Insider's High-Level "Exit" or a New Stage of Industry Innovation?

Author: RT Watson

Translation: Deep Tide TechFlow

Quick Overview

Altcoin Digital Asset Treasuries (DATs) are raising billions of dollars from investors, aiming to promote specific tokens while achieving profitability through publicly listed companies.

Supporters believe that DATs will enhance token visibility, drive widespread adoption, and generate returns; critics argue that this model may send concerning signals, suggesting that major holders are quietly planning an exit strategy.

Digital Asset Treasuries (DATs) have become one of the most controversial trends in the crypto industry. Supporters argue that they can drive token adoption and yield substantial returns, while critics worry that this model may imply that major holders are quietly planning to cash out.

With billions of dollars flowing in, notable figures such as U.S. President Donald Trump, Binance founder Changpeng Zhao, and Tron founder Justin Sun are involved.

Brian Rudick, Chief Strategy Officer of Solana treasury company Upexi, is one of the staunch supporters of DATs.

In an interview with The Block, Brian Rudick stated: “Most digital asset treasury companies are one-way acquisition tools that can drive up token prices, attracting users, developers, and decentralized applications (dApps). They can significantly enhance the visibility of the token ecosystem, especially among traditional investors and institutions.”

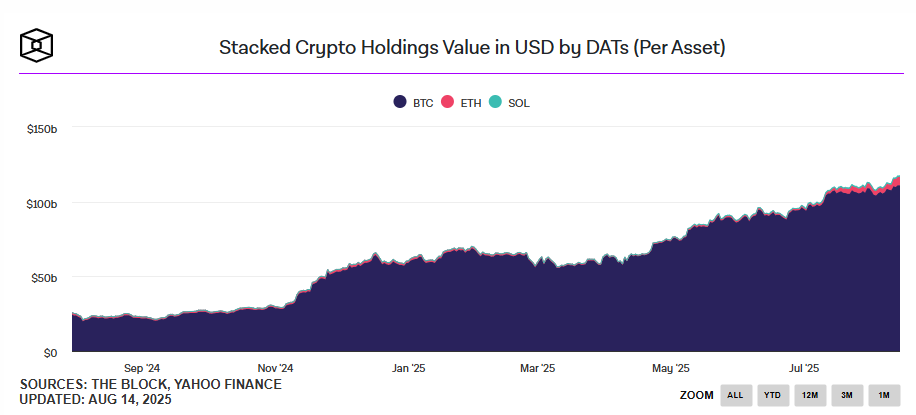

The concept of DATs can be traced back to Michael Saylor's decision five years ago when he transformed his publicly listed software company MicroStrategy (now renamed Strategy) into a Bitcoin accumulator. After a significant rise in Bitcoin prices, especially at the end of last year, the shareholder value of Strategy saw exponential growth. The company's Bitcoin-centric strategic shift suddenly appeared very wise, and Strategy's success has inspired many in the crypto space to emulate this model.

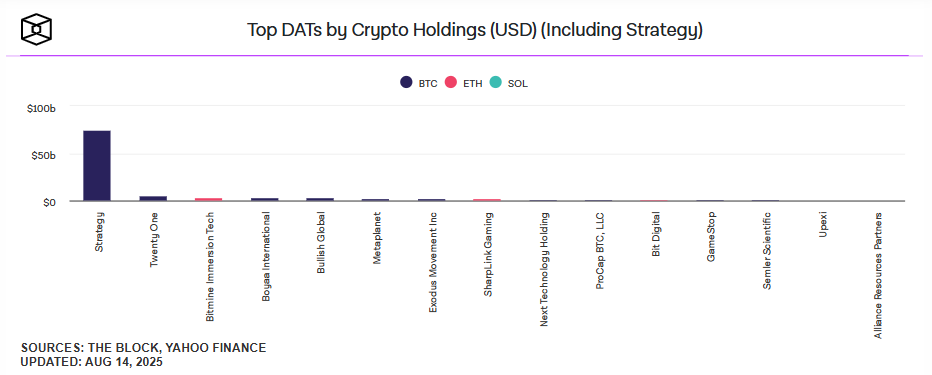

Image Source: The Block Data.

The frenzy around DATs began to spread slowly in 2024, initially sparked by other companies announcing Bitcoin fund management strategies. Soon after, these companies began to hold large amounts of other popular cryptocurrencies, such as Ethereum and Solana.

