Author: Nancy, PANews

Half a year later, renowned rapper Kanye West has officially announced the launch of the MEME coin YZY. As market interest rapidly rises, controversies surrounding the control model and potential insider trading have led to significant skepticism regarding this coin issuance.

High Team Control, Operation Model Similar to RUG Coin LIBRA

On August 21, Kanye announced the launch of the new brand YZY MONEY on social media and issued the token YZY on Solana. To prove the project's authenticity, the official team released a video featuring Kanye himself as endorsement.

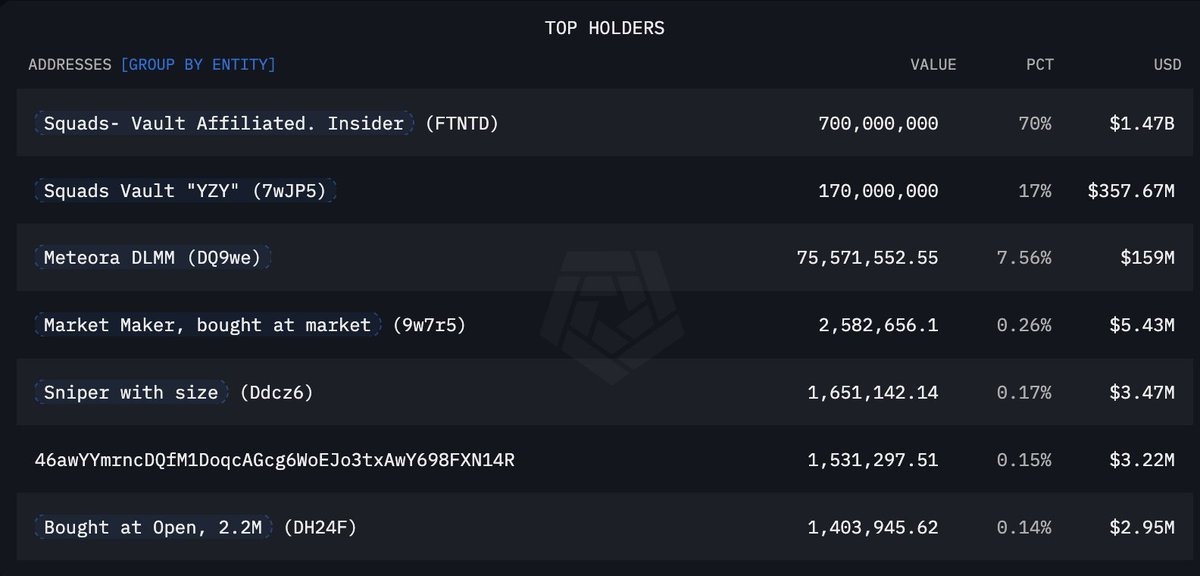

According to the tokenomics of YZY, 20% is allocated for public issuance, 10% for the liquidity pool, 30% to Yeezy Investments LLC (locked for 3 months, linear release over 24 months), 20% to the team (locked for 6 months, linear release over 24 months), and 20% for the ecological development fund (locked for 12 months, linear release over 24 months). This means that over 70% of the shares are held internally, with limited circulation in the public market.

To avoid common front-running attacks, the team pre-deployed 25 contract addresses and randomly selected one as the official contract. However, some users still lost money by front-running and choosing the wrong address. For instance, according to on-chain analyst Ai Yi, a certain address spent $767,000 betting on YZY on August 20 and ended up cutting losses, losing about $704,000 within 3 hours. Although this mechanism seems to enhance fairness, it also provides ample operational space for internal funds.

Simultaneously, YZY MONEY established partnerships with several popular MEME ecosystem platforms on Solana, including Meteora, Jupiter, and MoonPay, and within 15 minutes of the announcement, it was listed on Moonshot.

