Author: Little Pig Web3

Introduction

On August 12, 2025, before the U.S. stock market opened, Circle, known as the "first stock of stablecoins," announced its first financial report since going public: as of June 30, the circulation of USDC reached $61.3 billion, a 90% increase compared to the same period last year.

Thanks to the significant growth in USDC circulation, revenue and reserve income reached $658 million, a year-on-year increase of 53%. The financial report also showed that Circle had a net loss of $482 million, primarily due to two non-cash expenses related to the IPO, including employee stock compensation costs attributed to the company's listing and the increase in the valuation of convertible bonds due to rising stock prices. Following the report, Circle's stock price surged nearly 14% in pre-market trading.

Just prior, on July 31, the "first stock of cryptocurrency exchanges," Coinbase, released its second-quarter financial report, which showed profits skyrocketing to $1.4 billion, far exceeding last year's profit of $36 million, but this was mainly due to substantial gains from its investment in Circle. However, the core business performance was weak, with revenue falling short of Wall Street expectations, leading to a more than 16% drop in stock price the following day, which also dragged down Circle's stock price by over 8%.

The partnership between Circle and Coinbase is one of the most notable strategic alliances in the cryptocurrency space. If USDC is likened to a circle, Circle and Coinbase can be compared to the two legs of a compass, forming a unique symbiotic relationship within the USDC stablecoin ecosystem through a carefully designed business structure.

Circle's Past and Present

In 2012, Coinbase was founded in Delaware, USA, by former Airbnb engineer Brian Armstrong and former Goldman Sachs trader Fred Ehrsam, with its earliest product being a Bitcoin wallet. The following year, Circle was founded by Jeremy Allaire in Boston, USA, launching the Bitcoin payment product "Circle Pay" to help investors "more easily convert, store, send, and receive Bitcoin and other digital currencies."

In 2013, Coinbase began venturing into cryptocurrency exchanges, becoming one of the earliest cryptocurrency exchanges. By 2015, Coinbase became the first cryptocurrency exchange in the U.S. to hold a formal license. In 2017, Circle acquired the U.S. compliant exchange Poloniex for approximately $400 million, thereby entering the exchange business and forming three major business lines: exchange, OTC, and its original payment business.

In 2018, Coinbase and Circle jointly established the Centre Consortium, collaborating to launch the USDC stablecoin. USDC is jointly owned by Coinbase and Circle, with Coinbase receiving 100% of the reserve interest income from USDC on its platform, while USDC outside of Coinbase's platform is split 50% between Coinbase and Circle in terms of reserve interest income distribution.

In 2019, Circle shut down all three business lines to fully focus on the operation of the Centre Consortium. On April 14, 2021, Coinbase went public on the Nasdaq stock exchange in the U.S., reaching a market capitalization of up to $100 billion post-IPO, becoming the first publicly traded cryptocurrency company in the U.S.

In March 2023, the collapse of Silicon Valley Bank, which held part of Circle's reserves, caused USDC to temporarily depeg to $0.87. In August, Circle and Coinbase restructured their partnership: the Centre Consortium was dissolved, and Circle acquired Coinbase's remaining shares in it, becoming the sole issuer of USDC, while Coinbase retained a strategic investment in Circle and kept the revenue-sharing agreement.

In May 2025, Coinbase was approved for inclusion in the S&P 500 index. On June 5, 2025, Circle successfully went public on the New York Stock Exchange, with an issuance price of $31 per share, and on its first day of trading, it began a rapid rise, reaching a peak of $298 on June 23, nearly a tenfold increase, with a market capitalization exceeding its reserve asset value. Circle's IPO also became the largest listing of a cryptocurrency company since Coinbase's IPO in 2021 and marked the first large-scale IPO by a stablecoin issuer.

Coinbase and Circle have formed a symbiotic relationship within the USDC ecosystem, with Coinbase providing crucial distribution channels and liquidity support for USDC, while Circle is responsible for issuance and compliance.

In terms of financing, from 2013 to 2016, Circle completed four rounds of financing, raising a total of $136 million, and after the D round of financing in 2016, it was valued at $480 million. In 2018, Circle completed a $110 million E round of financing, led by Bitmain, with a valuation of $3 billion. In 2022, Circle brought in a significant partner, BlackRock, as the manager of the USDC reserve fund and completed a $400 million F round of financing, led by BlackRock, with a valuation of $7.7 billion.

In terms of revenue, 99% of Circle's revenue in 2024 relied on income from reserve fund investments and bank deposit interest, totaling $1.661 billion. Of this, 90% of the reserves are managed by a fund set up by BlackRock for investments (in U.S. Treasury bonds maturing within 93 days), while the remaining 10% of the reserves are deposited in Bank of New York Mellon as bank deposits. Due to the revenue-sharing agreement with Coinbase, Circle paid $908 million to Coinbase in 2024, accounting for 54.2% of its revenue.

