This report is written by Tiger Research and analyzes how Stable, a blockchain focused on USDT, promotes the large-scale adoption of stablecoins through zero gas fees for P2P transfers and sub-second settlement.

Key Points Summary

Stable positions itself as the "Trojan Horse" of the stablecoin market, aiming for large-scale adoption through USDT-centric infrastructure.

It offers fee-free USDT transfers, sub-second settlement, and a simplified interface to address key barriers such as high fees, slow transaction speeds, and complex user operations.

The anticipated plan is to attract users with free, seamless transfer services, then expand into payment, decentralized finance (DeFi) services, and institutional partnerships.

1. Stablecoins: The "Trojan Horse" Entering the Market

Stablecoins have quietly entered the cryptocurrency market like a "Trojan Horse."

Stablecoins have now evolved into a dominant force within the ecosystem. Initially, they were primarily seen as tools to reduce volatility. Over time, stablecoins have become a core component of market infrastructure.

In the USDT-dominated stablecoin market, the circulating supply exceeds $150 billion, with over 350 million users and trading volumes even surpassing Visa. The circulating supply exceeds $150 billion, with over 350 million users.

Their development reflects the bridging role between traditional finance and digital finance. In centralized exchanges, they are the primary medium for converting fiat currency to cryptocurrency. In the decentralized finance (DeFi) space, they serve as benchmark assets for providing liquidity and lending. For cross-border remittances, they offer a faster and more economical option than traditional banks.

The shift in market behavior is noteworthy. Early cryptocurrency trading relied on direct token-to-token exchanges, such as BTC/ETH or BNB/ETH, with value referenced in Bitcoin. Today, trading pairs like BTC/USDT and ETH/USDT dominate. DeFi yields are often denominated in USDT. In parts of Southeast Asia and Latin America, USDT is increasingly used for direct payments, replacing physical dollars.

The market once relied on volatile token valuations, but now stablecoins have become a universal unit of account.

They were initially introduced out of demand and have now become the central axis of the cryptocurrency ecosystem.

2. The Shadow of Growth: Limitations of Emerging Infrastructure

Rapid expansion has also exposed structural weaknesses. The current stablecoin infrastructure faces three key constraints.

1. Unpredictably High Transaction Fees

Stablecoins operate across multiple blockchain networks, but when networks become congested, fees can spike dramatically, making small transactions impractical. In some cases, sending $10 could incur a $20 fee. This undermines the core utility of stablecoins as a medium for everyday payments.

2. Slow Settlement Times

On Ethereum, the confirmation of stablecoin transactions can take several minutes or longer, depending on network conditions. Real-time settlement is crucial for use cases like online checkout or physical retail, and such delays are unacceptable.

3. Complex User Experience

Managing gas fees, wallets, and private keys still presents a high entry barrier for average users. For consumers accustomed to simple payment interfaces like PayPal, the current methods of using stablecoins remain overly complex.

These infrastructural limitations pose significant obstacles to the next phase of stablecoin adoption. Ironically, within the cryptocurrency ecosystem, stablecoins have long been the de facto benchmark asset, yet their everyday usage remains low for the average user.

Stablecoins have fulfilled their initial role as a "Trojan Horse," bringing stability to a turbulent market and occupying a central position in the ecosystem.

The next challenge is to break through the cryptocurrency realm and penetrate traditional financial markets and mainstream consumer payment sectors. Achieving this requires fundamentally addressing the current technological limitations, necessitating a new "Trojan Horse" strategy.

3. Stable: The New "Trojan Horse"

Creating a new "Trojan Horse" for the market does not require inventing another stablecoin. Stablecoins are merely tools pegged to the dollar. The next "Trojan Horse" is to build dedicated infrastructure for existing stablecoins, especially those that already dominate the market.

This is where Stable comes into play. Unlike generic blockchains, Stable is specifically designed for USDT. It does not simultaneously support USDT and other tokens but serves as a high-speed network dedicated to USDT transactions.

