OKB Price Surge Fueled by Supply Shock, X Layer Upgrade, and Market Bu

The OKB price has stunned the market this week. In a single day, the token surged over 50%, bringing it within striking distance of the $200 price level.

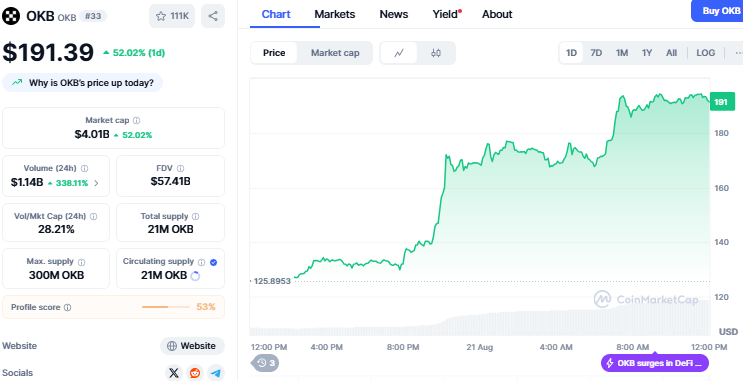

Source: CoinMarketCap

The coin is now trading at $191 with an increase of 52%, while the trading volume spiked by 341% to reach $1.14 Billion in the last 24 hours.

Traders have insisted that the OKB price rally was not a deviation, a unique token burn, network upgrades, and favourable market sentiment all sent the coin soaring.

The Supply Shock That Sparked the Rally

On August 15, OKX conducted one of the biggest token burns in cryptocurrency history.

Over 279 million tokens were eliminated from circulation, reducing the total supply to 21 million. In plain terms, half the tokens are forever lost.

This action immediately made it in short supply. It also changed its utility as OKB took over from OKT as the network's primary gas token.

To most investors, this was a sign that the value of the coin could resist the pressures of time, just like in Bitcoin's finite model of issue.

During its previous rally the CoinGabbar experts predicted that it will go to $200. It was discussed in the OKB price prediction , that a renewed rally above $117 might preserve the current bullish momentum and retest resistance at $165 and $200.

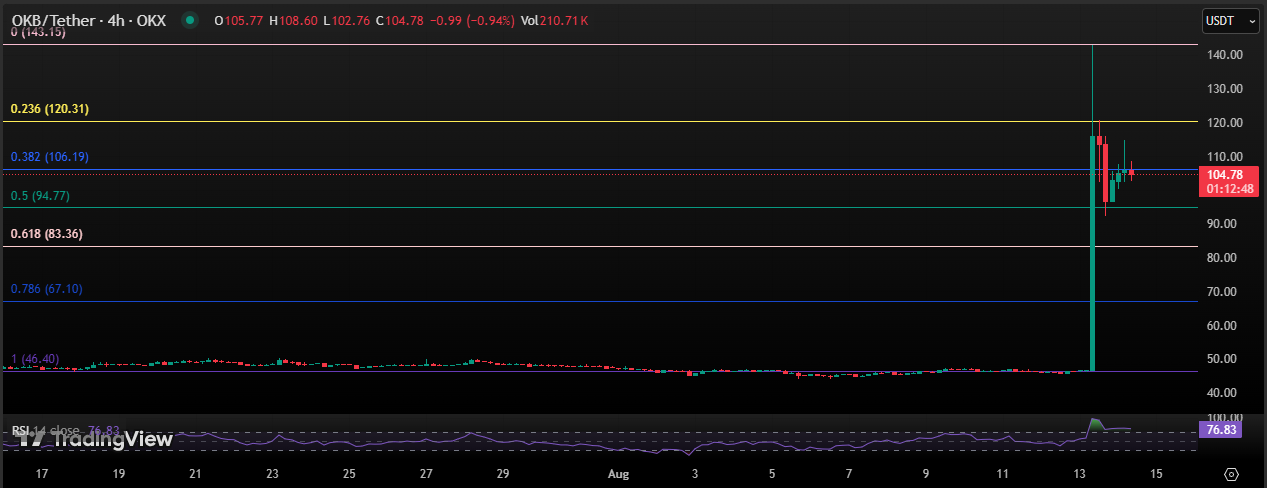

Source: TradingView

Why Does the X Layer Upgrade Matters?

Another contributor to the rally is OKX's blockchain upgrade. X Layer was upgraded earlier this month to handle as many as 5,000 transactions per second with nearly zero fees.

It also became more convenient for Ethereum developers to develop on.

This new use provided this crypto with a fresh purpose. Besides trading, it is now utilized throughout wallets, payments, and DeFi applications in the OKX ecosystem.

Increased action on X Layer translates to increased demand for OKB crypto, fueling today's rally.

Technical Breakout and Market Sentiment

The OKB price surge has also drawn the attention of technical traders.

-

The token pierced long-term resistance and is presently sitting close to $193.

-

Indicators already indicate that the market is overheated and RSI has moved above 90, which is a common level that precedes correction.

-

Support levels are around $146 and $106. If they hold, then another spike higher is possible.

-

Resistance at $200 and $214 on the upside can be the next big targets.

What Could Shape the Next Move?

Looking ahead, its future price will hinge on supply, adoption, and regulation. Supply is established now, and that leaves long-term shortage.

Adoption is a function of how well X Layer performs in the DeFi and payment landscape.

But regulatory issues still exist: Thailand has instructed OKX to close down next year, and the Philippines has marked it as unlicensed.

Conversely, OKX is planning U.S. expansion, potentially offsetting those risks.

Conclusion

The OKB price surge has been fueled by supply reductions, network improvement, and high trader demand.

The underlying appears favorable, but the token is technically overbought, and regulation taints the outlook.

Whether it will break and sustain above $200 will determine whether this rally extends or fizzles out.

Also read: Spell Wallet Daily Puzzle 21 August 2025: Earn Reward of 1 MANA免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。