Ethereum is undergoing an unprecedented structural reshaping—traditional finance is stepping in, while crypto natives are cashing out.

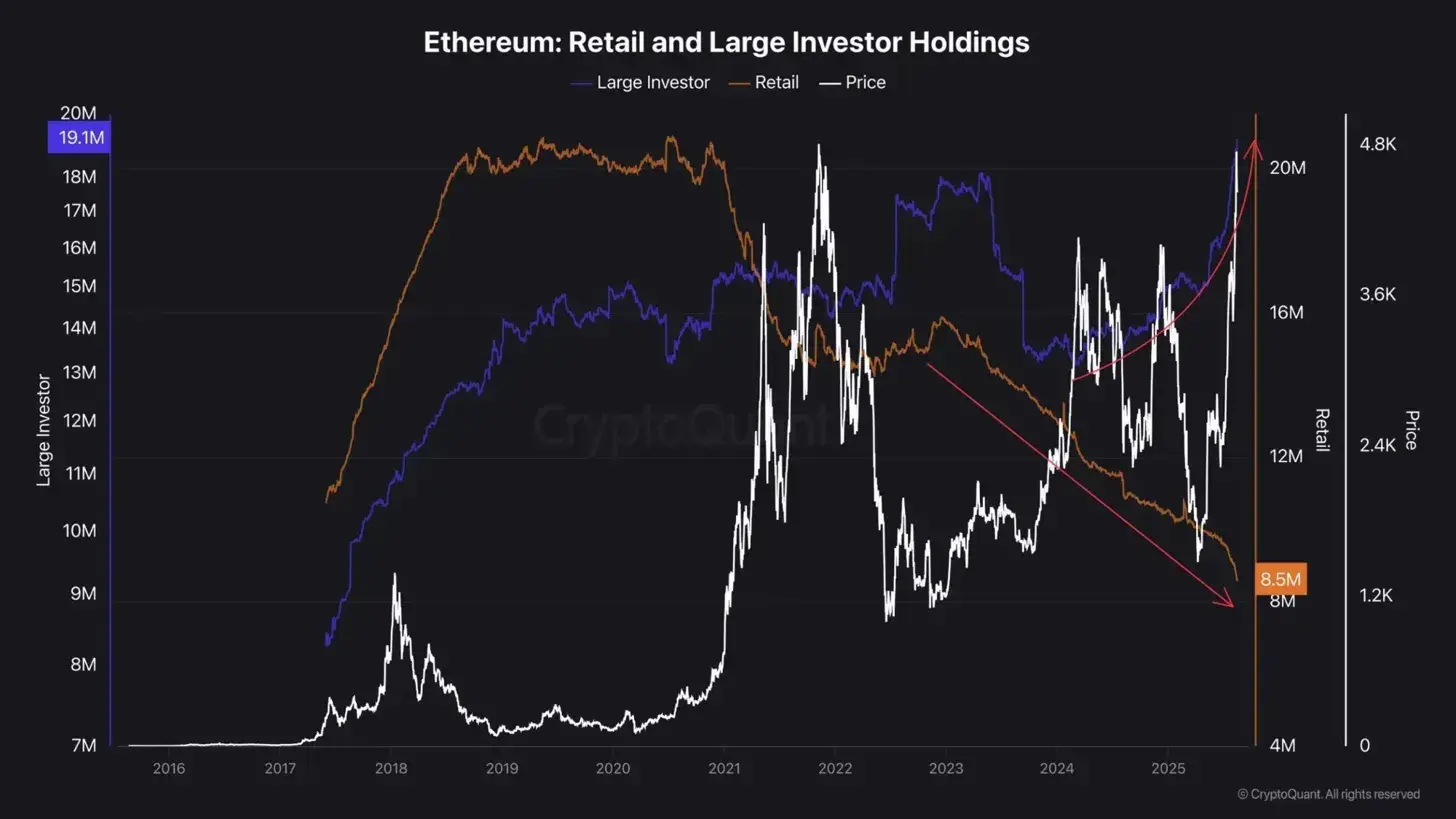

New on-chain data indicates that the market dominance of ETH is shifting from retail-driven to institution-driven. The number of retail investors has continued to hit near-term lows, dropping to around 8 million; meanwhile, the amount held by institutional investors has recently surged.

