Author: On-Chain Mind

Translation: Shaw Golden Finance

In the financial realm, there are certain concepts that most of us accept without ever truly questioning them. For instance, the price-to-earnings ratio, the "fair value" metric, and even the belief that the value of money itself will remain stable over time. However, when you take a step back, some of these notions begin to appear less like immutable natural laws and more like collective beliefs supported by tradition.

This article delves into the concepts of Strategy (MSTR), the market capitalization to net asset value ratio (mNAV), and how these concepts adapt to the evolving world of companies centered around Bitcoin. It offers a more fundamental and philosophical examination of this new type of company, linking familiar ideas from traditional finance (TradFi) while questioning many assumptions that investors take for granted.

In the end, you will understand that companies like MSTR are not just "buying Bitcoin" — they are reshaping the potential landscape of stock value for the next decade.

Let’s get started.

Key Takeaways

- Challenging Traditional Metrics: Free Cash Flow per Share (FCF/Share) is the "North Star" of traditional stock investing, and it closely resembles the per-share Bitcoin in companies that hold Bitcoin reserves.

- The Power of Growth Narratives: Investors bet on long-term growth, even amidst numerous unknowns, which complements Bitcoin's exceptional compound growth rate.

- mNAV as the "New P/E Ratio": It is not only a valuation tool but also indicates operational strength, financing capability, and investor confidence in Bitcoin holdings.

- MSTR's Technical Signals: Indicators such as the 200-day moving average and Z-score probability waves suggest that the company's current price of around $350 is an attractive entry point.

FCF/Share: The North Star of Traditional Investing

If we simplify the essence of stock investing, one metric often stands out: Free Cash Flow per Share (FCF/Share).

Why? Because free cash flow represents the actual cash a company generates after paying for operating expenses and capital investments.

Free Cash Flow per Share is typically seen as the ultimate measure of a stock's effectiveness in returning capital to shareholders, whether through dividends, buybacks, or reinvestment. A consistent annual growth rate of 15% in Free Cash Flow per Share is often referred to as "exceptional," as compounding at this rate means the stock's value roughly doubles every five years — a feat few companies in the world can sustain.

This is why the market tends to give such companies a premium valuation, usually with price-to-earnings ratios between 25 and 30 times. In some cases, investors may even accept price-to-earnings ratios exceeding 100. At first glance, this seems absurd — many companies do not survive long enough to see the expected return period. But the reason is simple: growth. If the story is compelling enough, investors are willing to pay a high price.

The Madness of High P/E Ratios

Willingness to pay extremely high price-to-earnings ratios for earnings is one of the widely accepted quirks in the investment field. Few stop to think about the reasons behind it. But if you take a step back, people are essentially betting on an unknowable future.

- Will this company still exist in 25 years?

- Will it still dominate its industry?

- Will earnings compound growth continue uninterrupted?

Despite these uncertainties, the growth narrative itself has become a form of currency. The market holds it as a standard.

The reason is that if many people believe in a company's growth, this belief can drive its stock price up for years to come. This concept is widely accepted in the investment community, but when you analyze it simply and engage in a bit of philosophical thinking, you realize it is quite mad.

The Rise of mNAV

Now, apply this logic to Bitcoin treasury reserve companies. Currently, the same concept is playing out in the realm of Bitcoin reserve companies. mNAV (market capitalization to net asset value ratio) is the "premium" that investors pay for a company to acquire more Bitcoin in a way that they themselves cannot achieve efficiently.

I like to compare it to the price-to-earnings ratio of the "new era." In reality, it conceptually resembles the price-to-book ratio, although this term is less familiar to the average investor. Interestingly, the current price-to-book ratio of the S&P 500 is about 5.4 times, with historical fluctuations ranging from 1.5 to 5.5, astonishingly similar to MSTR's historical average mNAV.

The price-to-book ratio measures the relationship between a company's market value and its book value (assets minus liabilities). It indicates how much investors are paying for each dollar of net assets.

It is refreshing to see many investors questioning why we should pay a premium for the underlying Bitcoin assets, rather than blindly accepting this concept as is done in many aspects of traditional finance. We should question why things are priced this way. I believe this is a significant advantage for ordinary Bitcoin investors: the ability to question widely accepted views that are simply accepted because "that's how it's always been done."

Why Does the Bitcoin Premium Exist?

