Author: Frank, PANews

On August 13, OKX released an upgrade announcement that triggered a dramatic market reaction, with OKB skyrocketing from $46 to a peak of $142.88 in a short time, reaching a maximum increase of 200% within an hour. The reason for such a strong market response lies in the fact that this announcement was not merely a technical upgrade, but rather a well-considered strategic shift. PANews conducts an in-depth analysis of the content behind this announcement to interpret the multifaceted impacts that OKX's layout may produce.

The key points of this announcement can be briefly summarized as follows:

Restructuring of the OKB economic model: A one-time massive burn will permanently lock the total supply at 21 million tokens, and the smart contract will be upgraded to remove the minting function, moving towards deflation.

Focus on X Layer strategy: Establishing X Layer as the sole core of the OKX on-chain ecosystem and completing significant performance upgrades to support all future on-chain business.

Dual-chain integration: OKT Chain will gradually exit the historical stage, and its token OKT will be exchanged for OKB at a fixed price, achieving the unification of value and ecosystem.

After the burn and merger, what should the price of OKB be?

The most direct trigger for the market was undoubtedly the new token economic model of OKB. OKX announced a one-time burn of approximately 65.25 million OKB, permanently fixing its total issuance at 21 million tokens—this number clearly benchmarks Bitcoin. This burn, calculated at the market price at the time, had a total value of nearly $3 billion, making it one of the largest burn events in crypto history.

More critically, to provide cryptographic-level assurance for this commitment, OKX announced that after the burn is completed, the smart contract for OKB will be upgraded to permanently remove the minting and manual burning functions. This means that the cap of 21 million will be hardcoded, unaffected by the will of any centralized entity. OKB has transformed from a functional platform token into a scarce core asset with a "digital gold" narrative.

However, there are still many questions to be resolved in this process. For example, what will happen to OKT on OKT Chain, and what should the real price of OKB be after its surge?

In the announcement, the official stated that "the average closing price of OKB and OKT on the OKX exchange's spot market from July 13 to August 12, 2025, will be used to periodically and automatically exchange users' OKT for an equivalent amount of OKB." Additionally, before January 1, 2026, OKT holders can still recharge to OKX for exchange.

According to calculations, the exchange ratio of OKB to OKT is approximately 1:9.5. Following the announcement, OKT trading was halted on various exchanges, with the final price settling around $10.3. Based on the current circulation of approximately 17.84 million OKT, the total circulating market value of OKT should be around $183 million.

On the other hand, before the surge, the total circulating market value of OKB was approximately $2.8 billion. Since OKT will ultimately merge into OKB, the total market value of both should be around $2.98 billion. Averaging this over 21 million tokens, the token price would be approximately $141.9. This price also aligns with the market peak hitting $142.

However, the merger of OKB and OKT cannot simply be summed up as 1+1 for the final market value. After all, in addition to the token merger, the existing users, assets, and potential application scenarios within the OKT ecosystem will all be directed to X Layer. This brings new demand and fundamental support for OKB. Therefore, this merger undoubtedly enhances the overall market value and ecosystem value of OKB, achieving a "1+1>2" effect.

Why did the dual-chain competition ultimately choose X Layer?

The core of OKX's recent announcement is a significant strategic decision regarding its on-chain ecosystem layout: after operating both OKT Chain and X Layer, it ultimately decided to terminate support for the former and concentrate all resources and future bets on the latter. This decision is not a simple "either-or" but is based on a thoughtful consideration of technological generations, ecological strategies, and value narratives, choosing a more forward-looking and competitive development path.

To understand the inevitability of this choice, we need to review the development trajectories of both chains.

OKT Chain: Established in 2021, it is a Layer 1 public chain built on the Cosmos SDK, representing OKX's early exploration in the public chain field.

X Layer: Launched in 2023 in collaboration with Polygon Labs, it is a zkEVM Layer 2 network built on Ethereum.

