Reports indicate that Kanye West’s so-called Solana-powered meme token, yeezy money (YZY), has officially gone live. West’s X account broadcast the news to his 33 million followers, declaring that “Yeezy Money is here.” Hip-hop icon and rap mogul Kanye West, who now goes by Ye, shared a video where he personally unveiled the new project.

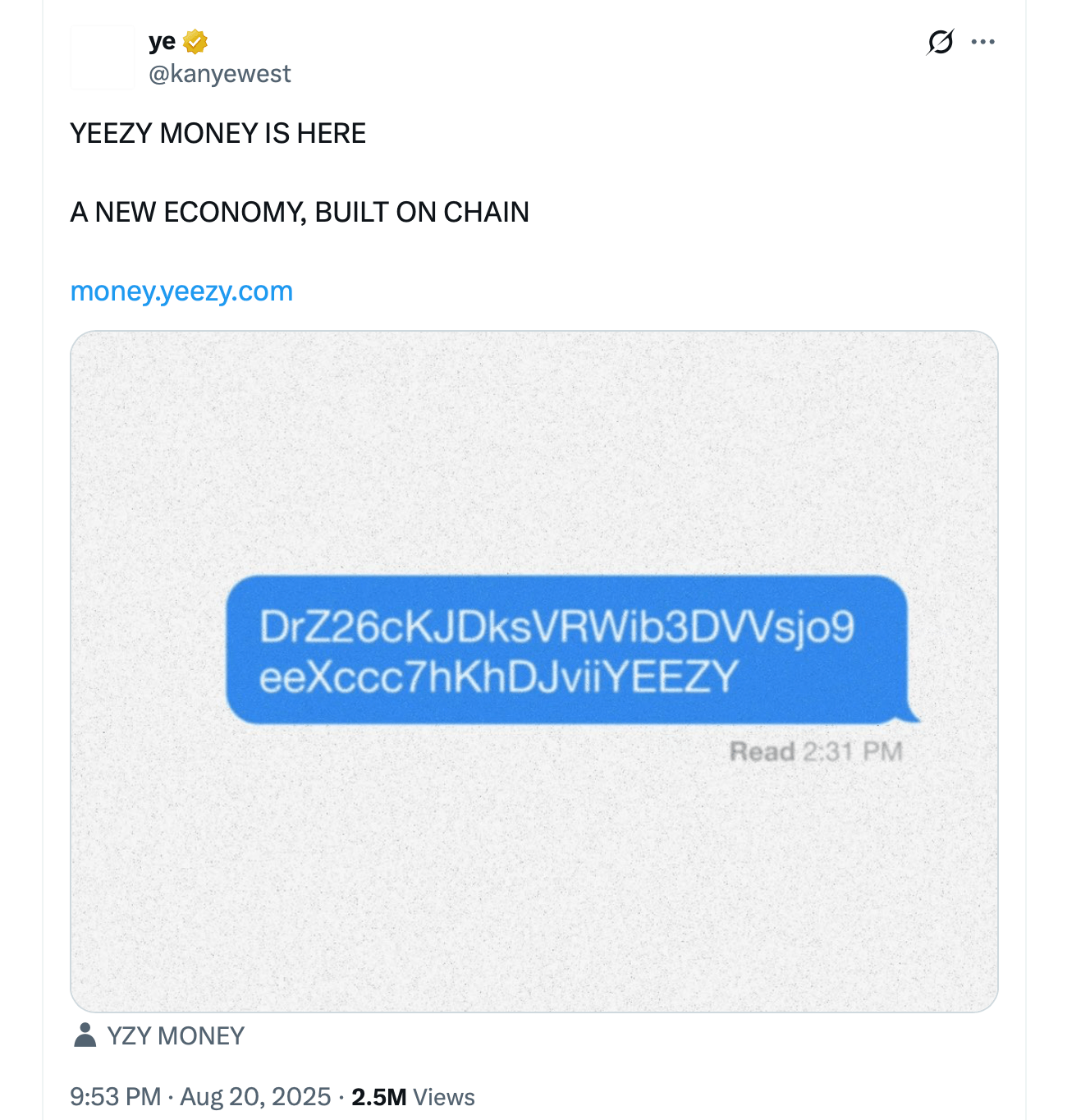

On Aug. 21, Ye shared the contract address and a link to the YZY Money website, describing the project as “A NEW ECONOMY, BUILT ON CHAIN.” The website bills YZY as the currency for a new financial system, promoting Ye Pay, a crypto payments processor, and a YZY card for transactions within its ecosystem.

