As Sui's TVL continues to grow and institutional adoption accelerates, Momentum X will become a key infrastructure in the crypto space.

Written by: 1912212.eth, Foresight News

Imagine a morning in 2028 when you wake up, pick up your phone, open your crypto wallet, and with one click, access the ocean of global financial flows, allowing you to buy and sell highly sought-after financial assets for investment or arbitrage. What would happen?

This is not an unattainable dream; it is the future path that Momentum is paving—a world where liquidity never dries up and assets are seamlessly tokenized, enabling ordinary people to easily ride the wave of wealth.

In the crypto world, numerous projects in NFTs, blockchain games, inscriptions, and social media emerge crazily and then quickly vanish without a trace, soon becoming forgotten. The sands of time leave behind those true innovators who address pain points. DeFi has witnessed the rise and fall of many industry hotspots: Ethereum's journey from being heavily criticized to reclaiming its throne, the meme frenzy on Solana, and the quiet rise of emerging public chains like Sui. With the airdrops from ecological communities and the wealth effect of the SUI token, many lending, DEX, and staking protocols have emerged.

In this blue ocean, Momentum stands out; it is not only a DEX on Sui but will also create the institutional trading layer for tokenized assets, Momentum X.

Institutional Trading Layer for Tokenized Assets: Momentum X

If DeFi is the evergreen tree of crypto, then the current wave of tokenization sweeping the globe is one of the main thoroughfares of crypto today.

From the earliest days, we have witnessed the tokenization of the US dollar (USDT and USDC), and now the tokenization of US stocks. Tens of thousands, even hundreds of trillions of assets are still slowly making their way onto the blockchain. Exchanges like Karen, Coinbase, and Bybit have long targeted this blue ocean, and in terms of protocols, Ondo Finance is also working hard to launch tokenized stock trading in the coming months.

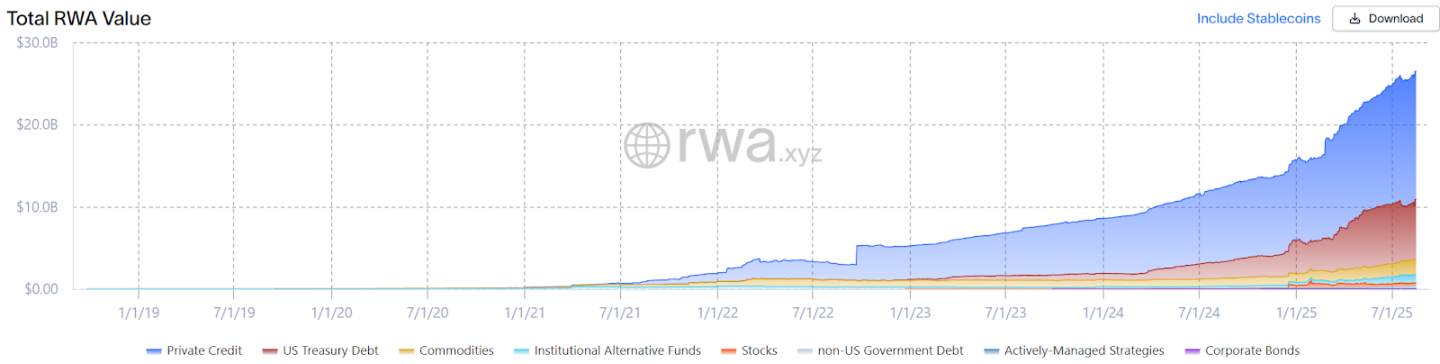

According to the latest data from RWA.xyz, the value of on-chain tokenized assets has risen to $26.48 billion, with rapid growth.

Funds from outside the city want to flow in, and users inside the city also want to explore various financial assets outside the city to participate in wealth generation.

Transparency, immutability, and global accessibility allow traditional financial assets such as real estate, stocks, bonds, and commodities to circulate on-chain in tokenized form, enabling 24/7 trading and fractional ownership.

Future investments will become very easy. As a retail investor, you can sit in a café and buy tokenized Apple stocks with one click through Momentum X. Without time zone restrictions or intermediaries, you can complete transactions directly on the Sui chain, with 24/7 instant settlement. Fractional ownership allows you to participate in large investments with just $100, opening the door to countless wealth opportunities.

