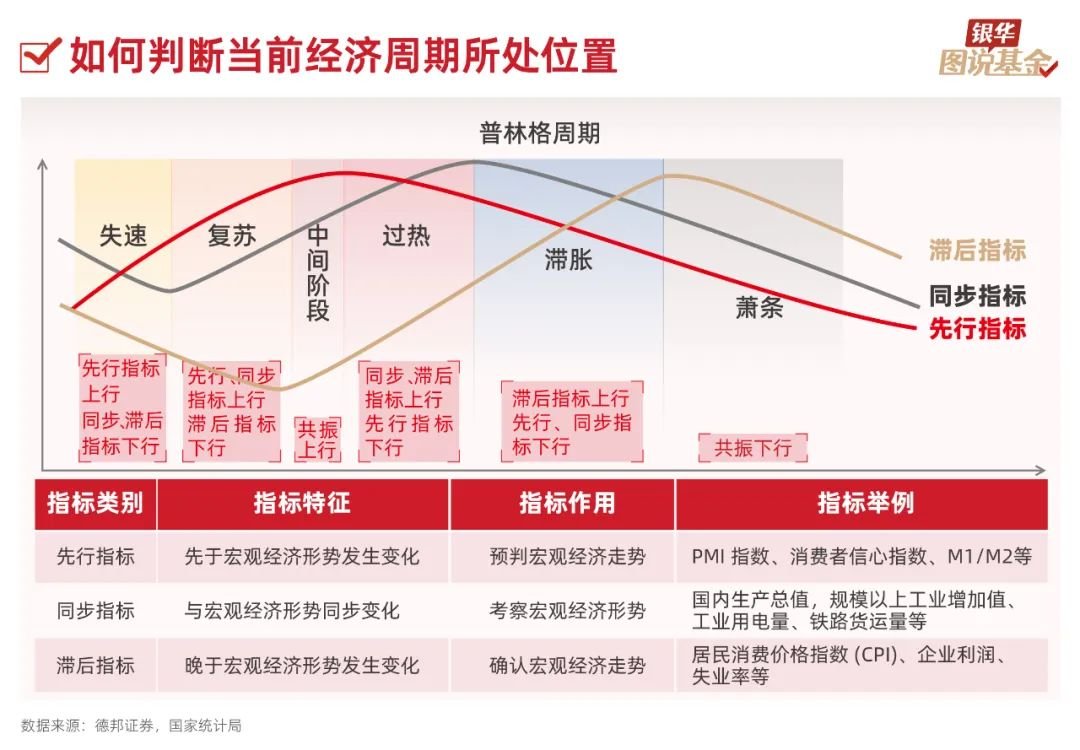

The Kitchin cycle, which I have mentioned multiple times, as shown below on May 25, 2022, predicted in advance that the first quarter of 2023 would be an expansion period of the Kitchin cycle (at that time, #BTC was around $20,000, and Nvidia was below $20). Now we are approaching the peak of the expansion period and transitioning to a contraction period, which may require attention! ⚠️

I have always believed that the rhythm of the market is regular, like tides—it's not always rising, nor is it always falling. One useful "tide chart" is about a 4 to 4.5-year cycle: the first 2-3 years are the expansion period, and the following 2 years or so are the contraction period. During the expansion period, we can increase our allocation to risk assets, as the tolerance for error is high and opportunities are abundant. In the contraction period, we should increase our allocation to fixed income and defensive assets, as the tolerance for error is low, opportunities are scarce, and patience is required!

By April 2025, the economic activity peak of the Kitchin cycle will have actually occurred. Interestingly, the stock market usually lags behind because after the turning point in economic data, the stock market will still have some inertia, especially in the U.S. stock market, which often behaves with a "money-driven" attitude. Currently, the global stock market (especially the U.S. market) is still in the expansion period, but it is clear that we are approaching the end.

Here are a few signals I have been monitoring, which increasingly feel like they are wrapping up:

1️⃣ The stock markets of more and more countries are struggling to reach new highs.

Previously, global stock markets were competing with each other, but now many countries' stock markets have lost momentum, and the U.S. market's independent exuberance is particularly evident, which is a typical characteristic of the late stage.

2️⃣ Weak indices within the U.S. stock market are lagging behind.

The leading stocks in the S&P 500 and Nasdaq 100 are still holding up, but indices like the Russell 2000, which represent small-cap stocks, are starting to show signs of fatigue. History tells me that once there is internal divergence, the overall market will eventually decline.

3️⃣ Leading indicators in commodity futures (such as copper and some industrial materials) are no longer reaching new highs.

These commodities are particularly sensitive to the economic cycle and tend to move ahead of the stock market. Their inability to push higher is actually giving an early "tide warning" to the stock market.

4️⃣ Time window.

I am someone who loves to look back at historical data— the last longest Kitchin expansion was when the Nasdaq 100 rose from August 2011 to July 2015, lasting 47 months, which was truly a "nine-lived bull market." The S&P 500 during that period lasted only 43 months.

And what about this cycle? The S&P and Nasdaq have already risen for 34 months, exceeding the average of 33 months. Theoretically, the gains after this point are likely to be "illusory," meaning that the subsequent Kitchin contraction will likely erase these gains.

So my current mindset is—there's no rush to join the excitement of these last few months, but rather to wait for the contraction period to arrive and for bargains to appear.

The current U.S. stock market is like a high-speed train that has been running for over three years, nearing its final destination. Although it can still coast for a while, its speed has clearly slowed down. The smart move is to stand at the door, ready to get off and wait for the next train, rather than desperately trying to squeeze in during the last few kilometers! The same can be applied to crypto! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。