Coinbase has risen more than 11 times from its historical low in 2022 during this bull market cycle, far exceeding the increase of BTC during the same period and outperforming the vast majority of crypto assets.

Author: Alex Xu, Research Partner at Mint Ventures

Report data as of: 2025.8.24

1. Research Summary

As a leader in global crypto asset trading and services, Coinbase is one of the core targets for capturing the long-term development dividends of the crypto industry, thanks to its brand trust, extensive user base, diversified products, and early layout in compliance.

Specifically:

It has a long history and brand accumulation in compliant operations and security, with numerous institutional partners, which helps attract more institutional and retail customers.

Revenue from subscriptions and interest is developing well, with a more diversified business model that no longer solely relies on transaction fees, enhancing its counter-cyclical ability compared to the past.

The balance sheet is healthy, with low debt levels and ample cash on hand, providing the company with a buffer and offensive capability in technological innovation, international expansion, and adverse environments.

Sovereign countries like the United States are tending towards relaxed regulation and encouraging innovation in crypto, with long-term industry trends still pointing towards growth. Blockchain and digital assets are expected to increasingly integrate into mainstream finance, and Coinbase has positioned itself in key areas of the industry.

However, while its revenue and profits have shown less volatility compared to the previous cycle, they still cannot avoid significant fluctuations (see Section 6 for operational and financial performance), a situation that has become very evident in the latest two quarters' financial reports.

Additionally, Coinbase is in a highly competitive arena, facing direct competition from Robinhood and Kraken in the U.S. market, while overseas it must contend with numerous offshore crypto exchanges like Binance, as well as rapidly developing decentralized trading platforms like Uniswap and on-chain exchanges like Hyperliquid, which are challenging the market share of traditional CEXs.

It is worth mentioning that Coinbase has risen more than 11 times from its historical low in 2022 during this bull market cycle, far exceeding the increase of BTC during the same period and outperforming the vast majority of crypto assets.

It can be said that the competitive challenges and opportunities of the times coexist for Coinbase. This report is Mint Ventures' first coverage of Coinbase, and we will continue to track it over the long term.

PS: This article reflects the author's thoughts as of the time of publication, which may change in the future. The views expressed are highly subjective and may contain errors in facts, data, or reasoning. All opinions in this article are not investment advice, and criticism and further discussion from peers and readers are welcome.

2. Company Overview

2.1 Development History and Milestones

Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam, with its headquarters in San Francisco. In its early days, the company focused on Bitcoin brokerage services and obtained one of the first Bitcoin trading licenses (BitLicense) issued by New York State in 2014.

Since then, Coinbase has continuously expanded its product offerings: in 2015, it launched the exchange platform "Coinbase Exchange" (later renamed Coinbase Pro), and in 2016, it began supporting trading of various crypto assets including Ethereum; in 2018, it entered the blockchain application field through the acquisition of Earn.com and brought in former LinkedIn executive Emilie Choi to lead mergers and acquisitions; in 2019, it acquired the institutional business of custody provider Xapo, establishing its leading position in custody services. In the same year, the company's valuation surpassed $8 billion. On April 14, 2021, Coinbase successfully went public on NASDAQ, becoming the first large exchange in the crypto industry to be listed (and remains the only one to date), with a market cap that once exceeded $85 billion. After going public, the company continued to expand its global footprint and enrich its product line: in 2022, it acquired the futures exchange FairX and entered the crypto derivatives market, launching an NFT marketplace (though trading volume later declined). In 2023, it launched the Ethereum Layer 2 network Base, focusing on the on-chain ecosystem. In the same year, while actively responding to regulatory challenges in the U.S., it obtained licenses in multiple regions including Singapore, the EU (Ireland), and Brazil, and officially completed the acquisition of the leading options trading platform Deribit in 2025.

After more than a decade of development, Coinbase has grown from a single Bitcoin broker to a comprehensive crypto financial platform covering trading, custody, payments, and more.

2.2 Positioning and Target Customers

Coinbase's mission is to "increase global economic freedom," and its vision is to update the century-old financial system, allowing anyone to participate fairly and conveniently in the crypto economy. The company positions itself as a secure and trustworthy one-stop platform for crypto assets, attracting retail users with simple and easy-to-use products while providing institutional-grade services to meet the needs of professional investors.

Coinbase's customer base can be roughly divided into three categories:

Retail Users: Individual investors interested in crypto assets. In addition to trading mainstream cryptocurrencies, Coinbase also allows users to earn yields through staking and offers various payment functionalities. Its monthly transacting users (MTU) peaked at 11.2 million (Q4 2021) and remained above 7 million during the downturn in 2022-2023, with approximately 9.2 million monthly active trading users in Q1 2025, slightly decreasing to about 9 million in Q2 2025.

Institutional Clients: Coinbase has focused on the institutional market since 2017, providing services such as Coinbase Prime brokerage and Coinbase Custody. Its clients include hedge funds, asset management companies, and corporate treasury departments. By the end of 2021, it had over 9,000 institutional clients, including 10% of the world's top hedge funds. Institutional clients contribute the vast majority of trading volume on the platform (approximately 81% of institutional trading volume in 2024), and although the fee rates are lower, they provide stable custody fees and trading income.

Developers and Ecosystem Partners: Coinbase also views developers and blockchain projects as ecosystem clients, supporting blockchain network construction through infrastructure like "Coinbase Cloud" (node services, API interfaces) and collaborating with new projects through investments and token listings. Additionally, the stablecoin USDC was jointly launched by Coinbase and Circle, with Coinbase serving as both an issuing partner and a major distribution platform, significantly sharing interest income and channel fees from Circle.

Overall, Coinbase possesses the dual advantages of being user-friendly for the public and trusted by institutions, connecting the retail and institutional markets, and playing the role of a "bridge between fiat currency and the crypto world" in the crypto ecosystem.

2.3 Equity and Voting Rights Structure

The company adopts a dual-class share structure with Class A common stock listed on NASDAQ, with one vote per share; Class B common stock is held by founders and executives, with 20 votes per share. Founder and CEO Brian Armstrong controls over 64% of the voting rights through approximately 23.48 million shares of Class B stock, making Coinbase a highly controlled company. A few early investors (such as Andreessen Horowitz) also hold some Class B shares. In mid-2025, Armstrong slightly converted and sold some Class B shares but still retained about 469.6 million votes equivalent to Class A voting rights. Since Class B shares can be converted into Class A shares at a 20:1 ratio at any time, the total share capital of the company will slightly change with conversions. This dual-class share structure ensures that the founding team maintains control over the company's strategic direction, but it also means that common shareholders have limited influence on corporate governance. Overall, Coinbase's equity structure is highly concentrated, with significant founder influence, ensuring consistency in the company's long-term vision and strategic direction.

3. Industry Analysis

3.1 Market Definition and Segmentation

The market in which Coinbase operates is broadly defined as the cryptocurrency trading and related financial services market. Core areas include:

Spot Trading Market: The buying and selling of crypto assets, which is also Coinbase's main business area. It can be further segmented into fiat-to-crypto (fiat entry) trading and crypto-to-crypto trading based on the trading objects. By customer type, it can be divided into retail trading and institutional trading.

Derivatives Trading Market: This includes leveraged derivative products such as cryptocurrency futures and options trading. This market has grown rapidly in recent years, with crypto derivatives trading volume accounting for about 75% of total trading volume in the first half of 2025 (data source: Kaiko). Coinbase started late in the derivatives field and currently operates through regulated futures exchanges and overseas platforms.

Custody and Wallet Services: Providing secure storage solutions for institutions and individuals holding large amounts of crypto assets. The custody market is closely related to trading, as clients often require compliant custody services for large transactions on exchanges.

Blockchain Infrastructure and Others: This includes stablecoin issuance and circulation, blockchain operations (Base), payment settlement, staking, and other "blockchain financial" services. This part expands revenue sources beyond trading, as Coinbase earns interest and fee income through the USDC stablecoin and node staking.

3.2 Historical Scale and Growth Rate (Past Five Years)

The overall crypto market is characterized by significant volatility following cycles. Measured by trading volume, the total global crypto trading scale surged from about $22.9 trillion in 2017 to $131.4 trillion in 2021, with an extremely high annual growth rate. Subsequently, in 2022, trading volume fell to $82 trillion due to market downturns (a -37% decrease from the previous year), and continued to decline slightly to $75.6 trillion in 2023. In 2024, driven by a new market boom, total trading volume reached a new high of about $150 trillion, nearly doubling compared to 2023.

The industry scale is highly correlated with crypto asset prices and volatility: for example, during the bull market in 2021, various token prices soared, and speculative trading was active, with trading volume increasing by nearly +196% year-on-year; while in the bear market of 2022, prices were sluggish, and trading volume plummeted by nearly 40%. In terms of user scale, the number of global cryptocurrency holders also fluctuates with market conditions, but the overall trend is upward. According to research by Crypto.com, the number of global crypto users grew from about 50 million in 2018 to over 300 million in 2021, and after a decline in 2022, it rebounded to around 400 million by the end of 2023.