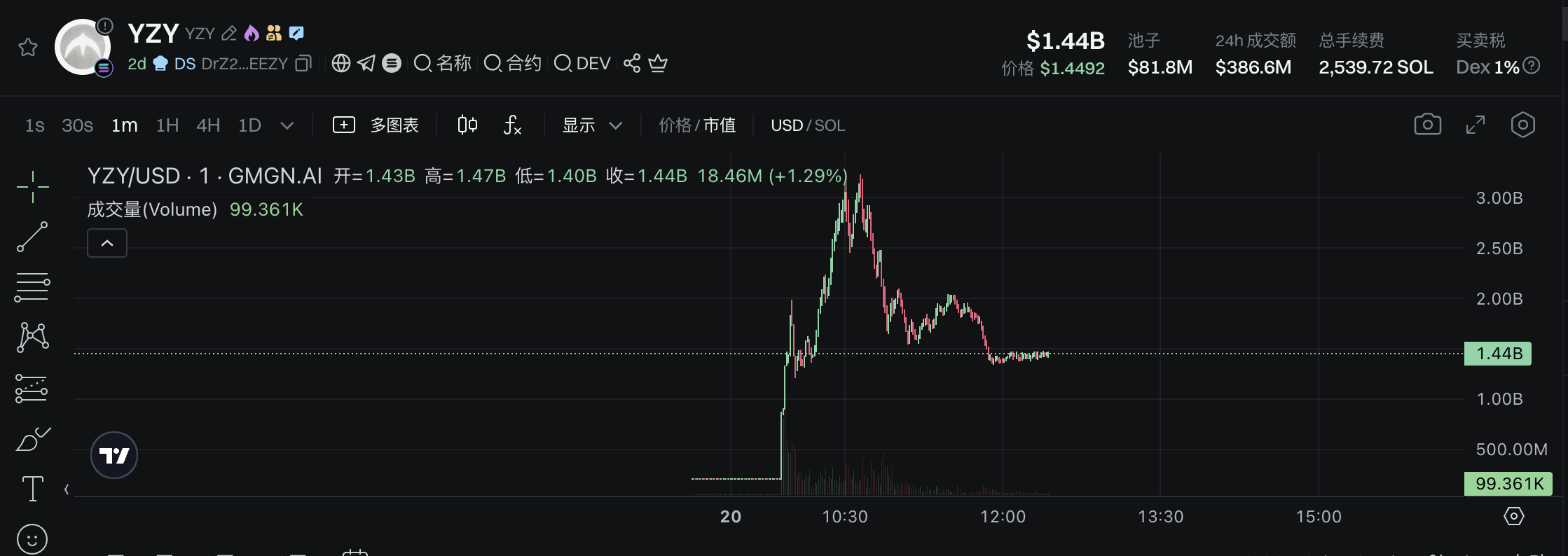

The star effect combined with careful planning quickly ignited interest in YZY. GMGN market data showed that YZY's market cap once exceeded $3.4 billion but has now fallen below $1 billion, with daily trading volume exceeding $380 million and its fee income surpassing 2,500 SOL.

However, behind the fervent atmosphere, on-chain data reveals more details of insider operations. According to Lookonchain's monitoring and analysis, currently, only YZY has been added to the liquidity pool, with no USDC. Developers can sell YZY by adding/removing liquidity, similar to MEME coin LIBRA. Multiple insider wallets had funds ready in advance and immediately bought YZY after the announcement. The insider wallet 6MNWV8 knew the contract address in advance and even attempted to purchase it yesterday; today, 6MNWV8 spent 450,611 USDC to buy 1.29 million YZY at $0.35 and sold 1.04 million YZY for $1.39 million, leaving 249,907 YZY (about $600,000), with profits exceeding $1.5 million; an insider spent 450,000 USDC through two wallets to buy 1.89 million YZY at $0.24 and then sold 1.59 million YZY for $3.37 million USDC at $2.12. To ensure they could enter first, one wallet even paid 129 SOL (a priority fee of $24,000).

Moreover, Coinbase executive Conor Grogan pointed out that at least 94% of the new Kanye token is held internally, with 87% previously controlled by a single multi-signature wallet, which has now been distributed to multiple addresses; about 3% was bought in large amounts by multiple wallets at the opening, and 7% was allocated to the liquidity pool.

Crypto KOL scooter (@imperooterxbt), who previously exposed insider information about the LIBRA token, stated that he can be 99% sure that Hayden Davis (LIBRA project advisor) participated in the release of the YZY token, as the YZY model is highly similar to LIBRA from a few months ago.

Interestingly, just hours before the YZY announcement, a U.S. judge lifted the freeze on $57.6 million in funds belonging to the initiators of Libra. Scooter remarked that it was probably not a coincidence that YZY was released 5 hours after Hayden Davis's funds were unfrozen.

To prevent investor lawsuits, YZY even explicitly stated a "class action waiver" in its official documents. The document states, "To the extent permitted by law, you agree not to bring, join, or participate in any class action lawsuit regarding any claims, disputes, or controversies you may have against any protected party. You agree that the court may grant injunctive relief to prevent such lawsuits or remove you from the lawsuit. You agree to pay any protected party's attorney fees and litigation costs incurred in seeking such relief."

Additionally, during the YZY issuance, Kanye also launched two independent projects: Ye Pay and YZY Card.

