CoinW Research Institute

Key Points

The total market capitalization of cryptocurrencies is $4.08 trillion, down from $4.2 trillion last week, representing a decline of 2.86% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $54.97 billion, with a net inflow of $548 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.67 billion, with a net inflow of $2.85 billion this week.

The total market capitalization of stablecoins is $285 billion, with USDT's market cap at $166.5 billion, accounting for 58.42% of the total stablecoin market cap; followed by USDC with a market cap of $68.2 billion, accounting for 23.93% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 1.88% of the total stablecoin market cap.

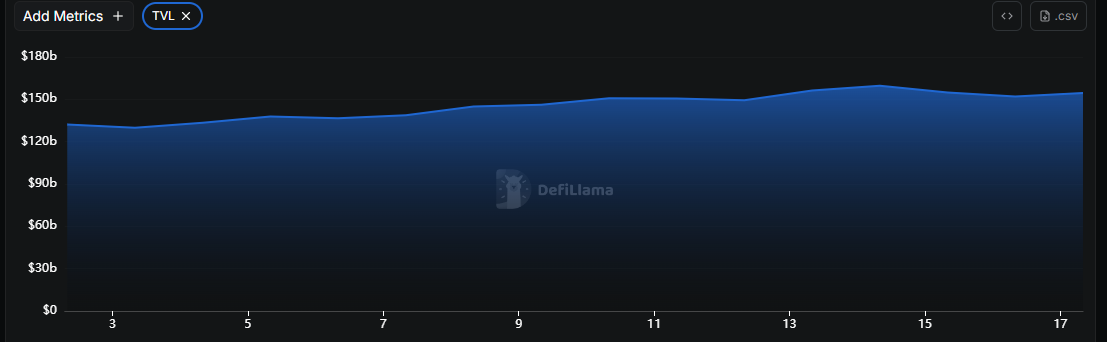

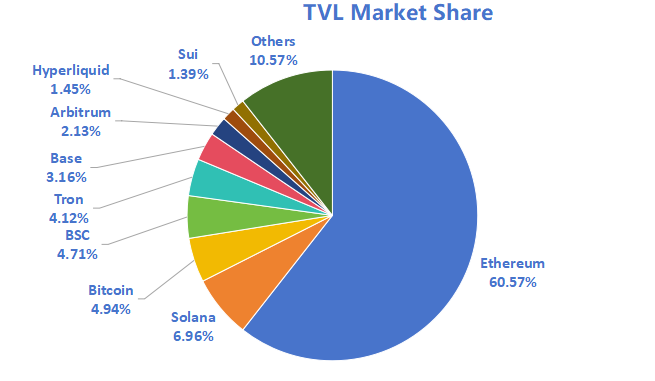

According to DeFiLlama, the total TVL of DeFi this week is $154.4 billion, up from $144.9 billion last week, representing a growth of 3%. When categorized by public chains, the top three public chains by TVL are Ethereum with a share of 60.57%; Solana with a share of 6.96%; and Bitcoin with a share of 4.94%.

From on-chain data, the overall trading volume of public chains this week shows a downward trend, with Ethereum down 35%, Sui down 10%, Solana down 13%, and BNBChain and Aptos remaining flat compared to last week. In terms of transaction fees, except for Ethereum, which decreased by 50% compared to last week, the transaction fees of other public chains are on the rise, with Sui up 200%, Solana up 50%, and Toncoin up 50%. In terms of daily active addresses, this week, except for BNBChain, which increased by 27.13% compared to last week, other public chains show an overall downward trend, with Sui experiencing the most significant decline of 70.06% compared to last week. In terms of TVL, the overall change trend is not significant, with Ethereum up 2.67%, BNBChain up 2.83%, and Aptos down 2.17%.

Innovative projects to watch: Caesar is focused on providing users with professional, verifiable, and literature-supported research results, covering various application scenarios from protocol risk assessment to AI-driven research integration; Colossus is a decentralized credit card network based on stablecoins, aiming to combine traditional credit card systems with on-chain payments; BRRR is dedicated to connecting blockchain networks with traditional payment systems, providing foundational support for programmable transactions globally.

