, those who can provide more liquidity will gain more voice and economic benefits, continuously forming a growth flywheel that integrates liquidity, security, and incentive distribution.

2. What does POL v2 bring?

In fact, in Berachain v1, the BGT token, which serves both governance and incentive functions, has deeply integrated into Berachain's economic cycle. As an incentive asset with inflationary properties, BGT has clear native use cases at the chain's base layer and possesses sustainable earning capabilities.

In contrast, the other core token, BERA, had a relatively weak economic role during the v1 phase. Aside from covering gas fees and serving as the staking asset for validators, users could hardly obtain on-chain earnings from BERA in a native manner. Therefore, most BERA holders had to rely on third-party DeFi protocols, such as participating in LP farming in PoL pools supporting BERA or its wrapped assets, to indirectly earn returns. However, these paths often have high barriers to entry, cumbersome operations, and poor user experiences.

Similarly, in the current globally tightening regulatory environment, BERA, like other native PoS assets on chains, faces similar issues, namely a lack of compliance-friendly earning models, making it difficult for institutional users to adopt or integrate into traditional financial systems, thus limiting market expansion.

Therefore, the most intuitive improvement of v2 for Berachain is the introduction of the BERA incentive module, which allows BERA to better integrate into the Berachain economic ecosystem and empower the ecosystem without significantly altering the existing economic structure.

BERA Incentive Module

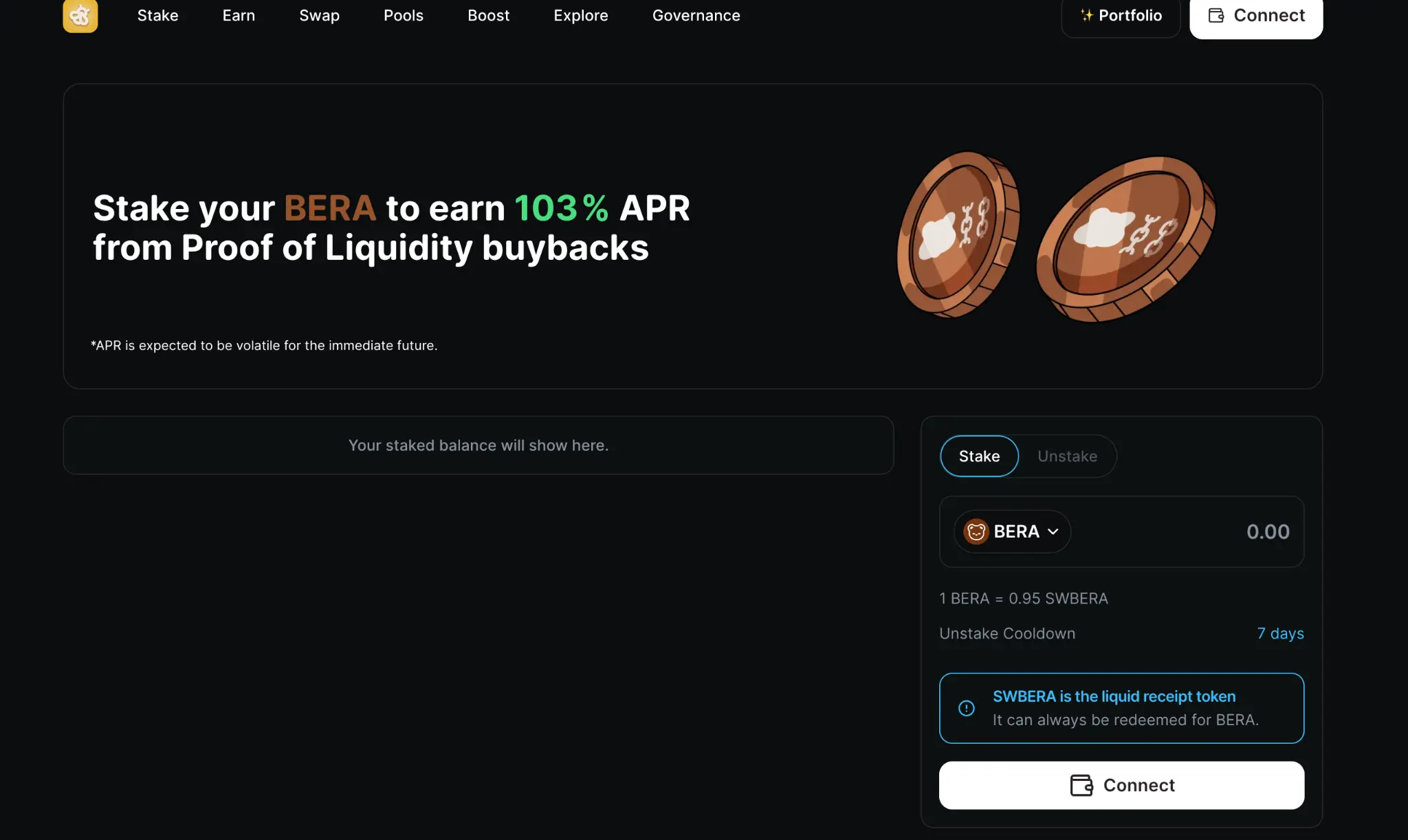

In v2, Berachain further introduced the BERA incentive module, allowing users to stake BERA tokens directly in a single-coin staking manner through Berahub to earn native returns from the chain's ecosystem.