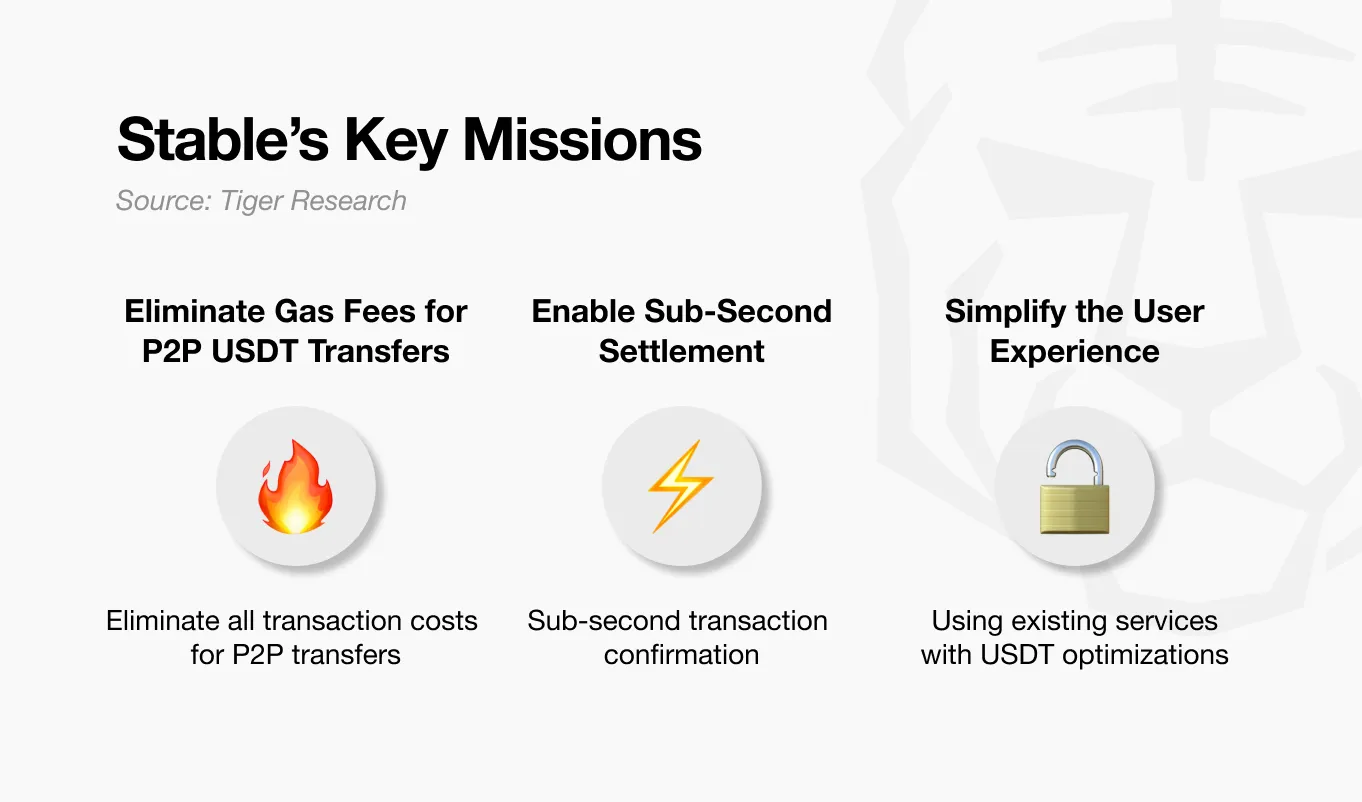

Stable's mission has three aspects:

Eliminate fees for P2P USDT transfers: Completely waive fees for P2P USDT transfers, addressing the inefficiency where even a $10 transfer could incur excessive fees on existing networks.

Achieve sub-second settlement: All transactions are settled within one second, eliminating the common wait times in physical and online retail payments.

Simplify user experience: Hide fee calculations and wallet management, enabling intuitive operations without technical burdens.

The key is that these improvements are interrelated. Eliminating fees simplifies the user experience, while faster transaction processing enhances practicality in real-world commerce. Together, these factors lay the groundwork for stablecoins to expand from the cryptocurrency ecosystem into mainstream payment markets.

Stable's vision is not just to become another blockchain but to be the core infrastructure supporting the $160 billion USDT ecosystem.

