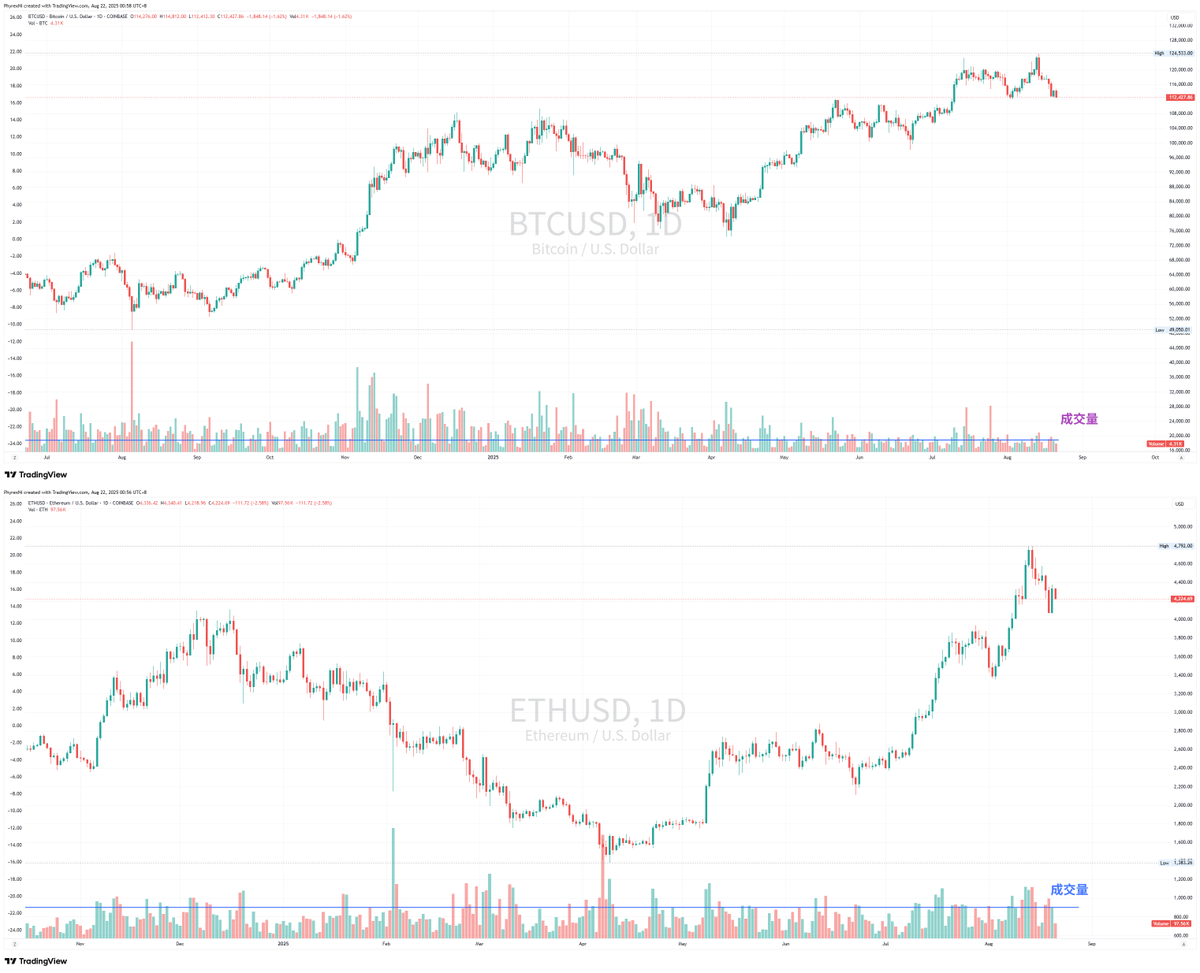

Recently, $BTC has been quite concerning. In the past two days, there has been an alternating pattern between Asian and American time zones, with one day seeing a rise and the next a fall, and vice versa. In contrast, $ETH has shown much greater stability, leaving many who were bearish on ETH surprised.