In fact, the BERA incentive module itself is similar to a staking method. If users natively stake BERA tokens, the system will first convert them into wrapped tokens WBERA, and after staking them in the network, it will provide a receipt token sWBERA. Additionally, users can also directly stake WBERA tokens, and the system will similarly provide a receipt token sWBERA.

Similar to Lido's stETH, the sWBERA token acts as a liquid staking token (LST), which can serve as a receipt asset and is also expected to capture returns in Berachain's DeFi protocols, enhancing capital utilization for multiple benefits.

In v1, BGT holders delegated BGT to validators to help increase their "Boost" value.

In contrast, when users stake BERA tokens, they directly stake them into Berachain's contracts, providing a user experience similar to single-coin staking in PoS, rather than delegating to validators. However, it is important to note that redeeming sWBERA for BERA requires a 7-day unlocking period.

From the perspective of revenue sources, in v1, the earnings of BGT stakers came from the bribe income that validators received after providing incentives for specific PoL pools (additional incentives obtained from the treasury or related protocols), which, after deducting delegation fees, were mostly distributed to BGT stakers. In v2, 33% of this bribe income will be repurchased as WBERA and then distributed to BERA stakers (reinvestment), with the amount of staking income users receive depending on their proportion of staked BERA tokens relative to the total.

We see that in v2, the threshold for users to earn income from BERA has been significantly lowered, allowing for direct staking at the chain's base layer, which is safer and more reliable. Users no longer need to engage with third-party protocols to become LPs or delegate types of staking.

In terms of returns, the current yield for single-sided staking of BERA can reach 103% (the highest single-coin staking yield among Layer 1s), which is a very considerable yield state. Although CEX also offers a BERA earning feature, the overall yield is around 60% to 90%. Overall, directly staking on-chain, specifically on Berahub, is more cost-effective (https://hub.berachain.com/stake/).

BERA Staking Returns Have Real Revenue Sources

In fact, the native staking of BERA does not rely on inflation to "distribute tokens." Its mechanism is supported by real revenue.

This is quite understandable. In Berachain's PoL model, protocols initiate "bribes" to validators to compete for BGT rewards. Most of these bribe funds come from the protocols' own treasuries, paid in stablecoins, mainstream assets, or protocol tokens. These funds are not directly given to validators but are auctioned by the network at a 33% fee to convert into WBERA, which is then proportionally distributed to users staking BERA.

In other words, while BERA rewards are indeed issued on-chain, this is not like other PoS networks that create inflation out of thin air. There is real funding backing this process, which is similar to the network selling the "token issuance rights" and then distributing the monetized income to stakers.

Berachain's article provides a good example of this:

If both ETH and BERA issue $100M worth of tokens annually:

ETH directly gives $100M to stakers;

Berachain sells inflation through the bribe mechanism, and if the efficiency is 80%, it will obtain an additional ~$80M in real revenue.

The result is: with the same inflation, Berachain can achieve $180M in on-chain value return, while ETH only has $100M.

Therefore, the staking returns of BERA belong to "real protocol-level revenue," which is not only more sustainable but also provides long-term value support for its native staking scenarios.

Institutional Friendliness

Another aspect is the institutional friendliness mentioned by Berachain.

Previously, we mentioned that the Berachain PoL v2 model transforms inflation into real protocol revenue, creating a clear and well-sourced on-chain real income model for BERA. This model does not rely on third-party protocols or secondary market speculation; it entirely comes from the real bribe expenditures of on-chain protocols, which are converted into traceable incentive funds through auctions.

The revenue generated by this model can be uniformly packaged, split, and distributed in a CEX custody environment, allowing BERA staking to have the potential to be packaged by institutions as financial products, custody agreements, and structured income tools. This effectively addresses a pain point of being difficult to directly reach institutional users.

On the other hand, I am reminded of the recently discussed "Clarity Act," which establishes a clearer compliance framework for crypto assets. Therefore, the launch of PoL v2 is timely, as it binds revenue to real economic behavior at the mechanism level. On-chain financial instruments should have clear income sources, an underlying structure that is auditable, and asset attributes that are custodial and explainable for holders. This aligns with one of the directions advocated by the Clarity Act.

If BERA were to launch a Digital Asset Treasury in the future, it would also provide a compliant, custodial, and sustainable cash flow pathway for on-chain income for institutions and even publicly listed companies.

Overall, the significance of the v2 launch is not merely to accelerate the flywheel within the ecosystem; it also possesses deeper long-term strategic significance for ecological development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。