It aims to address the structural limitations of existing stablecoin infrastructure, including unpredictable fees, slow settlement speeds, and complex user interfaces. This approach moves away from the fragmented model of each chain independently supporting USDT, shifting towards a unified environment optimized for USDT operations.

4. How the Stable Architecture Works

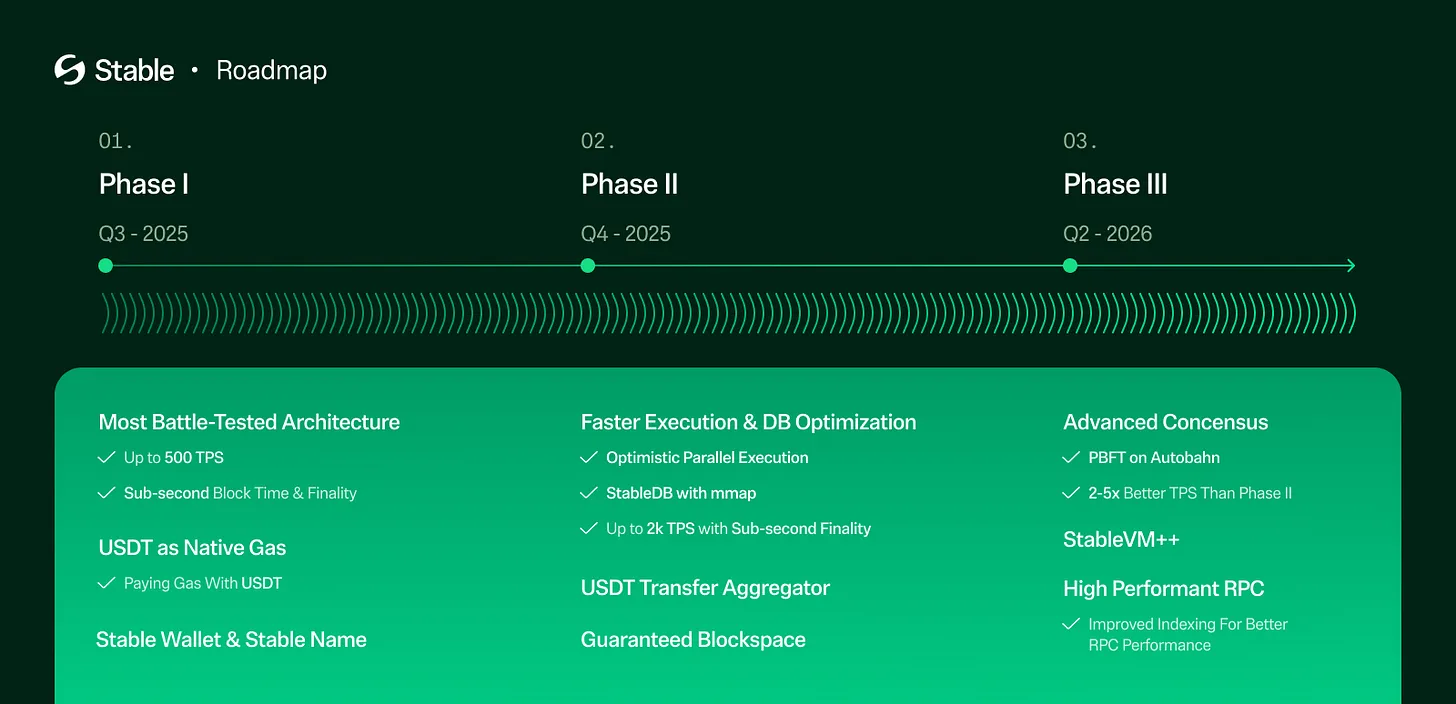

To realize Stable's core vision, multiple technical elements must work in harmony. Stable is currently still in the testnet phase, and the team is preparing for the official launch. Its anticipated architecture clearly illustrates the operational structure of the system.

4.1 Fee-Free USDT0 Transfers: EIP-7702 and Account Abstraction

The stable network operates with two types of tokens.

USDT0 represents USDT brought in from external networks via cross-chain bridges. gasUSDT is a network fee payment token, pegged 1:1 to USDT0, used solely for transaction fees. Both can be exchanged 1:1 for actual USDT.