The announcement clearly states that the shutdown of OKT Chain is due to its "high overlap" with X Layer. Rather than allowing two functionally similar chains to disperse resources, it is better to concentrate all efforts on building a flagship. X Layer's clear positioning in DeFi, payments, and RWA, along with an ecological fund and liquidity incentive program, can more effectively build a deep and defensible professional ecosystem.

From both technical and ecological perspectives, X Layer has comprehensive advantages:

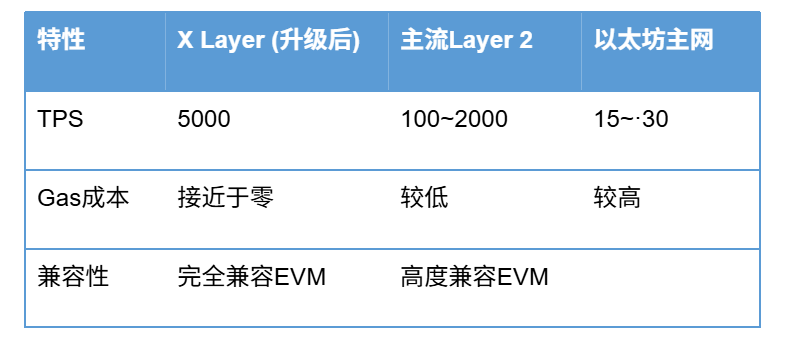

Technological generational leadership: As a Layer 2, X Layer naturally inherits Ethereum's security and achieves high scalability through ZK technology. Its performance upgrade metrics are impressive.

Regarding this performance metric, OKX founder Star has boldly stated on social media that this is far from the end: "For a zk-rollup, 5000 TPS is not a big deal. We will reach even greater heights."

Compared to OKT Chain, X Layer, as a Layer 2, has better compatibility with Ethereum and is more likely to gain market recognition. From a technical standpoint, X Layer's advantages of 5000 TPS and near-zero gas fees make it more suitable for OKX's focus on payment and high-frequency DeFi scenarios.