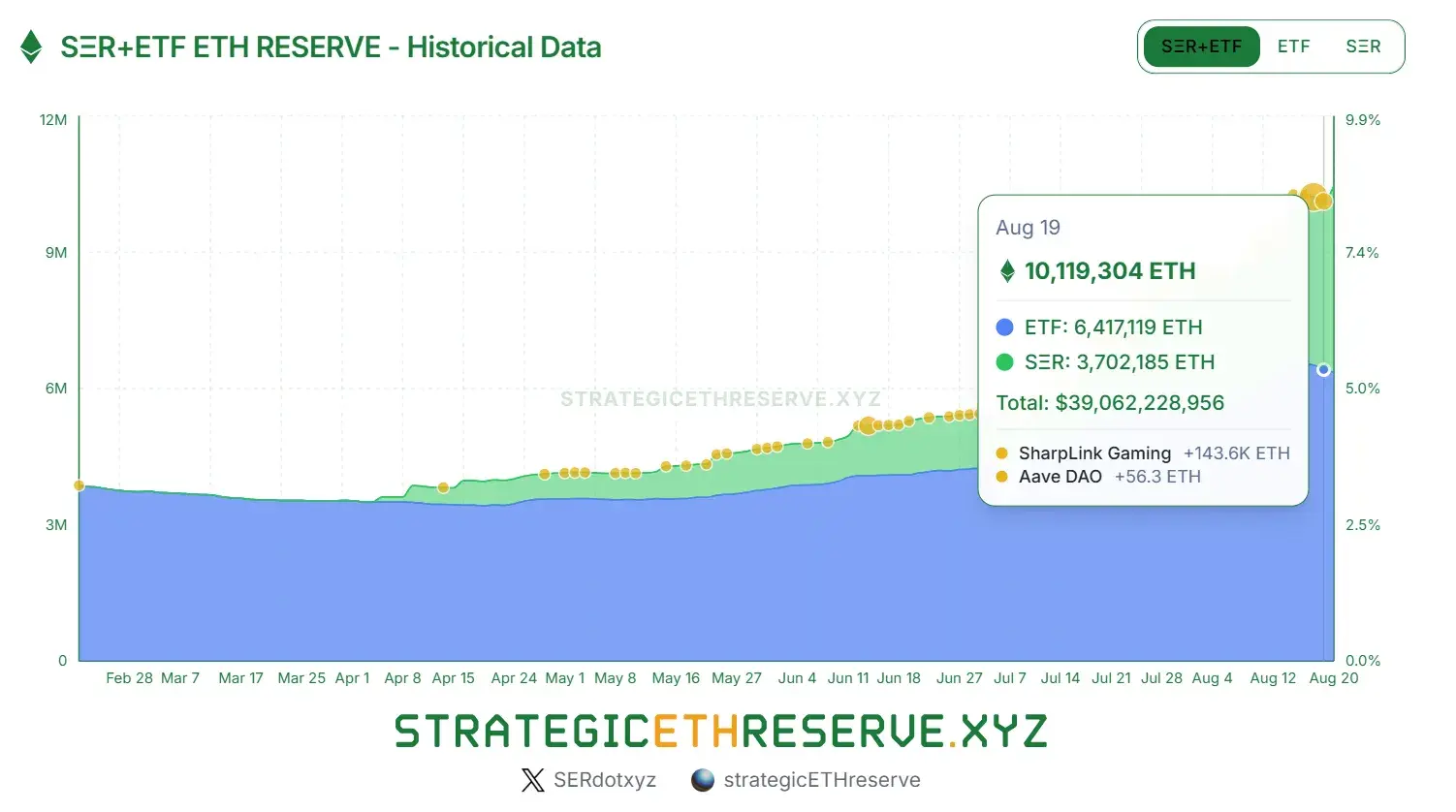

Currently, corporate treasuries and ETFs have accumulated over 10 million ETH, valued at nearly $40 billion, with no signs of stopping their buying spree. This likely marks a historic transition of ETH from a speculative asset dominated by "crypto natives" to a mature asset allocated by "traditional financial giants."

1. Wall Street's ETH Awakening: From "Digital Gold 2.0" to "Infrastructure REITs"

1.1 Epic Influx of Institutional Funds

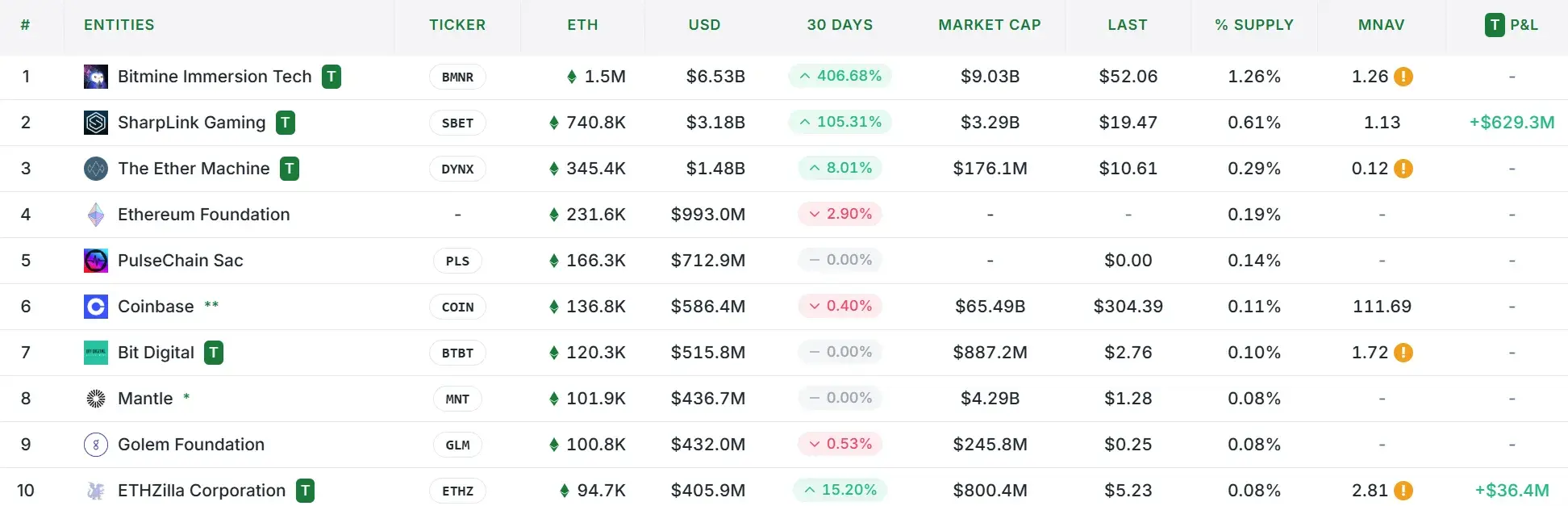

In just one month, Wall Street capital has surpassed the Ethereum Foundation and Coinbase, which have been deeply entrenched in the crypto space for years.

Wall Street's interest in ETH is shifting from observation to action at an astonishing pace.

- Record inflows into ETFs: In July 2025 alone, Ethereum ETFs attracted up to $4.7 billion in inflows, nearly double the total amount since their launch. By the end of the month, Ethereum accounted for over 84% of the $1.9 billion spent by investors on cryptocurrency ETFs, indicating overwhelming capital preference.

