1. Market Observation

The latest U.S. July CPI data shows a moderate trend, rising 0.2% month-on-month and 2.7% year-on-year, overall lower than market expectations, which has led to a surge in market expectations for a rate cut by the Federal Reserve in September. Although the core CPI rebounded due to rising service prices, analysts generally believe that inflationary pressures are manageable, and the transmission effect of tariffs has yet to manifest, clearing the main obstacle for a rate cut. Additionally, the total amount of U.S. Treasury debt has historically surpassed $37 trillion, and according to CME's "FedWatch" data, the market predicts a 90.1% probability of a 25 basis point rate cut in September, with a cumulative probability of over 60% for a 50 basis point cut in October.

U.S. Treasury Secretary Scott Basset has publicly called for the Federal Reserve to consider a larger 50 basis point rate cut at the September meeting, given that the revised employment data is weaker than the initial value, and hopes that his supported candidate Stephen Milan can be confirmed by the Senate as a Federal Reserve governor before this meeting to bring new decision-making voices. Basset also criticized the Federal Reserve's bloated state, stating that a leader capable of initiating reforms is needed, and revealed that Trump is completely open to the next chairperson's candidate.

Bitcoin has hovered around $118,000 to $120,000 in the past two days. CoinDesk's Omkar Godbole warned that if the price forms a double top pattern near $122,000 and breaks below the neckline at $111,982, it could trigger a massive sell-off, pushing the price down to $100,000. ZAYK Charts also analyzed based on the Wyckoff method, suggesting that if Bitcoin enters a distribution phase, it could pull back to $95,000 to fill the CME gap. However, more analysts hold an optimistic view; QCP Capital pointed out that the derivatives market shows traders hedging risks in the $115,000 to $118,000 range. FxPro's Alex Kuptsikevich believes that the technical resistance level has broken above $120,000, with the next target range possibly between $135,000 and $138,000. Titan of Crypto also set a target price of $137,000 based on trendline breaks. AlphaBTC predicts that Bitcoin will hit a historical high after short-term fluctuations but may experience a larger adjustment in September to October, culminating in a bull market peak by the end of the fourth quarter.

Ethereum's performance is particularly eye-catching, with its price breaking through $4,600, reaching a three-year high, mainly driven by strong institutional buying and favorable regulatory news. CryptoQuant analysis indicates that although market leverage is close to historical highs, which may trigger short-term volatility, strong institutional inflows and improvements in network fundamentals are expected to support a long-term upward trend. After breaking $4,366, ETH began a new round of increases, targeting a price of $4,868. The key support level is at $4,094; if it falls below this, it may pull back to the 20-day moving average of $3,833. Analyst Ali's data shows that the TD Sequential indicator has issued a sell signal on the daily chart, and if it loses the key support at $4,150, it may drop to $3,980 or $3,860. However, most analysts believe the upward trend remains unchanged, with Matrixport's ultimate target still at the historical high of $4,892. Man of Bitcoin believes that Ethereum's price has reached the 2.382 Fibonacci extension level and is currently in the third wave of an ascending structure, with a local top area possibly between $4,596 and $5,094. In the short term, attention should be paid to the micro support level of $4,438 to maintain upward pressure.

Since its inception, Ethereum, with its powerful smart contract functionality and decentralized application potential, has evolved from a supplementary role to early Bitcoin into a core platform supporting trillions of dollars in ecosystems such as DeFi, NFTs, and RWAs, continuously leading the development of global blockchain technology. HashKey's chief analyst Jeffrey Ding pointed out that Ethereum's price dynamics are always a direct reflection of its technological advancements and the macro market environment. The historical high of $4,800 set during the 2021 bull market was a concentrated embodiment of its accelerated transformation from an emerging asset to a mainstream value storage tool, driven by multiple factors such as the global low-interest-rate environment, economic stimulus policies during the pandemic, and explosive growth of the ecosystem. Therefore, the current rise in Ethereum's price is not only a clear signal of the overall market recovery but also a critical moment to test its growth logic and intrinsic value in the new cycle.

