Fed Rate Cut Expectations Depend on Jobs Report and Powell’s Next Move

The debate around a possible Fed Rate Cut is getting sharper after the release of the latest Federal Reserve minutes .

Source: The Kobeissi Letter

Most members said that inflation risks are still stronger than employment concerns, even before the weak July payrolls report came out.

This has raised new questions on what Federal Reserve Chair Jerome Powell will signal in his upcoming speech on Friday.

Inflation vs Employment: The Federal Reserve’s Balancing Act

The Federal Reserve meeting minutes showed a clear message: inflation remains the top concern. Members believe that price pressures from tariffs and supply chain costs are outweighing risks from a slowing labor market.

This means that any Fed rate cut will likely depend on how much weakness shows up in jobs data.

The central bank has often repeated that “one datapoint is not enough” to prove the labor market is in trouble. This classic line suggests they will not rush into big cuts unless they see consistent signs of job losses.

In September 2024, the Fed rate cut happened by 50 basis points, blaming the labor market as the main cause.

But with inflation back above 3% on Core CPI and producer prices jumping 0.9% month-on-month, a similar move looks unlikely now.

Market Odds Split Ahead of September

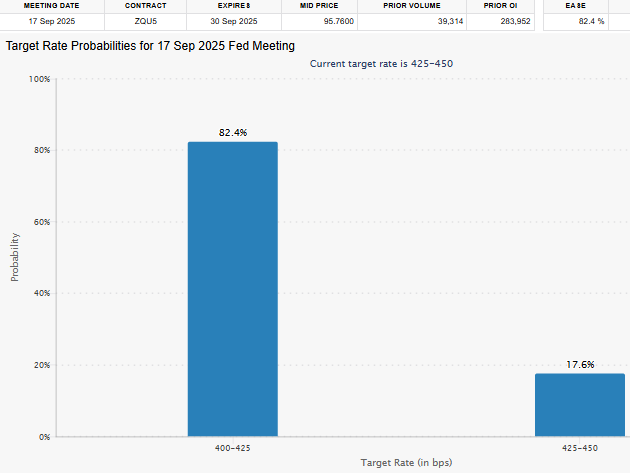

The upcoming September 17 FOMC meeting is now seen as the most important event of the year.

CME FED-Watch Tool Prediction:

There is an 82% chance of a rate cut at that meeting. However, traders are divided on how big that decrease could be.

Source: FedWatch Tool

Most agree that a 50 basis point cut is “off the table” for now. The odds of a 25 basis point decrease are shifting closer to a 50-50 chance, especially if the next jobs report on September 5 turns out weak. If the report is catastrophic, they could be forced to move by 25 basis points.

Morgan Stanley Statement:

Meanwhile, they have released a bold statement saying the Fed rate cut is not going to happing this year at all.

Polymarket Prediction:

On the other hand, Polymarket shows a 90% chance of lowering the rates before year-end.

Source: X (previously Twitter)

This divide shows just how uncertain the market is.

Public and Investor Reactions

Many investors and economists have voiced frustration over the Fed’s approach.

-

Critics argue that interest rates themselves add costs for businesses, which can raise prices.

-

One comment summed it up: tariffs add taxes that the central bank calls inflation, while higher interest rates add expenses that the Fed calls deflation.

-

Others say a Fed Rate Cut would not help the labor market because cheaper borrowing often goes into stock buybacks instead of hiring.

-

Some believe it is better to keep rates higher so savers earn more, while the government should focus on jobs through stronger immigration and visa policies.

Still, there are concerns that Powell may “cave in” under pressure even if a pause is the wiser choice. For now, everything depends on the September jobs data.

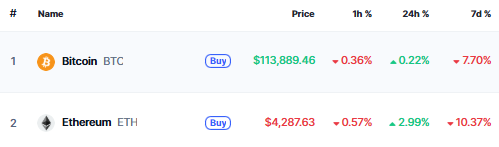

Impact On Crypto Market

A postponed Fed Rate Cut can limit the rise of crypto since investors will remain hesitant. However, lowering the rates can temporarily drive up the price of Bitcoin, Ethereum and other altcoins due to cheaper money.

As of now the current crypto market cap stands at $3.87 Trillion. The Bitcoin price is at $113,889 with an increase of 0.22%, while Ethereum is trading at $4287 with an increase of 2.99% in the last 24 hours.

Source: CoinMarketCap

Conclusion

Inflation risks and the weak labor market are now opposing each other on the Fed Rate Cut.

Inflation is proving to be resilient and the employment figures are not so good, the Federal Reserve has a tough decision to make in September. The words of Powell this Friday, in addition to the September 5 job report will be the determining factor of the way forward.

Also read: BNB Hits New ATH $880 as Windtree Therapeutics Faces Nasdaq Delisting免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。