- BlackRock's clear positioning: The world's largest asset management company, BlackRock, increased its ETH holdings by $1.2 billion in July, while its increase in BTC holdings was only $267 million during the same period. This is not just a matter of capital allocation; it is a value vote from Wall Street on Ethereum's future potential.

- Asset allocation competition among corporate treasuries: From Bitmine Immersion Tech (BMNR) to SharpLink Gaming (SBET), Wall Street capital has strategically built positions in Ethereum in just one month, surpassing the holdings of long-established crypto institutions like the Ethereum Foundation and Coinbase. This indicates that ETH is being rapidly incorporated into the balance sheets of traditional enterprises.

1.2 A New Valuation Paradigm for ETH on Wall Street

The traditional financial understanding of ETH has evolved from the early concept of "Digital Gold 2.0" to a more sophisticated cash flow-driven valuation framework.

- From speculative target to infrastructure investment: Wall Street is redefining the value of ETH using the language of traditional finance. It is no longer just a simple store of value but the "fuel" and "toll booth" of the entire Web3 economy. Tom Lee likens it to "the crypto version of infrastructure REITs," a comparison that is gaining increasing acceptance within Wall Street.

- Cash flow-driven valuation logic: Unlike Bitcoin's "digital gold" narrative, the Ethereum network generates billions of dollars in real revenue each year. In 2024 alone, Ethereum network fee revenue exceeded $3 billion, providing institutions with an analytical framework similar to traditional infrastructure investments, allowing them to quantify its valuation using DCF (Discounted Cash Flow) models.

2. Gradual Exit of Old Players in the Crypto Space: An Unspoken "Unwinding Wave"

Wall Street's entry coincides perfectly with the exit of another force.

