Author: Airis.N

Our regulatory framework should not be bound by past experiences — that would be ruthless in the face of a new era. The future is rushing in, and the world will not wait. — Paul Atkins in a speech for Project Crypto.

This year, we all witnessed the successful listing of Circle, but who remembers that just two years ago, it experienced a significant de-pegging, with USDC once dropping to $0.87.

At that time, Circle had $3.3 billion in reserves stored at SVB (Silicon Valley Bank), which faced a financial crisis on March 8, with its stock price plummeting 60% that day, triggering a chain panic among Silicon Valley startups and institutional investors. In the following 48 hours, investors in SVB faced a series of blows including trading halts, suspensions, and regulatory takeover, ultimately leading to the bank's closure on March 10. This misfortune also affected Circle, causing USDC to de-peg.

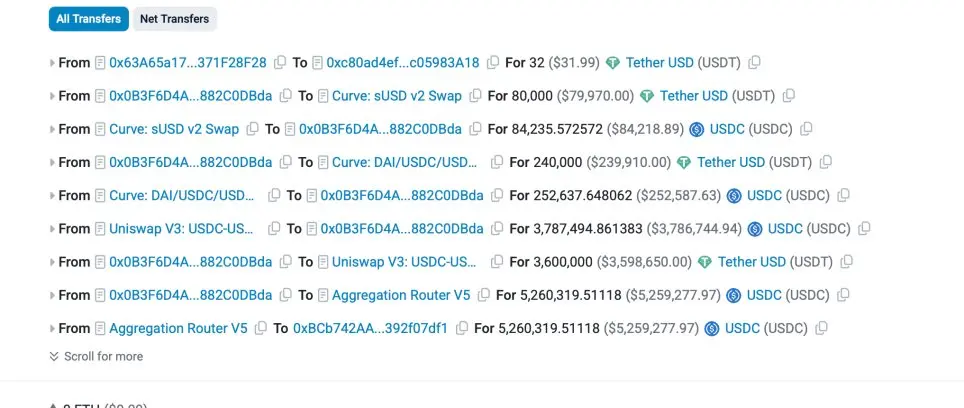

However, those holding SVB stocks could only watch helplessly as the market value in their accounts evaporated each night. Quick-reacting investors might have cut their losses on Thursday morning, while slower ones were forced to zero out. In contrast, USDC holders were in a different situation; during the weekend of SVB's closure, people in web3 were frantically arbitraging through platforms like AAVE and Curve. For instance, one wallet address managed to earn $16.5 million during this period by exchanging USDT for USDC/DAI based on price differences. Oh right, it was Sun's wallet.

This comparison of the "same source storm, different outcomes" is precisely what Paul Atkins wanted to express in the opening quote: the shortcomings of traditional financial markets versus the efficiency revolution of a new round of financial markets, yes, I am referring to tokenized stocks.

Limitations of Traditional Stock Markets

Time limitations: Taking the US stock market as an example, trading is only allowed from Monday to Friday, 9:30 AM to 4:00 PM (EST), with limited liquidity for pre-market and after-hours options. Often, many significant events occur outside trading hours, leading to "gaps" at the opening, leaving investors with no opportunity to react in real-time.

Geographical limitations: Overseas investors wishing to participate in US stocks must navigate complex compliance processes and cross-border brokerage accounts. Many friends in the domestic market should be well aware of this.

This structure was reasonable in the past because securities trading relied on physical locations and centralized settlement systems. But in the face of blockchain? Forget it.

Why Tokenized Stocks Are the Future?

- Higher capital efficiency and liquidity

The biggest breakthrough of tokenized stocks lies in 24/7 uninterrupted trading. This means:

- Global investors can enter or exit the market at any time, without having to stay up all night or wait until the next day in the face of black swan events.

- Market sensitivity significantly increases; just yesterday, before the US stock market even started to rally, E-guardians were already on their way to pick up their cars.

Of course, higher liquidity can also lead to overtrading, enticing retail investors to incur losses. But in any case, more efficient pricing and rights confirmation are the fundamental differences between tokenized stocks and traditional stocks.

- Higher leverage and potential returns

Tokenized stock trading platforms are likely to offer higher leverage. Traditional brokers can only provide 2-4 times leverage, but for friends in web3, 10 times leverage is just like dropping a ball on a roulette. In other words:

- For risk-loving investors, tokenized stocks provide a new casino;

- For arbitrage funds and quantitative funds, tokenized stocks offer more flexible risk hedging methods;

More dangerous? Yes, as a certain mob boss once said—

- Lower participation thresholds

For many investors living in the mainland, the difficulty of opening a US stock account is well known. Now, we can directly open accounts using crypto wallets on platforms like @xStocksFi and @stablestock. This means:

- Investors no longer need to go through cumbersome cross-border brokerage account opening processes; one wallet can access US stocks.

- For the US, global capital can more easily enter US stock trading, thus opening up channels for overseas capital investment.

And with more widespread crypto adoption and higher market capitalization.

Let’s return to the SVB example; what would happen if this event occurred on a tokenized stock platform?

At the moment SVB announced its loss, the tokenized stock market would not halt trading, and global investors could react immediately, either quickly selling off or shorting, or arbitraging based on on-chain price differences, etc. Countless trading experts on-chain are living examples — anyone can act quickly in a 24/7 market without passively waiting for the next trading day to open.

Tokenized stocks are definitely not just a digital mapping of traditional stocks; this new round of financial revolution is certainly not just empty talk from the government. It represents faster trading and settlement, higher returns and risks, and lower participation thresholds.

This is the future that finance needs.

Click to learn about job openings at ChainCatcher

Recommended reading:

Backroom: Information tokenization, a solution to data redundancy in the AI era? | CryptoSeed

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。