By Omkar Godbole (All times ET unless indicated otherwise)

The current bull market is emulating a bicycle race's paceline, where the front rider expends energy to drive forward, creating a slipstream for the riders behind before rotating to the back to rest while another rider picks up the effort.

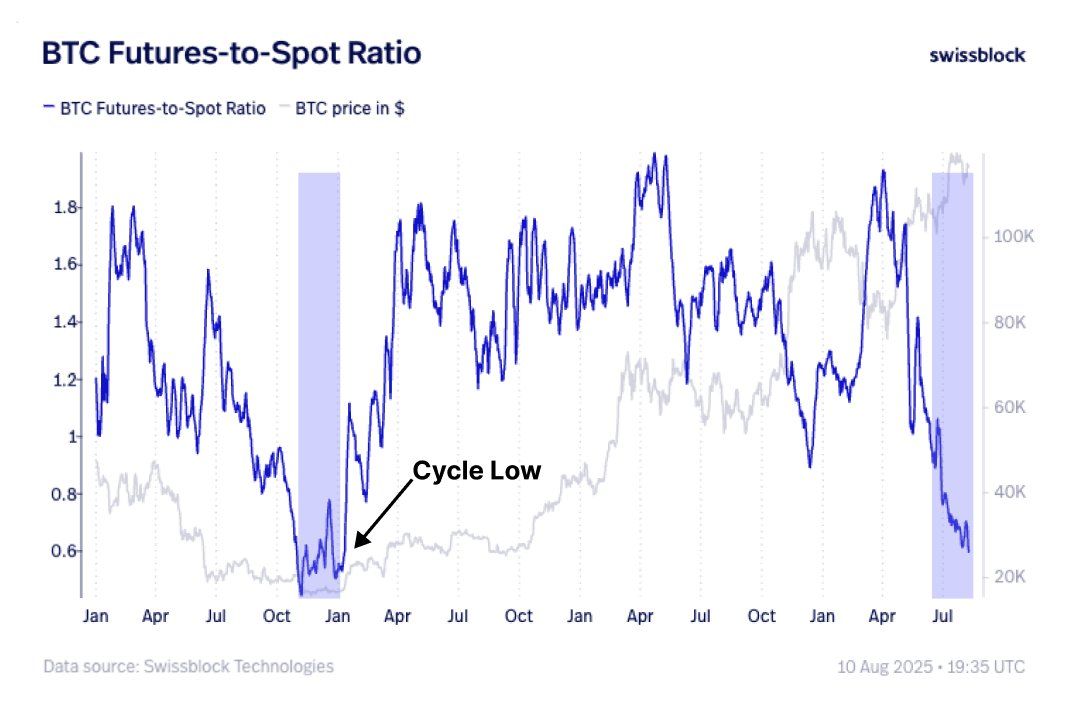

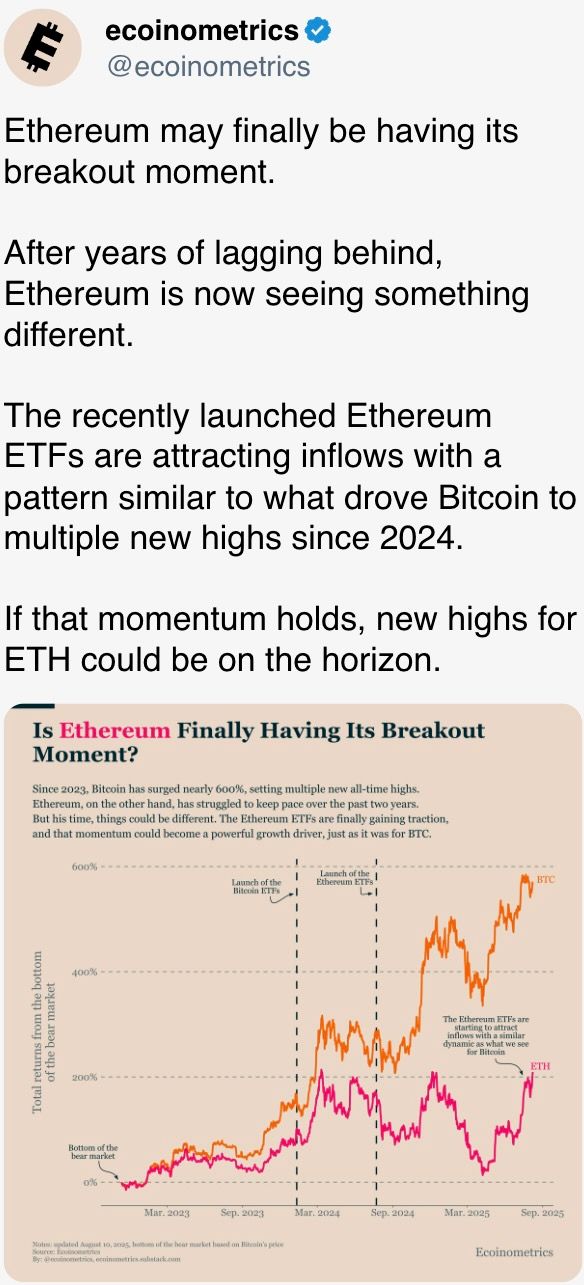

Ether (ETH) took the leader's duties over the weekend. The second-largest cryptocurrency rose from $3,000 to over $3,300, dragging along bitcoin (BTC), which had been struggling to extend gains. Early this morning, BTC rotated to the front, rising from $119,000 to $122,300.

"This is one of the few times when a rally in major altcoins has inspired BTC to break through. It's usually the other way around," Alex Kuptsikevich, a senior analyst at the FxPro, said in an email. "Altcoins are mostly staying out of this race for now, taking a break after last week's rally."

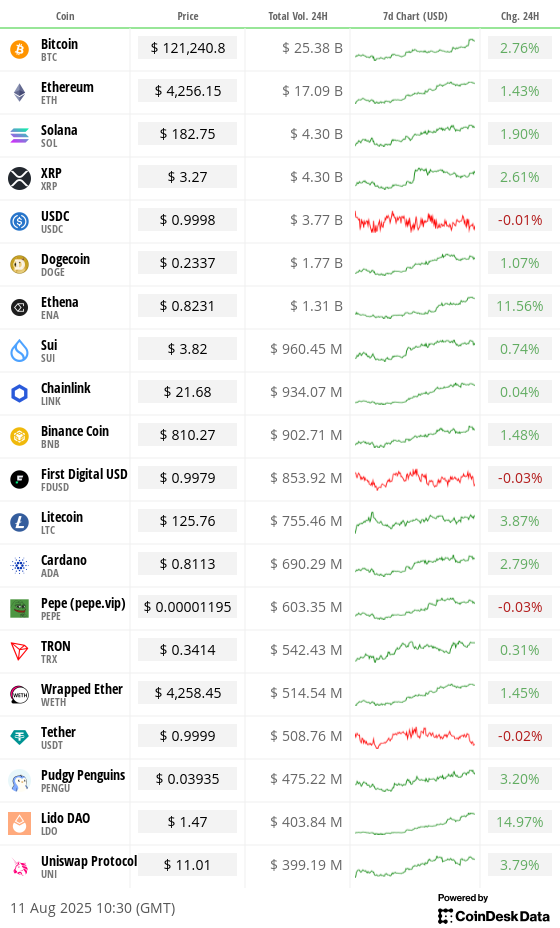

BTC's ascent continues to be driven by spot market demand, as evidenced by the narrowing ratio between trading volumes in futures and spot markets. The ratio has dropped to the lowest since 2022, according to Swissblock Technologies.

Still, at least two factors call for caution on the part of the bulls. Firstly, according to Coinglass, bitcoin is still trading at a discount on Coinbase relative to Binance, a sign of weak demand from U.S.-based institutions. Secondly, cumulative spot and futures trading volumes are notably lower than in July (see Chart of the Day), when prices first topped $120,000, according to Swissblock Technologies. This negative volume divergence indicates weaker buying pressure.

The bullish mood remains more pronounced in ether than bitcoin. On Deribit, the notional open interest in ether calls is nearly 2.3 times greater than in ether puts. The figure for bitcoin is well below 2. ETH's rise is supported by on-chain activity, with daily transaction volume on the network hitting records and the number of new addresses nearing the high reached four years ago.

Still, ether appears vulnerable to pullbacks because 97% of ETH-holding addresses are "in-the-money," according to Sentora. In other words, the current price is above the acquisition cost of most addresses, which means there is a strong incentive for these holders to take profits.

A similar trend exists for XRP, the payments-focused cryptocurrency, which lagged over the weekend but rose 3% early Monday. Speaking of the broader altcoin market, it could soon have its time because BTC's dominance rate is close to breaching a key support. (Check the Technical Analysis section.)