Coinbase's own business has risen with the industry: in terms of trading volume, its platform trading volume increased from $32 billion in 2019 to $1.67 trillion in 2021, then reduced to $830 billion in 2022, and further dropped to $468 billion in 2023. In terms of active users, Coinbase's monthly trading users grew from less than 1 million in 2019 to an average of 9 million in 2021, then fell back to an average of 7-9 million per quarter in 2022-2023.

In summary, the industry scale has shown a long-term growth trend amid significant fluctuations over the past five years.

3.3 Competitive Landscape & Coinbase Market Share (Past Five Years)

The crypto trading industry has numerous competitors, and the landscape has evolved with the market.

Globally, Binance has rapidly risen to become the largest exchange by trading volume since 2018. Its global spot market share exceeded 50% at the peak of the bull market; by early 2025, it maintained about 38% market share, ranking first. Other major players include OKX, Coinbase, Kraken, Bitfinex, and regional leaders like Upbit in South Korea. In recent years, some emerging players (such as Bybit and Bitget) have also gained significant market share. Coinbase's share in the global market fluctuates around 5-10%; for example, in the first half of 2025, based on spot trading volume, Coinbase accounted for about 7% of the total volume of the top ten exchanges globally, comparable to OKX and Bybit. In contrast, Binance alone holds several times that share. It is worth noting that Coinbase, due to its focus on the compliant U.S. market, has not participated in a large amount of speculative trading of altcoins, which often leads to its global ranking being surpassed by more aggressive platforms that list new tokens. However, in the fiat-compliant market, especially in the U.S., Coinbase has a clear advantage. Since 2019, Coinbase has consistently held the top position in U.S. trading volume and further increased its market share in the U.S. spot and derivatives markets in 2024. With the collapse of competitor FTX in 2022, Coinbase's position in the U.S. has become even more solidified.

Dynamic Competitive Landscape

There have been several notable changes in the past five years:

The market share of trading platforms has shifted from concentration to dispersion. After the FTX collapse in 2022, Binance's market share rose from 48.7% (Q1) to 66.7% (Q4), after which market shares began to diversify, with Bybit, OKX, Bitget, and others increasing their shares, making competition more intense.

Increased regulatory pressure has led to regional differentiation—competition in the U.S. market has decreased (with only a few players like Coinbase and Kraken remaining), while Asian platforms have risen (such as Upbit in South Korea and Gate in Southeast Asia).

3.4 Future 5–7 Year Industry Scale and Growth Rate Forecast

Looking ahead to the next 5-7 years, the crypto trading industry is expected to continue growing, but the growth rate will depend on multiple factors and scenario assumptions. Industry research reports (from Skyquest/ResearchAndMarkets/Fidelity/Grand View Research) generally predict that the crypto market will maintain a double-digit annual compound growth rate. In the baseline scenario (assuming a stable macro environment and no severe deterioration in the regulatory environment), the total market capitalization of the global crypto market is expected to rise from the current approximately $3 trillion to around $10 trillion by 2030, corresponding to a significant increase in trading volume. However, as the market matures, volatility may decrease simultaneously, leading to a trading volume growth rate slightly lower than the market cap growth rate, with an expected annual growth of around 15%.

Key growth drivers for the crypto industry include:

Asset Price Trends: If leading assets like Bitcoin continue to reach new highs, it will drive overall market upward momentum. Price increases and heightened volatility will stimulate trading activity, thereby amplifying trading volume.

Derivatives Penetration: The derivatives market currently accounts for about 75% of trading volume and is expected to expand further. For example, institutional investors prefer hedging tools like futures, and retail investors may gradually accept leveraged trading, which will increase overall trading volume. We assume that by 2030, the share of derivatives will rise to 85%, which will boost total trading volume by approximately 1.2 times.

Institutional Entry: If more traditional financial institutions (asset management, banks, etc.) enter the crypto market, it could bring in trillions of dollars in new funds. For instance, the approval of more ETF varieties and access for institutions (many institutions are still not allowed to hold direct exposure to crypto assets, including ETF shares) and sovereign fund allocations will significantly deepen the market. This will drive simultaneous growth in trading volume and custody demand. Firms like Fidelity predict that institutional funds could add hundreds of billions of dollars to the total crypto market cap annually in the coming years.

Regulatory Clarity: A clear regulatory framework will reduce concerns for market participants and attract more entrants. In an optimistic scenario, major economies establish reasonable regulations (such as developed countries widely issuing licenses, legalizing and expanding ETFs), which will increase the user base and activity; in a pessimistic scenario, if regulations tighten (such as restricting bank support or imposing strict capital requirements), market growth may be limited or even stagnate. Currently, with the formal passage of the U.S. Genius stablecoin bill and the Clarity bill in the House, its demonstration effect can gradually radiate to developed economies globally, making the overall clarification of crypto policies promising.

Scenario Breakdown: We can construct three scenarios to forecast the industry scale from 2025 to 2030:

Baseline Scenario: Assuming a stable macroeconomic environment, mainstream countries implement friendly but cautious regulations, and crypto assets are gradually accepted by more investors. The annual growth rate of crypto market cap is about 15%, and the trading volume growth rate is about 12%. By 2030, global annual trading volume could reach around $300 trillion, with industry revenue (trading fees) growing alongside trading volume. Leading compliant platforms like Coinbase will see stable increases in market share. In this scenario, the industry will grow healthily without experiencing a speculative bubble.

Optimistic Scenario: Assuming a boom similar to "Internet Finance": major economies (especially the U.S.) completely clarify industry regulations, large institutions and enterprises enter en masse, and crypto technology sees widespread application (such as leaps in DeFi scale and adoption). Asset prices soar (for example, Bitcoin could reach a million-dollar level by 2030, as ARK Invest has a long-term outlook for this), with global market cap growth rates exceeding 20% annually and trading volume growth rates reaching 25%. According to this projection, total trading volume could reach $600-800 trillion by 2030. Compliant giants like Coinbase will gain substantial profits during explosive growth, significantly raising the industry's ceiling.

Pessimistic Scenario: Assuming an unfavorable macro environment or severe regulatory constraints: for example, major countries impose strict restrictions, leading to prolonged stagnation in crypto assets. The industry scale may stagnate or only see slight growth, with even years of contraction. In the worst case, the annual trading volume growth rate could drop to single digits or even stagnate and regress, with total trading volume by 2030 possibly hovering around $100-150 trillion. Compliant exchanges like Coinbase may increase their market share (as gray platforms are pressured out under strict regulations or see their shares shrink), but the absolute growth rate of business scale will be limited.

In summary, the author leans towards a slightly optimistic outlook for the baseline scenario: the crypto trading industry is expected to continue its growth amid cyclical fluctuations over the next 5-7 years, with overall scale increasing year by year. Crypto users and industry consortiums have become a force that cannot be ignored in the political landscape of various countries and are also one of the main driving forces behind the Republican Party's challenge to the Democratic Party in the 2024 U.S. elections. As a result, the Democratic Party's attitude towards crypto legislation, which requires bipartisan cooperation, has also shifted to a more moderate stance. In the recently passed Genius (effective in both chambers) and Clarity bills (in the House), many Democratic lawmakers also voted in favor.

4. Business and Product Lines

Coinbase currently has a diversified business model, with its main revenue sources divided into two major segments: trading and subscriptions/services, encompassing multiple product lines.

The following is an overview of the business models, core metrics, revenue contributions, profitability, and future plans for each major business:

Trading Brokerage Business (Retail Trading): This is Coinbase's original and core business, providing crypto asset buying and selling services to individual users. In terms of model, Coinbase acts as a brokerage and matching platform, allowing users to buy and sell cryptocurrencies with a single click through the app or website. Coinbase charges relatively high fees for retail trading (previously 0.5% of the transaction amount plus a fixed fee, changed to a spread and tiered fee structure after 2022, see PS below). As a result, retail customers have contributed the vast majority of the company's trading revenue in the past. For example, in 2021, retail trading volume accounted for about 32% of the total but contributed approximately 95% of the revenue (which decreased to 54% in 2024). Core metrics include the number of monthly trading users (MTU) and average trading volume per user, as well as the level of trading fees. During the bull market in 2021, MTU peaked at 11.2 million; due to market downturns in 2022-2023, MTU fell to around 7 million. The retail trading business is highly profitable, with trading fee income driving the company's net profit margin to high levels during the bull market (46% net profit margin in 2021, and around 42.7% in the past year). However, during the bear market, trading volume shrank, leading to a sharp decline in this business's revenue (with retail trading revenue down approximately 66% year-on-year in 2022), which negatively impacted overall profitability. PS: The "spread" in retail customer trading is charged in several transaction categories such as "one-click buy/sell / Simple / Convert / card spending," meaning the fee is embedded in the asset pricing— the price you pay to buy is slightly higher than the market price, and the price you receive when selling is slightly lower than the market price; this difference is the "spread." The fee structure for Advanced trading (limit orders/taker orders) uses a tiered fee rate, where the larger the trading volume over the past 30 days, the lower the maker and taker fees.