Table of Contents

Key Points

Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Cap and Issuance Situation

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

Insights on New Projects

III. New Industry Dynamics

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Proportion

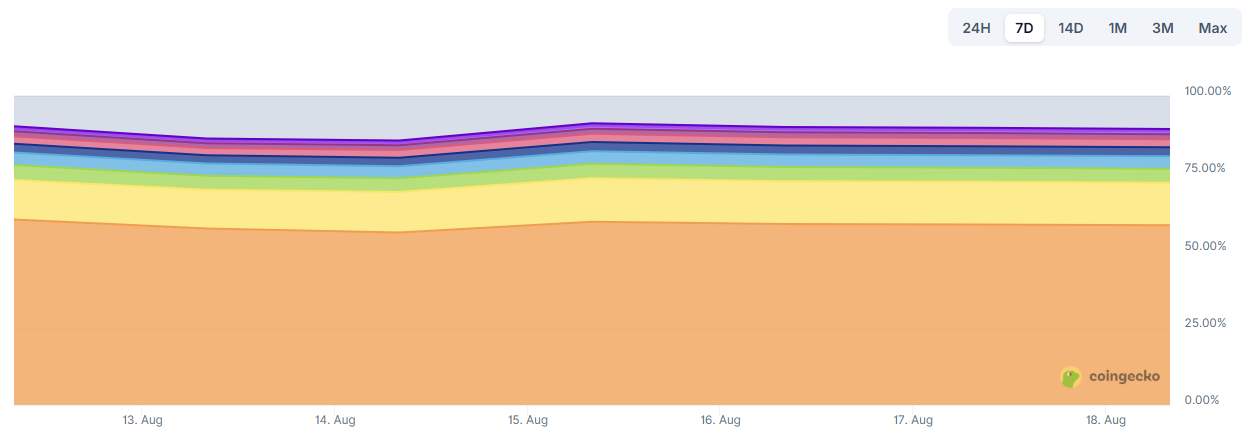

The total market capitalization of cryptocurrencies is $4.08 trillion, down from $4.2 trillion last week, representing a decline of 2.86% this week.

_Data Source: cryptorank_

As of the time of writing, the market cap of Bitcoin is $234 billion, accounting for 57.4% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $285 billion, accounting for 6.99% of the total cryptocurrency market cap.

Data Source: coingeck

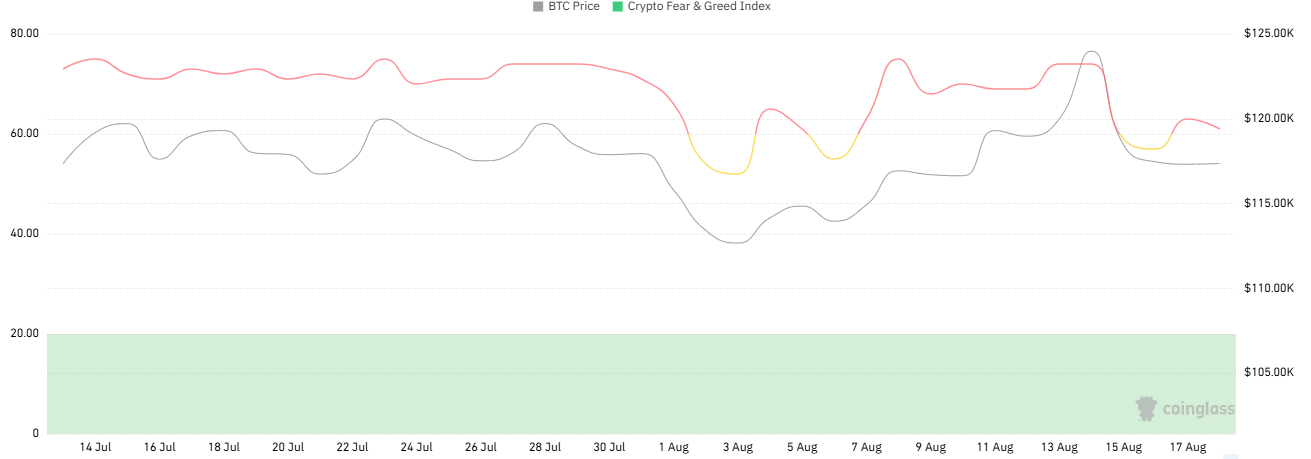

2. Fear Index

The cryptocurrency fear index is 61, indicating greed.

