Target Price: $190,000, Potential Upside: 67%

Written by: Tiger Research

Translated by: AididiaoJP, Foresight News

Summary:

Acceleration of institutional adoption of Bitcoin: The opening of 401(k) investment channels in the U.S., continued large-scale accumulation by ETFs and corporate entities

The best environment since 2021: Global liquidity is at an all-time high, and major countries are in a rate-cutting mode

Shift from retail-led to institution-led market: Despite signs of overheating, institutional buying strongly supports downside risks

Global liquidity expansion, institutional accumulation, and regulatory tailwinds drive Bitcoin adoption

Currently, there are three core drivers pushing the Bitcoin market: 1) Expanding global liquidity, 2) Accelerating institutional capital inflow, and 3) A cryptocurrency-friendly regulatory environment. These three factors are working together to create the strongest upward momentum since the bull market of 2021. Bitcoin has risen approximately 80% year-on-year. In the near to medium term, there are limited factors that could disrupt this upward momentum.

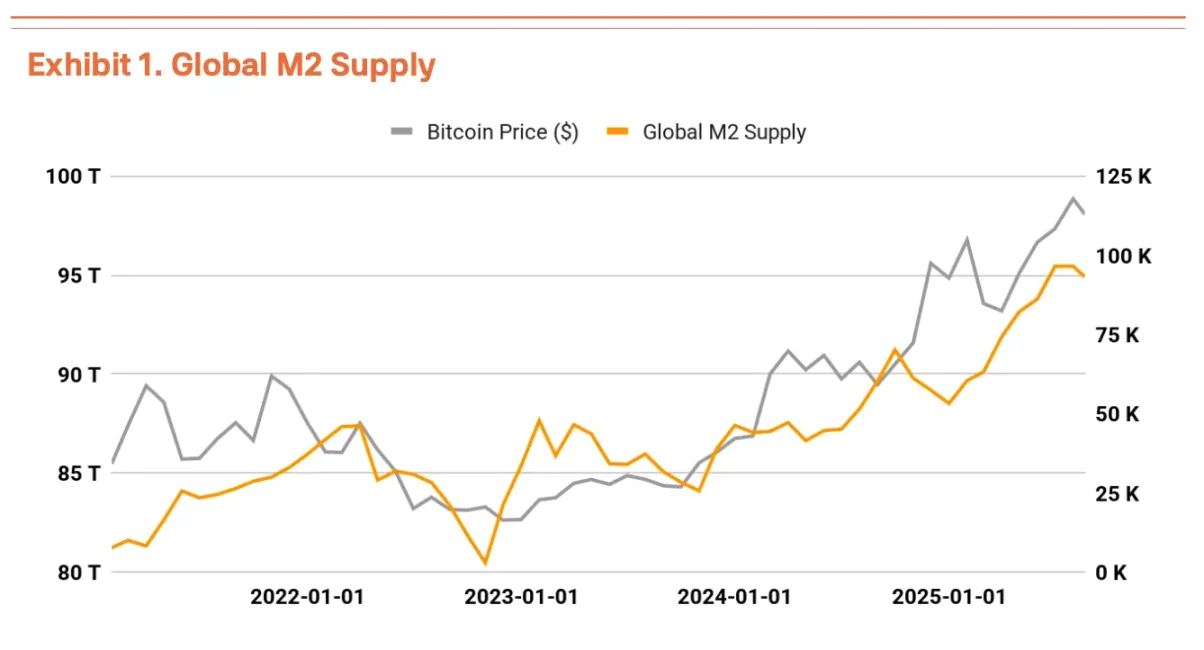

In terms of global liquidity, a notable point is that the M2 money supply of major economies has exceeded $90 trillion, reaching a historical high. Historically, the growth rate of M2 and Bitcoin prices have shown similar directional patterns; if the current monetary expansion continues, there is still room for further appreciation (Chart 1).

Additionally, pressure from President Trump to cut interest rates and the Federal Reserve's dovish stance have opened pathways for excess liquidity to flow into alternative assets, with Bitcoin being a major beneficiary.