2.1 Strategic Reduction of Early Holders

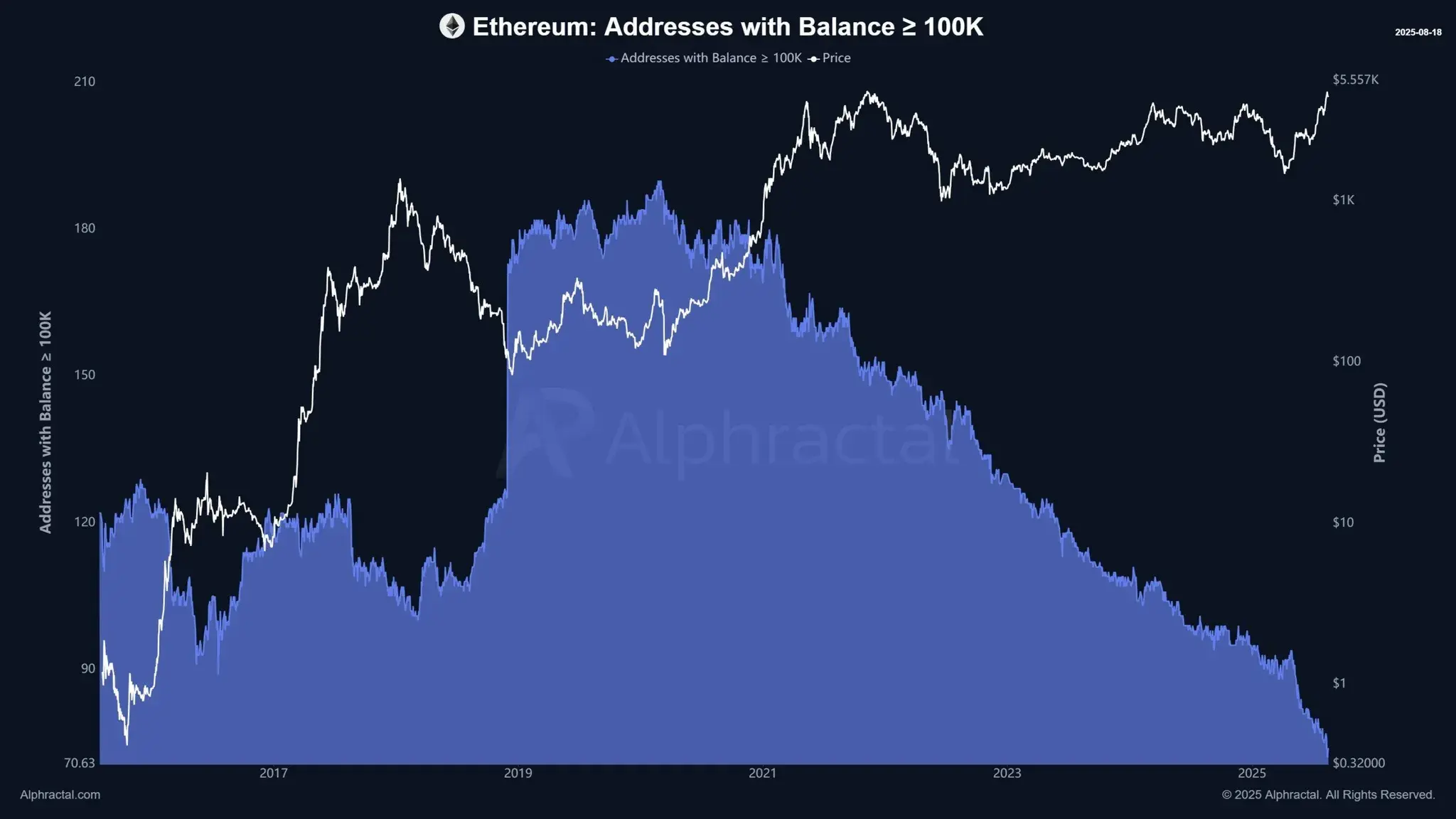

Data shows that a large number of early Ethereum investors are strategically reducing their holdings. The number of traditional crypto whales (addresses holding over 100,000 ETH) has plummeted from over 200 in 2020 to about 70 in 2025, marking a near-decade low. Monitoring of whales indicates that many early supporters who held ETH since the ICO phase have noticeably accelerated their pace of transferring tokens to centralized exchanges, seeking to realize profits.