- Future Plans: Coinbase is enriching its retail products to enhance user stickiness, such as launching the Coinbase One membership service (offering zero-fee limits and other value-added benefits), continuously listing new tokens (with 48 new trading assets added in 2024, including popular memecoins to attract traffic), and improving user experience (such as simpler interfaces and educational content). The company is also exploring features like social trading and automated investing. As the market recovers, retail trading will remain the cornerstone of revenue, with growth depending on crypto market popularity and an increase in Coinbase's market share.

Professional Trading and Institutional Brokerage Business: This segment includes trading services aimed at high-net-worth and institutional clients, such as Coinbase Prime and Coinbase Pro (now integrated into a unified platform). In terms of model, these professional platforms offer deep liquidity, lower fees, and API access to attract large traders and market makers. Institutional trading volume accounts for 80-90% (for example, in 2024, institutional trading volume reached $941 billion, accounting for 81% of the total), but the fee rates are only a fraction of a percent to a few basis points, so the direct revenue contribution is relatively limited (in 2024, institutional trading revenue accounted for only about 10% of trading revenue). However, the indirect benefits from institutional business are significant: institutions often keep large amounts of assets with Coinbase for custody and participate in staking, contributing to custody fees, interest income, and more. Additionally, having active institutions helps enhance platform liquidity and pricing advantages, benefiting the trading experience for retail customers. In terms of core metrics, the number of institutional clients and assets under custody (AUC) are key focuses. Coinbase's AUC reached as high as $278 billion in Q4 2021, then fell to $80.3 billion by the end of 2022 due to market declines, and rebounded to around $145 billion by the end of 2023. Entering 2025, the institutional custody business maintains strong momentum: in Q1 2025, Coinbase's average custody assets reached $212 billion, an increase of $25 billion from the previous quarter, and in Q2, it reached a new high of $245.7 billion. In terms of profitability, while the direct profit contribution from institutional trading itself is not high, it can generate additional income from custody/financing services.

Future Plans: Coinbase is focusing on derivatives to meet the comprehensive needs of institutions. In 2023, it launched perpetual futures products overseas and obtained futures brokerage qualifications in the U.S. through its subsidiary Broker, starting to offer Bitcoin and Ethereum futures to U.S. institutions. Additionally, Coinbase established the Coinbase Asset Management department (restructured from the acquisition of One River Asset Management in 2023) and plans to issue crypto investment products such as ETFs and baskets of indices to increase institutional participation. To enhance its crypto derivatives landscape, Coinbase announced the acquisition of Deribit, a global leading crypto options exchange, at the end of 2024. The deal was valued at approximately $2.9 billion, including $700 million in cash and 11 million shares of Coinbase Class A common stock. This acquisition is one of the largest mergers and acquisitions in the crypto industry, aimed at rapidly enhancing Coinbase's position and business scale in the global crypto derivatives market. As a dominant options platform, Deribit had a trading volume of $1.2 trillion in 2024, a 95% year-on-year increase. By integrating Deribit, Coinbase gained a dominant share in the Bitcoin and Ethereum options market (with Deribit holding over 87% of the Bitcoin options market). This acquisition further expands and complements Coinbase's derivatives product line (covering options, futures, and perpetual contracts), solidifying its position as the preferred platform for institutions entering the crypto space.

Custody and Wallet Services: Coinbase Custody is an industry-leading compliant custody service primarily aimed at institutional investors, providing cold storage custody. The custody business model mainly involves charging custody fees (typically a few basis points of the assets under custody annually) and withdrawal fees. As of 2024, the assets held in Coinbase Custody accounted for 12.2% of the total global crypto market capitalization. Especially after large products like Grayscale chose Coinbase as their custodian, its reputation has further improved. Although custody revenue is included in the "subscriptions and services" category in financial reports and is not large (with $142 million accounting for 2.2% of total revenue of $6.564 billion that year), its strategic significance is substantial: custody ensures the security of high-net-worth clients' assets and supports large transactions on the exchange. Additionally, Coinbase's wallet service (Coinbase Wallet), as a self-custody wallet application, does not directly generate revenue but helps complete the ecosystem and attract DeFi and other on-chain trading users. In terms of profitability, the custody business has a high profit margin (almost pure income aside from relatively fixed security operation costs) and has been steadily increasing in recent years (in Q4 2024, custody fee revenue reached $43 million, a 36% quarter-on-quarter increase), providing the company with a more stable source of fee income.

Future Plans: Coinbase will continue to invest in enhancing the security of custody technology to meet regulatory requirements (such as the regulated Custody Trust under the New York trust license). It also plans to expand custody services to more asset classes and regions, such as supporting institutional staking services and providing custody for ETFs (in 2024, Coinbase was selected as the custodian for several Bitcoin spot ETFs).

Subscription and Service Revenue (Staking, USDC Interest, etc.): This is a diversified revenue segment that Coinbase has focused on developing in recent years. It mainly includes:

Staking Services: Users can delegate their held cryptocurrencies through Coinbase to participate in blockchain staking and earn block rewards, from which Coinbase takes a commission (typically around 15%). Staking provides users with passive income while the platform enjoys a share of the rewards. Since staking for mainstream coins like Ethereum opened in 2021, this revenue has grown rapidly.

Stablecoin Interest Income (USDC): Interest income from USDC has become an important component of Coinbase's revenue in recent years. In 2023, as interest rates rose and USDC reserves expanded, Coinbase earned approximately $695 million from USDC reserve interest (accounting for about 22% of total revenue that year, significantly higher than in previous years). Entering 2024, due to continued increases in USDC market interest rates and circulation, Coinbase's annual USDC-related interest income rose to approximately $910 million, a 31% increase from 2023. In 2024, USDC interest income accounted for about 14% of the company's total revenue; although the proportion decreased, the absolute amount reached a new high. The Q2 2025 financial report shows that Coinbase's stablecoin interest income has reached $333 million, accounting for 22.2% of quarterly revenue. This stable interest income mainly comes from the revenue-sharing agreement between Coinbase and Circle: both parties share the interest income generated from USDC reserves equally, and all interest earnings from USDC stored on the Coinbase platform belong entirely to Coinbase. Thus, USDC interest has become the fastest-growing and largest single business in Coinbase's subscription and service revenue segment, providing a recurring income source beyond trading fees.

Other Subscription Services: This includes Coinbase Earn (earning rewards by watching educational content), cashback on debit card transactions through Coinbase Card, and revenue from Coinbase Cloud's blockchain infrastructure services, among others. These currently have a smaller scale but present business synergies and align with the company's goal of building a comprehensive crypto platform. For example, Coinbase Cloud provides nodes and exchange interfaces for institutions and developers, assisting multiple blockchain projects in launching their networks in 2024, which could potentially become a "crypto version of AWS" in the long run.

The revenue share of the subscription and service segment has increased from less than 5% in 2019 to the current 40-50%, becoming a stable source of income for the company during trading downturns. In terms of gross margin, since interest and fees are the main components, costs are very low, resulting in a gross margin close to 90%. In the future, Coinbase will continue to promote subscription business growth, such as launching more subscription packages for high-frequency users, expanding the types of assets supported for staking, and deepening the global application of USDC (including using USDC as margin for U.S. futures trading, among other innovations). This segment is expected to become an important "stabilizer" for the company against trading market fluctuations.

In 2023, Coinbase strengthened its strategic partnership with Circle, making significant adjustments to the existing joint operation model of Centre (the jointly created governance body). First, Coinbase acquired equity in Circle for the first time, becoming one of its minority shareholders. It was disclosed that Circle purchased the remaining 50% stake in the Centre Consortium held by Coinbase for approximately $210 million in stock, in exchange for which Coinbase received Circle shares of equivalent value. This transaction increased Coinbase's ownership stake in Circle (the specific percentage was not disclosed but granted Coinbase economic benefits and certain influence). Subsequently, the USDC governance body Centre Consortium announced its dissolution, and the issuance and governance rights of USDC were transferred solely to Circle. Although Circle took full control of USDC management, Coinbase's influence in the USDC ecosystem increased as an important shareholder and partner: under the new agreement, Coinbase has substantial participation and veto rights in major strategies and partnerships involving USDC. For example, Coinbase has a veto right over new partnerships proposed by Circle for USDC, ensuring that its interests align with the development direction of USDC. Additionally, adjustments to the revenue-sharing mechanism (such as the aforementioned interest income sharing) further bind the incentives of both parties in promoting USDC. A series of measures have made Coinbase more proactive in promoting USDC applications, including pushing for USDC to be launched on more blockchains and offering USDC incentives and rewards in its international exchange and wallet products (such as increasing USDC holding yields). In summary, the equity investment and agreement adjustments in 2023 significantly strengthened the alliance between Coinbase and Circle regarding USDC, with Coinbase deeply participating in USDC governance through its shareholding while fully supporting the popularization of USDC to jointly expand the market influence and market capitalization of this compliant stablecoin.