Data Source: coinglass

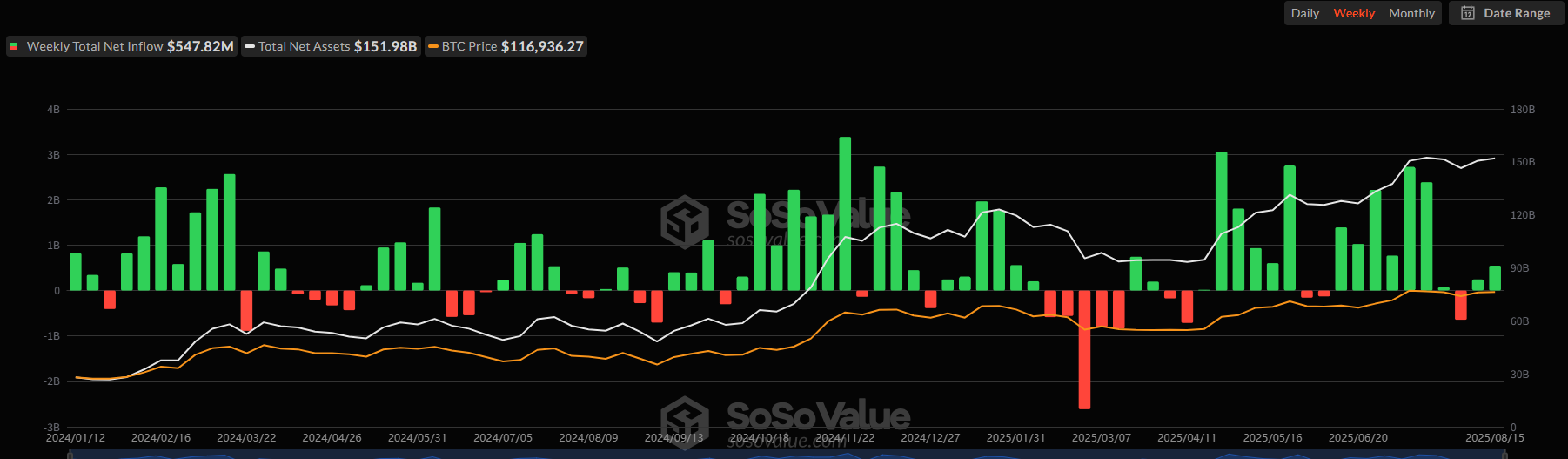

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $54.97 billion, with a net inflow of $548 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.67 billion, with a net inflow of $2.85 billion this week.

Data Source: sosovalue

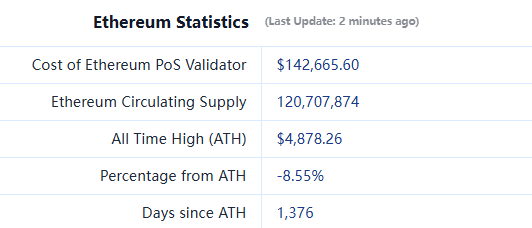

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $4,460, historical highest price $4,878, down approximately 8.55% from the highest price.

ETHBTC: Currently at 0.037981, historical highest at 0.1238.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $154.4 billion, up from $144.9 billion last week, representing a growth of 3%.

Data Source: defillama

When categorized by public chains, the top three public chains by TVL are Ethereum with a share of 60.57%; Solana with a share of 6.96%; and Bitcoin with a share of 4.94%.

