Mint infrastructure empowers stablecoin cross-border payments, achieving global deployment through three models.

Author: haonan

Translation: Deep Tide TechFlow

Previously, we proposed the issuance of dedicated stablecoins.

One of the most powerful application scenarios for stablecoins is cross-border payments, such as global merchant settlements. In this field, stablecoins can significantly reduce costs and shorten settlement times compared to traditional payment channels.

To unlock this potential, a global minting mechanism (Mint) needs to be established, which is the infrastructure for creating and managing stablecoins across regions. Next, we will explore what a minting mechanism is and how to achieve global access to stablecoins.

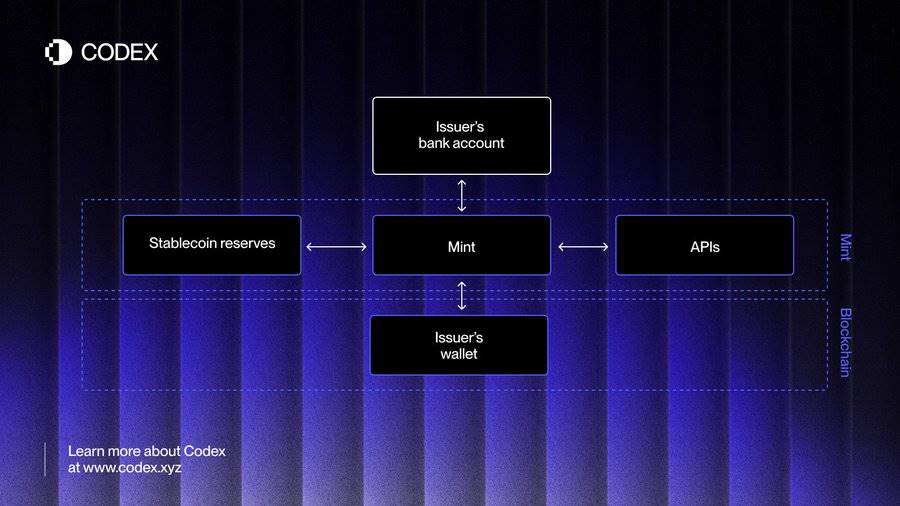

Core Structure of the Minting Mechanism

The core of stablecoin issuance lies in the "minting mechanism" (Mint), which is the infrastructure driving the entire process. This system supports the following three core processes:

- Minting and Burning: This is the fundamental process of stablecoin issuance, referring to the process by which the stablecoin issuer creates and destroys tokens on the blockchain. This process is managed by smart contracts on the blockchain, and requires supporting financial infrastructure, including bank accounts to facilitate fiat deposits and withdrawals, as well as IT systems and APIs for automated conversions.

Stablecoins are created through the minting process on the blockchain and reclaimed through the burning process. The stablecoin issuer controls the smart contracts, ensuring exclusive rights to mint and burn stablecoins.

Stablecoins maintain their peg to the underlying fiat currency through reserve assets. These reserves are typically invested in highly liquid, short-term financial instruments and managed by independent and trustworthy third parties. The value of circulating stablecoins directly reflects the value of these reserve assets.

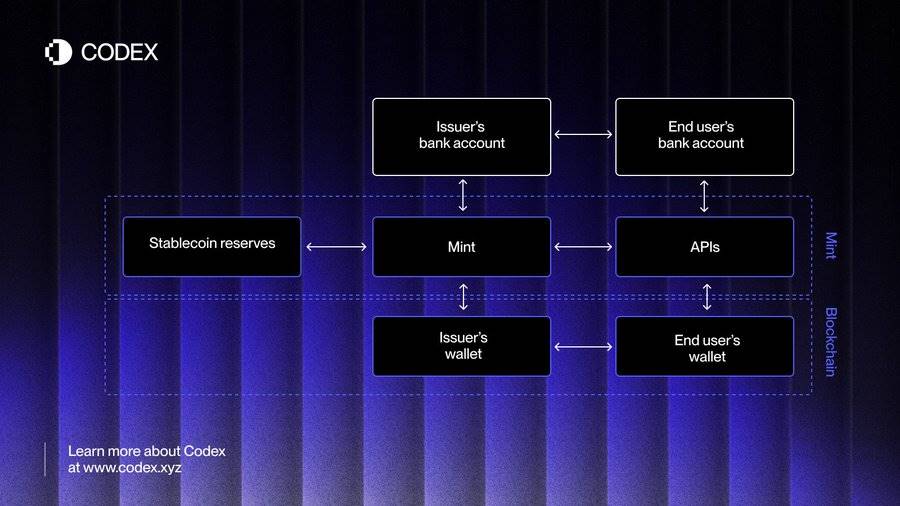

- On-ramping and Off-ramping: This is the method by which users convert fiat currency to stablecoins and vice versa. This seamless two-way process is at the core of stablecoin usability, allowing end users to easily convert fiat currency into stablecoins.