- Trust in Growth Plans — Companies will find ways to grow their asset portfolios faster than individuals.

- Access to Cheap Capital — This is something ordinary investors can never reach.

- Operational Leverage — Achieving faster expansion through structures like convertible bonds or equity financing.

Can you obtain loans at around 0% interest to accumulate more Bitcoin? Almost impossible. This is where the strength of the best Bitcoin reserve companies lies — especially larger and more committed companies like Strategy (MSTR).

Specifically, companies like MSTR utilize convertible bonds, where lenders accept lower interest rates in exchange for equity conversion rights. This effectively subsidizes the accumulation of Bitcoin. In traditional finance, this is similar to how tech growth companies use leverage to scale without immediately diluting equity.

But if a traditional financial stock's annual growth rate in Free Cash Flow per Share of 15% is considered "exceptional," why do we give companies like MSTR, which hold Bitcoin, a valuation premium of 1.5 times (or 4 to 5 times), knowing that Bitcoin has had a compound annual growth rate of 60% to 80% over the past 5 to 10 years?

I believe this is a major concept that the broader investment community has yet to grasp; they still generally do not understand that Bitcoin is one of the top five assets globally and is gradually consuming global capital value. This is also a significant reason why I am bullish on companies like MSTR in the long term.

mNAV Discounts: Traps and Real Signals

So, can a company trade at an mNAV below 1? Absolutely. According to Bitcoin Treasuries, among 167 publicly traded companies, 21 (about 13%) are trading at a discounted mNAV.

This is very similar to why some stocks trade at extremely low price-to-earnings ratios, such as 5 times. Many traditional financial investors fall into this "value trap," believing they have found bargains at low prices because the stock price is low. But in reality, most of the time, the reason a stock is cheap is that the company has failed to deliver on the performance promises expected by investors.

I believe this concept of value traps also applies to Bitcoin reserve companies. For those companies trading at a discounted mNAV, it indicates a skeptical market attitude, which may relate to factors such as:

- Weak governance;

- Fragile financing models;

- Operational risks in the current business.

In fact, this may also indicate that investors have confidence in these companies' ability to hold Bitcoin. Because, mathematically speaking, when mNAV is below 1, the beneficial action for the company's shareholders is to sell Bitcoin to buy back stock.

But companies like MSTR have resisted this temptation. Even when their mNAV fell below 1 during the bear market of 2022, they retained their entire Bitcoin holdings by restructuring debt. This is why I am quite certain that MSTR will not fall into this category. I have no doubt that even in less favorable circumstances, they will continue to hold all their Bitcoin. This long-term holding philosophy stems from Michael Saylor's vision of viewing Bitcoin as pure collateral.

I do not have the same confidence in the other 166 publicly traded companies. The only one I would categorize as a "HODL long-term hold" is Japan's Metaplanet.

Therefore, mNAV is not simply a buy or sell signal — it is a perspective. A premium may indicate strong confidence or merely hype, while a discount may reflect distress or contain value. The key lies in the specifics:

- How much is the company's per-share Bitcoin increasing?

- Does it have other revenue sources to support its valuation?

- How resilient is its funding model in market cycles?

MSTR's Financial Magic

What truly sets MSTR apart from many other Bitcoin reserve companies is its diversified fiat financing capability, which effectively allows it to purchase its held Bitcoin assets. Its low-cost financing tools, such as convertible bonds, and an expanding list of preferred stock issuances enable it to increase its Bitcoin holdings more rapidly without diluting the equity of ordinary MSTR shareholders.

For example, convertible bonds allow borrowing at nearly zero effective interest rates during bull markets when converted to equity. This creates a flywheel: more Bitcoin enhances collateral value, allowing for more borrowing. In my view, this financial magic deserves a significant premium. Just as in traditional finance, Nvidia commands a reasonable price-to-earnings ratio due to its Free Cash Flow growth rate far exceeding that of almost all other companies.

For most people, this is a completely new concept. Bitcoin reserve companies aim to increase the number of per-share Bitcoins as quickly as possible, while traditional financial companies seek to increase Free Cash Flow per share as quickly as possible. It is the same idea. One side hopes to grow a pure capital that appreciates at least 30% to 50% annually for the foreseeable future, while the other side tries to accumulate their preferred fiat currency, which depreciates at a rate of 8% to 10% per year.