To achieve fee-free P2P transfers, Stable leverages EIP-7702 and account abstraction technology. Its key advantage is that users only need to hold USDT0 to conduct all transactions.

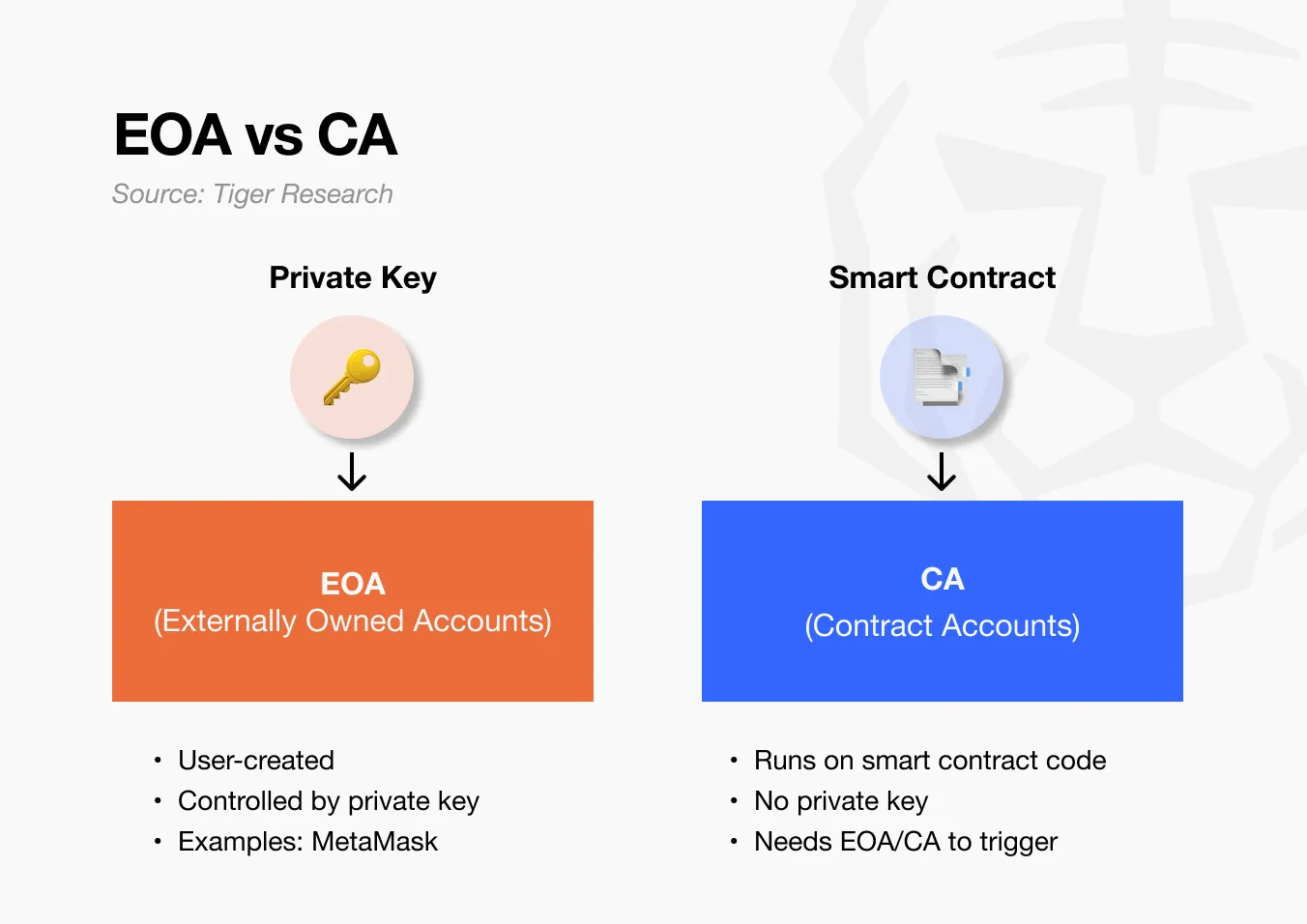

In current blockchain systems, there are two distinct account types:

Externally Owned Accounts (EOA): Standard wallets (e.g., MetaMask) controlled by private keys, capable of signing transactions but with limited functionality.