When users wish to acquire stablecoins, they simply transfer fiat currency to the issuer and trigger the conversion process via API. The issuer then mints new stablecoins and directly sends them to the user's digital wallet. The deposited fiat currency is held as reserve assets and used for investment to generate returns.

Conversely, when users wish to convert stablecoins back to cash, they transfer the tokens to the issuer. The issuer will burn these tokens, liquidate the necessary reserve assets, and return the corresponding amount of fiat currency to the user.

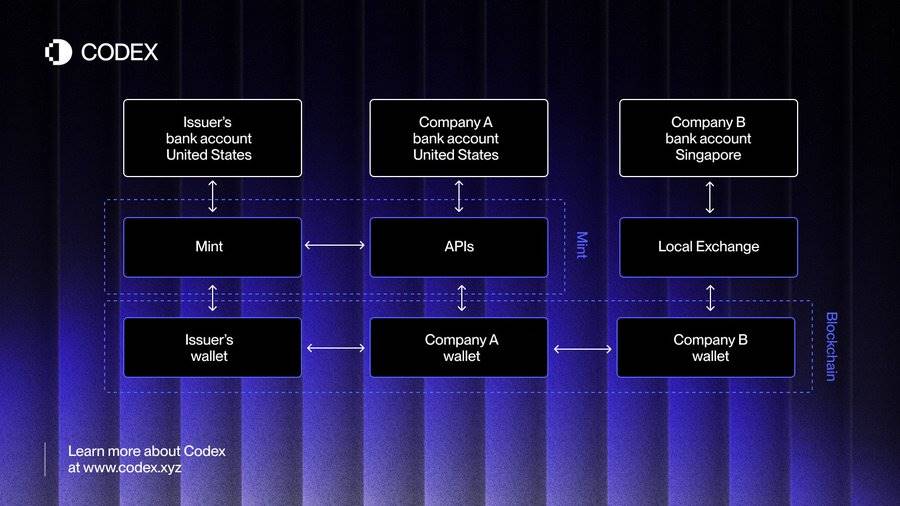

- Global On/Off-ramping: This is the third core process of stablecoin operation and the most transformative aspect. It addresses the critical need for seamless conversion between stablecoins and various fiat currencies across different regions.

In practice, this means integrating local payment channels and maintaining bank accounts in each region to support fiat deposits and withdrawals, allowing stablecoins to be exchanged with any local currency and vice versa.

This capability makes stablecoins a true attraction for global capital flows, often outperforming existing cross-border payment channels in terms of speed and cost.

Global Access Blueprint

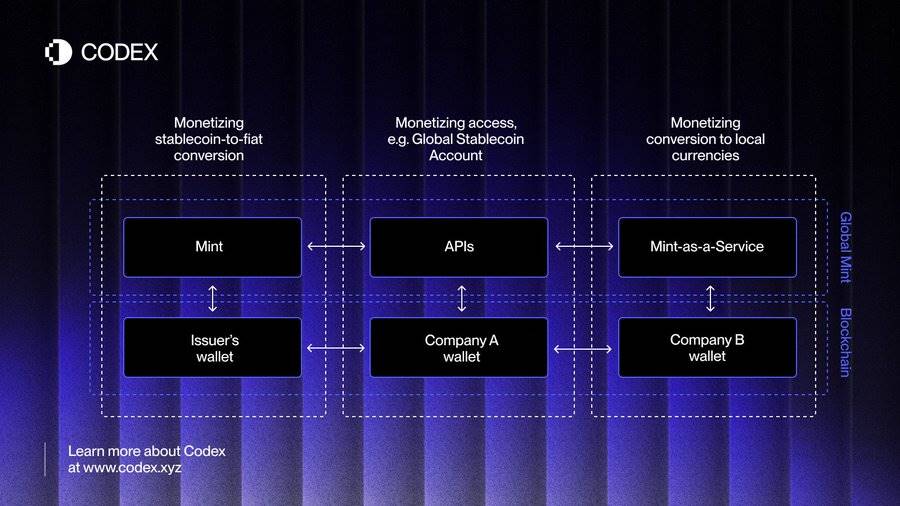

Building a global minting mechanism (Mint) equipped with local on-ramping and off-ramping channels is a complex and challenging task. Stablecoin issuers can achieve this goal through the following three main paths:

- Creating Regional On/Off-ramping Channels: This approach requires opening bank accounts in different regions and obtaining the necessary licenses. Stablecoin users will deposit fiat currency into these local bank accounts and then convert fiat currency into stablecoins through the minting mechanism.

Although this method is complex and time-consuming, it gives issuers complete control over the minting process in each region.

- Collaborating with Local Cryptocurrency Exchanges: By partnering with local exchanges and market makers in target countries, stablecoin users can use these exchanges to convert fiat currency to stablecoins or vice versa.

While this strategy can expand the issuer's global reach, it comes with higher costs due to listing fees, market-making costs, and the complexity of managing multiple partnerships.

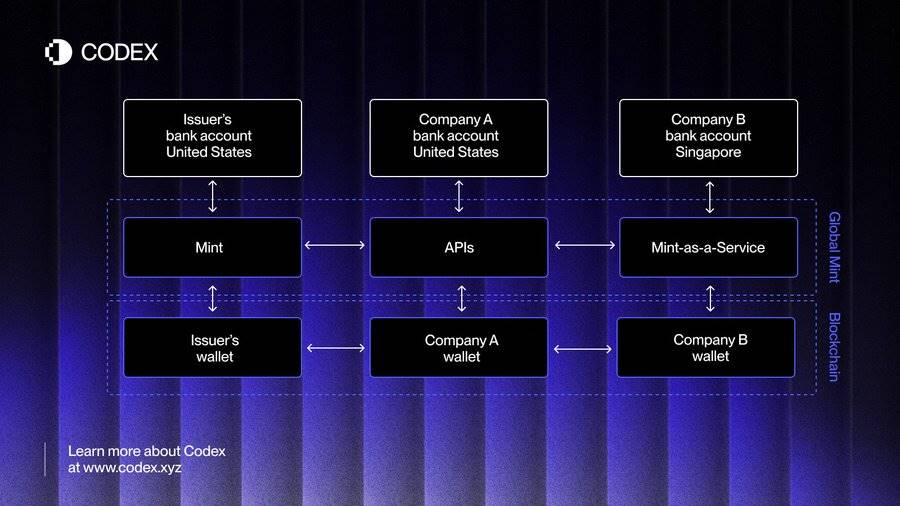

Adopting Mint-as-a-Service (MaaS) Model: A more efficient and scalable alternative is to collaborate with mint-as-a-service providers (e.g., Codex). In this model, the MaaS provider acts as a trusted local agent. Stablecoin users in specific countries can transact with the MaaS provider, which utilizes the issuer's core minting mechanism to handle conversions between fiat currency and stablecoins.

This mint-as-a-service model effectively eliminates the high costs and operational complexities of building a global on-ramping and off-ramping network from scratch. The high costs of on-ramping and off-ramping are often seen as a major bottleneck for the adoption of stablecoins, and the MaaS model directly addresses this barrier, paving the way for the globalization of stablecoins.

Key Strategic Considerations

To successfully implement a global stablecoin issuance strategy, stablecoin issuers need to focus on the following key areas:

Building a Robust Domestic Foundation: First, establish a secure and compliant minting infrastructure in major markets. This includes developing and deploying reliable smart contracts, partnering with banks for seamless fiat deposits and withdrawals, appointing asset managers for reserve management, and building a strong suite of APIs.

Enabling On/Off-ramping Channels in Strategic Areas: Identify key regions that most need on-ramping and off-ramping services based on the market demand for cross-border payments. Collaborating with mint-as-a-service (MaaS) providers is the best way to quickly and economically establish local on-ramping and off-ramping channels.

Developing Competitive Pricing Models: Issuers can optimize services through strategic pricing. While they can choose to charge access fees, minting fees, burning fees, and foreign exchange fees, issuers can also opt to subsidize these costs for users, profiting from the returns generated by stablecoin reserves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。