Meanwhile, institutional accumulation of Bitcoin is occurring at an unprecedented pace. U.S. spot ETFs hold 1.3 million BTC, accounting for about 6% of the total supply, while Strategy (MSTR) alone holds 629,376 BTC (valued at $7.12 billion). The key point is that these purchases represent structural strategies rather than one-off trades. Strategy is continuously buying through the issuance of convertible bonds, particularly marking the formation of a new layer of demand.

Furthermore, the executive order issued by the Trump administration on August 7 represents a game-changing factor. Opening Bitcoin investment to 401(k) retirement accounts means potentially tapping into a capital pool of $8.9 trillion. Even a conservative allocation of 1% would mean $89 billion, about 4% of Bitcoin's current market value. Given the long-term holding characteristics of 401(k) funds, this development should not only help with price appreciation but also reduce volatility. This marks a clear transition of Bitcoin from a speculative asset to a core institutional holding.

Institutional-driven trading volume, retail activity declines

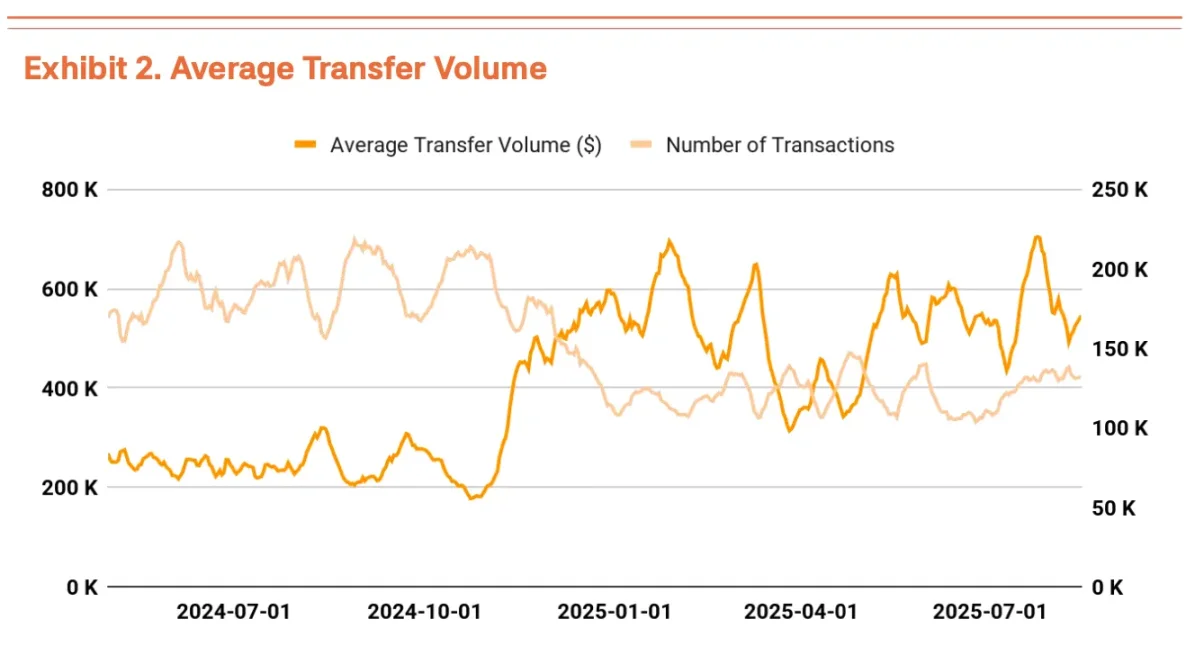

The Bitcoin network is currently restructuring around large investors. The average daily transaction count has decreased by 41% from 660,000 in October 2024 to 388,000 in March 2025; however, the amount of Bitcoin transferred per transaction has actually increased. The growing large transactions from institutions like Strategy have expanded the average transaction size. This marks a shift in the Bitcoin network from a "small, high-frequency" to a "large, low-frequency" trading model (Chart 2).