In traditional markets, the U.S. two-year Treasury yield, which is sensitive to short-term interest-rate expectations, held below its 200-day average for the first time since 2022. The decline is consistent with expectations for Fed interest-rate cuts.

The case for a September reduction has strengthened, with some analysts suggesting that even a hotter-than-expected CPI release this week would not deter the Fed from easing. Stay alert!

What to Watch

- Crypto

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Aug. 20: Qubic (QUBIC), the fastest blockchain ever recorded, at over 15 million transactions per second and powered by Useful Proof of Work (UPoW), will undergo its first yearly halving event as part of a controlled emission model. Although gross emissions remain fixed at 1 trillion QUBIC tokens per week, the adaptive burn rate approved by the network’s Computors, the key validators and decision makers, will increase substantially — burning some 28.75 trillion tokens and reducing net effective emissions to about 21.25 trillion tokens.

- Macro

- Aug. 12: The U.S.-China trade truce, which temporarily reduced reciprocal tariffs from triple-digit levels to about 30%, is set to expire. Many analysts say they expect President Donald Trump to extend the truce by another 90 days as both sides seek to avoid escalating the trade war.

- Aug. 12, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July consumer price inflation data.

- Inflation Rate MoM Prev. 0.24%

- Inflation Rate YoY Prev. 5.35%

- Aug. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases July consumer price inflation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.9%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%

- Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%

- Aug. 13, 3 p.m.: Argentina’s National Institute of Statistics and Census releases July inflation data.

- Inflation Rate MoM Prev. 1.6%

- Inflation Rate YoY Prev. 39.4%

- Earnings (Estimates based on FactSet data)

- Aug. 11: Exodus Movement (EXOD), post-market, $0.12

- Aug. 12: Bitfarms (BITF), pre-market, -$0.02

- Aug. 12: Fold Holdings (FLD), post-market

- Aug. 14: KULR Technology Group (KULR), post-market

- Aug. 15: Sharplink Gaming (SBET), pre-market

- Aug. 15: BitFuFu (FUFU), pre-market, $0.07

- Aug. 18: Bitdeer Technologies Group (BTDR), pre-market, -$0.12

Token Events

- Governance votes & calls

- Compound DAO is voting to appoint ChainSecurity and Certora as joint security provers with ZeroShadow handling incident response under a $2 million, 12-month COMP-streamed budget starting Aug. 18. Voting ends Aug. 13.

- Aug. 14, 10 a.m.: Lido to host a tokenholder update Call.

- Aug. 14, 10 a.m.: Stacks to host a townhall meeting.

- Unlocks

- Aug. 12: Aptos (APT) to unlock 2.2% of its circulating supply worth $53.38 million.

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating supply worth $40.35 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating supply worth $17.36 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating supply worth $17.81 million.

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating supply worth $42.77 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating supply worth $91.6 million.

- Token Launches

- Aug. 11: SatLayer (SLAY) and Celeb Protocol (XCX) to be listed on Binance Alpha.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Day 1 of 3: AIBB 2025 (Istanbul)

- Day 1 of 7: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 15: Bitcoin Educators Unconference (Vancouver)

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole, Wyoming)

Token Talk

By Shaurya Malwa

- LayerZero Foundation proposed acquiring Stargate (STG) and folding its token economy into the LayerZero (ZRO) ecosystem, consolidating both protocols’ cross-chain infrastructure under a single governance and rewards asset.

- The plan would convert all STG into ZRO at a fixed swap ratio, retiring STG entirely.

- Stargate bridge revenues — which generated $939,000 for stakers over the past three months — would be redirected to LayerZero, with potential ZRO buybacks funded from these revenues.

- Stargate’s current fixed-yield staking program would be discontinued. Former STG holders would instead participate in LayerZero’s broader token economy without a dedicated yield mechanism.

- LayerZero argues the merger will streamline governance, reduce overlap and concentrate value in one token, positioning the combined platform for stronger network effects.

- Early community reaction was mixed: Some STG holders say the swap undervalues their tokens compared with historical highs and current income streams, while others want improved terms or alternative incentives to offset lost yield.

- If approved, the move would be one of the largest token mergers in this cycle’s layer-1 ecosystem, setting a precedent for how tightly linked protocols manage governance consolidation and revenue redistribution.

