Source: Bitcoin Fortress

Translation: Shaw Golden Finance

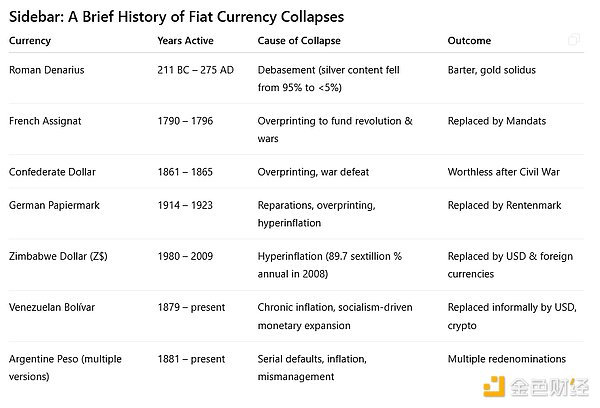

History does not simply repeat itself—it manifests in similar forms. In terms of currency, this pattern of manifestation has been quite consistent for thousands of years. From the Roman denarius to the German paper mark, from the French "assignat" to the modern dollar, fiat currency—government-issued money without intrinsic value—follows a predictable lifecycle: birth, expansion, devaluation, collapse.

The specific details may change—sometimes currency is initially backed by gold or silver, sometimes by paper money backed by precious metals, and sometimes it is purely digital currency—but the pattern has never changed.

Bitcoin offers a way out for the first time in history.

Four Stages of Fiat Currency Decline

1. Robust Beginning

Almost every fiat currency starts as "hard currency," backed by scarce items. The Roman denarius was initially made of nearly pure silver. The dollar was backed by gold and silver for most of its early history. This limitation prevented governments from overspending—if you wanted to print more money, you needed to mine or acquire more gold.

2. The Temptation of the Printing Press

As the size of government expands, so do its expenditures—wars, public works, welfare, and bureaucracies. Thus, the temptation to print money "just this once" becomes irresistible. Rome began to reduce the purity of its coinage and mixed in cheap metals. The U.S. suspended gold convertibility during the Civil War, again in 1933, and permanently stopped gold convertibility during President Nixon's administration in 1971.

Once currency is no longer bound by scarcity, politicians find it easy to cover deficits without raising taxes. Printing money is politically painless—at least at first.

3. Inflation Phase

With no upper limit on the money supply, the growth of the money supply outpaces the growth of goods and services it measures. Prices rise. The public begins to notice their purchasing power gradually declining. Sometimes inflation is gradual, as in the U.S. after 1971, where the dollar's purchasing power has fallen by over 85%. Other times, inflation accelerates to double or even triple digits annually, as seen in today's Argentina or early 21st-century Zimbabwe.

As trust begins to erode, the velocity of money circulation increases—people spend faster because they fear that waiting will devalue their money in the future. This accelerates the vicious cycle.

4. Collapse and Reboot

Eventually, confidence is completely lost. Currency disappears—not necessarily due to hyperinflation, but often because it is replaced. The French assignat devalued by 99% in less than a decade and was ultimately abolished. In 1923, hyperinflation made pushing a cart full of cash a national joke, and Germany's paper mark was replaced by the rentenmark.

This "reboot" often returns to some form of commodity-backed system or shifts to a new type of fiat currency that promises stricter controls. But history shows that such cycles inevitably begin again.

Why Fiat Currencies Always Fail

The root cause lies in human nature and political motives. Scarce hard currency can constrain governments, but fiat currency eliminates these limitations. Once the ability to create money is no longer bound by a fixed supply, short-term political interests will always triumph over long-term stability.

The collapse of fiat currency is not a question of if, but when. Over 700 fiat currencies have existed since records began, and without exception, they have either collapsed or are on the path to collapse.

Bitcoin: A Breakthrough in the Cycle

Bitcoin is fundamentally different from the fiat currency model for the following reasons:

Fixed Supply—The total supply of Bitcoin will always be 21 million, a rule guaranteed by decentralized consensus and cryptographic proof, not political promises.

Decentralization—No single entity controls the network, preventing governments or central banks from unilaterally devaluing the currency.

Transparency—Bitcoin's ledger is open and auditable to anyone in the world, eliminating the opacity of central bank balance sheets.

Global Accessibility—Anyone with an internet connection can participate, store value, and transact, bypassing capital controls and political borders.

Portability and Divisibility—Unlike gold, Bitcoin transfers easily worldwide, and each Bitcoin can be divided into 100 million satoshis, making it suitable for both small transactions and large settlements.

How Bitcoin Ends the Death Cycle of Fiat Currency

By eliminating the power to arbitrarily print money, Bitcoin reintroduces fiscal discipline. Governments or any entity can only use their income, honestly borrowed funds, or voluntarily acquired resources. Monetary policy becomes predictable, eliminating the "invisible tax" of inflation that has eroded savings for decades.

This fundamentally changes the mechanisms that lead to the collapse cycle of fiat currency:

Endless wars cannot be funded by printing money—they must be financed through taxes or voluntarily purchased bonds.

No asset bubbles fueled by cheap credit—interest rates reflect real risks, not central bank manipulation.

No intergenerational theft—savings can maintain purchasing power for decades.

Inevitable Transformation

History tells us that every fiat currency has a lifespan. The question is not whether the current global fiat currency system will end, but what will replace it. The collapse of past monetary systems has forced people to accept new fiat currency regimes. And this time, for the first time in human history, there is another option: a clean, decentralized, globally accepted currency.

When the fiat currency cycle shifts again—which is bound to happen—those who have turned to Bitcoin will no longer scramble to find a safe haven. They will already be living in the next monetary era.

Final Thoughts

The collapse of the fiat currency system is an inherent characteristic, not a flaw. Bitcoin is the first monetary technology in history that allows this cycle to be optional. You can choose to exit—not when the collapse arrives, but right now. History will not stop repeating itself, but you can choose to write a different chapter.

This is not financial or legal advice, for entertainment purposes only, and research is encouraged. I hope you find this article useful in planning your personal financial path and building a Bitcoin fortress by 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。