Author: arndxt

Compiled by: ShenChao TechFlow

This is a liquidity-driven bull market, but it lacks the support of traditional liquidity.

The Federal Reserve continues to maintain a tight policy, and fiscal stimulus is gradually weakening, yet risk assets continue to rise. What is the reason? Because capital gains driven by artificial intelligence (AI) and capital expenditures (Capex) in hyperscale enterprises are being transmitted layer by layer, while Crypto Treasury Companies (TCos) have designed a new transmission mechanism that converts stock market frenzy into on-chain bidding.

This "flywheel effect" can weather seasonal weakness and macro noise until the capital expenditures of hyperscale enterprises begin to decline or ETF demand stagnates.

Image source: https://x.com/lanamour69/status/1957087662105415896

Three Key Insights

Shift in Liquidity Sources: Liquidity no longer comes from the Federal Reserve or the Treasury, but from the equity gains and capital expenditures of AI hyperscalers. The wealth effect brought by companies like NVIDIA and Microsoft, combined with a wave of over $100 billion in capital expenditures, is gradually being transmitted to the labor market, suppliers, and especially retail investor portfolios, thereby pulling the curve of risk assets towards the crypto space.

New Major Buyers in the Crypto Space: Treasury companies (such as MicroStrategy's investment in BTC; Bitmine and other companies' investments in ETH) have become a bridge between public equity capital and spot tokens. This structural buyer is a key factor that has been lacking in previous cycles.

Temporarily Controllable Macro Cross-Impacts: Although data shows sticky inflation risks (tariffs, wages, dollar) and weakness in the labor market, the productivity options brought by AI and favorable regulations in the crypto space still compress risk premiums.

1) AI at the Top of the Pyramid

Capital Gains → Risk Rotation: As the S&P 500 index is overvalued (high forward P/E ratio), retail investors are starting to shift towards loss-making tech stocks, high short baskets, and crypto assets.

Capital Expenditures as a Source of Liquidity: Record spending by hyperscale enterprises acts as a liquidity pump similar to the private sector, channeling funds to suppliers, employees, and shareholders, which then flows back into the market.

Side Effects: The construction of AI infrastructure (data centers, chips, power) is currently manifesting as investment growth, while productivity improvements require a time lag. Time lag → wealth effect is immediate.

2) Crypto Treasury Companies (TCos) = Digital Asset Treasury Companies (DATs)

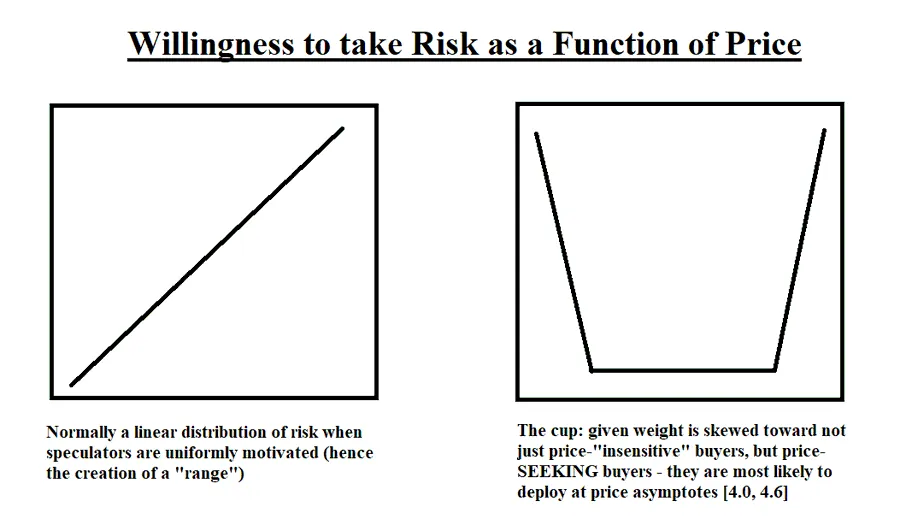

From "Zero Generation" to Price-Seeking TCos: Early TCos (like Michael Saylor's strategy) acted as price-insensitive bottom support. The new generation of ETH-focused TCos is more price-seeking, able to defend key price ranges and drive breakthroughs while accelerating upstream equity value.

Reflexive Cycle: Equity financing → Purchase of reserve assets (BTC/ETH) → Token price increase → TCo equity value rise → Lower cost of capital → Cycle repeats. This is the so-called "flywheel effect."

Fatal Weakness: Gaps between key ranges. If ETF treasuries or retail funds cannot fill the intermediate gaps, failed breakout attempts will force TCos to conserve cash, and prices will quickly retreat.

