According to official news, on August 22 at 16:00 (Singapore time), cryptocurrency options contracts worth over $4.8 billion will expire, with Bitcoin options having a notional value of $3.83 billion and Ethereum at $948 million. This large-scale options expiration event may trigger significant short-term market volatility, and investors should be cautious of price fluctuations.

Options expiration is often seen as a "time bomb" for the crypto market. Before the contracts expire, traders may amplify price fluctuations through hedging or closing positions, causing asset prices to gravitate towards the "Max Pain Point." This point refers to the price level at which most contract holders incur the largest losses at expiration. According to data, Bitcoin's Max Pain Point is at $118,000, while Ethereum's is at $4,250. This means that if prices fail to effectively break through these levels, some options contracts will become worthless, further intensifying market selling pressure or buying interest.

Bearish Sentiment Dominates, Bitcoin Put/Call Ratio Reaches 1.31

Bitcoin options contracts account for the vast majority of this expiration, with a notional value of $3.83 billion and a Put/Call ratio of 1.31. This ratio being above 1 indicates that the number of put options significantly exceeds that of call options, reflecting a cautious or even pessimistic attitude among market participants regarding Bitcoin's short-term trend. The Put/Call ratio is a key indicator for assessing market sentiment; when it exceeds 1, it typically suggests that investors are more inclined to hedge downside risks by purchasing put options rather than betting on price increases.

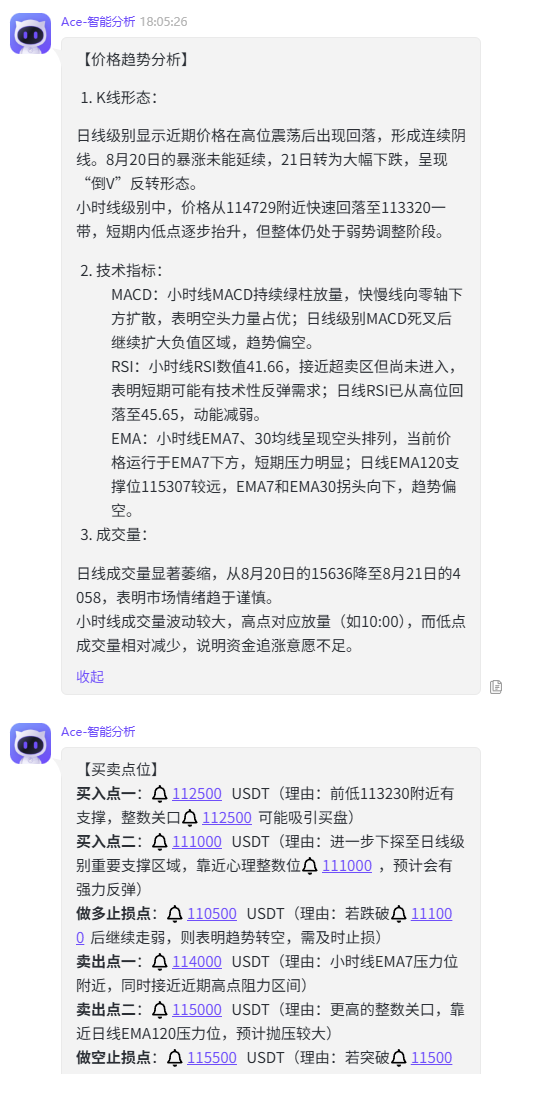

Currently, Bitcoin's price has fallen about 8% since reaching a high of $124,500 last week, now reported at around $113,500. This pullback is closely related to macro factors, including inflation concerns highlighted in the Federal Reserve's July meeting minutes and a slowdown in consumer spending. Analysts suggest that Bitcoin's support level may be around $112,000, and if this level is breached, the price could further test the $110,000 mark.

The impact mechanism of options expiration lies in "Gamma hedging." Market makers, when selling options, need to hedge risks through the spot or futures market. As the expiration date approaches, this hedging behavior can amplify volatility. For example, if Bitcoin's price approaches the Max Pain Point of $118,000, put option holders may take profits by closing their positions, while call options face the risk of becoming worthless. This could lead to increased selling pressure in the short term, pushing prices down. Historical data shows that options expirations of similar scale often trigger intraday volatility of 5%-10%. In a similar event in 2024, Bitcoin's volatility surged to over 40% around the expiration date, ultimately resulting in a nearly 7% price drop.

