Ethereum ETFs Cross $1B Inflows as Investors Show Strong Confidence

Ethereum ETFs reaches its daily all time high $1 billion

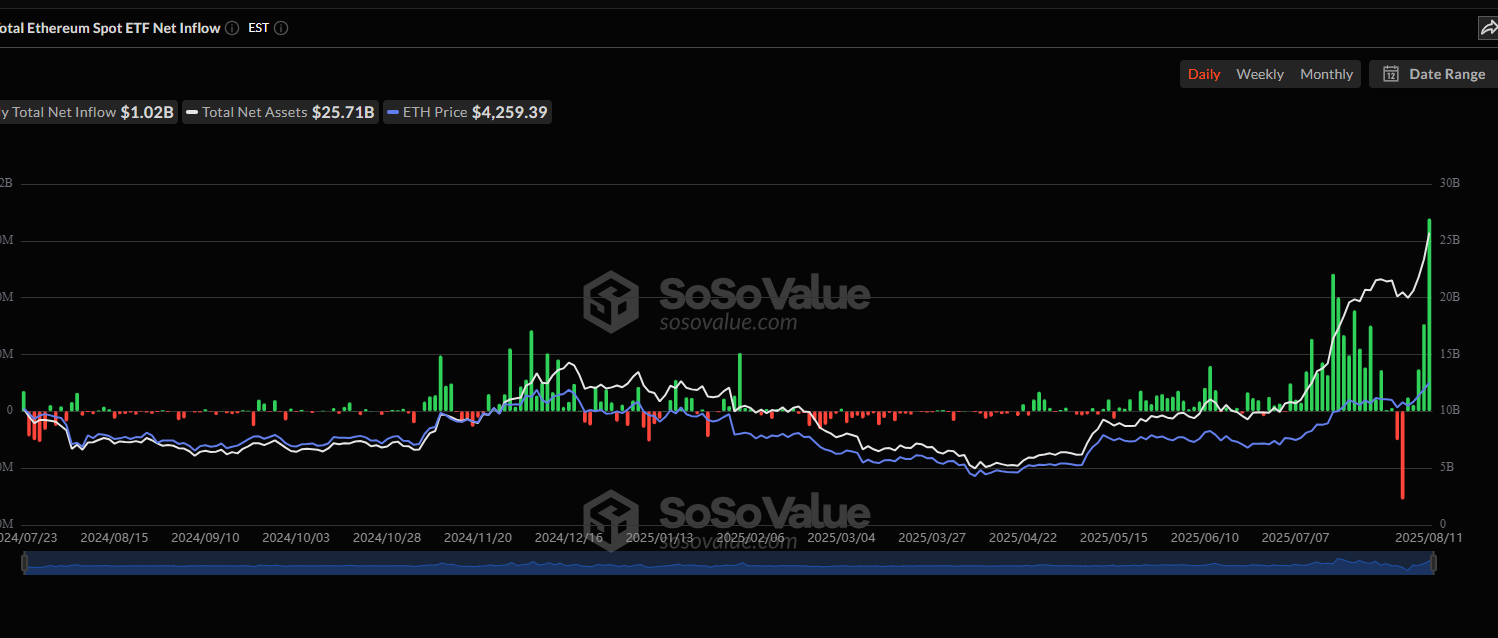

From the last updated data of SoSo Value that is of August 8, 2025 it was recorded that the total net Inflow was $461.21M and the recent data of August 11, 2025 it has marked its significant all time high of $1.02B.

Source: SoSo Value

This has created waves in the world of cryptocurrency, as Ethereum ETFs is showing shocking moves. As per CoinMarketCap , although the it is running little down today around 0.29% as it might be due to geopolitical risks, it is for a very short term soon and currently ETH is trading at $4,312.17. Previously, last time when ETH has shown highest daily Net Inflow was recorded on July 15, 2025 at $192.33 million surge. Afterthat it is the second time it created a record by crossing $1 billion.

The total Net asset of Ethereum ETFs is $25.71 billion. In the current week the total Net Inflow is $1.02B whereas when compared to previous time, the weekly report of July 18, 2025 has surpassed this value by $2.18 billion. At that time the coin was trading at $3,551.59. But what’s driving Ethereum’s remarkable performance?

Ethereum ETFs spot Rally With Strong Inflows

Many big investors like BitMine and Sharplink are continuously purchasing and boosting their asset treasuries. As their prediction says in coming times its prices will soar and is the right time to buy.

This might be the reason it is rising day by day, boosting investors as well as holders confidence. According to SoSo Value, as of August 11, 2025 Blackrock (ETHA) has shown a total net inflow of $639.79 million and cumulative net flow of $10.49B and attained 1st position by surpassing Fidelity and Grayscale (ETH) with total net inflow of $276.90 million and $66.57 million.

How Ethereum ETFs market is performing

-

The prices are getting surged, making and breaking the records, big investments and buying of investors and further giving positive predictions.

-

It is on a strong run right now, surely the geopolitical risks could cause a few bumps along the way but for the moment it is firmly in the driver’s seat.

What asset Surge Means for Bitcoin

Ethereum ETFs are still way behind Bitcoin’s, but lately Bitcoin has just been steady while the another keeps going up every day. Beating Bitcoin isn’t easy for ETH, but running its own slow and steady race and who knows, maybe soon it’ll be right there in the competition

Source: SoSo Value

The overall volume of Bitcoin ETFs on August 8, 2025 was $403.88M and on August 11, 2025 it is $178.15 million, a decrease of $225.63 million which is huge. The daily overall Inflow of Bitcoin is $178.15 million and the total asset value is $154.42 billion. Currently Bitcoin is trading at $118,751.24.

Conclusion

It have smashed records with $1B in daily inflows, showing strong investor faith. While Bitcoin stays steady, Ethereum’s steady climb is keeping it in the spotlight.

Also read: MicroStrategy Shares Soar After Buying 155 BTC for $18M免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。