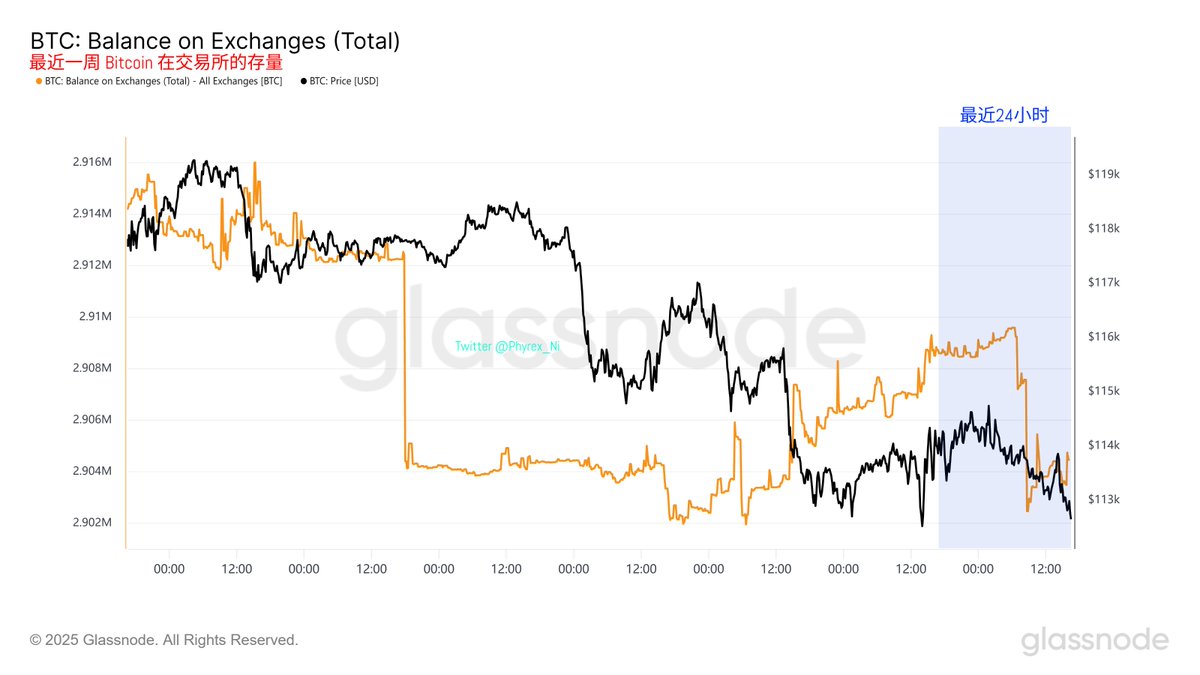

This issue has been discussed for a long time, and there is a wealth of data summarized in the weekly report. The recent rise and stability of BTC are not due to a significant increase in purchasing power; there is no spot market, no ETF, and while contracts have increased, Bitcoin's price changes are primarily due to a decrease in sellers.

However, when negative expectations arise, selling pressure increases, while purchasing power does not, thus disrupting price stability. Even now, there are still sporadic selling pressures that have not been fully released.

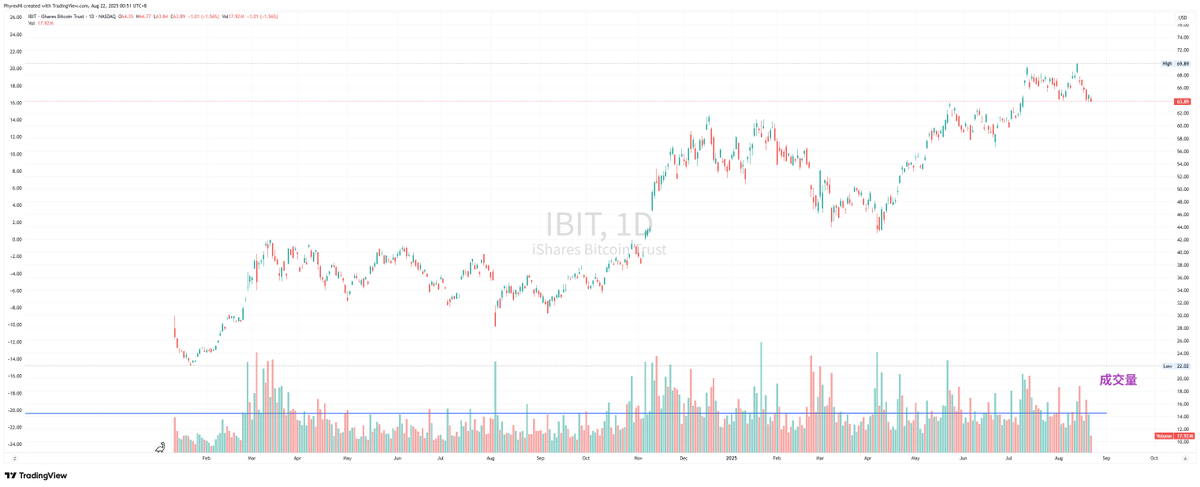

Moreover, looking at the trading volume, BTC's trading volume has been sluggish recently, indicating that low prices are becoming increasingly less interesting to the market, even in the $IBIT primary and secondary markets. The purchasing power in the primary market is shrinking, and the trading volume in the secondary market is declining, making BTC increasingly resemble U.S. stocks, which are more strongly influenced by U.S. macro policies and sentiment.

On the other hand, ETH is somewhat different. Although ETHA's trading volume has also been declining in the past two days, it still shows a significant increase compared to before. Even when compared to its peak, the decline in trading volume remains limited, indicating that ETF investors are still genuinely supporting ETH with real money. While the primary market may be struggling, the secondary market is very strong.

Additionally, from the perspective of exchange trading volume, ETH is gradually trending upwards, while BTC has long been at a low trading level.

What I want to emphasize is that the market structure has changed. BTC still has fewer sellers and not many buyers (no change), while ETH has become dominated by both ETF and spot market volume.

In simpler terms, BTC is betting on the future, while ETH is buying into the present. BTC investors believe the future will be bright, so there are fewer sellers now, whereas more ETH investors think now is a good time to buy, especially since the exchange rate is still quite low, making it an appropriate opportunity to enter.

Currently, ETH resembles BTC just after the ETF approval period in February 2024 (with the ETF approved in January followed by a pullback).

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。