Data Source: CoinW Research Institute, defillama

Data as of August 17, 2025

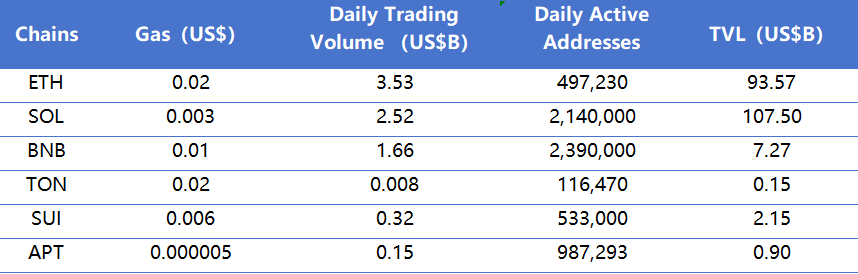

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of August 17, 2025

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, the overall trading volume of public chains shows a downward trend, with Ethereum down 35%, Sui down 10%, Solana down 13%, and BNBChain and Aptos remaining flat compared to last week. In terms of transaction fees, except for Ethereum, which decreased by 50% compared to last week, the transaction fees of other public chains are on the rise, with Sui up 200%, Solana up 50%, and Toncoin up 50%.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of trust users have in the platform. In terms of daily active addresses, this week, except for BNBChain, which increased by 27.13% compared to last week, other public chains show an overall downward trend, with Sui experiencing the most significant decline of 70.06% compared to last week. In terms of TVL, the overall change trend is not significant, with Ethereum up 2.67%, BNBChain up 2.83%, and Aptos down 2.17%.