Although the prospects for asset tokenization are optimistic, there are still many real-world issues that need to be addressed.

The Triple Dilemma of Retail and Institutional Investors

Currently, different issuers operate independent KYC, interfaces, and compliance logic. Even if backed by the same type of real-world assets, tokens on different chains are often viewed as non-interchangeable independent tools, leading to a fragmented market, reduced efficiency, and an inability to form a truly deep unified market, resulting in fragmented liquidity for tokenized assets. Tokenized assets on the base chain and Solana often struggle to interoperate.

Moreover, some markets often face absurd situations due to insufficient depth in buy and sell orders. On July 3, a user attempted to purchase about $500 worth of Amazon token AMZNX, briefly pushing its price up to $23,781.22, over 100 times the previous day's closing price of Amazon.

In terms of off-chain compliance, most rules rely on intermediaries for execution rather than being directly completed by smart contracts, which gives some unscrupulous project parties or protocols an opportunity. On August 13, user Caroline's 6.2 million USDT was frozen on the decentralized RWA trading platform MyStonks. Despite submitting a large amount of certification materials, the issue remains unresolved, leading to high market trust costs.

The three major challenges facing ordinary users today are insufficient liquidity of some tokenized assets, abnormal pricing, and asset security.

What about institutions with resources and backgrounds? They also have many unspoken difficulties.

Fidelity, as one of Wall Street's giants, manages over $10 trillion in assets, with daily trading involving traditional financial products such as stocks, bonds, and funds. However, they still face tricky issues when handling large amounts of corporate bonds.

For example, when Fidelity buys hundreds of millions of dollars worth of U.S. corporate bonds for pension funds or hedge funds, the traditional trading process for these bonds includes:

Fragmented liquidity: The bond market is highly decentralized, with liquidity not interconnected between different exchanges or OTC platforms, leading to price volatility and execution delays.

Low settlement efficiency: It takes 2-3 days from trade to settlement, involving multiple intermediary institutions, increasing costs and risks (e.g., counterparty default).

Compliance barriers: Cross-border transactions must comply with regulations from the SEC, FINRA, etc., while facing KYC/AML requirements that restrict global liquidity.

How can we address the pain points of institutional-level needs, achieve instant settlement of tokenized assets on the blockchain, and ensure institutional-level security and compliance?

In the crypto era, traditional financial institutions like Fidelity need an institutional-level bridge to truly "bring traditional assets on-chain."

Wallet + Identity Verification to Tap into the Trillion-Dollar Wealth Market

This is precisely the core issue that Momentum X aims to solve: as the institutional trading and settlement layer for tokenized assets, it not only provides trading functionality but also addresses the "last mile" problem of RWA.

Momentum X builds a unified RWA ecological framework, embedding compliance, auditing, and logic into the token layer, and leveraging Sui's dedicated architecture for underlying support.

Unified identity layer: Based on ZK technology, Walrus and encrypted Seal permissions enable one-time KYC/AML verification;

Interoperability among issuers: Tokenized RWAs from different issuers can be exchanged and traded;

Programmable compliance: Investor rights, jurisdiction, and trading restrictions are directly embedded at the asset layer;

If you are a professional institution, through Momentum X's DeFi native integration, you can market or stake tokenized bonds without leaving the chain. Cross-chain liquidity issues in a multi-chain era are resolved, with EVM assets deployed to Sui in hours, ensuring high throughput without congestion. Pension funds can utilize automated Vault strategies to dynamically adjust positions and capture market fluctuations, while real-time compliance tools attract more TradFi giants to enter the market, driving RWA transformation from hundreds of billions to trillions.