Decentralized Business: Base Layer-2 Network

Positioning and Vision: Base is an Ethereum L2 launched by Coinbase in August 2023, based on the Optimism OP Stack, aimed at smoothly directing over 100 million Coinbase users to the on-chain ecosystem. The official roadmap for January 2025 emphasizes "completing sequencer decentralization by the end of 2025" and sharing network revenue through community governance.

Key Operational Metrics: As of August 2025, the total value of assets on the Base chain is approximately $15.46 billion, with 30.7 million monthly active addresses, 9.24 million transactions in 24 hours, and $204,000 in 24-hour on-chain fee revenue, ranking first among all L2s in revenue.

Revenue Contribution: Coinbase classifies Base "sequencer fees" as "other trading revenue." In 2024, Base contributed approximately $84.8 million in revenue to Coinbase (according to Tokenterminal data; the official financial report did not disclose specific figures), and as of 2025, revenue has reached $49.7 million. Base has become one of the most growth-oriented "on-chain revenue engines" for Coinbase outside of trading fees and interest income.

Other Potential Business Lines: Coinbase is also exploring new opportunities, such as the previously launched NFT digital collectibles market (Coinbase NFT launched in 2022, but user activity was low, leading the company to reduce related investments in 2023), payment and merchant tools (Coinbase Commerce allows merchants to accept crypto payments, primarily as a strategic layout), etc. These businesses currently contribute limited financial impact but have strategic significance in completing the ecosystem loop and enhancing user reliance on the Coinbase platform.

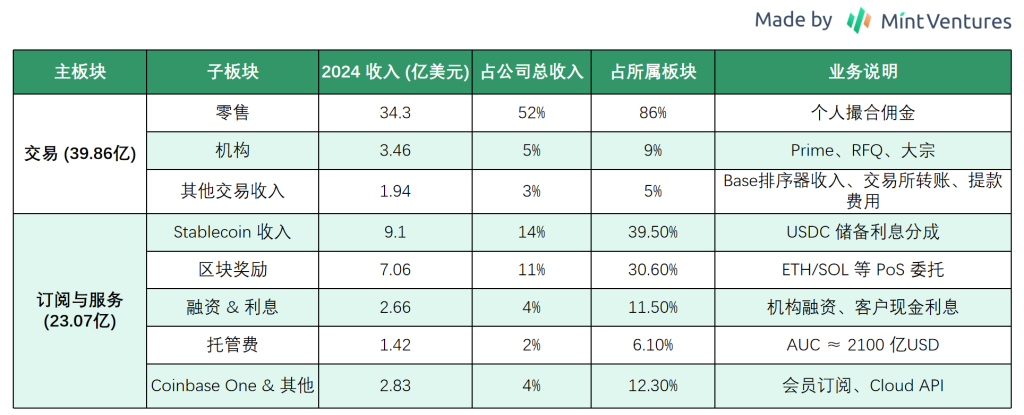

Through the table, we can see the composition and proportion of Coinbase's revenue in 2024:

Summary of the Business and Product Lines section.

Coinbase's business has expanded from a single trading model to a multi-engine driven approach that includes trading, custody, staking, and stablecoins. This diversification reduces excessive reliance on trading fees (with non-trading revenue accounting for 40% in 2024) and enhances customer stickiness (users are less willing to migrate their assets elsewhere as they earn staking interest and use stablecoins on the platform). The various business segments create synergies: trading leads to asset retention, which in turn generates staking and interest income, further encouraging users to engage in more trading. This "flywheel effect" is one of the moats Coinbase is striving to build. However, the company must also balance regulatory compliance and resource investment to ensure the sustainability of each business. For instance, staking and lending must comply with securities laws, and stablecoins must maintain transparent reserves. Overall, Coinbase has a complete product line layout and has taken the lead in building a comprehensive crypto financial services platform in the industry, providing a relatively robust revenue structure and growth path amid fierce competition.

5. Management and Governance

In terms of company management, we focus on several dimensions: 1. the background of executives and the stability of core members; 2. the level of past strategic decision-making.

5.1 Core Management Team Background

Brian Armstrong – Co-founder, Chief Executive Officer (CEO), and Chairman of the Board, holding the majority of voting rights in the company. Born in 1983, he previously worked as a software engineer at Airbnb. He founded Coinbase in 2012 and is one of the earliest entrepreneurs in the crypto space. Armstrong emphasizes long-term mission and product simplicity, known internally for his adherence to principles (such as the "politically neutral" company culture statement released in 2020).

Fred Ehrsam – Co-founder and Director. A former foreign exchange trader at Goldman Sachs, he co-founded Coinbase with Armstrong in 2012 and served as its first president. He left day-to-day management in 2017 to establish the well-known crypto investment fund Paradigm but has remained a director, providing insights on industry trends and company strategy.

Alesia Haas – Chief Financial Officer (CFO). She joined Coinbase in 2018, previously serving as CFO of hedge fund Och-Ziff (now Sculptor Capital) and an executive at OneWest Bank, with extensive experience in traditional finance and capital markets. She led the company through its IPO financial preparations, emphasizing financial discipline, and decisively implemented two rounds of layoffs in 2022 to control costs. Haas also serves as the head of Coinbase subsidiary Coinbase Credit, exploring crypto lending.

Emilie Choi – President and Chief Operating Officer (COO). She joined Coinbase in 2018 as Vice President of Business Development and was promoted to President and COO in 2020. Before joining, she was responsible for mergers and acquisitions at LinkedIn (leading the acquisition of SlideShare, among others) and is known for her expertise in strategic expansion. At Coinbase, Choi has driven a series of acquisitions (including Earn.com, Xapo custody, Bison Trails, etc.) and international expansion, being regarded as one of the most influential executives after Armstrong. She is also responsible for daily operations management, talent acquisition, and strategic project execution.

Paul Grewal – Chief Legal Officer (CLO). He joined in 2020, previously serving as Deputy General Counsel at Facebook and as a former federal judge. Grewal is responsible for handling legal and regulatory matters involving Coinbase, including the legal battle with the SEC in 2023. His team plays a crucial role in compliance and policy lobbying.

Other key executives: The Chief Product Officer position was previously held by Surojit Chatterjee (a former Google executive), who led product development from 2020 to early 2023; after his departure, the product team has been managed by several department heads. The Chief Technology Officer (CTO) role has been held by Greg Tusar and others, and is currently co-managed by engineering executives. The Chief People Officer (CPO) LJ Brock is responsible for recruitment and cultural development, playing a role in the company's cultural transformation. Notable mentions include Chief Marketing Officer Kate Rouch (former Facebook marketing director), among others; these talents from Silicon Valley tech and Wall Street bring cross-industry experience to Coinbase.

The overall profile of the management team is a combination of young, entrepreneurial founders and professional managers from traditional finance and tech giants. This diverse background helps Coinbase balance technological innovation with compliance execution. Executives hold significant equity or option incentives, with Armstrong having a special CEO performance equity reward plan to motivate him to achieve the company's market capitalization goals within ten years.

5.2 Personnel and Strategic Stability

Coinbase has experienced fluctuations in personnel and strategy but has generally maintained coherence:

Executive turnover: Most of the core founding team has remained since the company's inception (Armstrong and Ehrsam are on the board). However, in recent years, some executives have left: for instance, former Chief Product Officer Chatterjee departed in early 2023; the Chief Technology Officer and Chief Compliance Officer positions have also undergone several changes. Some personnel changes are related to market conditions: the bear market and performance decline in 2022 led to management streamlining. After Armstrong announced the "no political discussions" policy in 2020, about 60 employees accepted severance (including the former Chief People Officer). Nevertheless, the overall retention rate among senior management is relatively high—CEO, CFO, and COO have been in their positions for many years and led the company to its IPO, while the legal head has also remained stable. This indicates a relatively mature management tier with no frequent upheaval in key positions.

Strategic direction coherence: Since its establishment, Coinbase's core mission has remained unchanged (to build a trusted crypto financial system). The strategic focus may adjust with industry evolution, but the overall trajectory is clear: initially concentrating on Bitcoin brokerage and expanding the user base; then expanding the range of cryptocurrencies and international markets; since 2020, clearly pursuing a "dual approach"—serving both retail and institutional clients while increasing subscription revenue to diversify the business model. Even during market downturns (such as in 2018 and 2022), management has continued to invest in new products (such as launching the USDC stablecoin in 2018 and investing in the NFT platform and derivatives layout in 2022), demonstrating confidence in the long-term trends of crypto. Of course, there have been corrections: for example, after the NFT product cooled down, the company reduced resources in 2023; and blind expansion led to the need for two rounds of layoffs in the 2022 fiscal year, totaling about 2,100 employees (about 35% of the workforce), prompting management to improve operational efficiency. Overall, Coinbase has strong strategic execution capabilities, with no disruptive shifts or major failures, and its decisions generally align with industry developments.

