The news about Bridgewater liquidating its Chinese concept stocks has caused quite a stir in various financial groups today. After all, I also invested in Bridgewater's fund in China, specifically the China Resources Creative Qiao Yun No. 9, which has performed exceptionally well this year with a return rate of over 40%. However, the sudden strategy of the main fund to exit China was unexpected!

We carefully studied Ray Dalio's Bridgewater's 13F report for the second quarter of 2025, and in simple terms: the old man has completely "abandoned ship" on Chinese internet stocks and has turned his attention to the embrace of AI giants in the US stock market.

1️⃣ Complete Withdrawal from Chinese Internet

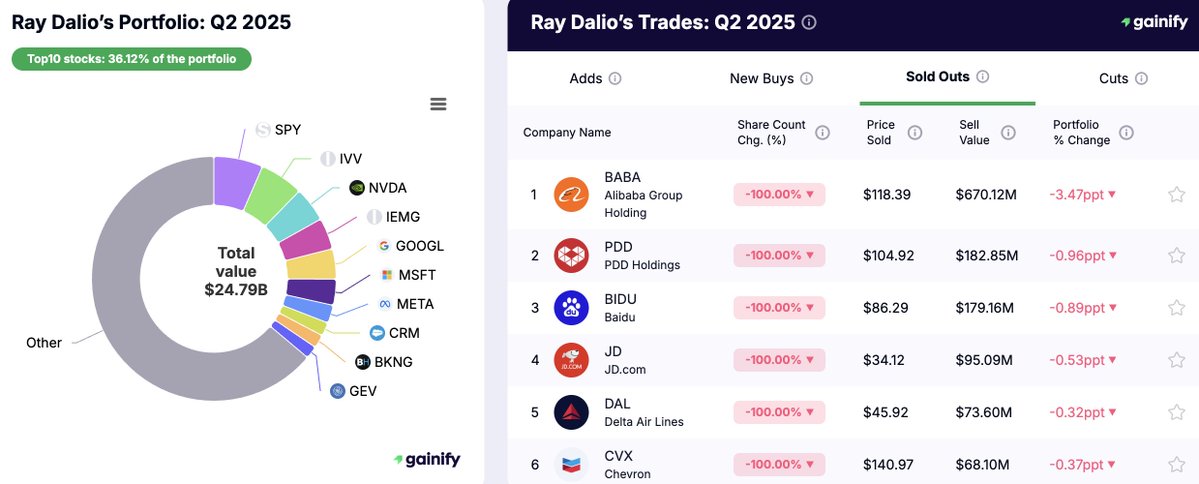

Bridgewater has completely liquidated its positions in $BABA, $PDD, $BIDU, and $JD, cashing out approximately $1.13 billion.

This is not just a "reduction," but a "cleaning out the fridge" type of exit.

In my view, there may be three reasons:

• The recovery of the Chinese economy is not as expected, with pressure on both consumption and exports.

• High policy uncertainty, especially with the lingering shadow of platform economy regulation.

• The returns in the US stock market's #AI sector are too tempting, making the opportunity cost too high.

In other words, Dalio does not think China lacks potential, but rather believes that the capital efficiency in the short term is too low, and it is better to put the money into sectors that can run immediately, especially in the #AI field.

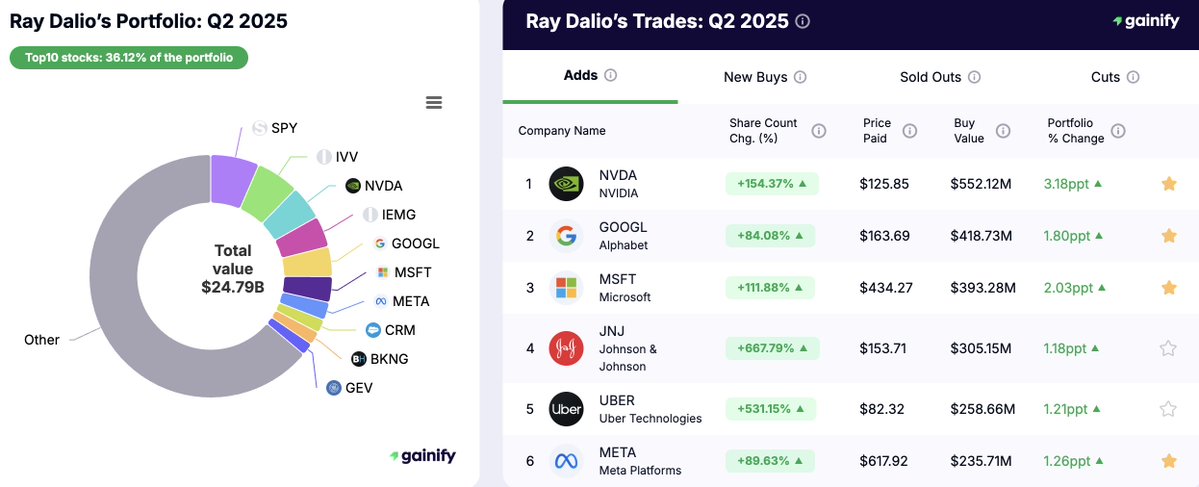

2️⃣ Heavy Investment in #AI and US Tech Giants

The increase in positions this quarter can be described as "violent":

• $NVDA increased by 154%, adding $552 million, now becoming the third-largest holding.

• $MSFT increased by $393 million.

• $GOOGL increased by $418 million.

• Even $UBER saw a massive increase of 5.31 times.

This combination directly ties #AI core hardware ($NVDA) + AI application platforms ($MSFT, $GOOGL, $META) into a war chariot, clearly betting on the #AI infrastructure wave in the next 3-5 years. Moreover, $Uber is also interesting, indicating their optimism about #AI's penetration in practical scenarios like transportation and logistics.

3️⃣ ETFs Still Core Holdings, But Starting to "Trim"

Although $SPY, $IVV, and $IEMG still hold large positions, Dalio has reduced his SPY position by 21.9%, cashing out $452 million.

This is a strategy of "scooping water from a large pool and pouring it into the #AI barrel." The ETF remains as a passive income core holding, but more actively offensive positions have been added.

Overall, considering the current A-shares at 3700 points, Hang Seng at 25270 points, and S&P 500 at 6468 points, with US stocks currently at historical highs, such a significant increase in US stocks while withdrawing from the Chinese market indicates that foreign capital, represented by Bridgewater, does not see positive returns in the Chinese market in the short term and thus does not occupy the capital pool. At this moment, with such historical highs, fully increasing positions in the #AI sector and concentrating funds on the most certain and sought-after core targets, this strategy of focusing on the big while letting go of the small is also worth pondering. As an all-weather strategy, it still retains passive exposure through ETFs to prevent excessive volatility in a single sector. The investment portfolio balances offense and defense, pursuing the #AI big trend while retaining defensive space! Worth learning from 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。