Ultimately, this trend gave rise to a new type of DAT—those focused on altcoins, directly related to the individuals and organizations behind the tokens. However, the nature of these transactions and the close relationships between some newly established DATs and token developers, major supporters, and primary holders have raised widespread concern. These DATs are often small-cap Nasdaq companies that previously had no connection to the crypto space, raising questions about their motives.

“Many digital asset treasuries involve insiders who were already associated with the target assets at the time these companies were created. These structures clearly raise ethical questions about who can gain privileged access and the information surrounding their formation and strategies,” said Steven Zheng, Research Director at The Block.

Digital Asset Treasuries Supported by the Trump Family: The Backstory of Unlisted Tokens

The cryptocurrency company World Liberty Financial, supported by the Trump family, announced this week plans to raise $1.5 billion to launch its WLFI governance token, which is currently non-tradable and not listed on exchanges.

Shortly thereafter, World Liberty co-founder Zach Witkoff disclosed specific transaction details about transforming a small tech company, ALT5, into a WLFI token accumulation machine during a CNBC television interview.

“If you look at the pre-market trading… our token (WLFI) is trading between $0.35 and $0.90, which means a fully diluted valuation between $35 billion and $90 billion,” Witkoff stated during the CNBC interview. “ALT5 acquired these tokens at a valuation of $0.20. If we take the simple average of the pre-market trading, the valuation is about $0.56. This means that based on ALT5's acquisition price, they acquired these tokens at about a 64% discount, which we believe will bring significant value to shareholders.”

World Liberty is the lead investor in this $1.5 billion financing, essentially exchanging WLFI tokens for ALT5 stock. Additionally, the company stated that Eric Trump serves on the board of ALT5 alongside Witkoff. President Trump and his sons are supporters of the World Liberty project.

World Liberty has not yet responded to requests for comment.

Discounts on Open Network DAT

This month, Nasdaq-listed Verb Technology announced plans to raise $558 million to increase its holdings in Toncoin (the native token of the Open Network, or TON blockchain). This multi-million dollar investment involves venture capital firms such as Kingsway Capital, Ribbit Capital, and Vy Capital. TON is an exclusive blockchain connected to Telegram, the instant messaging app operated by Pavel Durov, who stated in 2023 that he holds Toncoin.

According to an investor presentation submitted to the U.S. Securities and Exchange Commission (SEC), Verb Technology (renamed TON Strategy) expects to benefit from purchasing TON at a discounted price. The company stated in the presentation: “Based on the existing relationships of the TON Strategy board, management, and advisors within the TON ecosystem, the company believes it can acquire a significant supply of TON at approximately a 40% discount.”

According to a TON spokesperson, Kingsway Capital, Vy Capital, and Ribbit have been optimistic about TON since at least March of this year. At that time, these three investment firms collectively participated in a large-scale purchase of Toncoin worth $400 million from “early investors.” Kingsway Capital CEO Manuel Stotz currently serves as the chairman of the TON Foundation and the executive chairman of the newly established DAT and TON Strategy.

Some seasoned crypto industry insiders point out that transactions like those of TON Strategy and World Liberty showcase a familiar closed-loop operation model in the crypto space.

An anonymous industry insider stated: “Information in the gray areas of the cryptocurrency field is likely to be viewed as insider information in the stock market.”

Both TON Strategy and the TON Foundation declined to comment.

More High-Profile DAT Transactions Spark Scrutiny

World Liberty and TON Strategy are not isolated cases. Similar projects also exist with close trading relationships, including those involving Binance founder Changpeng Zhao and Tron founder Justin Sun.

For instance, Changpeng Zhao's family investment office led a $500 million investment to transform Nasdaq-listed CEA Industries into a BNB treasury. BNB is the native token of the blockchain created by Binance. Earlier this year, Zhao stated that 98% of his crypto assets are held in BNB.

In June of this year, Nasdaq-listed toy manufacturer SRM Entertainment announced it had signed a $100 million securities purchase agreement with a private investor to launch a DAT strategy focused on accumulating the native token TRX of the Tron network. At the same time, Tron founder Justin Sun was appointed as an advisor to the company.

Subsequently, SRM Entertainment was renamed Tron Inc. and holds 365 million TRX on its balance sheet, becoming the company with the largest TRX token holdings in the public market. At the end of last month, this DAT associated with Sun submitted a statement planning to issue up to $1 billion in mixed securities to purchase more TRX.

Hyperliquid DAT's Stock Price Rises in Early Trading

The DAT transaction involving Hyperliquid's native token HYPE also includes significant participants, with the project’s venture capital supporter Paradigm assisting in the transaction. The formation of the HYPE treasury involves Sonnet BioTherapeutics, Inc., a biotech company focused on “oncology,” which is transitioning to the DAT model. The company has now been renamed Hyperliquid Strategies Inc.