Strategic consistency: If we attempt to quantify Coinbase's strategic consistency, such as tracking the company's early positioning in key technologies/markets, we find that Coinbase has laid out plans for most important industry trends: for instance, supporting Ethereum as early as 2015 (recognizing the wave of smart contracts), launching a stablecoin in 2018 (betting on the prospects of compliant stablecoins), and applying for futures licenses in 2021 (anticipating the derivatives market), followed by launching its own L2. These decisions align closely with subsequent industry developments, indicating that management possesses good industry judgment. Of course, the company has made missteps, such as missing out on the rise of decentralized trading in DeFi from 2019 to 2020 (failing to capture the decentralized finance market like DEX until later through the development of Base). However, given Coinbase's emphasis on compliance, this may have been a strategic trade-off by design.

5.3 Strategic Capability Review

Key successes and failures of management in critical decision-making include:

Strategic success cases: Early emphasis on compliance – Coinbase has placed a high priority on compliance since its inception, proactively applying for U.S. FinCEN registration and state licenses in 2013. This decision proved wise later: while competitors were forced to exit the U.S. market due to compliance issues, Coinbase had established a regulatory moat and accumulated deep trust among U.S. users (Coinbase has never experienced a major incident of customer funds being stolen), expanding its market share in the U.S. Another success was the timing of the IPO – management seized the opportunity to go public at the peak of the 2021 bull market, providing the company with ample capital strength and brand endorsement, while also rewarding early investors and employees, thereby stabilizing team morale. Additionally, the acquisition strategy – acquiring Xapo's institutional custody business in 2019 made Coinbase one of the largest crypto custodians globally, seizing the institutional market opportunity. These reflect the management's strategic vision and execution capability.

Strategic failure cases: Overexpansion leading to layoffs – During the 2021 bull market, Coinbase's employee count surged from about 1,700 to nearly 6,000 by early 2022 (currently around 3,700), with many departments becoming bloated. Armstrong publicly acknowledged that being "overly optimistic" about personnel expansion led to decreased efficiency. As the market cooled in 2022, the company had to conduct two large-scale layoffs, impacting morale. Another setback was the poor performance of the new NFT Marketplace – Coinbase invested resources to launch an NFT trading platform in April 2022, hoping to replicate OpenSea's success. However, due to entering the market late and lacking differentiation, coupled with the overall cooling of the NFT market, the platform's monthly trading volume remained low for an extended period, leading the company to nearly abandon operations. Management's attempts in certain areas did not meet expectations, indicating some market judgment errors, but overall losses were limited, and the company was able to cut losses in a timely manner.

Overall, Coinbase's management level is commendable, with a high degree of stability among core members, strategic judgments aligning with industry trends, and no significant missed opportunities, despite past issues with cost control and some product exploration failures, which do not overshadow its strengths.

6. Operations and Financial Performance

In this section, we will focus on reviewing Coinbase's revenue, profit, costs, and balance sheet situation to assess the company's profitability and stability.

6.1 Income Statement Overview (5 Years)

Coinbase's revenue and profit performance is highly dependent on the crypto market conditions, exhibiting "roller coaster" fluctuations:

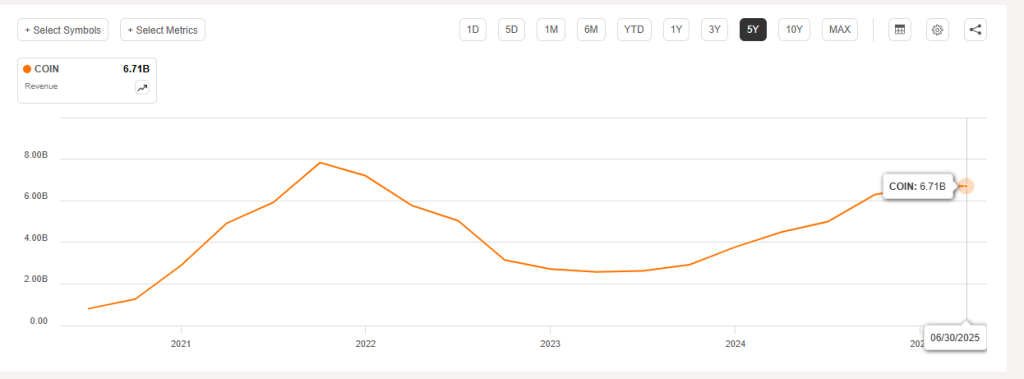

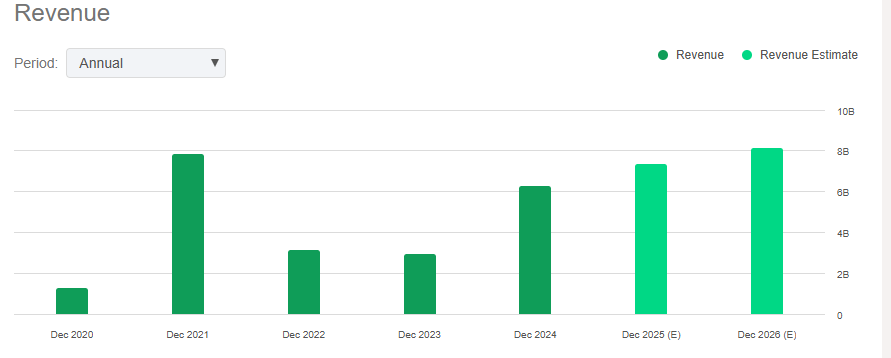

- Revenue: In 2019, total revenue was only $534 million. In 2020, influenced by a small Bitcoin bull market, it increased to $1.28 billion (+140%). In 2021, with the full-blown bull market, revenue skyrocketed to $7.84 billion (YoY +513%). In 2022, during the bear market, revenue plummeted to $3.15 billion (-60%), and further declined to $2.92 billion in 2023. However, in 2024, as the market warmed up, revenue rebounded strongly to $6.564 billion, doubling compared to 2023. In the first quarter of 2025, Coinbase continued the strong momentum from the end of 2024, achieving total revenue of approximately $2.03 billion, a year-on-year increase of 24%. In the second quarter of 2025, revenue saw a quarter-on-quarter decline: total revenue for the quarter was about $1.5 billion, a significant drop of 26% compared to $2.03 billion in Q1 2025. This was mainly due to a 16% decrease in volatility in the crypto market in the second quarter, leading to a decline in trading volume as investor trading willingness weakened. It is evident that Coinbase's revenue is still highly dependent on market fluctuations, with significant short-term volatility. However, compared to the same period last year, the company's total revenue in the first half of the year still grew by about 14%. Overall, the company's revenue has shown "roller coaster" fluctuations over the past five years, with significant cyclical elasticity: from 2019 to 2024, the average annual compound growth rate of revenue is about 40%, but annual fluctuations can exceed ±50%, with the bull market surging and the bear market halving still evident in the first half of 2025.

Coinbase Revenue (TTM) Trend, September 2020 - June 2025, Source: Seeking Alpha

Coinbase Annual Revenue (including forecasts), 2020-2026, Source: Seeking Alpha

Revenue Structure: Trading fees have always been the main source of revenue, but their proportion has gradually declined. In 2021, trading revenue was $6.9 billion, accounting for about 87%; in 2022, trading revenue fell to $2.4 billion, accounting for 77%; in 2023, trading revenue was only $1.5 billion, accounting for 52%; in 2024, trading revenue rebounded to about $4 billion, accounting for about 61%. Correspondingly, subscription and service revenue (staking, interest, custody, etc.) rose from less than 5% in 2019 to 48% in 2023, and then slightly decreased to about 35% in 2024 (absolute amount of $2.3 billion). In the first quarter of 2025, trading fee revenue was approximately $1.26 billion (YoY +17.3%), accounting for over 60% of quarterly revenue; subscription and service revenue reached $698 million (YoY increase of 37%), contributing more than 30% of revenue, mainly benefiting from the rise in USDC stablecoin interest income and the growth of the subscription product "Coinbase One" users. In the second quarter of 2025, trading revenue and subscription revenue shifted: trading fee revenue for the quarter was about $764.3 million, accounting for approximately 54% of total revenue; subscription and service revenue reached $655.8 million, a year-on-year increase of 9.5%, with the proportion rising to about 46%, nearly matching the scale of trading revenue. The growth momentum in the subscription segment mainly comes from USDC interest and custody services: the average USDC reserve balance in the second quarter increased by 13% compared to the previous quarter, reaching $13.8 billion, contributing considerable stablecoin interest income to the company. At the same time, staking services and institutional custody fees grew steadily, with Coinbase's subscription revenue continuing to hit record highs. In the first half of 2025, subscription/service revenue accounted for about 44% of the company's total revenue, significantly up from 35% for the entire year of 2024, further consolidating Coinbase's trend of business diversification. This change in revenue structure reduces the company's reliance on trading fees, helping to mitigate the impact of market volatility on revenue.