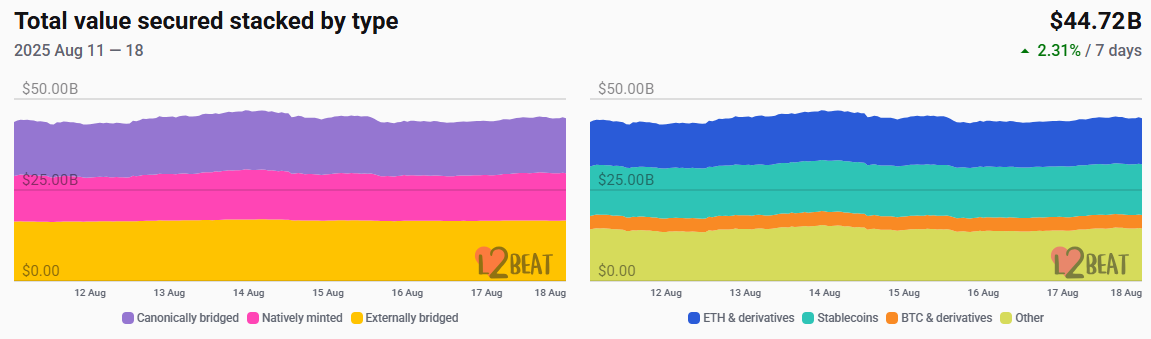

Layer 2 Related Data

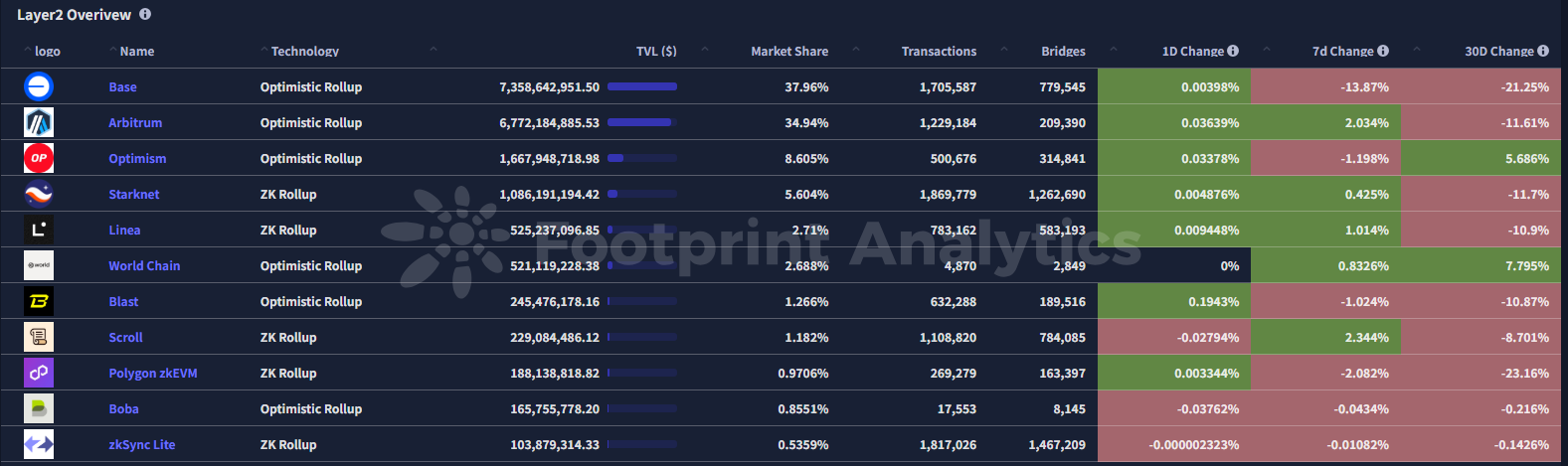

● According to L2Beat, the total TVL of Ethereum Layer 2 is $44.72 billion, up from $43.65 billion last week, representing an overall increase of 2.31%.

Data Source: L2Beat

Data as of August 17, 2025

- Base and Arbitrum hold the top positions with market shares of 37.96% and 34.94%, respectively, with Base still ranking first in Ethereum Layer 2 TVL this week.

_Data Source: _footprint

Data as of August 17, 2025

7. Stablecoin Market Cap and Issuance Situation

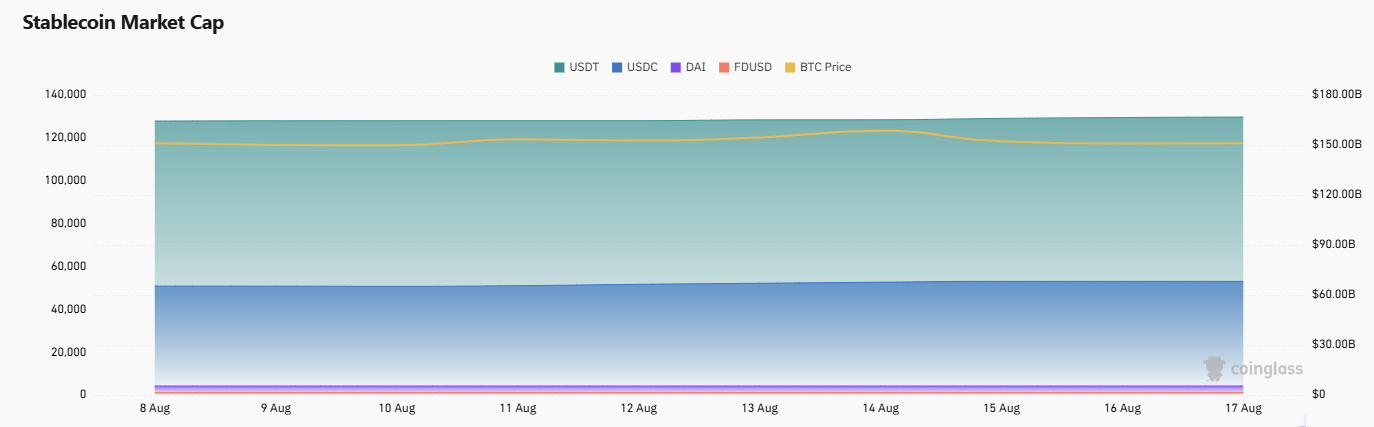

According to Coinglass, the total market capitalization of stablecoins is $285 billion. Among them, USDT's market cap is $166.5 billion, accounting for 58.42% of the total stablecoin market cap; followed by USDC with a market cap of $68.2 billion, accounting for 23.93% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 1.88% of the total stablecoin market cap.