Derivatives Positioning

- Bitcoin's early Monday rally failed to inspire increased activity in derivatives, where futures open interest (OI) remains pinned below 700K BTC. That's notably lower than late July's 742K BTC peak and points to a spot-driven rally or risk aversion among traders.

- Ether OI ticked higher to 13.68 million ETH from 12.70 million ETH, indicating demand for leveraged plays. The tally remains well below the July peak of 15.30 million ETH.

- Capital is flowing into altcoin derivatives, as XMR, UNI and BCH lead open interest growth among top 25 tokens by market value. That's not necessarily bullish because only BCH, BTC, BNB, UNI and HYPE boast positive OI-adjusted cumulative volume deltas (CVDs), a sign of net buying pressure. The 24-hour CVDs for other coins were negative.

- On Deribit, options-based implied volatility term structure for ether was inverted, pointing to stronger demand for short-term options. This, coupled with positive call-put skews, indicates market euphoria, a situation characterized by speculative demand for immediate bullish plays.

- Bullishness returned to longer term BTC options as prices topped $120,000.

- BTC block flows for August have mostly featured volatility selling strategies. In the past 24 hours, some traders bought upside call strikes by selling OTM puts.

- In ETH's case, someone bought Sept. 26 expiry $4,100 put while selling $4,300 call in the same expiry.

Market Movements

- BTC is up 3.76% from 4 p.m. ET Friday at $121,289.53 (24hrs: +2.69%)

- ETH is up 5% at $4,261.1 (24hrs: +1.43%)

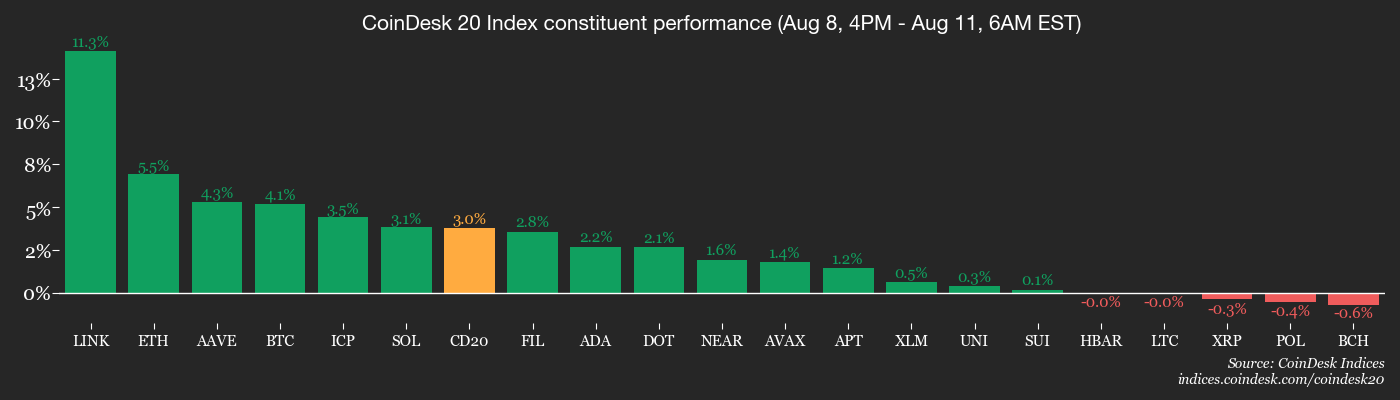

- CoinDesk 20 is up 2.8% at 4,198.32 (24hrs: +1.96%)

- Ether CESR Composite Staking Rate is down 1 bp at 2.91%

- BTC funding rate is at -0.0022% (-2.409% annualized) on KuCoin

- DXY is up 0.1% at 98.28

- Gold futures are down 2.17% at $3,415.40

- Silver futures are down 1.52% at $37.96

- Nikkei 225 closed up 1.85% at 41,820.48

- Hang Seng closed up 0.19% at 24,906.81

- FTSE is up 0.18% at 9,112.40

- Euro Stoxx 50 is down 0.13% at 5,340.88

- DJIA closed on Friday up 0.47% at 44,175.61

- S&P 500 closed up 0.78% at 6,389.45

- Nasdaq Composite closed up 0.98% at 21,450.02

- S&P/TSX Composite closed unchanged at 27,758.68

- S&P 40 Latin America closed down 0.32% at 2,658.01

- U.S. 10-Year Treasury rate is down 2.5 bps at 4.258%

- E-mini S&P 500 futures are up 0.11% at 6,420.25

- E-mini Nasdaq-100 futures are unchanged at 23,730.25

- E-mini Dow Jones Industrial Average Index are up 0.22% at 44,375.00

Bitcoin Stats

- BTC Dominance: 60.73% (0.4%)

