Today I saw a report from Deutsche Bank's research department titled: 'Mapping the World's Prices 2025', which discusses the comparison of currency devaluation and purchasing power across various countries. Without comparison, there is no harm; over the past 30 years, the "invisible tax" of currency devaluation has been surprisingly severe. 🧐

When I was at the securities research institute, I often told newcomers: "Inflation is the invisible thief that steals the money from your pocket."

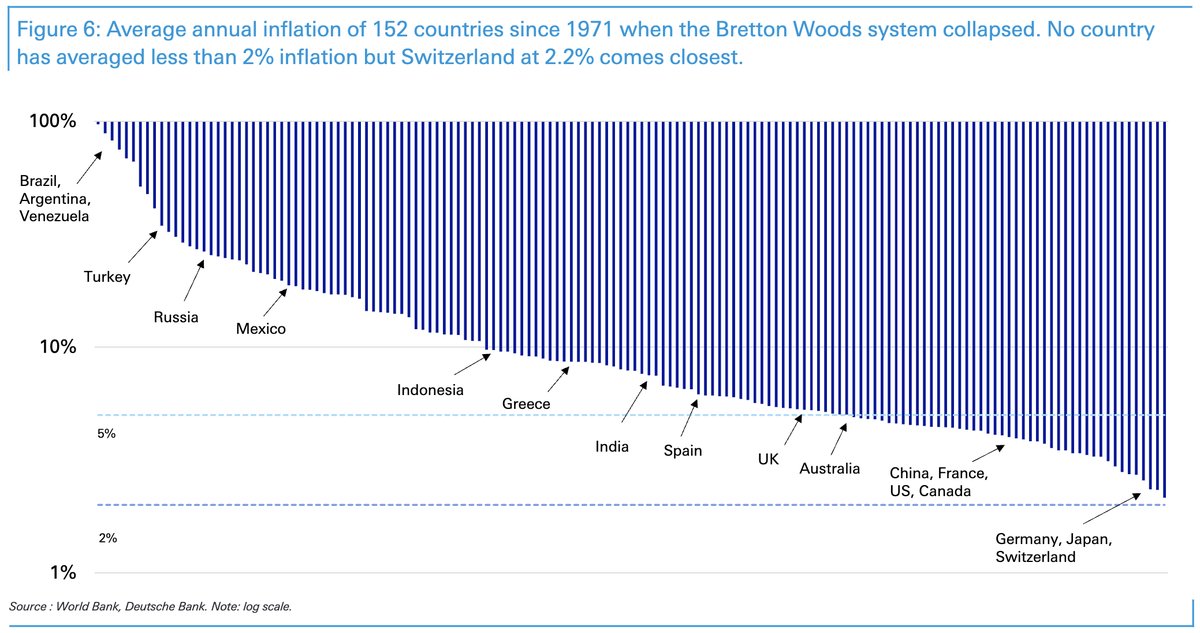

As shown in the image below 👇, since the collapse of the Bretton Woods system in 1971, no country in the world has managed to keep average inflation below 2%, with even the best performer, Switzerland, at 2.2%. In contrast, countries like Argentina and Brazil, which are inflation champions, have average annual inflation rates in the tens of percent, with money losing value faster than ice melts.

What does this mean? — If you only keep your money in the bank, even if you think your principal hasn't changed, your purchasing power is actually shrinking year by year. Therefore, doing nothing will definitely lead to losses.

📝 The impact of inflation and currency devaluation on investment

In recent years, we have observed a clear pattern in exchange rate trends:

High inflation countries → Long-term currency devaluation → The local currency you earn with great effort becomes increasingly worthless in the international market.

Low inflation countries → Long-term strong currency → High foreign exchange purchasing power, making it easier to attract foreign investment.

For example, Switzerland, with an average inflation of 2.2% and a strong Swiss franc, is why it consistently ranks among the world's most expensive cities — not because their lifestyle is extravagant, but because their money is strong.

Conversely, in places like Argentina and Turkey, decades of high inflation have turned the local currency into worthless paper. Even if stocks rise, the devaluation of the local currency when exchanged for dollars eats away at many of the gains.

🎯 U.S. stocks, cryptocurrency, and gold are powerful weapons against inflation:

Let's return to a question that most fans are concerned about:

If I invest in U.S. stocks, #BTC, and gold in an inflationary environment, what kind of returns can I expect in 30 years?

1️⃣ First, let's look at history — the annual nominal return rate of U.S. stocks (S&P 500) over the past nearly 100 years is about 9-10%.

2️⃣ #BTC has had an annual average return rate of about 124% over the past 10 years.

3️⃣ Gold has had an annualized return rate of about 5.7% over the past 30 years (from 1994 to 2024).

Since U.S. stocks have a longer time frame and are more operable, I will mainly discuss U.S. stocks. The average inflation rate in the U.S. has been about 3%, which means the actual purchasing power return is around 6-7%.

What does this mean? If you had invested $10,000 in the U.S. stock index 30 years ago and left it untouched, it would now be worth about $180,000 (considering actual purchasing power after compounding and inflation). This is why I often say that the long-term logic of U.S. stocks is not about short-term fluctuations, but about outperforming the "invisible thief" in an environment of inflation and currency devaluation. (But remember, stock selection and timing are also very important.)

Join our U.S. stock #RWA investment community: https://mystonks.org/?code=Vu2v44 (Message me for free access to the exclusive U.S. stock community)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。