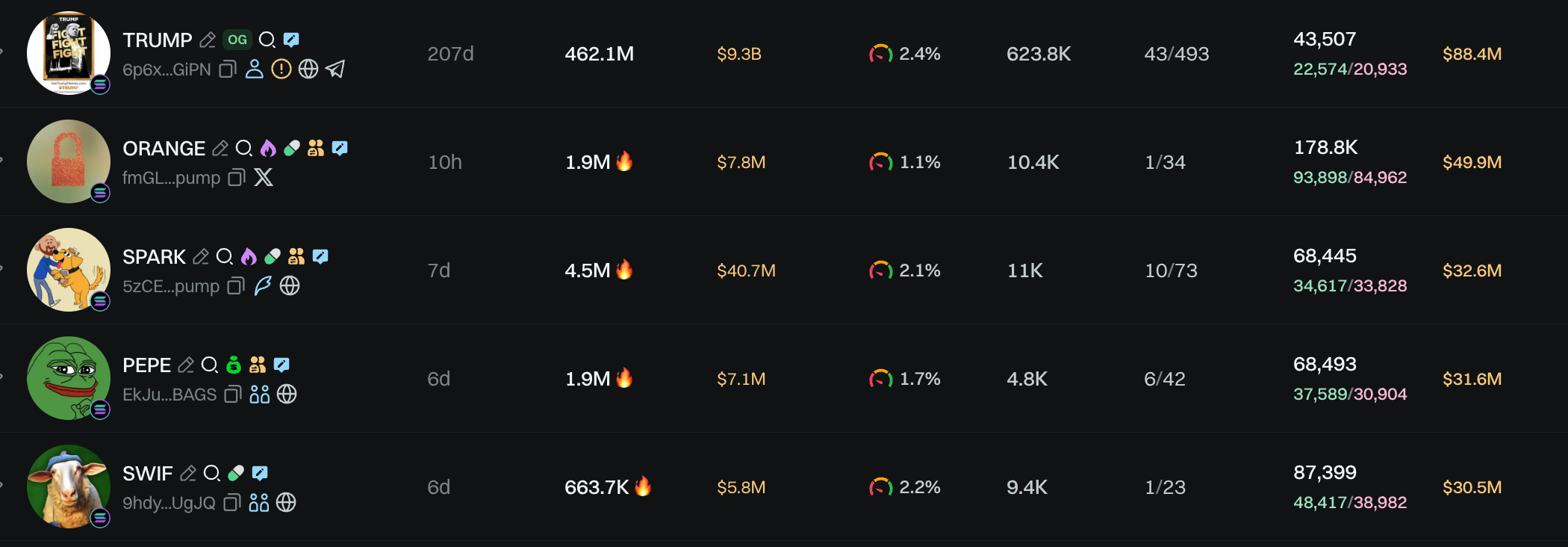

Solana's price has finally broken through $200 again, rising 15% in the past 24 hours, possibly benefiting from Arthur Hayes joining its strategic reserve advisory group, the on-chain issuance of 500 million USDC, and the active buyback by the PUMP project team. In the on-chain meme coin sector, the market value of $ORANGE, related to Taylor Swift's new album, once surged to $16.5 million and is currently fluctuating around $8 million. Meanwhile, an innovative PEPE token recently appeared on the Bags platform, which allows transaction fees to be directly paid to original meme creators, causing its token to rise over 2860% within 24 hours, with a current market value of about $7 million.

2. Key Data (as of August 13, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $119,348 (YTD +27.43%), daily spot trading volume $48.084 billion

Ethereum: $4,632.94 (YTD +38.88%), daily spot trading volume $59.384 billion

Fear and Greed Index: 73 (Greed)

Average GAS: BTC: 1 sat/vB, ETH: 0.59 Gwei

Market Share: BTC 58.5%, ETH 13.9%

Upbit 24-hour Trading Volume Ranking: ETH, CYBER, XRP, SOL, BTC

24-hour BTC Long/Short Ratio: 50.06%/49.94%

Sector Performance: AI sector up 9.98%; L1 sector up 8.78%

24-hour Liquidation Data: A total of 118,463 people were liquidated globally, with a total liquidation amount of $521 million, including $38.13 million in BTC, $286 million in ETH, and $21.78 million in DOGE.

BTC Medium to Long-term Trend Channel: Upper line ($118,326.25), lower line ($115,983.16)

ETH Medium to Long-term Trend Channel: Upper line ($4,102.96), lower line ($4,021.71)

Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of August 12)