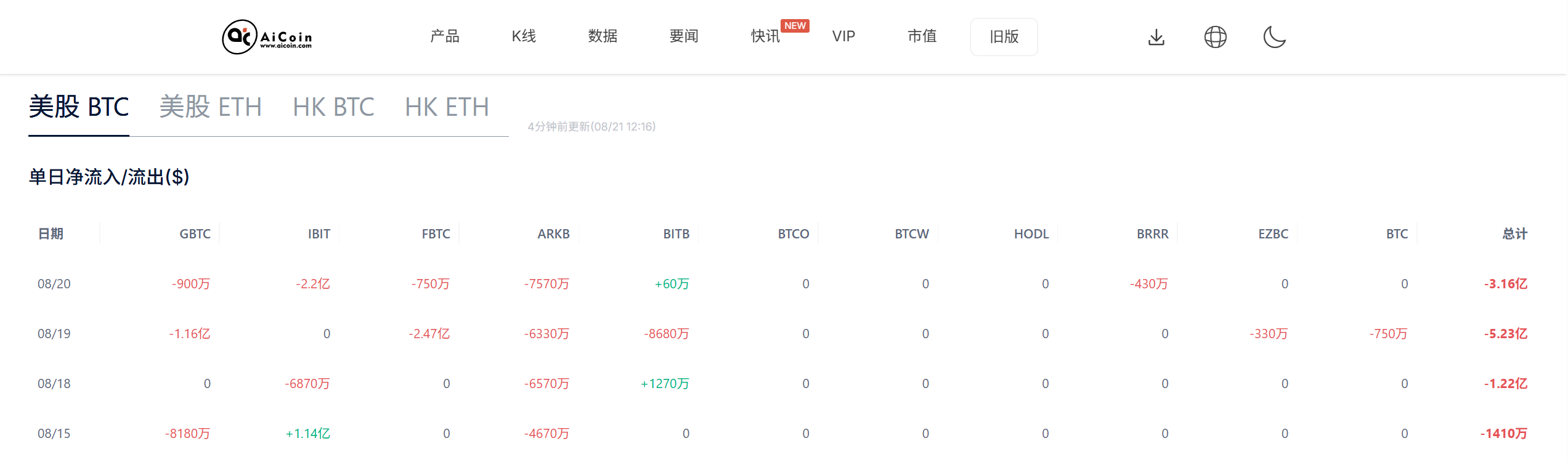

Additionally, recent outflows from Bitcoin spot ETFs have intensified bearish pressure. On August 20, Bitcoin ETFs saw a net outflow of $316 million, with Fidelity funds experiencing a $7.5 million outflow. Cumulatively, Bitcoin ETF holdings have dropped to 199,000 units, indicating that institutional investors are taking profits at high levels or shifting to defensive positions. Nevertheless, some institutions are still accumulating; for instance, Hong Kong's Ming Shing Group plans to acquire 4,250 Bitcoins (approximately $483 million) as a strategic reserve following stablecoin regulation. This suggests that bullish sentiment in the medium to long term has not completely faded, but the upcoming options expiration may amplify selling pressure.

Bullish Signals Emerge, Ethereum Put/Call Ratio Only 0.82

In contrast to Bitcoin, Ethereum options present a completely different picture. Among contracts with a notional value of $948 million, the Put/Call ratio is only 0.82, below 1, indicating that call options dominate the market, and investors are more inclined to bet on price increases. This aligns with Ethereum's recent performance: despite a price pullback last week, it has rebounded 3% this week to $4,299. The Max Pain Point is at $4,250, and the current price is slightly above this level. If it maintains strength before expiration, it could lead to more put options becoming worthless, releasing buying momentum.

The optimistic sentiment around Ethereum stems from its strong fundamentals within the ecosystem. Weekly network fees surged 38% to $11.2 million, far exceeding competitors like Solana and BNB Chain. This reflects a rebound in DeFi and NFT activities, with total locked value (TVL) accounting for 60% of the entire chain, nearing $100 billion. Ethereum's spot ETF has also attracted a net inflow of $11.801 billion.

Ethereum's futures open interest has skyrocketed from $2.8 billion in April (when ETH was below $1,500) to over $10 billion, with annual trading volume exceeding $4 trillion, breaking records for 2024, further supporting bullish potential. Although prices recently tested the $4,070 support level (a 15.1% drop, wiping out $817 million in leveraged long positions), futures premiums remain at a neutral level above 5%, and the options skew is only 4%, showing no signs of panic. Exchange ETH withdrawals reached $888 million, indicating a long-term accumulation trend.

Historical experience shows that when the Put/Call ratio is below 1, prices often adjust upward after expiration. In a similar event in 2023, Ethereum rose 12% a week after the expiration date, and the options expiration could drive Ethereum to rebound towards $4,700. However, macro risks should be monitored, such as expectations of interest rate hikes by the Federal Reserve or upward movements in the Bank of Japan's target interest rate, which could trigger a broad decline in risk assets.

Volatility Amplified, Multiple Risks to Watch

Although the $4.8 billion options expiration is not a historical peak, it occurs during a sensitive market period: Bitcoin's market capitalization is declining, and assets like Cardano and XRP are severely impacted. The total market capitalization of the crypto market has retreated, with Bitcoin ETFs experiencing net outflows for four consecutive days. Tether (USDT) issued $406 million while redeeming $381 million, indicating a delicate balance in liquidity. Investor strategy recommendations: avoid leveraged trading in the short term and focus on key levels of $114,000 (BTC) and $4,300 (ETH). In the long term, Ethereum's strong ecosystem may drive the ETH/BTC ratio to a new high in 2025. Positive developments such as Brazil's national BTC reserve hearing and SoFi Bank's Lightning integration also inject confidence into the market.

This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。