Contract Accounts (CA): Smart contracts that can execute complex logic but cannot independently initiate transactions.

Account abstraction merges these account types, enabling standard wallets to possess smart contract capabilities. This allows users to specify operations such as "pay fees with USDT" or "request fee waivers."

The first standard to address this issue is ERC-4337. It requires creating a new smart wallet and transferring funds from the existing wallet, a process prone to user error.

Previous Method: Create a new smart wallet → Transfer funds from existing wallet → Use new address

EIP-7702: Retain existing wallet → Add smart contract functionality → Keep the same address

EIP-7702 enables smart functionality on existing wallet addresses without the need to transfer funds, thus eliminating the migration step. Users can continue using their existing MetaMask wallets while adding smart features.

In Stable, all wallets natively support EIP-7702, enabling smart wallet functionality without additional setup. This includes features like transaction fee sponsorship available directly within existing wallets.

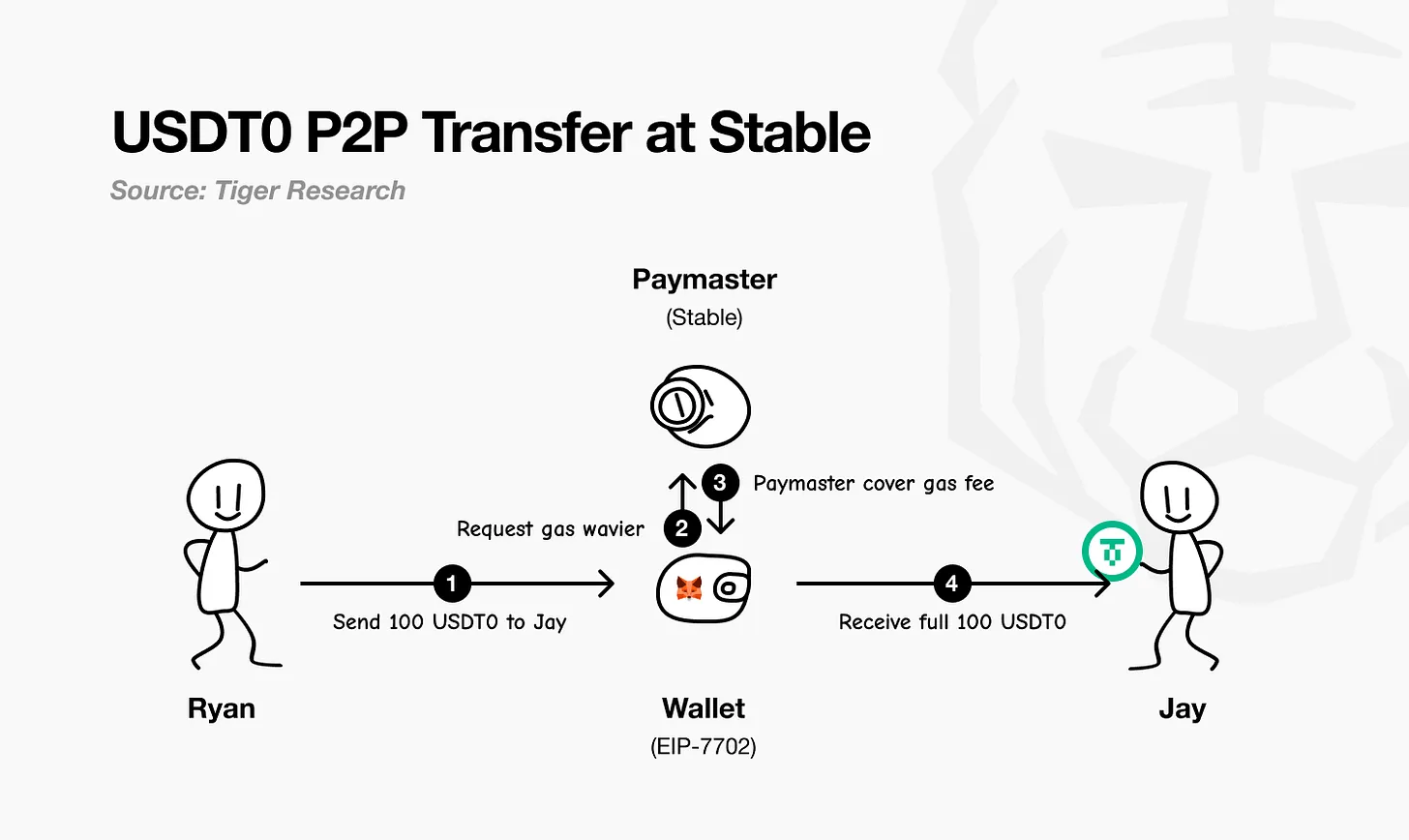

Example:

Ryan sends 100 USDT0 to Jay via MetaMask.

The EIP-7702-supported wallet requests a fee waiver.

The fee is borne by the payer.

Ryan's balance decreases by 100 USDT0, while Jay receives the full amount.

Without deducting fees, Ryan does not need to hold or calculate costs, similar to sending money via PayPal. This eliminates the need to hold fees separately or manually calculate costs.

4.2. Sub-Second Transaction Finality

Stable adopts the StableBFT consensus algorithm, generating a block approximately every 0.7 seconds and finalizing transactions after a single confirmation. This eliminates the common "pending" phase in many blockchain transactions, providing an experience similar to instant approval at payment terminals.

To further enhance speed, Stable is developing Block-STM parallel processing technology, capable of executing independent transactions simultaneously, which account for about 60% to 80% of network activity. This approach is akin to setting up multiple checkout counters in a store to reduce wait times.

In the long term, Stable plans to upgrade to a consensus mechanism based on Autobahn DAG. This structure allows multiple blocks to be proposed simultaneously and separates data propagation from sorting, thereby reducing bottlenecks. Internal tests have recorded transaction processing rates of up to 200,000 transactions per second, although this is still in the pre-production phase.

4.3. Simplified User Experience