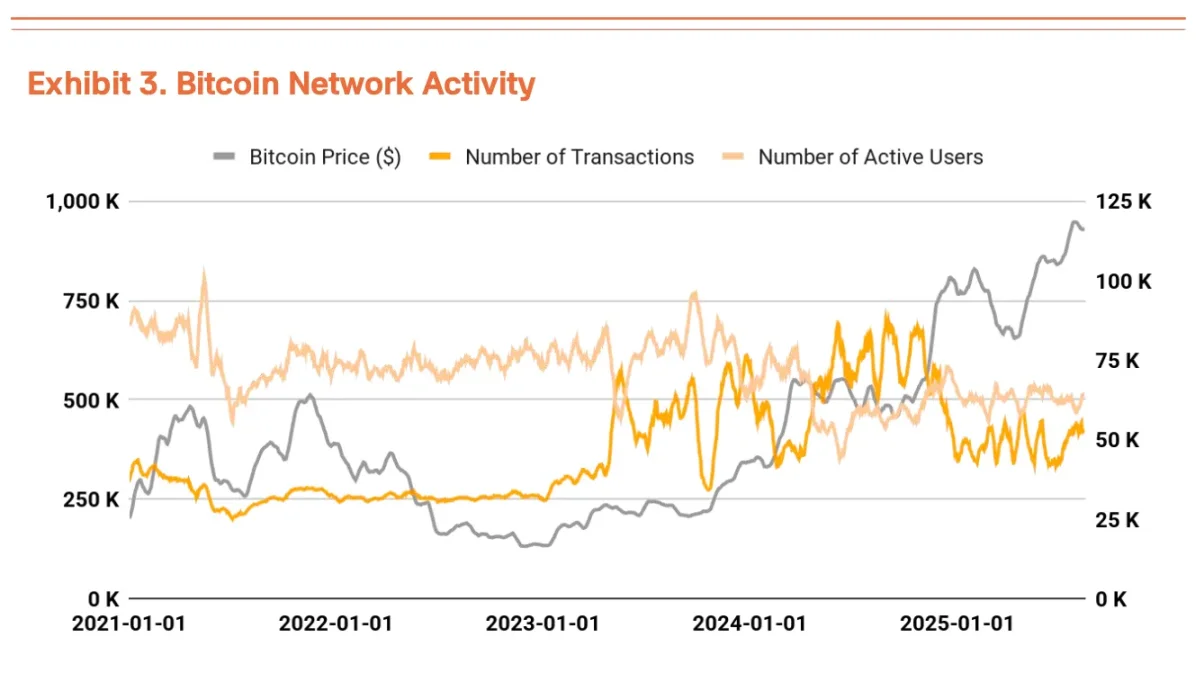

However, fundamental indicators show imbalanced growth. While institutional restructuring is clearly driving the value of the Bitcoin network higher, the number of transactions and active users has not yet recovered (Chart 3).

Improvements in fundamentals need to be activated through BTCFi (Bitcoin-based decentralized financial services) and other initiatives, but these are still in the early stages of development and will take time to have a meaningful impact.