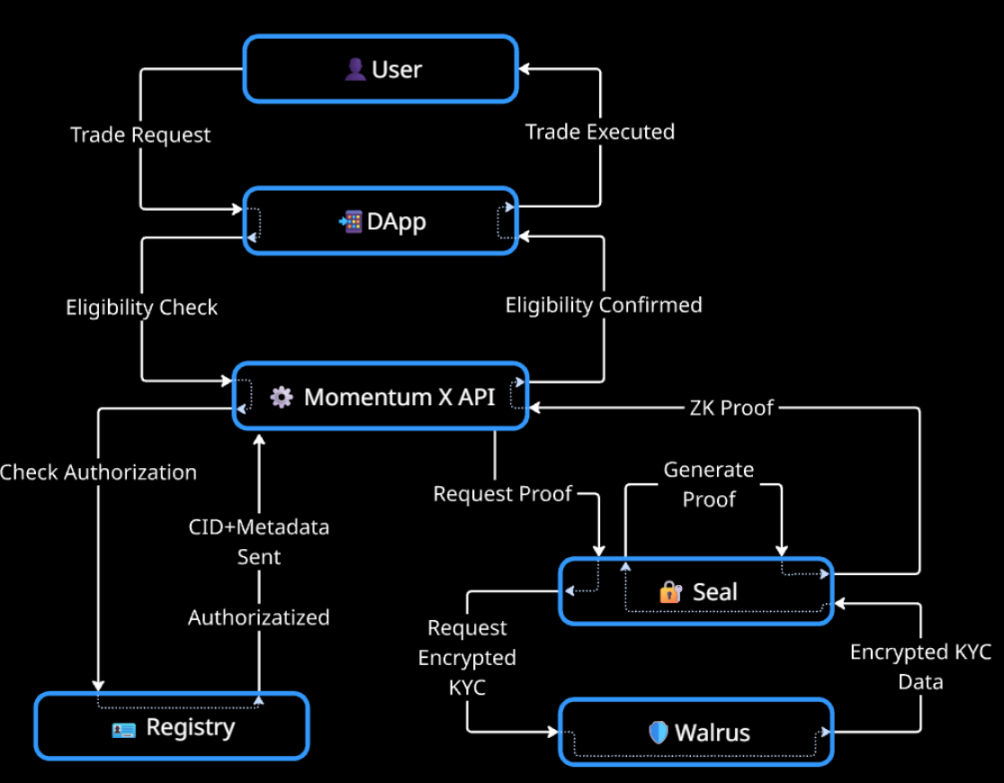

A very typical operational process is as follows:

When you initiate a transaction through the DApp, the system sends a qualification review request to Momentum X's API. This API confirms that the relevant application is authorized to request identity verification. Using Seal technology, the system retrieves encrypted identity data from the storage layer Walrus and only performs necessary decryption operations to prove compliance with the asset's compliance rules, such as jurisdiction requirements, qualification certifications, or transfer limits.

Subsequently, the verification proof is returned to the relevant application, and if the user meets the qualification requirements, the transaction will be approved in real-time. This method ensures compliance with regulatory requirements, protects user privacy, and provides a seamless trading experience for both institutional and retail users.

In summary, what Momentum X aims to do is to enable a single address and identity to overcome all the difficulties of trading in the trillion-dollar on-chain market. Sui's high performance and throughput provide the underlying technical support for Momentum X, while Walrus and ZK technology safeguard privacy, allowing users to easily and efficiently navigate the global financial market on Momentum X.

At some point in the future, after completing identity verification on Momentum X, whether on Fidelity, Robinhood, or other on-chain trading platforms, you can quickly purchase your desired financial assets through the on-chain verified address without having to submit cumbersome certification materials every time you log into a platform.

The lives of ordinary users will also be completely transformed: in the future, you can stake tokenized stocks on Momentum X, earn token rewards while maintaining liquidity, and then lend them out to earn passive income, all completed in one stop. Future expansions will cover more asset classes, such as private equity, with institutional-level staking strategies allowing large funds to participate seamlessly.

The speed of integration between DeFi and TradFi is accelerating—it's like shopping in a supermarket for RWA, with global capital flowing freely. The concepts of borders and time zones are gradually blurring.

