Metaplanet Signals Bitcoin Buy Via Latest Financial Moves

Metaplanet, often called Asia’s MicroStrategy, has made big strides to improve its financial position. The platform’s recent exercise of stock acquisition rights and partial early redemption of its ordinary bonds shows its commitment to building a solid financial foundation. Given the Japanese investment giant's Bitcoin investment strategy, this latest move suggests it might accumulate more BTC, aiming to obtain 210,000 coins by 2027.

Asia’s BTC Giant Strengthens the Balance Sheet

Through various financial actions, Metaplanet has improved its balance sheet, indicating its next crypto acquisition. According to an X post shared earlier today, the company successfully issued 27,500,000 new shares after exercising 275,000 stock acquisition rights. As of August 26, 2025, the platform has a total of 739,714,340 issued shares.

The number of unexercised rights shrank from 735,000 on August 13, 2025, to 460,000 after the exercise. Exercising these rights increased the company’s total issued shares from 712,214,340 (including 25,867 treasury shares) to 739,714,340.

Besides exercising stock acquisition, Metaplanet also performed a partial early redemption of its 19th Series of Ordinary Bonds. This step is part of the company’s ongoing effort in financial management. With these two important updates, the asset manager is setting itself up for future growth and investment opportunities.

Following the latest development, the stock price also saw a notable uptick, hitting 865 yen. In a day, the shares soared by 2.73%. However, the stock plummeted by a massive 26% over the past month despite a 4% 5-day surge.

Getting Ready for Next BTC Buy?

Interestingly, this move follows the Japanese investment firm’s recent purchase of 103 coins valued at $11.8 million. With this addition, the asset manager’s total Bitcoin holdings reach 18,991 coins.

Reports indicate that the platform aims to gather an ambitious 210,000 BTC by 2027. After already reaching its interim goal of acquiring 10,000 BTCs in 2025, Asia's MicroStrategy plans to continue its aggressive Bitcoin accumulation strategy to achieve its long-term vision.

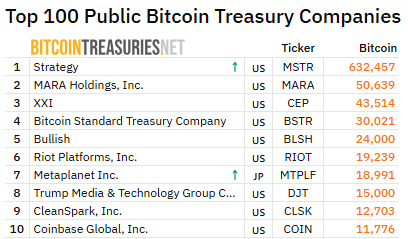

Currently, Metaplanet has the seventh-largest Bitcoin position, trailing behind other major players. The top six positions belong to MicroStrategy, led by Michael Saylor, followed by MARA, XXI, Bitcoin Standard Treasury Company, Bullish, and Riot Platforms.

Also read: Why the US is Moving GDP and Other Economic Data on Blockchain免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。