In terms of compliance, Circle holds MTL licenses in 46 states, including New York DFS BitLicense; in the EU market, Circle is the first stablecoin issuer to obtain MiCA compliance, allowing USDC and EURC (the euro stablecoin issued by Circle) to circulate legally in the EU; Circle has also received approval from Singapore's MAS. In some countries and regions, although licenses have not yet been issued, the legality of USDC has been recognized, such as in Thailand, Argentina, Japan, Brazil, and Mexico.

Circle's Future — CPN

In January, Circle released the "2025 State of the USDC Economy," which clearly outlined the future development of Circle and USDC, aiming to replace outdated global payment channels — such as SWIFT and ACH — with the Circle Payments Network (CPN).

SWIFT and ACH were established in 1977 and 1972, respectively. Today, global communication has undergone a complete transformation, allowing people to connect instantly worldwide. However, global payments remain stuck half a century in the past, reflected in extremely high transaction costs (0.1% remittance fees and fixed remittance communication fees), long transaction delays (1 to 6 business days), and significant transaction friction (exchange rate friction), as well as the financial inclusion issues faced by many who cannot access the global banking system.

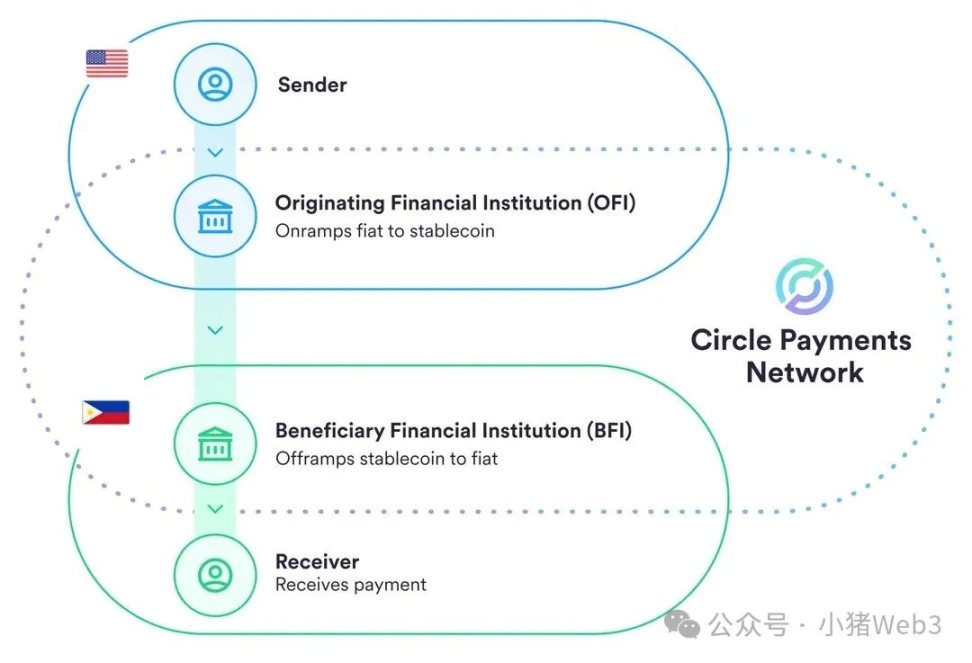

The emergence of stablecoins can leverage the innovative results of blockchain networks to improve the global banking financial system. Circle is building a value internet based on stablecoins to provide a network upgrade for global finance, which is the CPN mentioned above. CPN connects leading global banks, payment service providers, and other institutions, centering around the largest regulated stablecoin, USDC, linking all participants in a real-time global settlement system with very low transaction costs and global accessibility.

Circle serves as the main governance and standard-setting body for CPN, as well as the network operator. Through CPN, Circle is building a new platform and network ecosystem that will create value for every stakeholder in the global economy, helping to accelerate the benefits this new internet-based financial system brings to society. These stakeholders include:

- Enterprises: Importers, exporters, merchants, and large corporations can leverage financial institutions supporting CPN to eliminate significant costs and friction, strengthen global supply chains, optimize cash management operations, and reduce reliance on expensive short-term working capital financing;

- Individuals: Remittance senders and receivers, content creators, and other individuals who frequently send or receive small payments will gain greater value, as financial institutions using CPN can provide these improved services faster, at lower costs, and more simply;

- Ecosystem builders: Banks, payment companies, and other providers can utilize CPN's platform services to develop innovative payment use cases, leveraging the programmability of stablecoins, SDKs (software development kits), and smart contracts to create a thriving ecosystem. Over time, this will fully unleash the potential of stablecoin payments for businesses and individuals. Additionally, third-party developers and enterprises can introduce value-added services to further expand the network's capabilities.

