More ETFs Than Stocks Lead Confusion: How to Choose Right Investment?

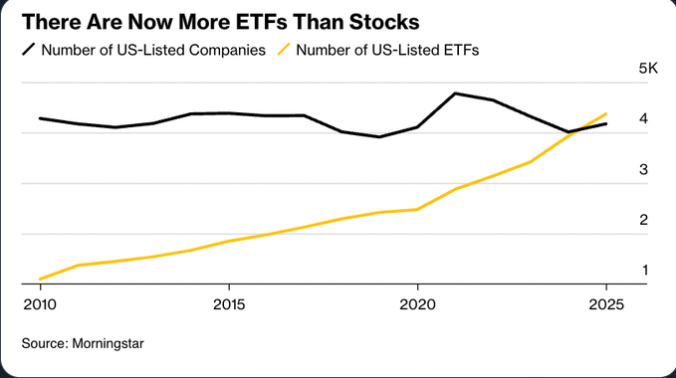

For the first time in history, there are now more exchange-traded funds than individual stocks in the United States. According to data compiled by Morningstar, the country has over 4,300 ETFs, compared with around 4,200 stocks.

This moment highlights how popular ETFs have become over the past decade. Once seen as a niche product, they have now taken center stage in how Americans invest their money.

It is for your reference that an Exchange-Traded Fund is a tradable fund holding multiple assets, offering diversification. A stock represents ownership in a single company. ETFs spread risk across many holdings, while stocks tie returns to one company’s performance.

Why ETFs are Booming, Outpacing Stocks In the US?

The growth has been nothing short of explosive. In just this year alone, issuers have launched more than 640 new ETFs—that’s an average of about four every single day. June even broke records with 108 new funds launched in a single month.

They are attractive because they combine the features of mutual funds with the flexibility of stocks. They tend to be cheaper, more tax-efficient, and can easily be accessed for a particular investment theme. Whether it is a broad market fund or a niche fund such as AI, defense, or even cannabis, there appears to be an ETF for everything.

Source: Jeffrey X

The Paradox of Choice: It’s a Too Many Choice Dilemma

As the choices increase, investors are starting to feel a little overwhelmed. Douglas Boneparth of Bone Fide Wealth explained, Choice is great until it becomes a burden.

The issue is that excessive variety can cause a paralysis of analysis. Investors can get bogged down attempting to select the correct fund, particularly when most ETFs are very similar. As an example, YouTuber Spencer Dunbar searched for a fund that was related to Coinbase stock and received eight different options with confusingly similar tickers.

Due to this complexity, the proportion of self-directed investors, who make their own investment decisions, has also declined to 25% in 2024 as compared to 41% in 2009. Increasing numbers of people are seeking the advice of financial advisers.

How Issuers Compete

The influx has also led to a lot of competition among fund providers. To differentiate themselves, many issuers are developing more risky products like single-stock, leveraged, and inverse Exchange Traded Funds, respectively. Critics caution that less experienced investors might not be fully aware of the risks.

Meanwhile, a large number of funds do not accumulate sufficient assets to be sustainable. This has created an environment where new ETFs are continually introduced and poorly performing ones are simply closed.

The Bigger Market Shift

The rise of ETFs has come at the expense of more traditional investment products like mutual funds, closed-end funds, and unit trusts, which have been declining in recent years.

Overall, the total number of investment vehicles remains stable at around 16,000, but now make up about a quarter of the entire universe—a sharp increase from just 9% a decade ago.

What It Means for Investors

The ETF Latest News has clearly democratized investing, making it easier for anyone to build a diversified portfolio. But it has also created a hall of mirrors, where investors face thousands of overlapping products.

For some, it’s a sign of progress: more options, more competition, and lower costs. For others, it’s a warning of over-saturation and the risk of speculative gimmicks.

As Morningstar’s Ben Johnson put it, while product experimentation will continue, only funds with real long-term value will survive in the end. Currently, the XRP ETFs approval timeframe is trending because of SEC feedback . What has been reverted by SEC? See the update now.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。