A new institutional insights report from Cryptoquant shows bitcoin locked in a pronounced profit-taking cycle amid a broad slowdown in demand. Analysts describe the market as cooling after the coin’s rally to record highs.

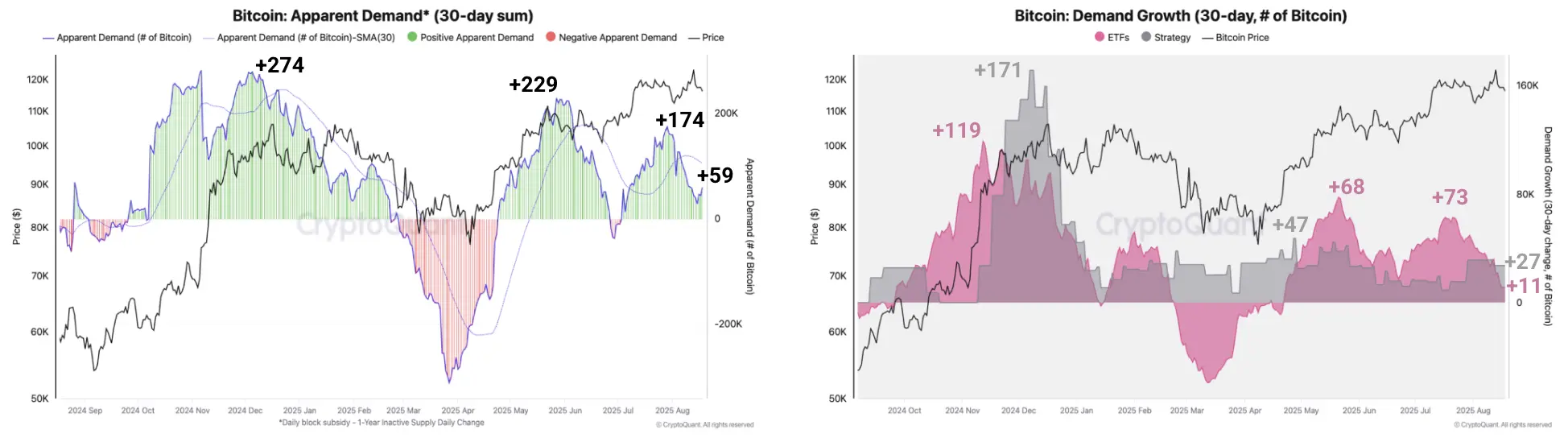

Cryptoquant’s metrics reveal that bitcoin’s “apparent demand” has fallen steeply—sliding 66% from July’s peak of 174,000 BTC to just 59,000 BTC today. This fading demand growth, the report notes, is a key driver behind the asset’s recent pause in price momentum.

Source: Cryptoquant’s latest institutional insights report.

At the same time, institutional inflows have cooled noticeably. Cryptoquant highlights that 30-day net purchases of U.S.-listed bitcoin exchange-traded funds (ETFs) sank to 11,000 BTC, marking their lowest since late April. Large-scale accumulation strategies also shrank, collapsing from more than 171,000 BTC in November 2024 to just 27,000 BTC over the past month.

Sentiment has adjusted accordingly. Cryptoquant’s Bull Score index shifted from an “Extra Bullish” reading to “Bullish Cooldown,” signaling that while the broader structure still leans positive, the once-powerful momentum is no longer driving the market.

This period is being defined by large-scale profit-taking. Cryptoquant estimates bitcoin holders have locked in $74 billion in net profits since July 4. That day alone saw $9 billion realized, the biggest single profit event of 2025. The trend continued into Aug. 16, when new whale investors banked an additional $2 billion.

Even so, downside pressure may have a floor. Cryptoquant points to $110,000 as a critical level of support—the “Trader Onchain Realized Price.” At this threshold, the average trader’s unrealized gains reset to zero, which historically has discouraged mass selling in bullish markets.

Overall, Cryptoquant’s takeaway is that bitcoin is consolidating. Until demand strengthens again, near-term upside potential will likely remain capped.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。