In the nearly two weeks leading up to the announcement of the transition, Sonnet's stock price had been hovering between $1.00 and $1.50 per share throughout the year. After the company sold $2 million in convertible bonds to specific qualified investors, its stock price began to rise. With increased trading volume, Sonnet's stock price surged over 300% at one point. Subsequently, according to Yahoo Finance, after the company announced its shift to the HYPE treasury, its stock price soared again to nearly $10.

Paradigm co-founder Matt Huang stated on the day of the announcement: “We have heard a lot of institutional demand for investment in Hyperliquid, but the native token HYPE is difficult to access in the U.S. We are very excited about this fund management strategy, and we believe it will contribute to the Hyperliquid ecosystem in many ways over time.”

In a mid-July announcement, various companies disclosed that the DAT is expected to hold approximately 12.6 million HYPE tokens, valued at around $583 million based on spot prices. However, the new ownership structure of this DAT appears quite complex: Sonnet merged with Rorschach I LLC, a new entity formed by Atlas Merchant Capital LLC and its affiliates Paradigm, along with other sponsors.

Currently, Rorschach owns 98% of Sonnet (now renamed Hyperliquid Strategies). Institutions such as Galaxy Digital and Pantera Capital are also involved in the creation of this DAT.

The phenomenon of stock prices significantly rising before such announcements may further reinforce external doubts about potential unfair profits for insiders.

Kadan Stadelmann, Chief Technology Officer of Komoto, commented on these DAT transactions related to founders and major holders in an interview with The Block, stating: “This closed-loop economy phenomenon will give skeptics in the crypto industry something to talk about for years.”

Kadan Stadelmann sharply criticized the operations of crypto treasuries. He stated: “When treasury companies use money from venture capital or foundations to purchase tokens that these VCs have long held, this is not asset management; it is creating exit liquidity. It is a self-dealing behavior disguised as capital deployment.”

In response, Paradigm declined to comment, and representatives of Hyperliquid Strategies have not yet responded to requests for comment.

In contrast, Mara Schmiedt, CEO of Alluvial, expressed a more optimistic view. She believes that the shift of crypto projects towards establishing publicly listed companies presents an opportunity to enhance accountability.

In an interview with The Block, she stated: “Publicly registered companies must adhere to strict disclosure requirements and are expected to maintain strong conflict-of-interest policies. When these entities participate in crypto treasuries, the sense of responsibility they bring can set higher standards for the entire ecosystem.”

Image Source: The Block Data.

“Insider Trading is a Crime”

The recently established SUI treasury company seems to be working to shape a narrative that instills trust among investors.

“Insider trading is a crime,” Stephen Mackintosh, Chief Investment Officer of Mill City Ventures, stated in an interview with The Block. He added that the DAT focused on SUI that he supports has not purchased any locked tokens from investors hoping to exit their lock-up period early.

At the end of July this year, Nasdaq-listed short-term non-bank lending company Mill City Ventures transformed into a SUI treasury strategy through a $450 million private placement. In addition to being part of Mill City's new leadership team, Mackintosh is also a co-founder of the London hedge fund Karatage, which is the lead investor in this private placement.

Mackintosh revealed that Mill City has reached an agreement with the SUI Foundation to purchase SUI tokens at a discount, but so far, the discount appears to be quite small, especially compared to the transactions of World Liberty and TON Strategy.

This week, the SUI treasury company announced the acquisition of approximately 5.6 million SUI tokens at an average price of $3.65, bringing its total holdings to nearly 81.9 million tokens. This price is only slightly below the trading range of $3.80 to $3.90 for SUI the day before.

Mackintosh maintains long-term connections with the SUI Foundation and the developers of the underlying technology, Mysten Labs. He stated that his team's shares will be locked for 12 months to demonstrate their commitment to long-term investment to the “SUI community, investors, and shareholders.” Additionally, he revealed that the tokens purchased from the SUI Foundation will be locked for about two years.

“We believe that SUI assets will achieve compound growth over the next 10 years,” Mackintosh said. “This is exactly what Michael Saylor has proven—you need to buy scarce assets.”

Update: References to unnamed "sponsors" in Hyperliquid Strategies have been removed, and it has been clarified that Galaxy Digital and Pantera Capital are involved in the creation of the treasury. Furthermore, additional details about Sonnet BioTherapeutics increasing its stake before announcing the implementation of the HYPE fund strategy have been added.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。