Stable eliminates the need to calculate transaction fees and manage separate fee tokens while maintaining compatibility with existing Ethereum. This allows users to continue using familiar tools like MetaMask and Etherscan without additional learning costs.

In addition to simple compatibility, these tools also feature optimizations for USDT, running more smoothly: MetaMask supports fee-free USDT0 transfers, while Etherscan presents USDT transaction records in a more intuitive format.

It's like upgrading to a new smartphone while keeping all existing applications. Users retain a familiar environment but gain enhanced functionality.

Additionally, USDT from other networks can be seamlessly imported through the existing LayerZero cross-chain bridge. USDT0 adopts LayerZero's OFT (Omnichain Fungible Token) standard, eliminating the complexities of traditional bridging. In the traditional model, each network maintains a separate version of USDT, leading to fragmented liquidity.

With the OFT standard, a single USDT0 functions identically across all networks. Whether bridged from Ethereum or Arbitrum, the resulting token is the same USDT0, thus eliminating liquidity fragmentation and simplifying asset transfers.

Planned development projects include the Stable Name System, which will replace complex wallet addresses with human-readable names, further enhancing usability. Similar to email addresses, users can send funds to identifiers like "ryan.stable" or "jay.stable." While still in the planning stage, implementation and widespread adoption may take some time. Technically, the system is expected to adopt a structure similar to Ethereum Name Service (ENS) and add features optimized for USDT transactions.

4.4. Additional Technical Components

The network is also developing StableDB, a dedicated database architecture that separates state submission from state storage.

In most blockchains, new blocks must be fully written to disk before the next block can be processed, and slow disk writes can cause processing delays. StableDB eliminates this bottleneck by first confirming execution results in memory and then writing them to disk in parallel.

This structure is enhanced by memory-mapped file input/output (mmap), which directly links files stored on disk to the operating system's memory space. This allows frequently accessed data to be read and written as if it were in memory, bypassing slower disk access and significantly improving processing speed. Its effect is similar to a busy restaurant where staff quickly jot down orders and later input them into the point-of-sale system, allowing the kitchen to start preparing immediately.