Source: X.com

According to Coingecko, YZY is trading at approximately $1.02 per token, down 32.8% in 24 hours. The token’s market capitalization is around $132.5 million, with a fully diluted valuation nearing $1.019 billion. The 24-hour trading volume reached $464.35 million, and the circulating supply is listed as nearly 130 million tokens, roughly 13% of the planned 1 billion total supply.

Coinmarketcap, which ranks YZY around #160, reported a slightly lower price between $0.98 and $0.99, a market cap of $297 million, and a circulating supply of nearly 300 million tokens. The platform also highlighted a 24-hour volume-to-market-cap ratio of 324%, indicating intense speculative trading.

Onchain data from Solscan shows the token address DrZ26cKjDksVRWib3DVVsjo9eeXccc7hKhDjviIYEEZY was first minted on Aug. 17, 2025 – four days before the public launch. The current supply is listed as nearly 1 billion tokens, with over 36,000 holders. Solscan also shows the authority address is enabled, meaning the contract owner can modify metadata, mint new tokens, or alter fees.

The official YZY Money website outlines “YZYNOMICS,” a distribution plan allocating 20% of tokens to the public, 10% to liquidity, and 70% to Yeazy Investments LLC. The company’s portion is subject to cliff-and-vesting schedules: 30% with a 3-month cliff and 24-month vest, 20% with a 6-month cliff and 24-month vest, and 20% with a 12-month cliff and 24-month vest. The project also claims 25 contract addresses were deployed, with one randomly selected to deter sniping bots. The site says tokens are vested using Jupiter Lock protocol.

Source: YZY Money website.

Despite these claims, holder concentration is severely skewed. Solscan data reveals that the top ten wallets control approximately 93% of the supply. The top four wallets alone hold 80%. The largest wallet contains 270 million tokens (27% of supply), followed by three wallets holding 180 million, 180 million, and 170 million tokens, respectively – all believed to be insider addresses. The fifth-largest holder is the Meteora DEX YZY-USDC liquidity pool, which holds 9.5% of tokens.

Ye’s X promotion triggered a buying frenzy. The token launched on Meteora with a single-sided liquidity pool containing only YZY tokens, no USDC. This allowed the price to surge arbitrarily, rising from approximately $0.035 to $3.16 within 40 minutes – a gain of 6,800%. At its peak, Nansen analytics estimated the market cap reached $3 billion before collapsing later that day.