Profit: Benefiting from a high-margin business model, Coinbase has strong profitability when trading volume is abundant. In 2019, it recorded a loss of $30 million; in 2020, it achieved a net profit of $322 million (net profit margin of 25%); in 2021, net profit soared to $3.624 billion (net profit margin of about 46%), exceeding the total profit of all previous years combined. In 2022, it suffered a massive loss of $2.625 billion (net profit margin -83%), marking the worst year in its history; in 2023, it returned to slight profitability with a net profit of $95 million (net profit margin of 3%). In 2024, net profit reached $2.579 billion (net profit margin of about 39%), second only to the peak in 2021. It is evident that Coinbase's profits fluctuate significantly in tandem with revenue. In Q1 2025, net profit was $66 million, which seems to be a significant decline compared to the previous quarter, but this was mainly due to the decline in the fair value of crypto assets, equity incentives, litigation costs, etc. After adjusting for the after-tax fair value gains and losses of crypto asset investments and other one-time items, the adjusted quarterly net profit was $527 million, which better reflects the core operating results. In contrast, in Q2 2025, Coinbase's profits saw a dramatic leap: GAAP net profit reached $1.429 billion, a year-on-year surge (net profit in Q2 2024 was only $36 million), with a net profit margin of about 95%. However, this exceptionally high profit mainly came from non-recurring income: the company recognized $1.5 billion in strategic investment income from the revaluation of its stake in stablecoin issuer Circle, as well as $362 million in crypto asset investment portfolio gains for the quarter. After excluding these one-time gains, the adjusted net profit for Q2 was only about $33 million (the adjusted net profit needs to add back the tax expenses of nearly $438 million caused by the two non-recurring gains), far lower than the $527 million in Q1 2025, reflecting a significant weakening of the company's core business profitability due to the decline in trading volume. Overall, Coinbase's profitability still fluctuates significantly with revenue: during prosperous market conditions, net profit can reach over 30-40% of revenue, while in downturns, if costs are not strictly controlled, losses may occur. However, after suffering a massive loss in 2022, the company was able to quickly restore its breakeven point in 2023 through layoffs and cost reductions, demonstrating a certain degree of cost flexibility and operational resilience.

Expense Composition: On the cost side, Coinbase's costs are mainly composed of operating expenses (R&D, sales, and general management), with direct trading costs relatively small. Sales and marketing expenses typically account for less than 10%, and after 2022, they have been reduced to below 5%, with marketing investments being more restrained. R&D and general management expenses together account for about 20-30%, including significant equity incentive expenses: for example, a one-time stock option expense was recognized during the IPO in 2021, and there have been ongoing equity expenses of about $300-500 million annually in 2022-2023 (employee stock options). The expense ratio (operating expenses/revenue) is significantly diluted during bull markets (only about 22% in 2021) but soars during bear markets (exceeding 100% in 2022). In 2023, after layoffs and cost reductions, the expense ratio fell back to 70%. Since 2024, the company has continued to strictly control expenses, aligning personnel and project investments with business needs. It is worth noting that in Q2 2025, a significant data breach occurred, leading to litigation and compensation expenses of about $307 million, causing total operating expenses for the quarter to surge by 15% to $1.52 billion (if excluding this one-time item, core operating expenses actually maintained a downward trend). At the same time, equity incentive (SBC) expenses remain a significant portion of expenses and require ongoing attention—SBC expenses were about $300-500 million annually in 2022-2023, and in Q2 2025, SBC expenses for the quarter reached $196 million, slightly increasing by 3% compared to Q1. If this trend continues, annual SBC expenses may exceed $700 million. Overall, Coinbase's expense structure is relatively flexible, with personnel and project expenditures adjustable according to market conditions, but attention must be paid to the dilution effect of equity incentives.

6.2 Profitability and Efficiency (5 Years)

Combining multiple ratio indicators to assess Coinbase's profit quality and operational efficiency:

Gross Margin: It has maintained a high level of 80-90% over the long term, reflecting the high-profit nature of trading fee businesses. For example, the gross margin was about 88% in 2021, approximately 81% in 2022, and rose to 84% in 2023 as revenue declined (due to a high proportion of interest in the revenue structure with no corresponding costs), and was 85% in 2024. In Q2 2025, despite a decline in trading volume, the gross margin was still about 83%. This indicates that regardless of market conditions, Coinbase can convert most of its revenue into gross profit, leading the industry (compared to traditional brokerage firms with gross margins of 50-60%).

Net Margin: It fluctuates dramatically. The net margin was 46% in 2021, comparable to the most profitable tech companies; in 2022, it was -83% with severe losses; in 2023, it recovered to a positive 3%; and in 2024, it reached 39%. In Q2 2025, the adjusted net margin after excluding non-recurring items was only about 2%. On average, Coinbase's net margin during normal/prosperous market conditions is about 30-40%, demonstrating strong profit leverage; however, during downturns, losses may occur, necessitating timely cost reductions to turn a profit.

ROE/ROA: Due to profit fluctuations, return on equity (ROE) and return on assets (ROA) also show significant volatility. In 2021, ROE exceeded 60% (high profits combined with limited net asset expansion from the IPO); in 2022, it showed a negative ROE of -40%; in 2023, ROE was less than 2%; and in 2024, ROE rose to about 25%. Regarding asset return, ROA was about 20% in 2021 and about 15% in 2024, indicating a slight decrease in efficiency after balance sheet expansion. Overall, Coinbase's ROE in profitable years is far higher than that of traditional financial companies, but stability is lacking.

Per Capita Efficiency: Due to significant changes in employee numbers, we measure efficiency using revenue per employee. In the bull market of 2021, due to business surges, annual revenue per employee reached about $1.9 million; in 2022, it plummeted to below $500,000; after layoffs, in 2023, it rebounded to the range of $800,000 to $1 million. This is still higher than the revenue per employee levels of most traditional financial institutions, placing it in the upper-middle range, reflecting the economies of scale of its digital platform model. It is expected that in the future, with a reasonably sized workforce (currently about 3,700 employees), revenue per employee can stabilize around $1 million, and if another super bull market occurs, it may exceed this level.

Comparison of Revenue per Employee in Trading Financial Institutions (2024)

6.3 Cash Flow and Capital Expenditures (5 Years)

Coinbase's operating cash flow also exhibits cyclicality but generally remains positive:

Operating Cash Flow: In 2021, OCF was very strong, with net cash inflow from operations for the year of about $10 billion (due to a surge in customer trading volume leading to cash accumulation), resulting in significantly positive free cash flow for that year. In 2022, there was an outflow of about $2 billion in operating cash flow, reflecting losses and changes in working capital. In 2023, through cost reductions and interest income, operating cash flow returned to positive at around $520 million. In 2024, OCF surged, with net cash inflow from operations for the year reported at $2.5 billion, more than doubling year-on-year. This was partly due to profit recovery and an increase in customer funds.

Cash Flow from Investing Activities: Coinbase is not a capital-intensive company, with relatively low capital expenditures (CapEx). The main investments are in acquisitions and platform R&D. From 2019 to 2021, capital expenditures averaged only tens of millions of dollars (for servers, offices, etc.). In 2022, it increased to about $150 million (the company purchased office buildings and expanded data centers). In 2023, CapEx shrank again to about $50 million. In terms of acquisitions, the company spent a significant amount of cash around 2021 (such as acquiring Bison Trails, Skew, etc., totaling about $100 million). Acquisitions slowed down in 2022-2023. In 2024, the company made small acquisitions, including One River Asset Management. Overall, investment cash flow is a net outflow but not substantial, not affecting the cash supply for the main business. Additionally, at the end of 2024 and the beginning of 2025, the company announced a significant acquisition plan for the derivatives exchange Deribit: the total transaction price is about $2.9 billion, which includes about $700 million in cash payments (the remainder being the issuance of approximately 11 million shares).

Free Cash Flow: Considering operating cash flow minus capital expenditures, Coinbase has very substantial free cash flow in profitable years: $9.7 billion in 2021, negative in 2022, recovering to about $400 million in 2023, and around $2.56 billion in 2024, demonstrating ample cash-generating ability. Coinbase invests excess cash in purchasing safe assets (such as short-term government bonds) or holds some crypto assets.