- Ether to bitcoin ratio: 0.03518 (-1.26%)

- Hashrate (seven-day moving average): 912 EH/s

- Hashprice (spot): $59.38

- Total Fees: 3.07 BTC / $363,812

- CME Futures Open Interest: 136,815 BTC

- BTC priced in gold: 35.9 oz

- BTC vs gold market cap: 10.14%

Technical Analysis

- BTC's dominance rate, which measures the cryptocurrency's share of the total crypto market value, is testing the long-term rising channel support.

- A breakdown could mean the onset of the long-awaited "alt season," a period marked by relatively bigger rallies in alternative cryptocurrencies.

Crypto Equities

- Strategy (MSTR): closed on Friday at $395.13 (-1.71%), +4.17% at $411.60 in pre-market

- Coinbase Global (COIN): closed at $310.54 (-0.08%), +4.62% at $324.90

- Circle (CRCL): closed at $159.03 (+3.99%), +2.2% at $162.53

- Galaxy Digital (GLXY): closed at $27.78 (-1.1%), +5.11% at $29.20

- MARA Holdings (MARA): closed at $15.38 (-3.57%), +5.01% at $16.15

- Riot Platforms (RIOT): closed at $11.08 (-4.32%), +4.6% at $11.59

- Core Scientific (CORZ): closed at $14.41 (+0.42%), +0.97% at $14.55

- CleanSpark (CLSK): closed at $10.07 (-6.06%), +3.77% at $10.45

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.96 (-1.62%)

- Semler Scientific (SMLR): closed at $36.13 (-3.76%), +3.76% at $37.49

- Exodus Movement (EXOD): closed at $31.9 (+1.79%), +0.25% at $31.98

- SharpLink Gaming (SBET): closed at $23.92 (+2.4%), +9.53% at $26.20

ETF Flows

Spot BTC ETFs:

- Daily net flows: $403.9 million

- Cumulative net flows: $54.41 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs:

- Daily net flows: $461 million

- Cumulative net flows: $9.83 billion

- Total ETH holdings ~5.72 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- BTC's futures-to-spot volume ratio has tanked to the lowest since October 2022.

- That's a sign of a rally being driven by spot market demand.

While You Were Sleeping

- Corporate America's Recession Fears Plummet Despite the Highest Average Tariff Rate Since 1910 (CoinDesk): Mentions of "recession" on S&P 500 second-quarter earnings calls fell to just 16, down from 124 in first-quarter calls and the lowest number since the fourth quarter of 2021.

- BofA Poll Shows Record Number of Investors Say Stocks Overvalued (Bloomberg): Despite improving sentiment about the U.S. economy, BofA’s survey shows cash levels at a sell-signal threshold. The survey found 16% of fund managers underweight U.S. equities and 49% seeing emerging markets as undervalued.

- Watch Out Below: Bitcoin’s Weekend Surge Leaves CME Gap (CoinDesk): Bitcoin’s weekend rally left a gap between Friday’s close and Monday’s open in CME futures. Traders say bitcoin often drops back to the earlier closing price before resuming an upward trend.

- Bitcoin Bulls Takes Another Shot at the Fibonacci Golden Ratio Above $122K as Inflation Data Looms (CoinDesk): Traders on Deribit are betting on bitcoin reaching $140,000. One strategist says a U.S. core CPI above estimates may spark volatility but probably won’t derail expectations for Federal Reserve interest-rate cuts.

- American Companies Are Buying Their Own Stocks at a Record Pace (The Wall Street Journal): Fueled by strong earnings and tax cuts, U.S. firms spent $983.6 billion on buybacks this year. Tech and banking giants led the spree, though some warn this diverts funds from long-term investment.

- U.S. Government to Take Cut of Nvidia and AMD AI Chip Sales to China (The New York Times): Following a White House meeting last week, the companies accepted a revenue-sharing condition for export licenses, prompting warnings this could erode U.S. technological leadership and advance China’s AI ambitions.

In the Ether

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。