2.2 Dynamic Differentiation in Staking Queues

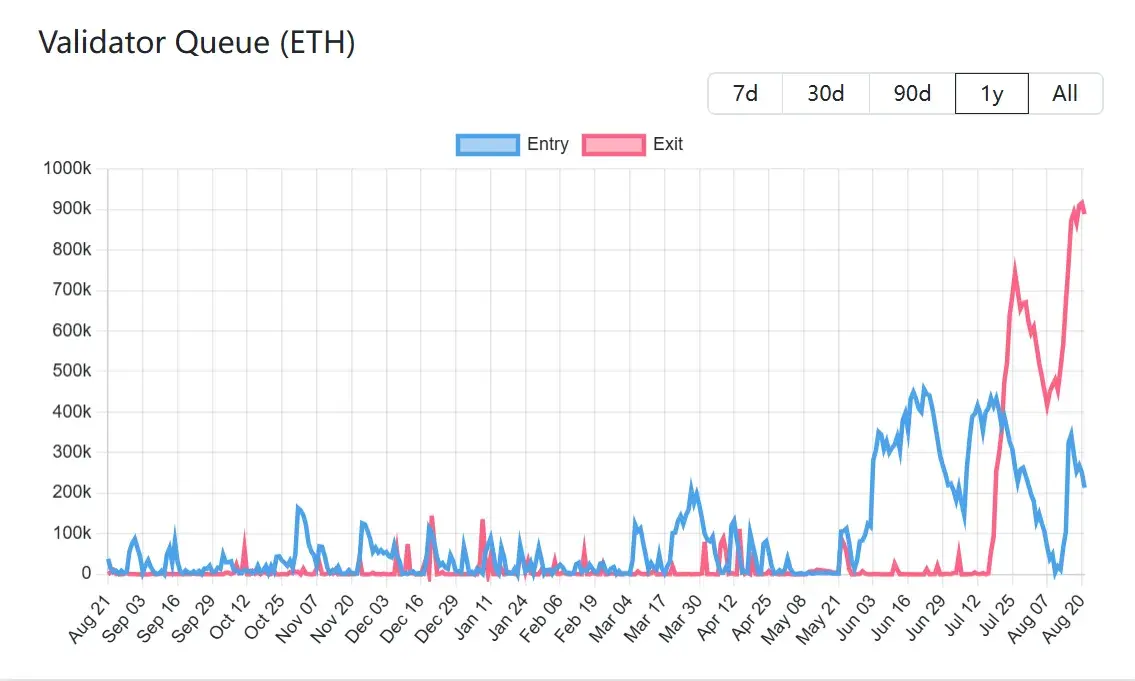

Recently, both the number of tokens joining and exiting the ETH network staking queue have reached new highs in nearly two years. This phenomenon reflects market differentiation and restructuring: on one hand, early stakers are choosing to unlock and sell their tokens after Ethereum's rebound from the April low; on the other hand, U.S. companies like SharpLink Gaming and BitMine Immersion are aggressively increasing their ETH holdings and staking, transferring tokens from the circulating market to long-term locked status.

3. Deep Drivers: A Historic Transfer Interwoven by Multiple Factors

3.1 Historic Release of Policy Dividends

The Trump effect continues to unfold: Since the results of the U.S. election in November 2024 became clear, the cryptocurrency policy environment has undergone a 180-degree turnaround. The new SEC Chairman Paul Atkins' crypto-friendly stance has completely reversed the regulatory hostility of the Gensler era. More importantly, Trump's promised "National Strategic Bitcoin Reserve" plan has injected unprecedented policy confidence into the entire digital asset industry.

Regulatory arbitrage window opens: Wall Street has keenly captured this signal of policy shift. Compared to the strict limitations of the EU's MiCA regulations, the U.S. is becoming a regulatory "oasis" for global crypto assets. This explains why global macro funds like Brevan Howard are so eager to bet on U.S. crypto assets; they know that this regulatory dividend will not last long.

3.2 The Glamorous Turn of ETH "Native Giants": A Wall Street Acquisition Led by OGs

When closely tracking the seemingly "Wall Street-led" investments, we uncover a shocking fact: the forces most actively promoting ETH reserve companies are actually core players in the Ethereum ecosystem (OGs). This indicates that this is not a unilateral action by Wall Street, but a sophisticated layout led by crypto-native capital, transferring and capitalizing assets through traditional financial tools.

Pantera Capital: From ICO Angel to Creator of "Corporate Treasuries"

As an angel investor in the Ethereum ICO, Pantera Capital's layout clearly demonstrates its long-term faith in ETH. In 2025, they launched the Digital Asset Treasury (DAT) fund, specifically investing in publicly traded companies that use digital assets as strategic reserves. They simultaneously invested in SharpLink Gaming (SBET) and Bitmine Immersion Tech (BMNR), which are currently the institutions holding the most ETH in corporate treasuries. This is a clever strategy: Pantera uses its capital to drive traditional companies with clear demand for ETH to enter, thereby creating new and sustained buying power for ETH.

ConsenSys: Transforming Infrastructure Value into Equity Returns

ConsenSys, as the developer of core ETH infrastructure like MetaMask and Infura, has its founder Joseph Lubin as one of the founding figures of the ETH ecosystem. ConsenSys directly invested in SharpLink Gaming and Lubin personally serves as its chairman, holding 9.9% of the shares. This move is significant: it marks that the OGs of the Ethereum ecosystem are transforming the value created by ETH as a technological infrastructure into equity and capital returns in traditional financial markets through direct investments and board participation.