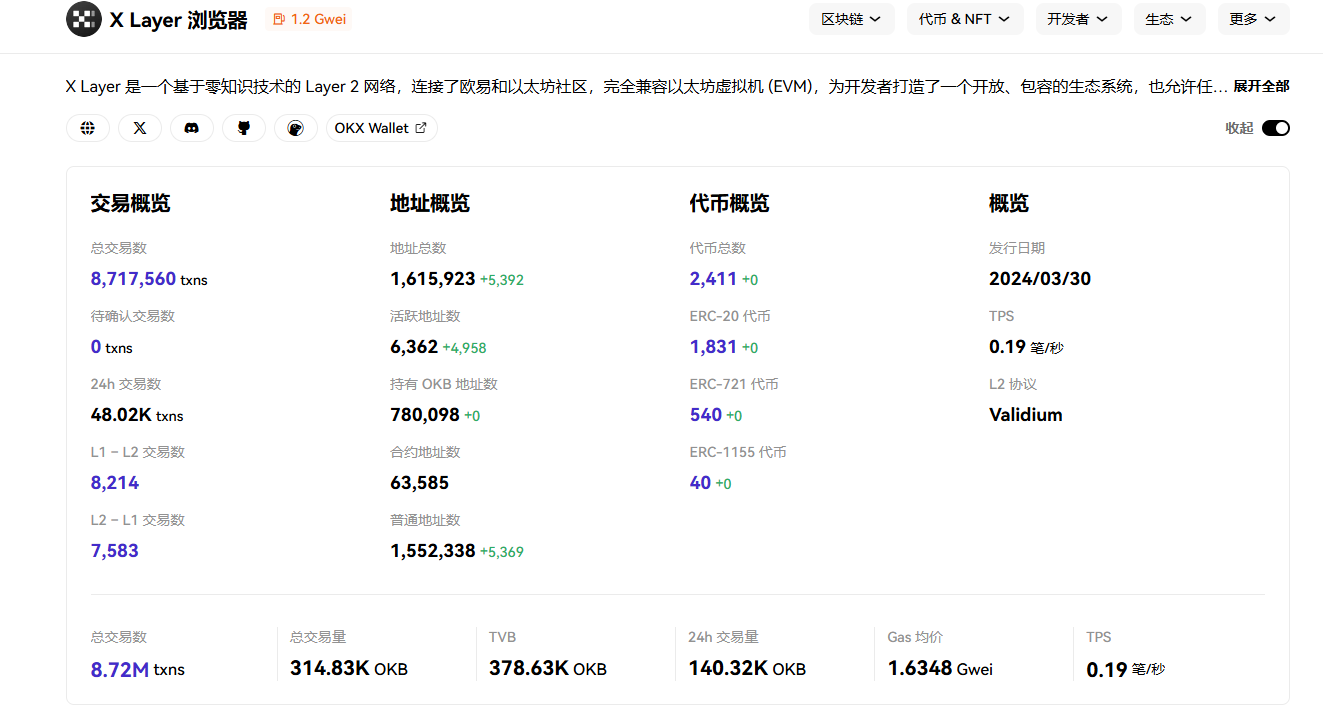

Current data shows that although X Layer has not been online for long, it leads OKT Chain in various aspects such as total addresses and active addresses, indicating a higher market recognition for X Layer.

What is the outlook for OKX's investment in X Layer?

Overall, this strategic upgrade is of milestone significance for OKX. However, from the current market situation, it is a transformation filled with both opportunities and challenges.

In an era where "CEX+L2" has become the industry standard, centralized exchanges have already established a layout for public chains. Whether it is Coinbase+Base or Binance+BSC, both have established first-mover advantages within this model. Coinbase cleverly leverages its brand influence and compliance image in the U.S. market to build Base into a hub for meme coins and SocialFi applications. BSC, on the other hand, has become one of the most active DeFi public chains by utilizing Binance's traffic and liquidity. Although OKX also entered the market early, the dual-chain model seems to have failed to achieve the desired effect. Now, with a strong focus on building X Layer, the challenges ahead are significant.

However, from another perspective, OKX currently has some advantages.

First, as one of the earliest leading exchanges to launch a wallet entry, OKX has accumulated a large number of users and a good reputation over the past year. This upgrade is a complete overhaul based on the existing product line, and the optimization of performance and fees will inject motivation for users.

Secondly, OKX Pay is one of the three major business segments of the OKX ecosystem (exchange, wallet, payment). Going forward, OKX Pay will default to using X Layer as its underlying public chain network. By building a high-performance X Layer, OKX provides a strong technical foundation for its payment tool OKX Pay, making it highly competitive in terms of speed and cost. At the same time, as a high-frequency application, OKX Pay will, in turn, bring a continuous stream of real users and transaction volume to X Layer, promoting the prosperity of the entire on-chain ecosystem and ultimately feeding value back to the core token OKB, forming an ecological flywheel of "exchange-wallet-payment-public chain."

OKX's global business capabilities built over years of operation provide precise partner resources for X Layer's ecological positioning (DeFi, payments, RWA). For example, to tokenize real estate or bonds (RWA) in a certain country, it is necessary to collaborate with local financial and legal entities, which is precisely what OKX's BD team excels at. They can introduce these "outside the circle" high-value resources to X Layer.

Creating a "super funnel" for user conversion, OKX has over 60 million users, and X Layer is designed as this "super funnel." Through seamless integration with the exchange and wallet and features like "0 Gas withdrawal," it minimizes the barriers for users to enter the chain, aiming to efficiently convert existing CEX users into incremental L2 users.

Therefore, the entire reform of X Layer and OKB can be seen as another impact of OKX+L2, and it is also an important foundation for OKX to improve its three major business segments of exchange, wallet, and payment.

Overall, the "heavy bomb" dropped by OKX may have an influence that goes far beyond the astonishing bullish line on the OKB price chart. This is not a simple technical iteration or a routine token burn, but a meticulously planned, interconnected strategic offensive. The price increase seems to be merely the clarion call for this transformation. With OKX's recent move, the crypto market may witness a new wave of an arms race between "exchanges and chains." The dust has yet to settle; let the bullets fly for a while.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。