Cash Flow from Financing Activities: In 2021, the company raised about $3.25 billion through convertible bonds and corporate bonds, while not issuing new shares during its direct listing (no fundraising). There were no significant financing actions in 2022. In 2023, Coinbase proactively repurchased or redeemed some bonds, buying back $413 million in debt at a discount, reducing interest expenses. The company has no dividend plans and only executed small-scale stock buybacks at the end of 2022 and in 2023 for equity incentive hedging. Overall, the financial policy is relatively conservative and prudent.

Cash Reserves: By the first quarter of 2025, Coinbase's cash and cash equivalents had reached $9.9 billion, while the cash and cash equivalents reported in the second quarter were $7.539 billion, a significant decrease, but still relatively ample.

6.4 Balance Sheet Robustness (5 Years)

Coinbase's balance sheet is relatively robust, characterized by high liquidity and low leverage:

Debt Levels: During the bull market in 2021, the company issued bonds twice: one was a $1.25 billion convertible bond maturing in 2026, and the other was senior notes totaling $2 billion maturing in 2028 and 2031. Therefore, the peak of long-term debt is about $3.25 billion. The company did not further incur debt in 2022-2023, and by the end of 2023, it repaid/redempted bonds, reducing debt to about $2.8 billion. With an adjusted EBITDA of about $3.35 billion in 2024, the net debt/EBITDA ratio is about 0 (net cash situation) or gross debt/EBITDA at 0.9 times, indicating extremely low leverage. The overall debt ratio has remained low since the IPO. It is worth mentioning that as of 2024, Coinbase has not used bank loans; all debts are public market bonds, eliminating the risk of loan withdrawal, and the maturities are long-term, resulting in low short-term repayment pressure.

Liquidity: Coinbase has substantial cash and cash equivalents, with a very high quick ratio. Excluding customer deposit liabilities (which have corresponding customer assets), the company's core operating liquid assets far exceed current liabilities. In the 2025 semi-annual report, its quick ratio (excluding customer-related items) exceeded 3.19x, with cash covering all short-term liabilities more than three times. Notably, the USDC reserves it holds are highly liquid (can be exchanged 1:1 with USD daily). After experiencing a brief USDC de-pegging event in 2023, the company quickly honored customer redemptions without liquidity crunch issues.

Asset Quality: Assets mainly consist of cash, cash equivalents, and short-term investments (high-rated bonds, etc.), accounting for over 60%. The scale of its own crypto assets is not large; as of Q2 2025, the fair value of crypto assets held was $1.839 billion, composed of: 11,776 BTC corresponding to $1.261 billion (68.6%), 136,782 ETH at $340 million (18.5%), and other crypto assets at $238 million (12.9%). Relative to the company's net asset size, this is manageable, and even with price fluctuations, it will not severely impact solvency.

Overall, Coinbase exhibits high financial security: low leverage, ample liquidity, and has withstood multiple stress tests. At the same time, a strong balance sheet also gives Coinbase the ability to invest counter-cyclically during market downturns; for example, during the industry's low point in 2022-2023, the company maintained R&D investments and international expansion, benefiting its long-term competitive position.

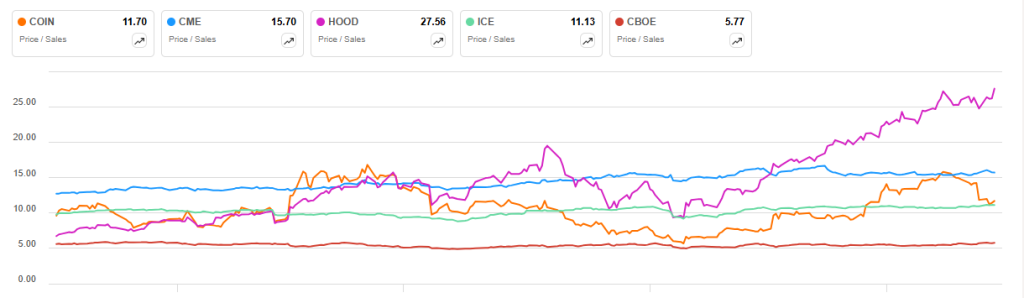

6.5 Industry Comparison

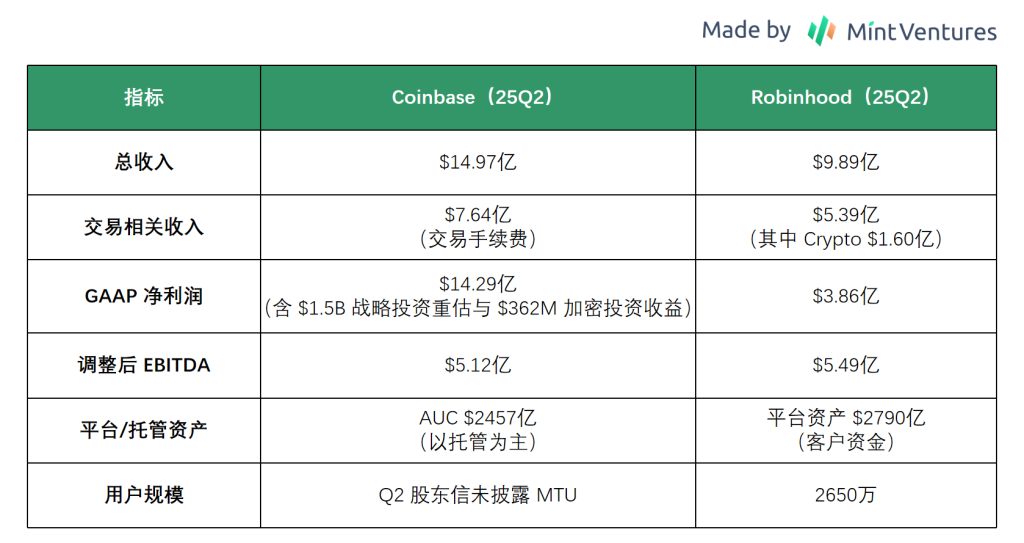

We compare Coinbase's financial metrics for Q2 2024 and Q2 2025 with other listed or comparable trading platforms.

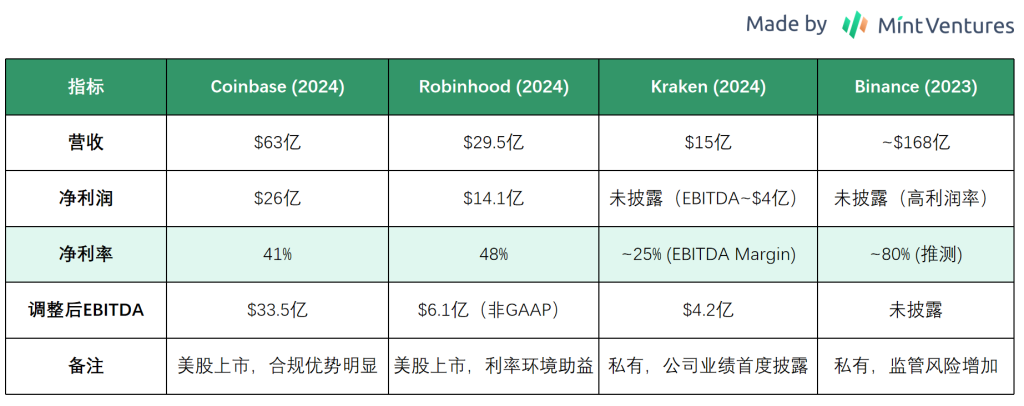

We selected Robinhood, Kraken, and Binance for comparison:

Robinhood (U.S. stock brokerage & crypto trading platform): In 2024, net revenue was approximately $2.951 billion, a year-on-year increase of 58%, achieving its first annual profit in history, with a net profit of $1.411 billion (a loss of $541 million in 2023). Benefiting from interest income driven by high rates and a rebound in trading, Robinhood's gross margin reached 94% in 2024, with a net margin of about 48%. In Q1 2025, revenue was $927 million (a year-on-year increase of 50%), with a net profit of $336 million. As performance improved, Robinhood's stock price has surged significantly from the end of 2024 to now, with a current market capitalization exceeding $95 billion.

Kraken (a well-established U.S. crypto exchange, not publicly listed): In 2024, trading volume surged, driving revenue to about $1.5 billion, a year-on-year increase of 128%, nearing historical highs. The adjusted EBITDA for the year was about $400 million, with an EBITDA profit margin between 25%-30%. By the end of 2024, Kraken's platform assets reached $42.8 billion, with 2.5 million monthly active paying users, and annual revenue per user exceeding $700. In Q1 2025, Kraken achieved revenue of $472 million (YoY +19%, slightly down 7% QoQ), while Q2 revenue was about $411.6 million, down 13% QoQ. As a private company, Kraken's latest valuation has not been disclosed; however, media reports indicated it sought over $10 billion in valuation financing in 2021. According to the private equity trading platform Hiive, Kraken's private equity price is $42.8, corresponding to a valuation of about $9.1 billion, which has surged nearly double in the past three months. The doubling of revenue in 2024 indicates a significant increase in its actual business scale, and its valuation relative to revenue multiples may be lower than those of publicly listed companies like Coinbase and Robinhood.

