Written by: Tuo Luo Finance

The downward trend seems to have no end in sight.

Just a few days ago, the atmosphere in the cryptocurrency circle was peaceful, but after five days of subtle declines, it has become unusually tense. This trend continues, and just this morning, Bitcoin fell below $113,000, reaching a low of $112,400, just a step away from breaking the support line of $112,000. Ethereum's performance is even more sluggish, briefly dropping below $4,100, with altcoins also experiencing widespread declines.

In this context, the voices in the market have become particularly noisy, with optimists advocating for a healthy correction and pessimists emphasizing the end of the bull market, making it difficult to reach a consensus. Interestingly, however, most analysts surprisingly share similar views on the upcoming trend.

On August 19, the three major U.S. stock indices fell during the day, closing mixed, with the Nasdaq down 1.46%, the S&P 500 down 0.59%, and the Dow Jones up 0.02%. Major tech stocks fell broadly, with Nvidia down 3.50%, Meta down 2.07%, Tesla, Amazon, and Microsoft down 1.75%-1.42%, Google A down 0.95%, and Apple down 0.14%.

When the stock market shows signs of weakening, the most anxious person is U.S. President Trump. When faced with such a situation, Trump's approach is also an old routine: creating and shifting conflicts. Early in the morning, Trump blasted Powell on the social platform Truth, "Can someone please tell Jerome 'Too Late' Powell that his actions are greatly harming the real estate industry? People are unable to obtain mortgages because of him. There is no inflation; all signs point to a need for significant interest rate cuts. 'Too Late' is a disaster!"

Some may wonder, what does the stock market decline have to do with the real estate industry? Although the trigger for the recent tech stock plunge was a report from MIT stating that "95% of organizations have seen zero returns on generative AI investments," the deeper concern is the market's worry about the overvaluation bubble in tech stocks. If we trace it back further, there is indeed a complex relationship between the stock market and real estate.

On August 18, the National Association of Home Builders released the Housing Market Index, which fell from 33 in July to 32, matching the reading since December 2022, and dropping to the lowest level in over two and a half years. According to disclosed data, more than one-third of residential construction companies are lowering prices, and about two-thirds of companies have introduced some form of incentives to attract homebuyers who are hesitant due to high mortgage rates and economic uncertainty.

Real estate is just a microcosm; what truly worries the market are the signals of recession. The U.S. housing market is performing poorly, even during the peak season from April to June, the number of signed home sales contracts nationwide hit a new low since 2012, and the supply-to-sales ratio of homes rose to 9.8 months in June. Historically, in the six instances when this data exceeded 9, five were accompanied by economic recessions. Real estate is an industry with high external effects, closely related not only to manufacturing and construction but also to other consumer goods transactions. Therefore, to some extent, its development is one of the risk signals for observing economic operations. In this context, the market is bound to generate a certain degree of risk aversion, with funds flowing from high-risk sectors into defensive sectors.

On the other hand, while Trump is making his remarks, Powell, dubbed "Mr. Too Late," has no time to respond, as the Jackson Hole Global Central Bank Annual Meeting on Friday is the main event. However, while Powell remains silent, many institutions are making predictions. Morgan Stanley believes that Powell will maintain a hawkish tone at Jackson Hole, aiming to avoid being locked into a 23 basis point rate cut expectation by the market, preserving policy options for September. They expect Powell's speaking style to continue from July, focusing on data and not making proactive commitments. If employment continues to weaken in August, the probability of a rate cut in September will continue to rise. If employment is strong and inflation rebounds, a wait-and-see approach may be maintained.

There are also institutions in China that share similar views. Wang Youxin, head of the Bank of China Research Institute, mentioned in a recent interview that Powell may emphasize that current economic data is gradually approaching the conditions for policy adjustment, but the specific pace and magnitude of rate cuts will strictly depend on subsequent data performance to avoid excessive market pricing, providing more flexibility for future policy adjustments and potential unexpected data changes.

However, traders have a different perspective. Recently, there has been strong demand for positions related to the overnight secured financing rate (SOFR), which is closely tied to policy expectations. Just this week, traders have once again increased their bets, with options contracts betting on a 50 basis point rate cut in September soaring to 325,000 contracts, with a premium cost of about $10 million. If the Federal Reserve cuts rates by 50 basis points as expected, these positions could yield profits of up to $100 million.