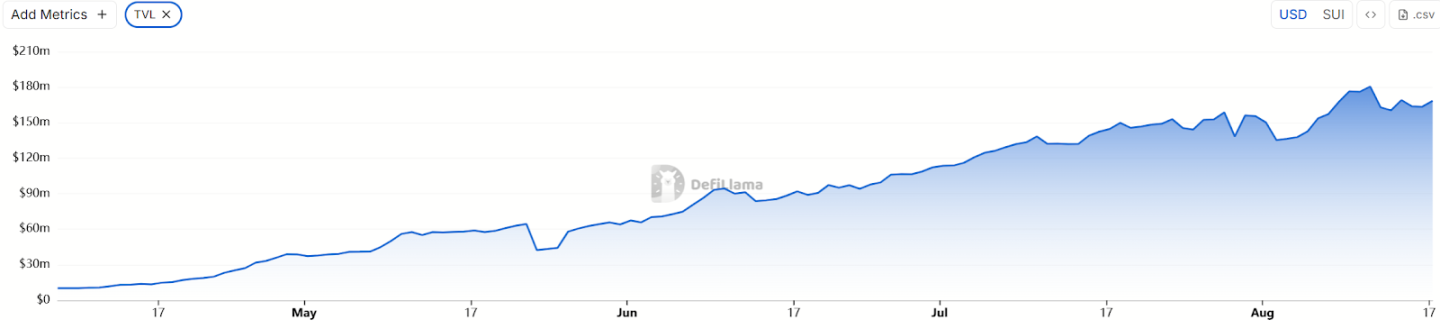

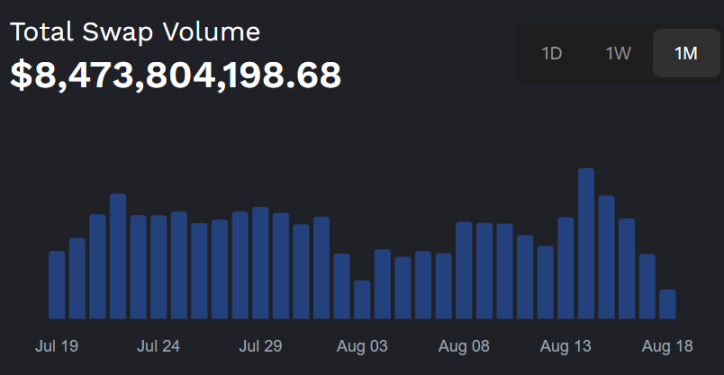

DEX Total Trading Volume Exceeds $8 Billion, TVL Over $180 Million

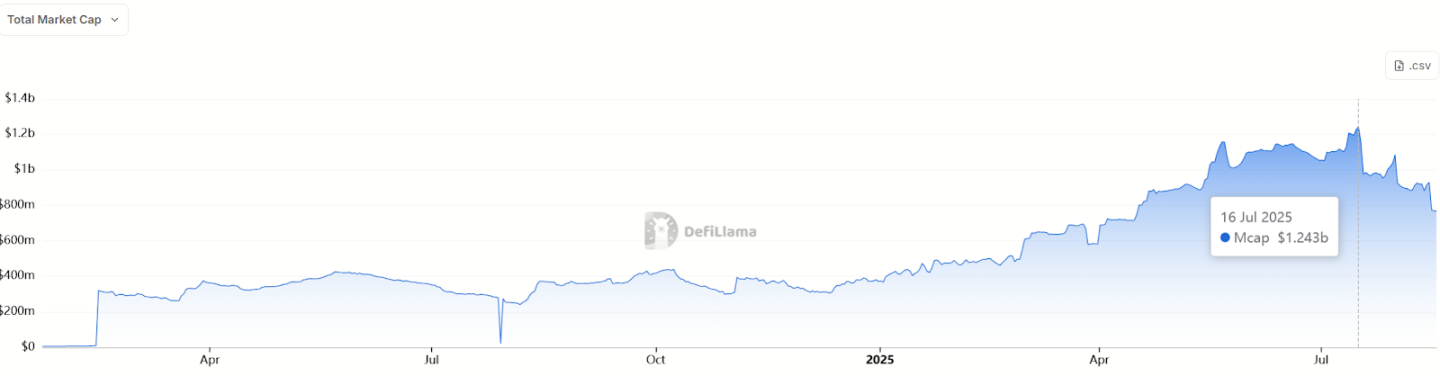

In 2023, the public chain Sui, developed by Mysten Labs, attracted developers with its unique Move language and optimized Sui's throughput and low-latency performance. Between 2024 and 2025, the supply of Sui stablecoins surged from $5.4 million to a record high of $1.243 billion on July 16 this year.

On the ecological front, DeFi's TVL once soared to about $2.25 billion, with daily DEX trading volume exceeding $300 million, and on August 15, it even surpassed $746.69 million in a single day. Lending protocols also benefited from this, with overall monthly DEX volume approaching $15 billion, reflecting strong user adoption and capital inflow.