Binance (the largest global crypto exchange, not publicly listed): As an industry leader, Binance's trading volume and user numbers far exceed its peers. Its financial data is not disclosed periodically, but previous industry analyses estimated its 2023 revenue at about $16.8 billion, a 40% increase from the previous year, approximately 2.7 times Coinbase's revenue during the same period. Binance reportedly achieved over $12 billion in revenue and nearly $10 billion in profit in 2022, reflecting astonishing profitability and business scale (profit margin around 80%). Due to its private status, Binance does not have publicly available market capitalization and valuation multiples; however, based on its revenue and profit scale, even with a low valuation coefficient, its implied market capitalization could still reach the hundreds of billions. In terms of regulatory environment, Binance has faced compliance pressures and litigation challenges in the U.S., Europe, and other regions, adding uncertainty to its future growth and potential IPO prospects. Overall, Binance leads the industry in absolute scale due to its overwhelming market share, but compliant listed platforms like Coinbase reflect higher market confidence in valuation levels (such as price-to-sales ratio, EV/EBITDA multiples), which is related to regulatory transparency and differences in business models.

We then compare Coinbase and Robinhood's Q2 2025 data:

Overall, the revenue scale and various indicators of the two companies are quite close, with Coinbase's current market capitalization at $79.8 billion and Robinhood's at $101.8 billion. However, the revenue structures of the two companies are actually quite different. Coinbase's revenue comes from: trading + subscription/custody/stablecoins/derivatives; while Robinhood's comes from: brokerage fees + interest income (the interest margin from user funds deposited in banks for investment + margin financing income) + subscription/options/crypto trading. In recent years, Robinhood's platform assets and user expansion have been rapid, and it has also acquired Bitstamp to promote internationalization, becoming a direct competitor to Coinbase in the U.S. and globally.

In summary, Coinbase's financial performance reflects the high growth and high volatility characteristics of the industry. However, with good cost control and a robust balance sheet, the company has maintained its survival strength during downturns and achieved excellent profitability during peaks. This performance elasticity is both an investment highlight and a risk: if the crypto market continues to improve, Coinbase is expected to reach profit peaks similar to those in 2021; conversely, if the market remains sluggish, the company needs to control expenses more strictly to avoid repeating the losses of 2022. Currently, even if it re-enters a bull market, the company maintains a lean workforce and good expense control. Future focus should be on whether the expansion of subscription services can smooth out cyclical impacts, making the company's financial performance more robust.

7. Competitive Advantages and Moats

Coinbase's ability to establish itself as a leader in the fiercely competitive crypto industry is closely related to the multiple moats it has built:

Brand Trust and Compliance Advantages

As one of the earliest exchanges to enter the compliance track, Coinbase has accumulated strong brand credibility. It is one of the few exchanges in the U.S. to obtain licenses in various states (having gradually acquired 46 state money transmission licenses since 2013, allowing it to operate legally in all 50 states), registered with FinCEN, and obtained a New York trust license, all while not experiencing any significant user asset loss incidents since its establishment. This has allowed Coinbase to establish an image of "safety and trustworthiness" in the minds of users, especially after the collapses of peers like Mt. Gox and FTX, as well as multiple thefts from crypto trading platforms, which has further highlighted this advantage. For large institutions and mainstream users, Coinbase is often the first choice or even the only option. For example, due to regulatory restrictions in the U.S., many traditional funds can only use licensed trading platforms, allowing Coinbase to capture natural market share. At the same time, Coinbase actively cooperates with regulators (KYC/AML, etc.), earning a good reputation among policymakers and lobbying for favorable regulations. The barriers formed by brand and compliance are difficult for latecomers to replicate quickly and at low cost (the license application cycle typically takes 12-18 months and is accompanied by ongoing capital adequacy, anti-money laundering, cybersecurity, and other annual inspections; new entrants would need to invest hundreds of millions in compliance costs to obtain licenses in all states) — even if a new platform is technically competitive, without compliance endorsement and a long record of no incidents, it will be difficult to shake Coinbase's position among conservative funds and novice users in the short term. This trust advantage also brings a premium: Coinbase can charge relatively higher fees because users are willing to pay for safety and reliability.

Network Effects and Liquidity

The exchange business exhibits significant network effects: more users and trading volume lead to deeper liquidity and a better trading experience, which in turn attracts more users. After years of operation, Coinbase has gathered a large global user base and massive trading volume. Statistics show that 67% of cryptocurrency holders in the U.S. have used Coinbase. Such a high coverage rate makes Coinbase the "gateway" platform in the crypto space; new coins and projects often aim to land on Coinbase to reach a broad user base. A large number of users also means a sufficiently deep order book and smaller bid-ask spreads, which are crucial for trading experience. Especially during periods of extreme price volatility, platforms with deep liquidity can better accommodate large trades without significant price slippage, further solidifying professional traders' reliance on Coinbase. The network effect is also reinforced through word-of-mouth: the more users there are, the stronger the recommendation effect, and novices are more likely to choose platforms that their friends are using, creating a positive feedback loop. It is very difficult for competitors to break this virtuous cycle unless they offer extremely differentiated services in a niche market (such as zero fees or support for special assets). Currently, Coinbase's network effect in the European and American markets appears to be solid.

Economies of Scale & Business Diversification Stickiness

Coinbase's scale advantage is reflected not only in liquidity network effects but also in cost advantages and business combinations. As a publicly traded company, Coinbase can raise sufficient funds to invest in system security, product development, and compliance teams, which lowers the cost per transaction. Smaller platforms often cannot afford the expensive compliance and security investments. Coinbase's operational efficiency improves as the number of customers increases, forming a moat of economies of scale. At the same time, the company's diversified business segments (trading, custody, staking, stablecoins, etc.) reinforce user stickiness — users not only trade on Coinbase but also store coins to earn interest, participate in staking for returns, and use USDC for payments, fulfilling multiple needs on the same platform, thus increasing switching costs.

Technical and Security Barriers

Although the technical threshold for trading is relatively lower than in high-tech industries, Coinbase has established certain technical barriers through years of accumulation in high-concurrency matching, wallet security, and multi-chain support. Its trading engine has been tested during peak bull market periods (for example, daily trading volumes in 2021 reached hundreds of billions of dollars), demonstrating stability in handling extreme trading surges; in terms of wallet security, it has not experienced any large-scale hacking incidents to date, a record that many competitors of similar caliber cannot claim (even Binance has had theft incidents in the hundreds of millions). Additionally, Coinbase has developed many internal systems, such as tools for analyzing and monitoring suspicious transactions and preventing market manipulation, as well as professional API interfaces, providing reliable technical support for institutions and partners. These are not easily replicable in the short term. Especially in terms of security and risk control, any new platform that experiences even a single serious vulnerability could suffer a significant reputational blow, while Coinbase's years of security investment have built a barrier in the minds of users.

Sustainability of the Moat Discussion

Can the above moats be maintained in the long term? Let's evaluate each aspect:

In terms of brand and compliance, as more mainstream institutions get involved and regulatory rules are established, Coinbase's existing accumulation of licenses will become more valuable, and the advantages of being a pioneer may further expand, as it has established a reputation foundation that is difficult to shake. Moreover, it has experience and scale advantages in license applications and compliance costs compared to latecomers. However, regulatory uncertainty may still pose challenges (for example, in the worst-case scenario, if the government and Congress change, the regulatory style in the U.S. may shift again, limiting Coinbase's main market).

The network effect is likely to be solid as long as Coinbase does not experience a trust crisis or prolonged technical failures; users are unlikely to leave easily. However, it is important to note that the rise of decentralized finance (DeFi) may weaken the network effects of centralized platforms among some professional users (some users are turning to DEXs like Uniswap and on-chain trading platforms like Hyperliquid for self-trading), but currently, the DeFi experience and liquidity are not sufficient to significantly shake Coinbase. Furthermore, Coinbase's own strong development of Base and smart crypto wallets is also hedging against and responding to this trend.

Economies of scale and diversified stickiness will become more pronounced as the company expands its business; the larger Coinbase becomes, the more favorable its cost structure, and the higher the user ARPU (average revenue per user), creating a positive cycle. However, there are also risks: having too many business lines may dilute management focus, and the regulatory requirements for different businesses are complex, necessitating assurance that "the big ship does not leak."

Technical barriers require ongoing investment to maintain; Coinbase invests heavily in R&D each year (in 2023, technology R&D expenses were $1.2 billion, accounting for 40% of revenue, with an absolute increase of 11% in 2024, but the revenue proportion decreased to 22%). As long as this level of investment is maintained, technological leadership should continue.