3) Tailwinds from Policy and Market Positioning

Favorable Policies in the Crypto Space: Deregulation of cryptocurrencies and a more friendly policy stance have opened channels for traditional financial capital inflow.

Tariff "Solutions" are Just a Mirage: Companies still cannot clearly define the exemption terms and court rulings related to China, Mexico, Canada, and the US-Mexico-Canada Agreement (USMCA). This uncertainty leads companies to favor financialization over capital expenditures—more funds flow into asset markets.

Current Status of Ethereum (and Why It Could Make a Comeback)

Treasury Demand and ETF Inflows: Treasury demand combined with ETF fund inflows provides a new narrative turning point for ETH, allowing it to stage a comeback after years of lagging behind L2.

"Cup Theory" Perspective: Price-seeking ETH treasury companies defend the key price level of $3,000 and push the price towards the $3,300–$3,500 → $4,000 range; ETF funds fill the gaps in between. If approximately $27 billion in queued demand is realized in phases, the current upward trend may continue; if not, the price gap will become a key issue.

Interpretation: ETH now has a buyer group that is completely different from past cycles. It is no longer a competition of "retail vs miners," but rather "ETF + TCos vs liquidity gaps."

Image source: https://x.com/lazyvillager1/status/1956414334558478348

Macro: The Wall of Worry (and Why the Market is Overcoming It)

Inflation

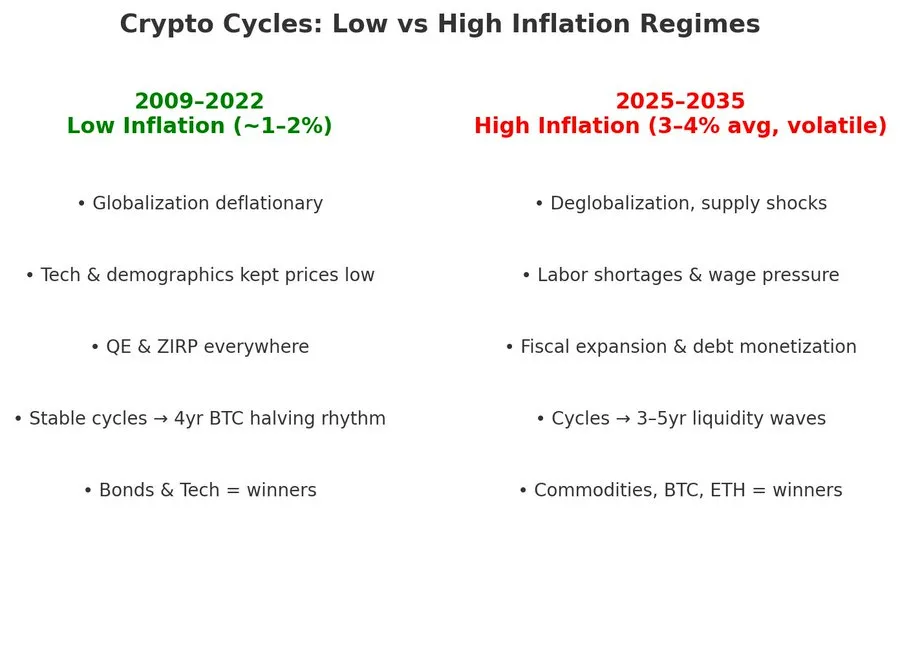

Survey Channel Pressure: The sales price index has risen for three consecutive months (reaching the highest level since August 2022), indicating commodity-driven price pressures. This aligns with tariff cost transmission, a weakening dollar, and sticky wages.

Interpretation: Implied inflation rates are close to about 4%. Although not at crisis levels, this complicates the prospect of rate cuts. The Federal Reserve can only tolerate growth-friendly inflation levels if there are no obvious cracks in the labor market.