Many companies have already joined CPN, including the emerging Latin American bank Nubank, one of Africa's largest fintech companies Chipper Cash, global payment service provider Worldpay, U.S. payment giant Stripe, and Hong Kong stablecoin sandbox participant Yuan Coin Technology.

Compliance: A Brief Discussion on Hong Kong's Stablecoin Regulation

In the global banking financial system, compliance is of utmost importance, which is why Circle prioritizes compliance and actively applies for licenses worldwide. Circle's compliance must meet local government requirements, typically manifested in:

- Issuance/Redeeming Phase: Ensuring KYC/AML, adopting a "full reserve model," and ensuring reasonable redemption periods;

- Circulation Phase: Real-time transaction screening, ongoing monitoring, and fulfilling obligations to regulatory authorities (e.g., freezing accounts).

On August 1, 2025, Hong Kong's Stablecoin Regulation officially came into effect, with KYC real-name verification requirements becoming a focal point of controversy. According to HKMA requirements, stablecoin issuers must not only verify user identity information and retain data records for over five years but also must not provide services to anonymous users. This means that Hong Kong's stablecoins may initially lack the ability to interact directly with DeFi protocols, isolating decentralized wallets and unlicensed addresses from the compliance system, and such interactions will be legally regarded as "unauthorized use."

It is evident that compared to the scalability and freedom of on-chain protocols, Hong Kong regulators focus more on controlling the regulatory authority over the circulation phase of stablecoins. Although Circle's USDC will also have real-time transaction screening and ongoing monitoring during the circulation phase, it does not significantly affect transfers between wallets and interactions with DeFi protocols. This move effectively excludes ordinary users from the usage scope of compliant stablecoins in Hong Kong, which also means that Circle's USDC will find it challenging to obtain a compliant stablecoin license in Hong Kong.

In my view, ordinary users can continue to use USDT/USDC, as Hong Kong's stablecoins cannot directly compete with USDT/USDC in scenarios like wallets and DeFi. The advantage of Hong Kong stablecoins, or compliant stablecoins from other countries or regions, lies in compliant scenarios controlled by the government. USDT/USDC will inevitably face limitations, such as collaborating with the Hong Kong Stock Exchange to purchase tokenized securities or other RWA tokens, which inherently require strict KYC and identity verification.

Focusing on the payment network of stablecoins, there will be significant impacts. For example, if a user A in Hong Kong pays in HKD, and a merchant B in the U.S. receives the corresponding converted USD, the actual participants in the stablecoin transaction and settlement process are Hong Kong's payment company R (e.g., Yuan Coin Technology) and the U.S. acquiring company S (e.g., Stripe), both of which are institutional users that can meet KYC real-name verification conditions. Of course, user A needs to undergo KYC, but it follows the KYC system of stored-value payment licenses.

The real question is why they would use a Hong Kong dollar stablecoin with lower market acceptance and higher restrictions for their transaction and settlement processes. If they used the widely adopted USDC, it would be easier for the U.S. acquiring company S to accept. However, the payment process involves payment company R converting HKD to USDC. They could either mint a Hong Kong dollar stablecoin using HKD and then exchange it for USDC off-chain, which carries legal risks, or operate a simple OTC license business, where the Hong Kong dollar stablecoin cannot participate.

Conclusion

Circle and Coinbase have formed a symbiotic relationship around USDC: co-founding Centre in 2018, and after restructuring in 2023, Circle became the exclusive issuer, while Coinbase serves as a strategic shareholder enjoying reserve interest sharing. Circle builds a value internet based on USDC as a foundational layer, with future strategies focusing on CPN to replace traditional global payment systems like SWIFT. If USDC is likened to a circle, Circle and Coinbase can be compared to the two legs of a compass, both indispensable.

The newly introduced Hong Kong Stablecoin Regulation's KYC requirements may limit Circle's development in the Hong Kong market, but it also restricts the use of local stablecoins in the stablecoin payment network. From the legislators' perspective, strict KYC to combat money laundering and prevent financial risks is understandable, but it also leaves some room for maneuver.

Looking at the development of mobile payments, it is evident that fintech companies represented by Alipay have, through their business models or innovations, forced financial regulatory agencies to introduce new regulatory policies or rules to address the challenges posed by digital payments and fintech. In the future, the payment field of stablecoins may give rise to a new "Alipay," and we may witness the cyclical nature of history once again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。