Andreessen Horowitz (a16z): A Dual Engine of Policy Lobbying and Ecological Penetration

a16z is one of the most influential venture capital firms in the crypto industry, with a profound and multi-dimensional layout for ETH. In addition to directly investing in ETH ecosystem projects, they are also key drivers of political lobbying. They invested $70 million in Lido Finance and used part of their held ETH for staking, becoming important participants in the ETH staking market. More importantly, a16z has invested significant resources in Washington, D.C., actively promoting crypto-friendly regulatory policies. They proposed "safe harbor" suggestions to the U.S. Securities and Exchange Commission (SEC), clearing key policy obstacles for the approval of ETH spot ETFs.

Coinbase: The Unsung Hero Behind ETFs and Custodial Cornerstone

Coinbase plays an indispensable role as an infrastructure provider in the institutionalization process of ETH. Almost all major ETH spot ETFs, including BlackRock's iShares Ethereum Trust (ETHA), have chosen Coinbase as their custodian. According to public data from Coinbase Prime, it holds digital assets worth up to $171 billion for institutional clients (as of March 31, 2024). This means that although institutional funds are entering through ETFs, the underlying ETH assets are actually held by Coinbase. This not only makes it an indispensable invisible core in this "change of hands" wave but also deepens the binding of institutions with the ETH ecosystem through its staking services.

3.3 The "Unwinding Wave" Triggered by ETH's Long-term Underperformance

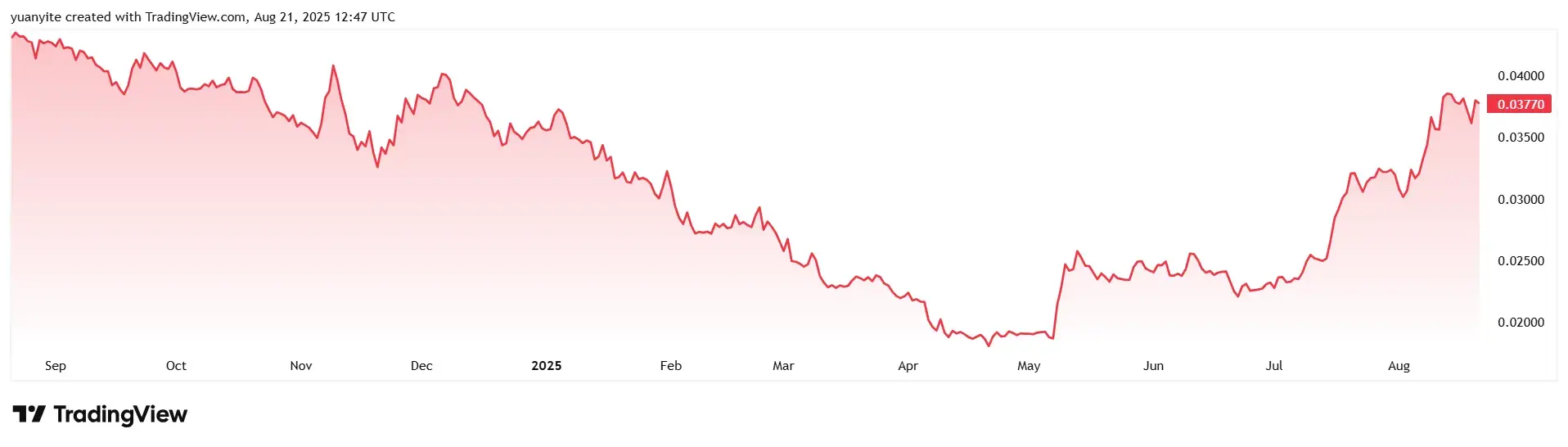

Significant relative performance gap: Compared to BTC's rise from $69,000 to $120,000, ETH has oscillated in the $2,000-$4,000 range for over three years, with the ETH/BTC exchange rate continuously declining. This significant relative performance gap has left many ETH investors who bought at the peak of the 2021 bull market deeply trapped.