Overbought, but institutions provide bottom support

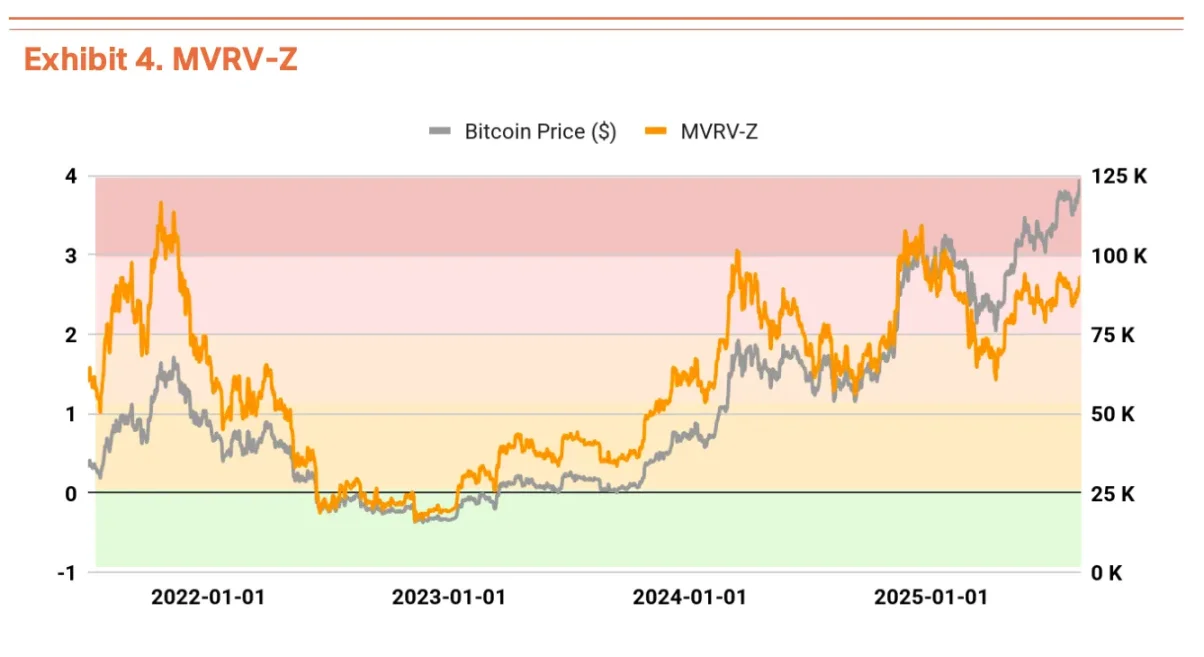

On-chain indicators show some signs of overheating, but significant downside risks remain limited. The MVRV-Z indicator (measuring current price relative to the average cost basis of investors) is in the overheated zone at 2.49 and recently spiked to 2.7, warning of a potential short-term pullback (Chart 4).