However, the biggest challenge faced by Sui in its early stages was still insufficient liquidity depth: users wanted to trade but struggled with low depth and high slippage. If the slippage loss of a transaction cannot be controlled within a range, even the wealthiest whales would hesitate to make large purchases.

Momentum improves traders' execution experience and enhances liquidity providers' returns by allowing LPs to provide liquidity within custom price ranges, thereby releasing deep liquidity at critical positions.

At the end of March this year, after the launch of the Beta version, Momentum's steep line chart showcased its explosive potential. In just four months, its TVL has risen to $180 million, setting a new historical high.

As of August 7, official data revealed that the number of wallet address users has exceeded 1 million, achieving a staggering growth of 2x in just two weeks. If TVL is just one key aspect, then trading volume better illustrates user trust and stickiness. On August 18, according to its official tweet, the total trading volume of its DEX has surpassed $8.4 billion.

All of this comes just over two months after the Sui ecosystem's Cetus protocol was hacked. Contrary to the pessimistic assertions of some in the market, Sui has not suffered a heavy blow; instead, it has demonstrated resilience and systemic vitality. During the hacking incident, multiple projects collapsed due to hacking attacks or liquidity exhaustion, and established DEXs like Cetus also saw a significant drop in TVL. Momentum actively responded to the call for fund recovery and quickly restored its own liquidity.

It is worth mentioning that Momentum originally started as MSafe, which launched on Aptos at the end of 2022 and on Sui in 2023. It is the first multi-signature treasury management and token vesting solution in the Move ecosystem. Its multi-signature management solution (mmmt platform mechanism) employs multi-party signatures to ensure that treasury assets do not fail at a single point.

Security has been greatly enhanced, allowing large funds to participate in liquidity pools, thereby benefiting the entire ecosystem and achieving a positive cycle.

