Security, Incentives Drive Aave’s Launch on Aptos

Aave has completed its first non-EVM blockchain deployment, bringing its lending protocol to the Aptos network. On launch, the protocol welcomes USDC, USDT, APT, and sUSDe as its supported assets. It additionally equips Aave to tap into liquidity markets emerging on the Aptos ecosystem.

The launch succeeded with governance approval and conformed to the platforms 2030 multi-chain strategy. The protocol has now enabled Layer 1 lending and borrowing via a network built with the Move programming language.

This launch underscores the protocol’s capacity to successfully integrate with a variety of blockchain architectures.

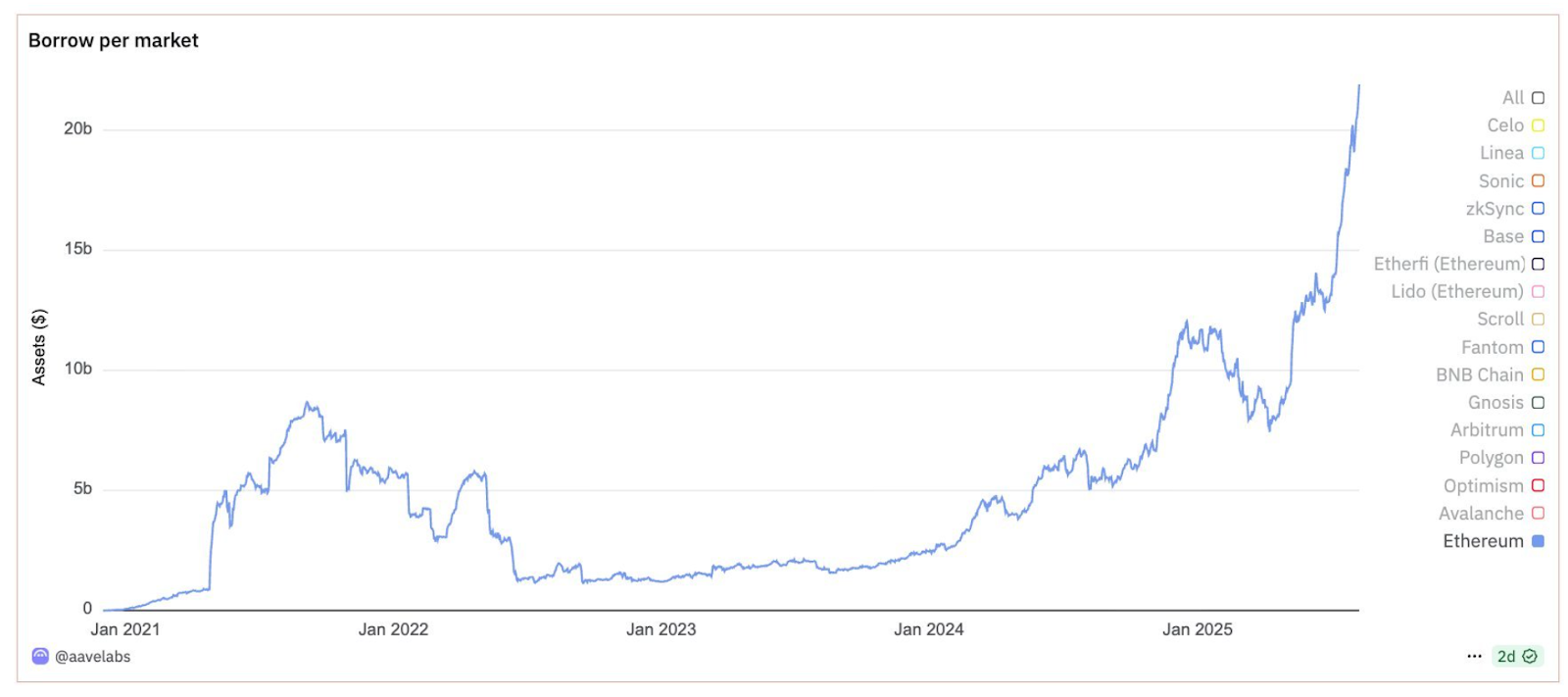

Borrow demand has soared, climbing past the $20-billion mark on Aave Labs' latest estimates. At present, the lending platform commands approximately 63% of the DeFi lending market.

Aave Surpasses Circle in TVL

Recent data indicates that protocal outpaced Circle in total value locked. The protocal's TVL stood at roughly $65 billion, compared with Circle’s $63 billion. These figures position Aave as the second-largest crypto firm by TVL and the equivalent of a top-40 U.S. bank.

Borrow per market : Source : X

This expansion is attributable to heightened borrowing activity, and its pace has sharply intensified in 2025. Total borrowing markets have hit new all-time highs, attesting to the surge in demand for decentralized credit. Although Ethereum still dominates overall activity, the platform's cross-chain growth only reinforced its standing.

More so, the ecosystem has likewise grown through the addition of new features. Through Ethena Labs, users can now employ Liquid Leverage to unite assets and scale their yields. This, in turn, augments lending applications and broadens the array of yield-generating options for DeFi users.

Security and Incentives on Aptos

The launch also introduces oracle-secured markets driven by Chainlink price feeds. They guarantee the precise valuation of collateral and safeguard the system from manipulation threats. A number of firms among them Zellic, Ottersec, and Certora, performed security audits.

The platform’s developers at the platform re-wrote Aave V3 in Move and released it alongside an updated SDK and front-end. Chaos Labs, together with LlamaRisk, specified risk parameters, while Cantina coordinated security contests. The platform further allocated a $500,000 bug bounty program denominated in the GHO stablecoin.

The Aptos Foundation will boost the launch by offering liquidity incentives and user rewards. Such incentives seek to promote early adoption and pull in additional lending and borrowing activity. At present, Aptos’s stablecoin market tops $1.3 billion, with USDT commanding most of that volume, ensuring that Aave enjoys substantial early liquidity.

Why Aptos Matters

Aptos casts itself as a high-performance Layer 1 platform for finance, consumer applications, and real-world assets. Developed in Move, it prioritizes rapid execution and Digitized low-latency finality. The rollout sets the platform on a course to broaden its reach into markets beyond EVM chains.

The network’s Global Trading Engine strategy harmonises with the protocal's multichain approach. Deploying its protocol on Aptos will enable extend access to institutional actors and individual retail users. In the past, chains that have integrated the protocal witnessed faster growth in total value locked.

More so, the rollout further deepens it's ever-growing presence in the DeFi space. Now holding more than $50 billion in net deposits and locking $37 billion, the ecosyste continues to stand as the second-largest protocol. Introducing Aptos could draw in new developers and users, while broadening the platform’s overall risk exposure across ecosystems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。