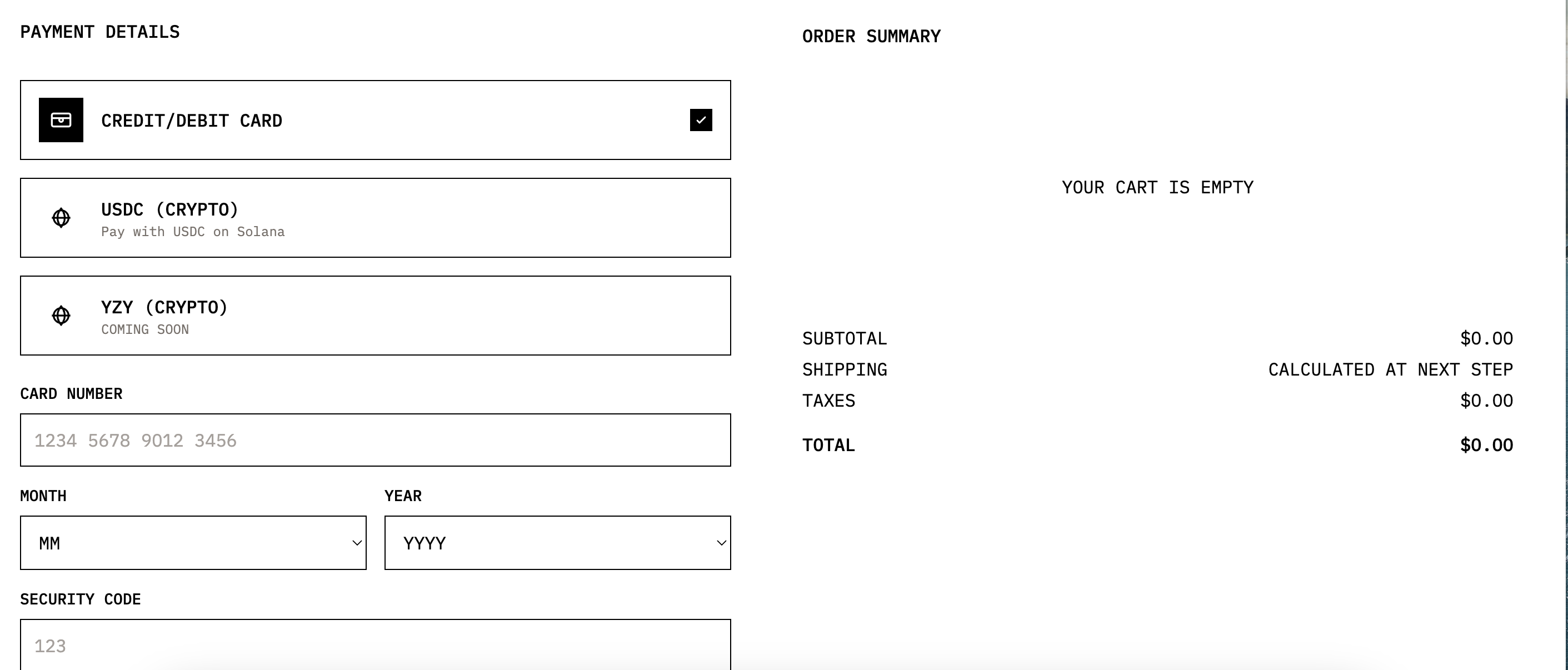

Ye Pay is a crypto payment processor that allows merchants to accept credit card and cryptocurrency payments, with fees lower than the typical 3.5% charged by traditional platforms. Merchants can seamlessly integrate Ye Pay into their websites or applications, providing consumers with a simple and quick checkout experience.

YZY Card is a debit card that can be used globally with YZY and USDC, allowing users to top up using fiat or cryptocurrencies from any non-custodial wallet, supporting assets like YZY, USDC, and USDT. Additionally, Kanye supports users purchasing Yeezy brand clothing using USDC or YZY (coming soon).

From Firm Resistance to Repeated Attitudes, Controversy Surrounding Coin Issuance

In fact, as early as February this year, when the MEME market was still in the celebrity coin issuance craze driven by Trump, insiders revealed that Kanye West had planned to emulate Trump's TRUMP token model to launch an official token for the Yeezy brand, YZY, expected to be issued on February 21 for use on its official website.

At that time, it was disclosed that in the token distribution plan, Kanye would personally receive 70% of the shares, with 10% for liquidity supply and 20% for investors. This information was reportedly disclosed via email by Yeezy's CFO Hussein Lalani. However, the coin issuance plan was ultimately postponed due to issues related to a Rug event involving a token associated with Argentine President Milei.

Subsequently, many tokens named YZY appeared in the MEME market. However, before this, Kanye had stated on social media that he received a $2 million proposal to promote a RUG MEME coin. The backers claimed that the collaboration could yield tens of millions of dollars, but Kanye rejected the partnership, emphasizing, "I will not issue a token; I only make products. I only do what I love and understand. I am already very wealthy and have no need to do anything else. Token speculation is deceiving fans, just like the hype around sneaker culture."

However, shortly after, Kanye posted again, stating, "All tokens currently are fake; I will launch next week." He then frequently followed or unfollowed accounts of some crypto practitioners, such as CZ and the founder of Polychain Capital, sparking market speculation about his direction for coin issuance. However, that tweet was later deleted, and the community once thought Kanye's coin issuance plan had fallen through, not realizing he was waiting for the right moment.

Such a flip-flopping attitude has drawn widespread criticism from the crypto community and raised doubts. Some KOLs speculated that Kanye's account might have been sold, citing several abnormal phenomena: for example, the system interface switched from dark mode to light mode, and new accounts related to Doginal were followed. However, Kanye denied this, stating that when he truly launches a cryptocurrency project, he will announce it in a formal and clear manner.

A similar attitude was also seen when Kanye participated in the NFT space. As early as 2021, he was involved in the issuance of the single "Can U Be/Forever Mitus" as an NFT, but later stated, "Don't make me do NFTs; I focus on real products in the real world, like food or clothing."

From early firm resistance to now personally launching a coin, Kanye's motives and operational methods have plunged the project into a whirlpool of controversy, and the ultimate direction of this carefully packaged capital game may only be revealed with time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。