It is evident that regarding the September rate cut, market views are polarized. Even returning to Powell's side, the current rate cut dilemma is not as simple as just data; the U.S. government is applying pressure, and whether the Federal Reserve follows or opposes seems to be evolving into a political issue. To maintain neutrality, their stance cannot be too weak. Under the influence of various factors, even the robust stock market has shown some risk aversion, reflecting a trend of panic stemming from rate cuts seemingly extending towards recession.

As the frontline of volatility, the cryptocurrency market has reacted most strongly. Bitcoin has fallen from $124,000 to $116,000, breaking below $113,000 this morning, approaching the recent major support level of $112,000. ETH has also been on a downward trend, falling below $4,100, with altcoins experiencing widespread declines, and the total market value of cryptocurrencies dropping from a high of $4.5 trillion to $3.9 trillion.

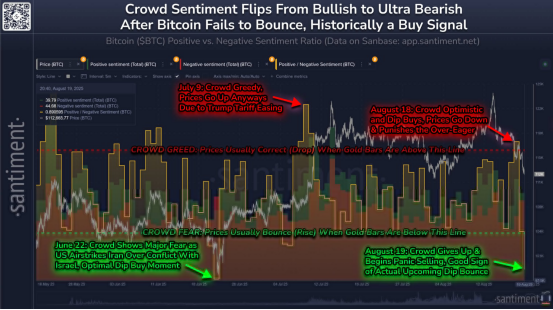

The shift in market sentiment is also very rapid. Alternative shows that the market, which was in a state of greed just two days ago, has suddenly turned into a state of panic today. According to Deribit data, the 30-day options delta skew (put - call) for Bitcoin has surged to 12%, reaching the highest level in over four months, indicating that the market is in extreme panic. Santiment shows that as of August 20, pessimistic sentiment on social media reached the highest level since the panic selling triggered by the war on June 22.

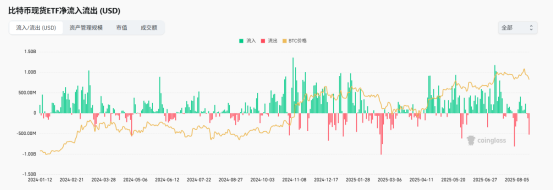

Institutions are also taking hedging measures. From the ETF data flow, mainstream ETFs are shifting from net inflows to net outflows, with BTC spot ETFs seeing outflows of $645 million in two days, and ETH spot ETFs seeing outflows of 140,900 BTC, with outflow amounts reaching $613 million.

It was previously mentioned that ETH faces greater challenges than BTC. After more than a month of continuous gains, market divergence regarding ETH has intensified. On one hand, there is a lack of confidence in ETH due to past experiences, and on the other hand, the entry of institutions and changes in the environment have shown positive sentiment. This performance is even more evident in public opinion; just two days ago, the market was optimistic that ETH would break $10,000 and outperform Bitcoin, but two days later, there were discussions about preparing for the largest black swan in history.

The seemingly mystical gap theory is also gaining traction. As ETH's gap between $4,098 and $4,230 on CME was filled in this decline, the remaining gap is in the range of $2,835 to $2,925, while BTC's gap is around $92,000, all of which are alarming to investors.

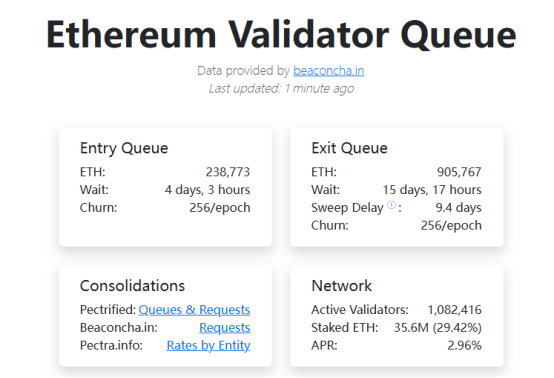

The panic among holders can also be seen from the data. The number of ETH exiting the validator queue has reached a new high of 910,000 ETH, worth up to $4 billion, while only 260,000 ETH have entered, with the disparity continuing to widen. In the past week, the amount of staked Ethereum has decreased from 35.651 million to 35.607 million, a net reduction of 43,873 ETH, worth about $178 million. Although exiting the queue does not necessarily mean absolute selling, it still adds selling pressure to Ethereum.