Liquidity and Innovation

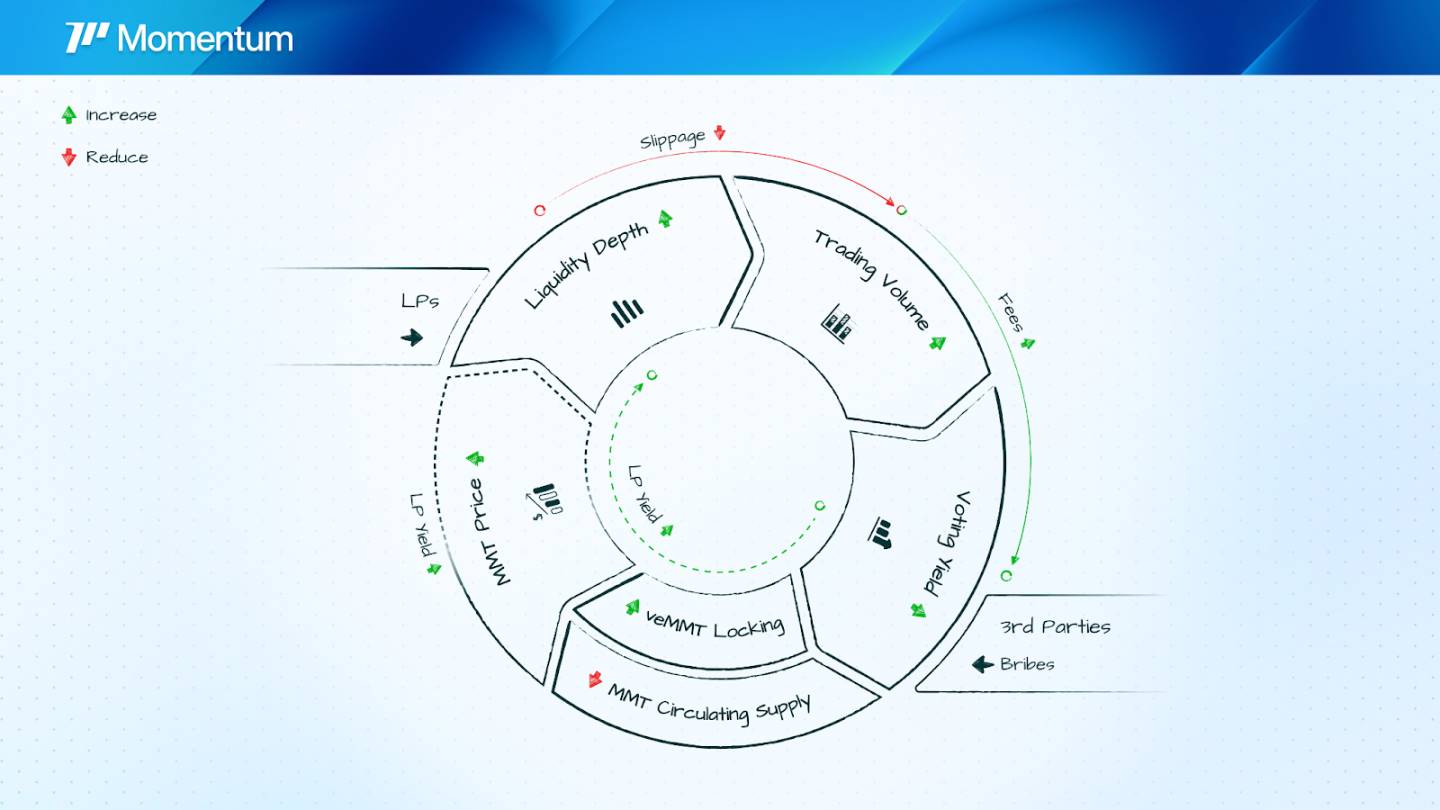

Delving into Momentum's product system, you will find that it far exceeds the traditional DEX category. Its core is the ve(3,3) mechanism, where users lock MMT tokens to obtain veMMT weights used for voting to determine reward distribution. Unlike Curve's veCRV, Momentum's (3,3) emphasizes a three-way win: traders enjoy low slippage, LPs receive high APR, and holders share in protocol fees.

In short, the ve(3,3) mechanism allows both token holders and LPs deeply involved in liquidity mining to participate confidently without worrying about price fluctuations and impermanent loss. Currently, this mechanism has not officially launched, but the official tweet disclosed that after the model is introduced, trading fees will be reduced by 80%, and LP earnings will increase by 400%. After the mainnet launch, the flywheel effect of ve(3,3) could enable the protocol's annual revenue to reach $60 million.

Recently, Momentum also launched the AI Vaults feature. If you were previously confused about impermanent loss and various parameters, not knowing how to participate, this feature now transforms DeFi from a game for professional players into a passive income tool for ordinary users, lowering the participation threshold for novice users.

Momentum has also introduced the Token Generation Lab (TGL), evolving from a pure trading platform into an incubator for Sui to create wealth effects. xSUI is a liquidity staking token designed for composability, yield maximization, and capital efficiency.

Now, if you are a SUI whale or a deep user, you can find ways to make money through staking for yield, AI strategy management, and new token offerings.

The backing of star venture capitalists and the rich experience of its founders undoubtedly inject strong confidence into its development.

In 2023, Momentum completed a $5 million seed round of financing, led by Jump. In March 2025, Momentum completed a $10 million financing round, led by Varys Capital, with participation from the Sui Foundation. Even as VCs have become increasingly cautious, in June of this year, Momentum still completed strategic financing at a valuation of $100 million, led by OKX Ventures, with participation from Coinbase Ventures.

The core team of the project consists mostly of experts in the Move language. Co-founder and CEO ChefWEN holds a Ph.D. in Computer Science from the University of California, Berkeley, and previously worked at Meta (formerly Facebook) for seven years, serving as a core engineer for the Libra/Diem project and directly participating in the development of the Move language.

Conclusion

Momentum X will subsequently expand RWA listings to cover more asset classes, such as tokenized private equity, and will launch new institutional-level staking and Vault strategies. Additionally, Momentum X will introduce institutional-level DeFi tools for compliant capital, including one-stop services such as automated KYC portals, real-time risk dashboards, and cross-chain settlement APIs, driving the RWA market from hundreds of billions to trillions.

Ordinary users will grow wealthy from passive income, while institutions will profit from efficient settlements.

It’s like a global financial paradise where we can all roam freely. DeFi is no longer an elite game but a future accessible to everyone. As Sui's TVL continues to grow and institutional adoption accelerates, Momentum X will become a key infrastructure in the crypto space, unlocking the next peak of the liquidity storm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。