Data Source: CoinW Research Institute, Coinglass

Data as of August 17, 2025

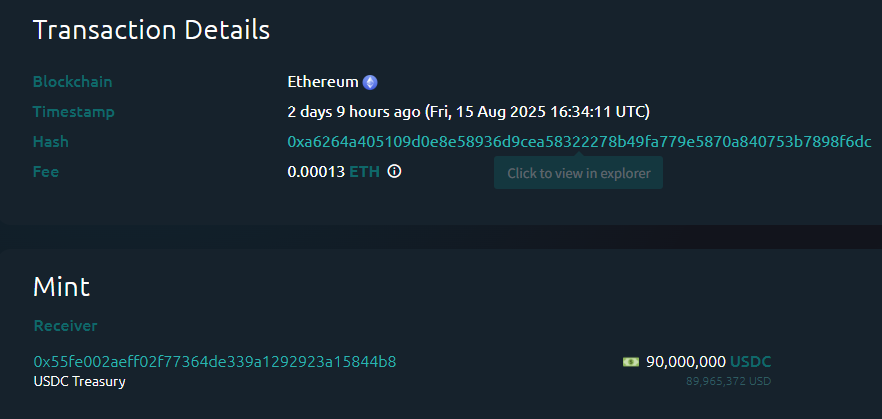

According to Whale Alert data, this week USDC Treasury has issued a total of 2.945 billion USDC, and Tether Treasury has issued a total of 1 billion USDT, bringing the total issuance of stablecoins this week to 3.945 billion, an increase of approximately 51.38% compared to last week's total issuance of 2.606 billion stablecoins.

Data Source: Whale Alert

Data as of August 17, 2025

II. This Week's Hot Money Trends

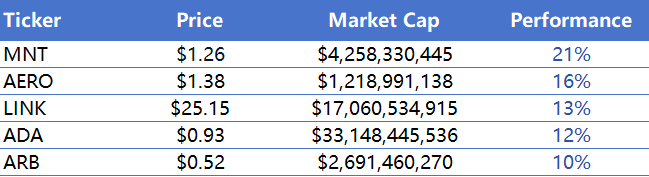

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of August 17, 2025

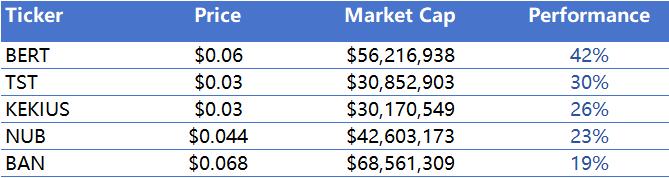

The top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of August 17, 2025

2. Insights on New Projects

Caesar is an AI-driven, cryptocurrency-supported deep research assistant established in 2024. The project's core focus is to provide users with professional, verifiable, and literature-supported research results, covering various application scenarios from protocol risk assessment to AI-driven research integration.

Colossus is a decentralized credit card network based on stablecoins, aiming to combine traditional credit card systems with on-chain payments, reusing existing credit card infrastructure while achieving instant settlement in stablecoins on Ethereum, enhancing the efficiency and transparency of cross-border payments and daily transactions. It is positioned at the intersection of DeFi and payments, providing users with a permissionless decentralized credit card solution.

BRRR is a universal settlement layer dedicated to connecting blockchain networks with traditional payment systems, providing foundational support for programmable transactions globally. Its native token BRRR serves as the core functional token of the Blockchain Reconciliation and Remittance Record protocol, driving settlement and cross-system interactions, positioned at the intersection of infrastructure and payments, aiming to enhance the efficiency and scalability of cross-chain and cross-border payments.