I know which one is more likely to create more value for shareholders in ten years, given their respective strategic developments.

Market Signals

Finally, let’s quickly browse some charts to uncover potential value opportunities.

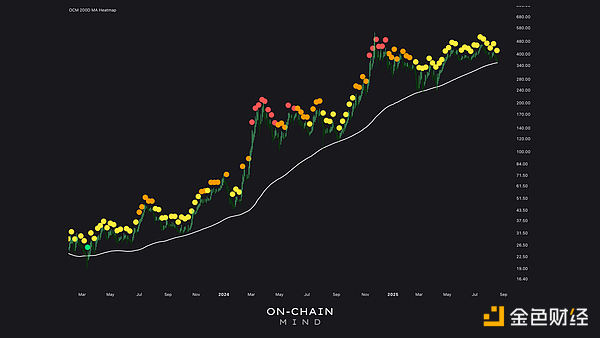

The 200-day moving average signal shows strength: MSTR is expected to present a green signal point on the 200-day moving average for the second time in this cycle, with its trading price at the 200-day average of $353. This level is a key support for bulls, marking the beginning of this rally. If it can stabilize at this price, it may indicate strong upward potential.

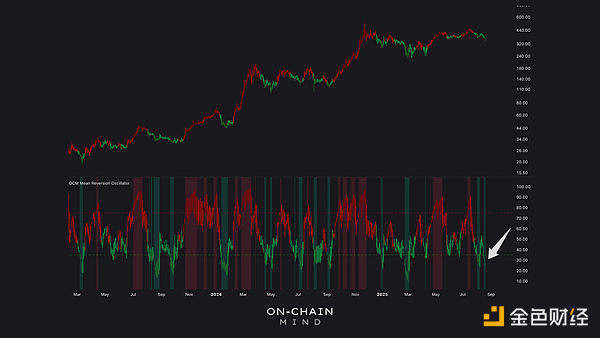

Z-score probability wave: MSTR's stock price has fallen to a level of negative 2 standard deviations, which is exactly $353. Historically, when stock prices fall below negative 1 standard deviation during this bull market, it often indicates significant price volatility, and if the macro situation remains optimistic, the stock price is likely to revert to the mean.

Oversold Condition: My mean reversion oscillation indicator (which operates similarly to the RSI relative strength index) shows that MSTR is in a deeply oversold area. Past occurrences at this level have often led to short-term rebounds, and sometimes even significant upward trends.

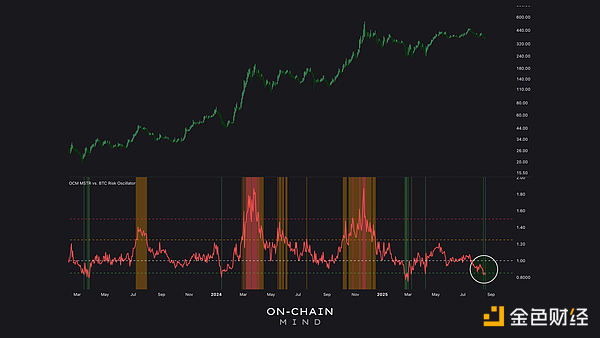

MSTR Investment Opportunity Priced in Bitcoin: When priced in Bitcoin, MSTR's risk oscillation indicator is at one of its lowest values, which serves as a strong signal for investors in a low tax environment to shift their investments from Bitcoin to MSTR. Historically, this lag in MSTR's stock price relative to Bitcoin has typically been quickly compensated.

Why I’m Not Worried About MSTR's Stock Price Lagging

In summary, am I concerned that MSTR's stock price is lagging behind Bitcoin's current gains? Not at all. Currently, the mNAV may have compressed to about 1.5, but the true measure of its Bitcoin strategy remains intact: the number of Bitcoins per share is still increasing weekly. To a large extent, that is all I care about.

Just like traditional stocks, their Free Cash Flow per Share may increase year over year, but the stock price can still fluctuate wildly. This is the fascinating aspect of irrational investor psychology. However, if the fundamentals continue to improve (such as the increasing number of Bitcoins per share), I would eagerly seize the opportunity to buy this company at a discount. Because as we know, when investor sentiment shifts and the price-to-earnings ratio eventually expands again, this stock has the potential to yield significant profits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。