Bitcoin ETF: +$65.974 million, continuing 5 days of net inflow

Ethereum ETF: +$524 million, continuing 6 days of net inflow

4. Today's Outlook

Binance Wallet will launch the Bitlayer (BTR) presale event on August 13

Binance Alpha will launch Overlay Protocol (OVL) on August 14

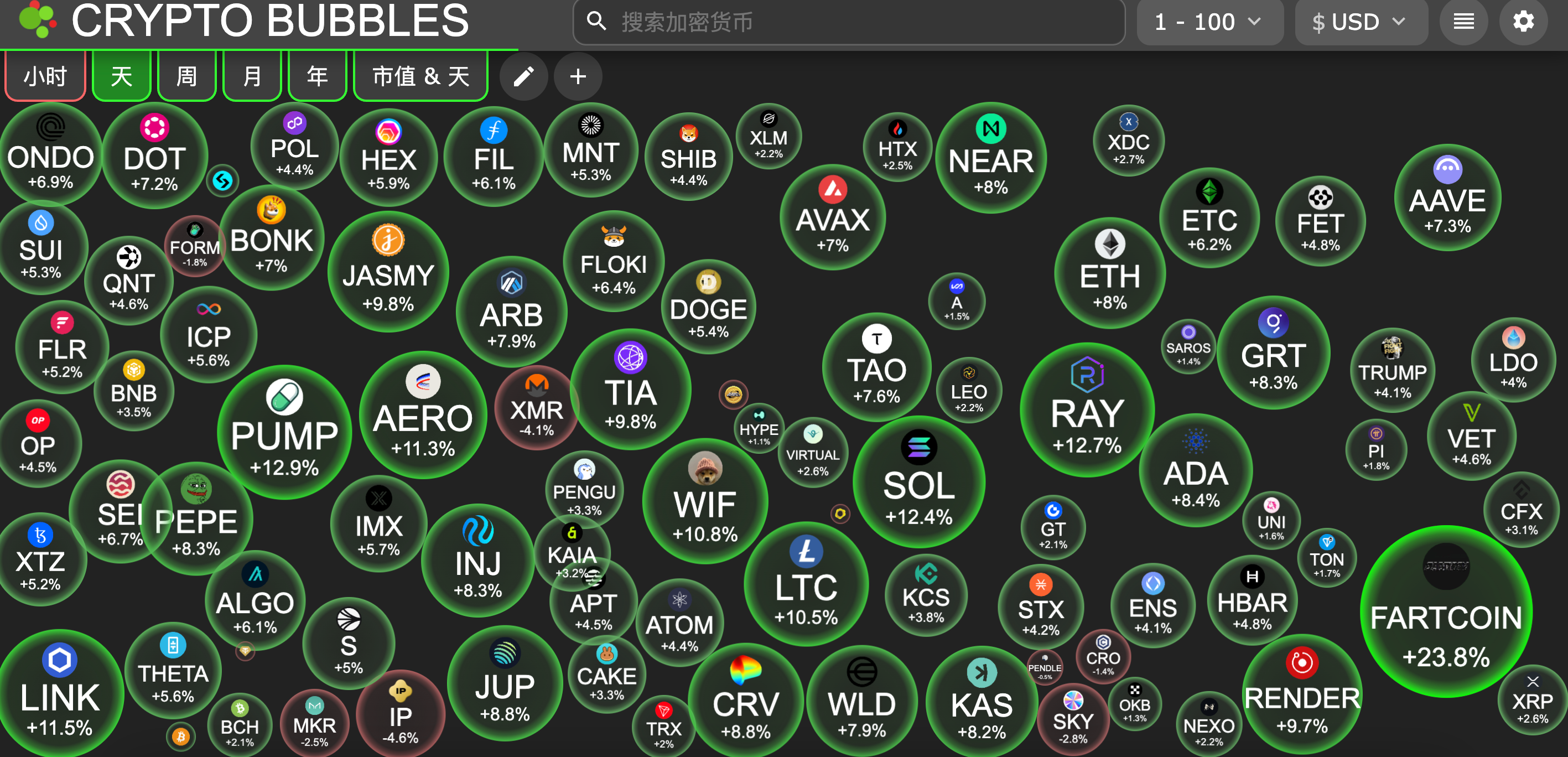

Top 100 Market Cap Gainers Today: Fartcoin up 23.8%, Pump.fun up 12.9%, Raydium up 12.7%, Solana up 12.4%, Chainlink up 11.5%

5. Hot News

Pantera Capital discloses investment of over $300 million in DAT company

Ethereum Foundation-associated address sold 1,694.8 ETH in the past 2 hours

U.S. stock market closes: all three major indices rise over 1%

Stripe appoints Paradigm co-founder Matt Huang as the first CEO of Tempo Blockchain

Coinbase includes WalletConnect Token (WCT) in its asset roadmap

Norwegian Sovereign Wealth Fund's Bitcoin exposure surges 192% to 7,161 coins by 2025

Circle's proposed Arc blockchain will use USDC as its native Gas

Hyperliquid Aid Fund has acquired $1.2 billion in HYPE tokens since its establishment

U.S. core CPI rises to a five-month high, exceeding expectations

This article is supported by HashKey, HashKey Exchange is the largest licensed virtual asset exchange in Hong Kong and the most trusted fiat gateway for crypto assets in Asia. It aims to set a new benchmark for virtual asset exchanges in terms of compliance, fund security, and platform protection.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。