III. New Industry Dynamics

1. Major Industry Events This Week

Spark announced the launch of its second season, which will end on December 12, 2025. New season point acquisition methods include: loyalty bonuses, where staking SPK within 24 hours of receipt can earn a 10% point bonus; holding sUSDC, earning 2 points for every 1 USDC held per day; governance, earning 3 points per day for holding and delegating 1 SPK/stSPK (must be continuous for 7 days); invitations, earning a 10% bonus for successful invites; and staking SPK to continue earning Spark points. Pendle is no longer part of this season's points program, with over 70 billion points distributed in the first season.

The stablecoin infrastructure platform Noble announced that its token is expected to launch within the next 2 to 6 months, scheduled after the launch of the Hyperliquid treasury (expected in 4 to 6 weeks). Additionally, the team stated that it will adopt a cautious strategy, prioritizing system readiness and community understanding over setting fixed dates. During the transition from the points system to the Noble token, the interests of early supporters will be considered while attracting new users.

GMX announced the successful completion of a compensation plan for the vulnerabilities affecting GMX V1, with approximately $44 million to be distributed to affected Arbitrum GLP liquidity providers. Users can apply for compensation through the GMX dApp, receiving GLV tokens, including GLV [BTC-USDC] and GLV [WETH-USDC], with token composition similar to the original GLP asset allocation. Additionally, users holding GLV for at least 3 months will receive a $500,000 retention reward from GMX DAO. GMX V2 remains unaffected, currently achieving weekly trading volumes in the billions of dollars.

2. Major Upcoming Events Next Week

The leaderboard for Moonbirds and KaitoAI will officially launch on August 18. Users can improve their rankings and earn Yaps by continuously posting content about Moonbirds, mythical creatures, and odd items. Other ecological rewards will soon be available for top-ranking users.

The yield protocol Cap will launch on the Ethereum mainnet on August 18, with all protocol functions officially enabled. This launch will initiate a new on-chain yield economy and reward the earliest explorers through the Frontier program. The Frontier program will last up to 5 months and will introduce a native points system called Caps, which may end early if specific targets are met. The program will be divided into several phases, each providing Caps for various activities.

The shared computing network Bless announced that it has opened the registration portal for the TIME token airdrop. Users must complete wallet registration by August 19 to participate in the upcoming TIME airdrop.

The first phase of the Boundless ZK protocol verification competition will end on August 20. The team will take a snapshot of the leaderboard. Based on this snapshot, 0.5% of the Boundless token supply will be allocated to participating users at TGE. After August 20, a new leaderboard will begin recording until the mainnet launch. Rewards from this leaderboard will be airdropped after the PoVW mainnet launch.

3. Important Investments and Financing from Last Week

EthZilla completed a private fundraising round totaling $425 million, with investors including Electric Capital, Borderless Capital, Polychain, and others. EthZilla (NASDAQ: ATNF) is an Ethereum asset management company established in 2025, focusing on providing investors with broader exposure to crypto assets through investments in Ethereum (ETH). (August 11, 2025)

Heritage Distilling completed a private fundraising round totaling $220 million, with investors including Andreessen Horowitz, Amber Group, Arrington Capital, dao5, Hashed, Mirana Ventures, Polychain, and others. Heritage Distilling (NASDAQ: CASK) is a craft spirits brand from the Pacific Northwest, established in 2012, known for its innovative flavors and community culture, with products including award-winning whiskey, canned cocktails, and crypto-themed products like "Bitcoin Bourbon" and Dogecoin giveaways. (August 11, 2025)

Bullish completed an IPO raising $1.11 billion. Bullish (NYSE: BLSH) is a digital asset exchange established in 2021, providing deep liquidity, automated market making, and high-level security, with operations covering Hong Kong, the U.S., and Singapore. (August 11, 2025)

Reference Links:

Caesar, https://x.com/caesar_data

Colossus, https://x.com/colossuspay

EthZilla, https://x.com/ethzilla_atnf

Heritage Distilling, https://x.com/heritagedistill

Bullish, https://x.com/Bullish

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。