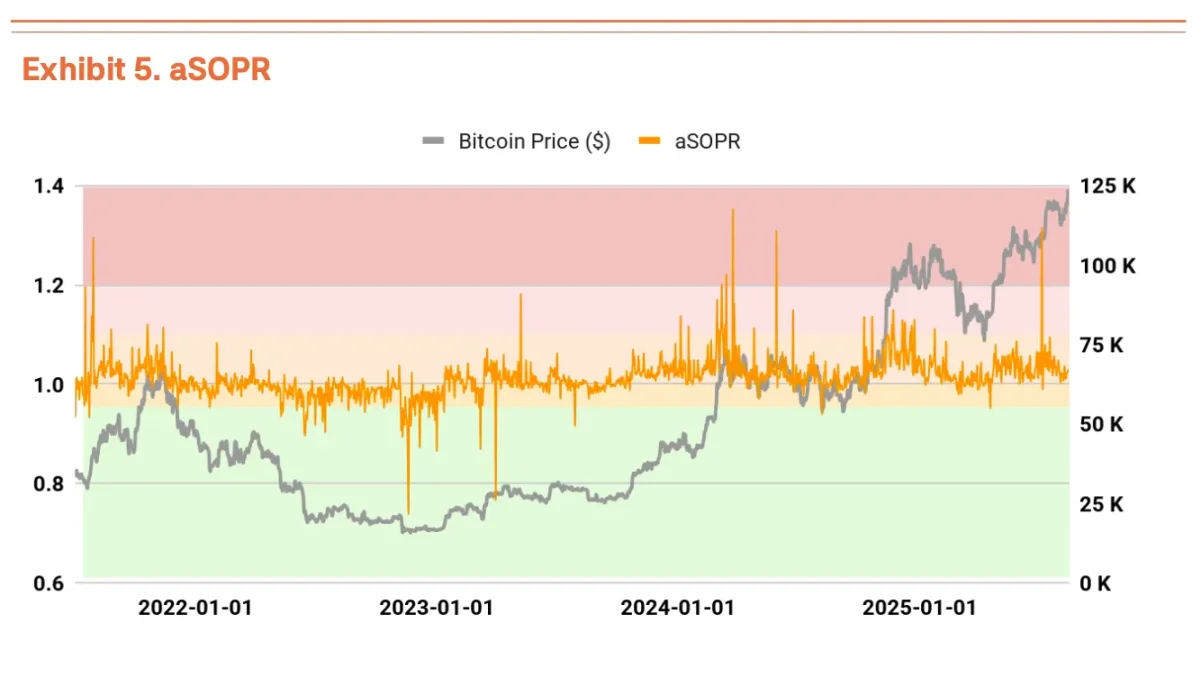

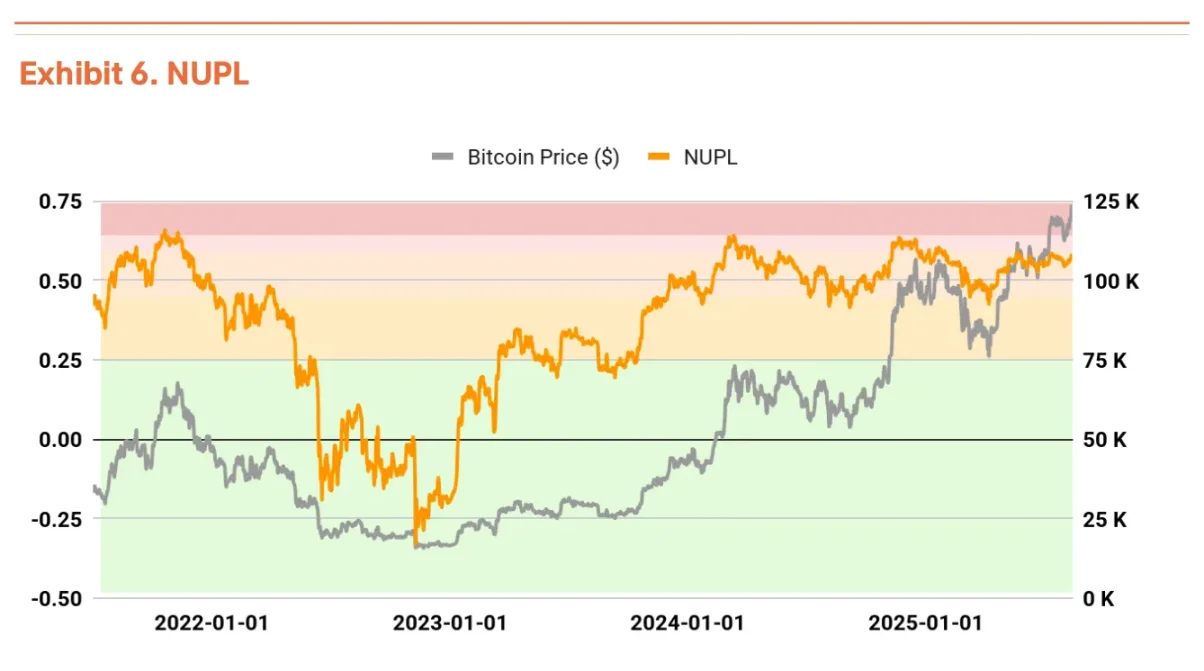

However, aSOPR (1.019, tracking realized profit and loss of investors) and NUPL (0.558, measuring overall unrealized profit and loss in the market) remain in stable zones, indicating overall market health (Charts 5, 6).

In short, while the current price is relatively high compared to the average cost basis (MVRV-Z), actual selling occurs at moderate profit levels (aSOPR), and the entire market has not yet reached an excessive profit zone (NUPL).

Supporting this dynamic is institutional buying power. Continuous accumulation from ETFs and entities like Strategy provides solid price support. A pullback may occur in the short term, but a trend reversal seems unlikely.

Target Price: $190,000, Potential Upside: 67%

Our TVM (Time Value Model) approach derives a target price of $190,000 through the following framework: we set a base price of $135,000 (removing extreme fear and greed sentiment from the current price), then apply a +3.5% fundamental indicator multiplier and a +35% macro indicator multiplier.

The fundamental indicator multiplier reflects the improvement in network quality: although the number of transactions has decreased, the transaction value is higher. The macro indicator multiplier captures three powerful forces: the continuously expanding global liquidity (e.g., M2 exceeding $90 trillion), accelerating institutional adoption (e.g., ETFs holding 1.3 million BTC), and an improving regulatory environment (e.g., 401(k) eligibility opening an $8.9 trillion capital pool).

From current levels, this implies a 67% upside potential. While the target is aggressive, it reflects the structural changes occurring as Bitcoin transitions from a speculative asset to a core allocation in institutional portfolios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。