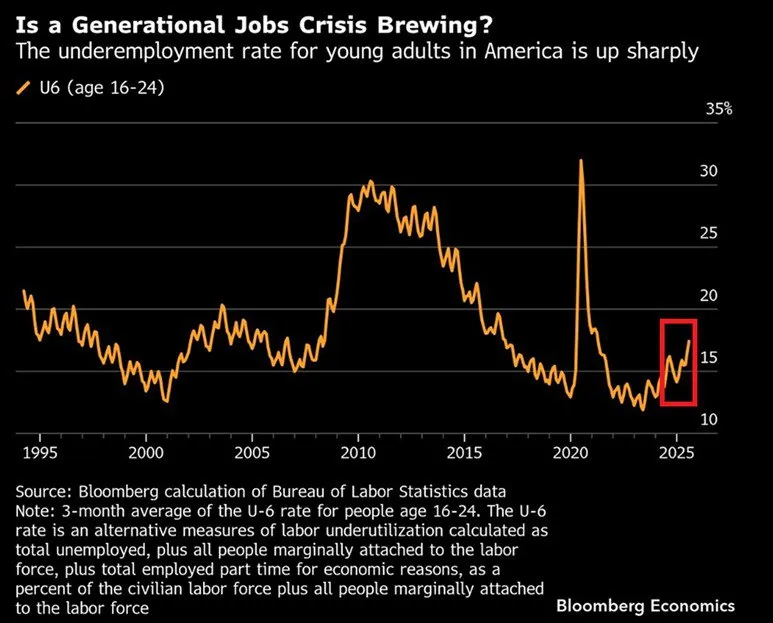

Labor Market

- Youth Underemployment Rate has surged (averaging about 17% over three months), serving as a warning sign in the early stages of the economic cycle. Young workers are the first to feel economic fluctuations; if this spreads to the core employment market, risk assets will be affected.

Growth, Debt, and AI

Fiscal Adjustment Role of AI: If, in the long run, total factor productivity (TFP) improves by 50 basis points annually due to AI, by 2055, the public debt-to-GDP ratio could drop to about 113%, compared to a baseline of 156%, with per capita real GDP rising by about 17%. In other words, AI is the only reliable growth lever capable of reversing the debt curve.

But Time Lag is Crucial: Just as the productivity gains from computer capital expenditures in the 1980s did not manifest until the late 1990s, the widespread application and efficiency improvements of AI will also require time. The current market is already valuing future efficiency gains.

Tariffs and Uncertainty

- Policy Fog = Valuation Clarity Risk: Unfinalized tariff rates, vague trade agreements (like EU/Japan), frequently changing exemption policies, and legal disputes lead to uncertainty in future cost curves. This causes CFOs to lean towards increasing financial asset allocations while reducing long-term physical investments—this phenomenon, in turn, supports the market in the short term while raising mid-term inflation risks.

Bear Market vs Bull Market: My Assessment Factors

Bearish Factors

Decrease in Treasury General Account (TGA) funds + Quantitative Tightening (QT) remains restrictive.

Seasonal weakness will persist until September.

Early signs of loosening in the labor market; inflation acceleration factors (tariffs/wages).

Bullish Factors (Weighted)

AI capital expenditures + wealth effect are the current sources of liquidity.

The shift in cryptocurrency policy has opened the floodgates for traditional financial (TradFi) capital flows.

Crypto treasury companies/ETF structures have become persistent mechanical buyers.

The composition of Fed members leaning dovish in 2026 is a credible long-term catalyst.

Summary: As long as the chain of AI → retail → crypto treasury companies → spot market remains intact, I will maintain a constructive outlook.

Factors That Could Change My View:

Decline in Capital Expenditures by Hyperscale Enterprises: A significant drop in AI infrastructure orders.

Stagnation in ETF Demand: Continued fund outflows or failures in secondary offerings.

Closure of the Crypto Treasury Company Equity Market: Declining valuations in funding rounds, failed ATM issuances, or collapses in net asset value premiums.

Cracks in the Labor Market: Weakness in youth employment spreading to the prime-age employment group.

Tariff Shock → Consumer Price Index (CPI): Commodity inflation forces the Federal Reserve to tighten monetary policy again rather than cut rates.

Cycle Positioning (Not Financial Advice)

Core Strategy: Focus on quality AI growth companies; selectively invest in "tools and infrastructure" sectors (computing, energy, networks).

Crypto Assets: Bitcoin as a systemic risk exposure for risk assets, Ethereum as a self-reinforcing reflexive flywheel mechanism. Pay attention to key defensive levels and estimate potential gaps in the market.

Risk Management: Adjust positions based on ETF fund flow data, crypto treasury company issuance timelines, and guidance from hyperscale enterprises. Increase positions at key support levels; for frenzied breakout trends lacking follow-through, reduce positions in a timely manner.

Core Summary

This cycle is fundamentally different from 2021.

Its driving force comes from the liquidity of the private sector brought by AI equity gains and capital expenditures, which are being transferred to the crypto space through new corporate structures and are recognized and driven by ETFs.

The growth flywheel is real: It will continue to operate until the hyperscale enterprises at the top of the pyramid show signs of instability.

Until then, the path of least resistance for the market remains upward and continues to rise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。