For enterprise clients, Stable plans to launch a "Guaranteed Blockspace" feature, a dedicated transaction capacity that ensures stable throughput regardless of network congestion, similar to a bus lane on a highway. Additionally, a confidential transfer feature is also in development to hide transaction amounts while still meeting anti-money laundering (AML) and KYC compliance requirements. Looking ahead, the current execution engine written in Go will be replaced by a C++ version called StableVM++, which will achieve lower-level memory control and performance optimization, aiming to increase execution speed by up to six times.

5. Expansion Scenarios for the Stable Ecosystem

Stable positions itself as a new Trojan Horse.

Fee-free USDT transfers, sub-second settlement, and a simplified user experience serve as entry-level incentives. This loss-leader strategy aims to drive large-scale adoption. Once a user base is established, revenue can be generated through a range of ancillary services.

From this foundation, there appear to be three main expansion paths.

5.1. Scenario 1: Expansion of Institutional Services and Partnerships

Stable can expand its ecosystem by developing institutional services and partnerships. A key factor is providing premium services like "Guaranteed Blockspace" to ensure low costs and high reliability.

This strategy is particularly effective in corporate cross-border settlements. Using Stable instead of traditional international transfer methods can significantly reduce time and costs. However, during peak periods like month-end, processing speed becomes crucial. Dedicated blockspace can ensure consistent processing speeds, and businesses are willing to pay extra for this reliability.

The same logic applies to fintech partnerships. Remittance companies like Limitless and Wise can offer better services to customers by integrating Stable's infrastructure. In turn, Stable can charge fees based on transaction volumes.

The same goes for cryptocurrency exchanges. By using Stable for USDT deposits and withdrawals, exchanges gain a reliable partner. While individual users can use the service for free, the real business target is high-volume institutional traders.

5.2. Scenario 2: Rapid Growth of On-Chain Service Ecosystem

Free transfers and high-speed transmission will significantly increase the usage of on-chain services. Nowadays, even a $10 DeFi transaction on Ethereum incurs high fees. However, on Stable, small-scale DeFi activities become economically viable.

Users can provide liquidity of $100 or stake at a very low cost, which will expand the user base of DeFi. Stable will charge smart contract execution fees from these activities, and as transaction volumes grow, its overall scale will also expand.

A more significant change is the emergence of new on-chain services. Real-time micropayments will enable direct transactions for blockchain-based content subscriptions, in-game item purchases, and tipping. Tipping a YouTube creator $1 or paying $0.10 for a single news article has become possible.

Once such a micropayment ecosystem is formed, the number of transactions will grow exponentially. Individual fees may be small, but the overall transaction volume will reach a considerable level.

5.3. Scenario 3: Deep Integration with the Real Economy

The most ambitious scenario is for stablecoins to become a standard payment method in the real economy. In Southeast Asia and Latin America, USDT payments are on the rise, but high fees and slow speeds limit the application of stablecoins.

If Stable can solve these issues, offline commerce could change rapidly. Paying $2 for a cup of coffee in a café in Vietnam or using USDT to buy daily necessities at a convenience store in the Philippines could become commonplace.

This would fundamentally change Stable's business model, transforming it from a blockchain network into a global payment infrastructure provider. It could provide payment terminals for merchants and digital wallets for consumers, charging fees from both sides.

By charging a minimal fee on every USDT transaction through the Stable network, it can establish a stable revenue base while transaction volumes grow.

Delays in the promotion of central bank digital currencies (CBDCs) also present opportunities. If private stablecoins are more convenient and accessible than government-issued digital currencies, users will naturally choose the former.

6. The True Strategy of Stable

Stable's strategy is clear: attract users through free USDT transfers and a convenient user experience. As the ecosystem grows, a business model will be built around the emerging diverse services.

Individual transactions may not generate significant revenue, but the rapid growth in transaction volume will create a considerable overall scale. This is similar to Amazon's early strategy of selling books at near-cost to acquire customers, later profiting through cloud services and advertising.

Free transfers are merely bait. Its true goal is to become the central hub of the USDT ecosystem, ensuring that all transactions occur through Stable. Once network effects are established, it will be difficult for users to switch to other platforms.

Ultimately, Stable secures a solid market position. This is the true strength of the new "Trojan Horse."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。