Even whales cannot hide their panic. On the day of the big drop on August 19, several whale addresses panicked and sold ETH, with three major addresses starting with 0x1D8d, 0x5A8E, and 0x3684 selling 34,400 ETH, totaling approximately $14.8 million. Today, according to on-chain analyst AI Yi ai_9684xtpa, a certain institution sold another 4,000 ETH (worth $16.65 million) in the past 12 hours, with an average price of $4,164, bringing the total sold from August 18 to now to 12,575 ETH.

Interestingly, although Bitcoin and Ethereum continue to decline, the altcoin market has not accelerated its decline as in the past, leading some to speculate whether this is a sign of an altcoin season. However, in reality, the existing altcoin market is more in a state of having nowhere to fall; after multiple rounds of cleansing, most altcoins have reached a low point, with investors generally in a state of loss, buy orders severely dwindling, and sellers unwilling to further discount, resulting in a reduced rate of decline.

Returning to the main topic, whether for mainstream coins or altcoins, what investors are more concerned about is the future market direction. The public discourse is incessant, with ongoing debates about correction versus recession, but among the majority of analysts speaking out currently, optimistic views still dominate.

The well-known analyst BitQuant, who successfully predicted Bitcoin's new high in 2024, believes that Bitcoin's price will not fall below $100,000 for the remainder of this bull market. However, it is worth mentioning that his latest prediction suggests that BTC's price is still expected to reach $145,000 within the year, a figure that was $250,000 last year.

Crypto analyst @IamCryptoWolf, who has over 110,000 followers on X platform, expressed the view that "this is just a correction for ETH after a 245% surge and breaking the long-standing $4,000 resistance level. A healthy correction, possibly just a retest of the breakout area."

Mark Newton, a fund analyst at Fundstrat Capital, shares a similar view, stating that Ethereum is experiencing a slight correction and expects the price to dip to the $4,075-$4,150 range by mid-week. Newton pointed out that the correction is a healthy trend, with a rebound expected to around $5,100 afterward. Bitcoin should not fall below $111,900 and is expected to rise to the $130,000-$140,000 range.

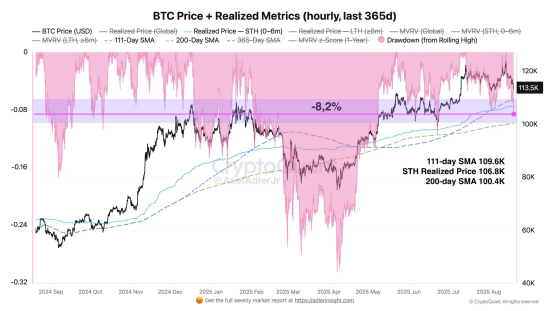

CryptoQuant analyst Axel stated on social media that the current pullback is relatively mild, with Bitcoin only dropping 8% from its local high. The mid-term support levels are at the 111-day moving average ($109,600) and the realized price for short-term holders ($106,800), forming a dense demand zone where stabilization attempts and rebound trends are expected. He previously emphasized, "The key is Powell's speech at the Jackson Hole summit on Friday (reviewing the economic outlook and framework), which may determine the direction of future market sentiment."

Trader Eugene Ng Ah Sio even opened a small long position in ETH, indicating he is looking for short-term opportunities in the $4,400–$4,600 range before reassessing whether to continue targeting higher levels.

Of course, there are exceptions. BiyaPay analyst stated that under the pressure of geopolitical news, the medium to long-term outlook for Bitcoin remains bearish, with the first downside target at $98,000, while the key support level in the short term is $112,000.

Overall, even though the cryptocurrency market is performing poorly under macroeconomic conditions and emotional pressure, many analysts maintain a relatively positive outlook. Highly optimistic Bernstein analysts even predict that the current crypto bull market may last until 2027, with Bitcoin potentially rising to $150,000 to $200,000 in the next year.

In recent terms, since $112,000 is the recent low for BTC, this price is indeed the current support level, while the key price level for ETH is around $4,100. In fact, the acquisition prices for ETH by listed companies have not significantly exceeded this price range. According to on-chain analyst Yu Jin's calculations, the two largest coin stock enterprises, BitMine and SharpLink Gaming, have cost prices of $3,730 and $3,478, respectively.

Overall, ahead of the globally watched Jackson Hole Global Central Bank Annual Meeting, volatility remains the main theme. Even with continued subtle declines due to risk aversion and other reasons, the true market direction is difficult to ascertain in the absence of a clear future tone. Currently, the market has shown signs of recovery, with BTC now reported at $113,819 and ETH at $4,225.66.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。