Golden unwinding opportunity provided by institutional uplift: The massive influx of Wall Street capital has provided these long-trapped retail investors with a once-in-a-lifetime opportunity to offload. Unlike previous rebounds, this institution-led rise has stronger sustainability and certainty, giving trapped investors enough confidence and time to reduce their holdings.

The perfect fit of the unwinding wave and institutional takeover: This has created an almost perfect market cycle—retail investors are eager to unwind and exit, while institutions are eager to build positions and enter, with both parties' interests highly aligned. Institutions acquire a large number of relatively cheap chips, while retail investors achieve the long-awaited unwinding; however, behind this "win-win" scenario, the control of ETH has completely shifted from retail investors to institutions.

4. Deep Evolution of Market Structure: A Capitalization Process of Technological Value

4.1 Historic Transfer of Pricing Power

The most profound impact of this "change of hands" is the complete transfer of ETH's pricing power. In the past, ETH's price was primarily driven by community sentiment and retail FOMO; now, institutional DCF valuation models, risk parity allocations, and quantitative strategies have become the dominant factors in pricing. Wall Street is re-evaluating Ethereum using traditional corporate valuation methods—viewing it as a "decentralized tech company" with an annual revenue of $3 billion.

4.2 Restructuring of Liquidity

Dramatic contraction of floating chips: Institutional long-term holding strategies and staking locks have further compressed market liquidity. Corporate treasuries like BitMine have explicitly stated their intention to hold ETH long-term, effectively "permanently exiting" the circulating market.

Polarization of trading depth: The spot market is showing a clear layering phenomenon—large transactions are primarily completed through OTC and block trades, while retail trading is concentrated in small spot and derivatives markets. This structural differentiation complicates the price discovery of ETH.

4.3 Technological Upgrade of Capitalization Methods

Past methods: Primarily attracted funds through native crypto narratives like ICOs, DeFi, and NFTs, generating hype on social media platforms like Discord and Twitter, targeting speculative funds within the crypto community.

Current methods: Attracting funds through traditional financial tools like financing and U.S. stock listings, making statements in mainstream financial media such as CNBC and Bloomberg, targeting allocation funds from traditional financial institutions.

4.4 Fundamental Conflict Between Decentralized Ideals and Capital Efficiency

The core contradiction facing ETH is the fundamental conflict in efficiency between decentralized technological architecture and centralized capital control. Distributed networks require a large number of small participants to maintain their decentralized characteristics, but the economies of scale in capital markets naturally tend to concentrate. When the amount of ETH staked controlled by a single company like Coinbase exceeds the GDP of many small countries, we must question the long-term sustainability of this hybrid model.

Final Thoughts

The "change of hands" of ETH is not just a market event; it is an important sign of the entire cryptocurrency industry's maturation.

This process may not be perfect and may even disappoint some—after all, it signifies that cryptocurrencies are losing their original "rebellious spirit" and becoming increasingly part of traditional finance. But from another perspective, it also means that blockchain technology and crypto assets are gaining recognition in mainstream society, moving from the margins to the center, transitioning from experimentation to application.

For investors, the most important thing is to make the right choice at this historic turning point:

Will you continue to immerse yourself in the past "crypto mindset," or actively adapt to the new "institutional reality"?

Will you complain about the changing rules of the game, or learn to survive and thrive better under the new rules?

Regardless of the path chosen, one thing is certain: in this market full of change and uncertainty, only those investors who can maintain their ability to learn, adapt, and think independently will succeed in the long-term game.

The data in this report was edited and organized by WolfDAO (x:10xWolfDAO). If you have any questions, please contact us for updates;

Written by: WolfDAO

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。