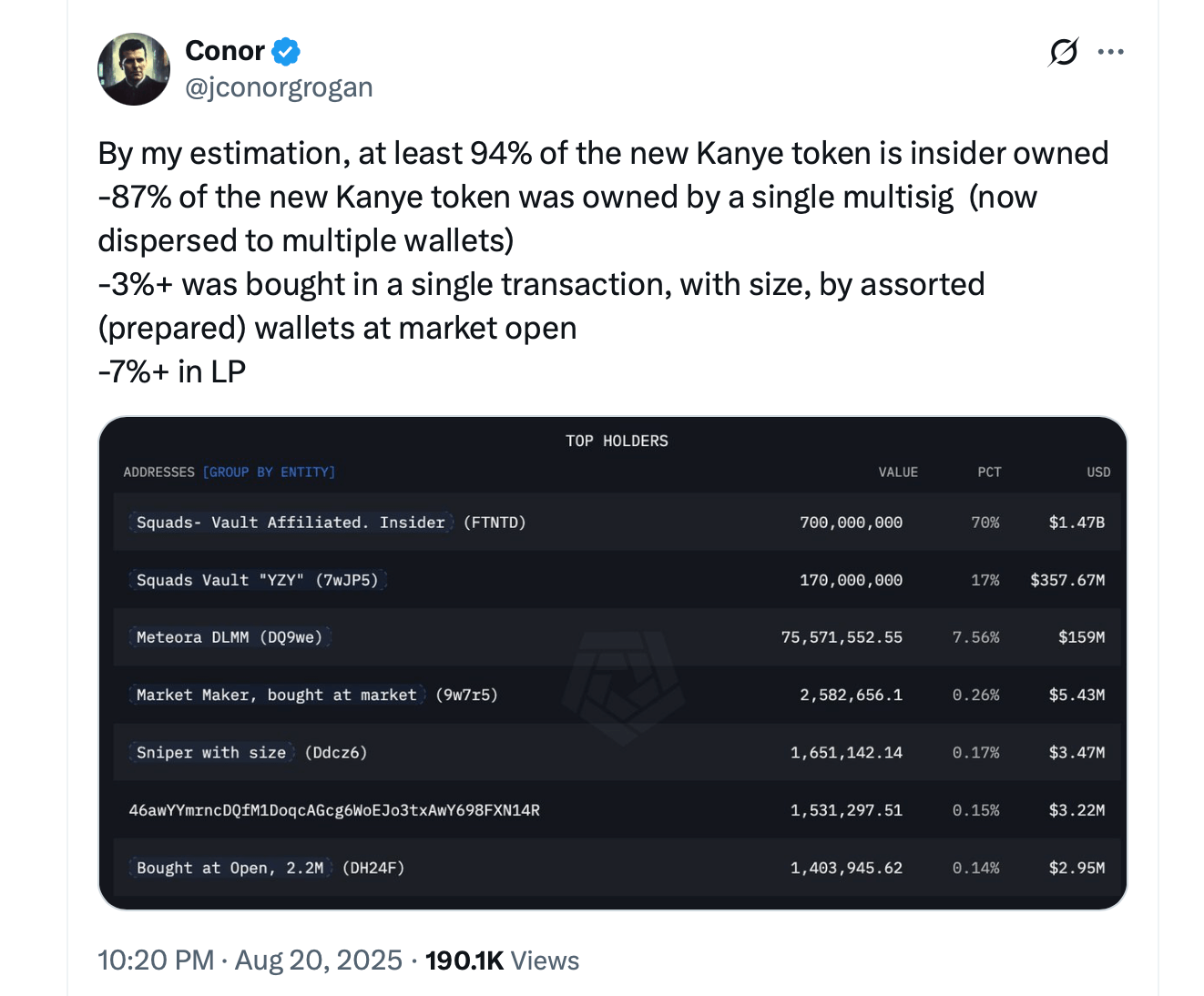

Multiple analytics firms raised insider trading concerns. Lookonchain noted the single-sided pool allowed developers to manipulate liquidity. Coinbase Director Conor Grogan stated that 94% of the supply was held by insiders at launch, with 87% initially in one multisig wallet. He estimated only 3% of tokens were bought at launch and 7% placed in liquidity.

Source: X.com

BitMEX co-founder Arthur Hayes spoke about the token, posting,

“PIs don’t rug me @kanyewest!!! $YZY for the win … cause bull market. Yachtzee.”

Profit-taking and manipulation fears led to a rapid crash. By the morning of Aug. 21, the token traded around $1, and the market cap fell to roughly $345 million. The launch exhibits several risks: extreme holder concentration, single-sided liquidity enabling manipulation, evidence of advance trading, and a disconnect between marketing hype and the project’s own disclaimer that YZY is “an expression of support and not an investment” and digital assets can result in complete loss.

YZY joins other celebrity tokens like LIBRA and TRUMP that have faced scrutiny. Given the token’s design and concentration, it operates more as a speculative meme coin than a sustainable financial system, carrying significant pump-and-dump risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。